The beginning of disinflation in Poland and Europe?

The end of the first quarter of 2023 heralds the acceleration of disinflation processes. The price index both in Poland and in key European economies started to slow down. One of the elements contributing to lower inflation dynamics is the high base effect from last year, resulting from the abrupt increase in prices after the outbreak of the war in Ukraine.

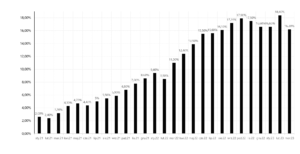

Inflation in Poland

The consumer price index in Poland fell from 18.40% to 16.20% in March, versus expectations of 15.90%. The main element contributing to the high level of inflation are food prices (24.00%) and energy carriers (26.00%). Compared to the previous year, the price of fuel for private means of transport remained virtually unchanged (0.20%). On a monthly basis, inflation was growing at 1.10%, with food and non-alcoholic beverages (2.30%) being the main component contributing to the increase.

Today's reading has some kind of symbolic meaning, as it will be officially said that the process of disinflation in Poland has started. In the following months, the downward trend in the price index dynamics will continue, and at the turn of Q2021/QXNUMX there is a good chance of inflation falling to single-digit levels. Undoubtedly, returning inflation to the target will be a major challenge. It should be mentioned here that prices were within its limits for the last time in the first quarter of XNUMX. The rate of decline in price growth will be one of the main determinants of the direction of action in the area of monetary policy. It can be assumed that the first interest rate cuts could take place when the inflation index approaches the main NBP rate.

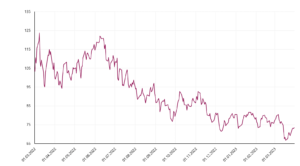

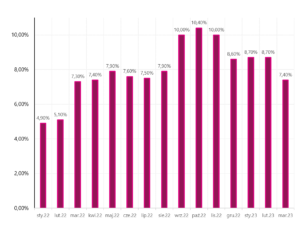

Inflation in European countries

The price index readings in European countries turned out to be a positive surprise. In Spain, CPI inflation fell in March from 6.00% to 3.30%. The first drop in core inflation in 23 months, which fell to 7.50%, is also good news. Yesterday's reading is the first symptom that the pass-through effect of high energy prices on consumer prices is starting to weaken. However, service inflation shows only slight signs of cooling so far. Good moods in the industry, measured e.g. Services PMI helps companies drive up prices further. Certainly, lower inflation readings are supported by a large base effect, but also by the reduction of tensions in global supply chains, as well as the gradual adjustment of demand to the market situation.

In the coming months, we can expect an increasing impact of the ECB's monetary policy on price developments not only in Spain, but also in the entire euro area. One of the main components affecting the inflation dynamics in the previous months was food, which was growing at a double-digit rate. Currently, market conditions and a drop in the prices of agricultural raw materials, which translates into inflation dynamics in the food segment with a delay of several months, allow us to look to the future with optimism.

A similar tendency characterizes inflation in Germany. In March, the CPI index decreased from 8.70% to 7.40% (forecast 7.30%), at the same time reaching the lowest dynamics since March 2022.

The main driver of inflation is commodity prices, which rose at a rate of 9.80%. Food is still in the foreground, with prices increasing by 12% over the last 22.30 months. Energy prices had a significant impact on lowering the inflation dynamics, the increase of which reached 3.50%, and a month earlier it was as much as 19.10%. Once again, the prices of services accelerated, the growth rate of which in March amounted to 4.80%.

A downward trend in inflation dynamics was also observed in France and Italy, where the indices fell to the level of 5.60% and 7.70%, respectively. The disinflation process continues throughout the euro area, as evidenced by the latest reading showing a decrease in the growth rate from 8.50% to 6.90%. Energy prices were the most important for today's data. In February, the annual dynamics for this inflation component was at the level of 13.70%, to be in negative territory in March (-0.90%). Also, to a large extent, the trend observed is the effect of a high base, and the data for the service sector are worrying. Inflation in this area increased again from 4.80% to 5.00%.

Inflationary pressure from food also persists, with prices increasing by an average of 15.40%. The highest inflation remains in the Baltic countries. Prices are growing the fastest in Latvia (17.30%), Estonia (15.60%) and Lithuania (15.20%).

Summation

Disinflation processes in Europe are accelerating. The main reason for the decline in inflation dynamics is the high base effect. However, one should not forget that the situation on the market of energy and agricultural commodities should support the price index in the coming months. The restrictive monetary policy of the European Central Bank is another element supporting the slowdown of inflation dynamics. The weakening of economic activity may be one of the key determinants determining the pace of inflation adjustment to the target. We will see how this process will proceed in the coming months.

Poland is in a slightly more difficult position, where inflation has approached the level of 20%. The initiated process of disinflation will most likely lead to a decline in the price index to single-digit levels at the end of this year. On the other hand, achieving the inflation target is a much more ambitious task and this process may extend over time to the following years. The balance of surprises in recent quarters was definitely negative, so one should not rule out a scenario that the pendulum will now swing the other way and we will be dealing with a faster than expected decrease in inflation dynamics.

Source: Piotr Langner, WealthSeed Investment Advisor

Disclaimer

This document is only informative material for use by the recipient. It should not be understood as an advisory material or as a basis for making investment decisions. Nor should it be understood as an investment recommendation. All opinions and forecasts presented in this study are only the expression of the author's opinion on the date of publication and are subject to change without notice. The author is not responsible for any investment decisions made on the basis of this study. Historical investment results do not guarantee that similar results will be achieved in the future.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)