Polish stocks are the most expensive after increases in domestic interest rates

After the previous Polish hike interest rates, domestic stocks rose the most of any country where rates were raised for the first time. It is no different today, when the WIG20 grows by more than 2 percent. after yesterday's hike. This shows that Polish stocks are not afraid of increases, and even expect them. This is a paradox because usually such increases are considered bad for the stock market.

About the author

Pawel Majtkowski - analyst eToro on the Polish market, which shares its weekly commentary on the latest stock market information. Paweł is a recognized expert on financial markets with extensive experience as an analyst in financial institutions. He is also one of the most cited experts in the field of economy and financial markets in Poland. He graduated from law studies at the University of Warsaw. He is also the author of many publications in the field of investing, personal finance and economy.

Pawel Majtkowski - analyst eToro on the Polish market, which shares its weekly commentary on the latest stock market information. Paweł is a recognized expert on financial markets with extensive experience as an analyst in financial institutions. He is also one of the most cited experts in the field of economy and financial markets in Poland. He graduated from law studies at the University of Warsaw. He is also the author of many publications in the field of investing, personal finance and economy.

Rates up, stocks ... up

It is obvious to any investor that increases in official interest rates are not good for the capital market. The higher interest rate on bank deposits - which is the result of such increases - causes some of the money to flow out of stocks there. Higher interest rates also reduce corporate profits and negatively affect share prices. The exceptions are banks and companies from the financial sector, whose profits grow along with higher rates. This is evident in the reaction of capital markets to interest rate hikes, which are usually negative. However, the direct reaction of the markets is also related to the information policy of a given central bank, because if it pursues an open policy, decisions on rate hikes do not come as a surprise and thus do not trigger a sudden market reaction.

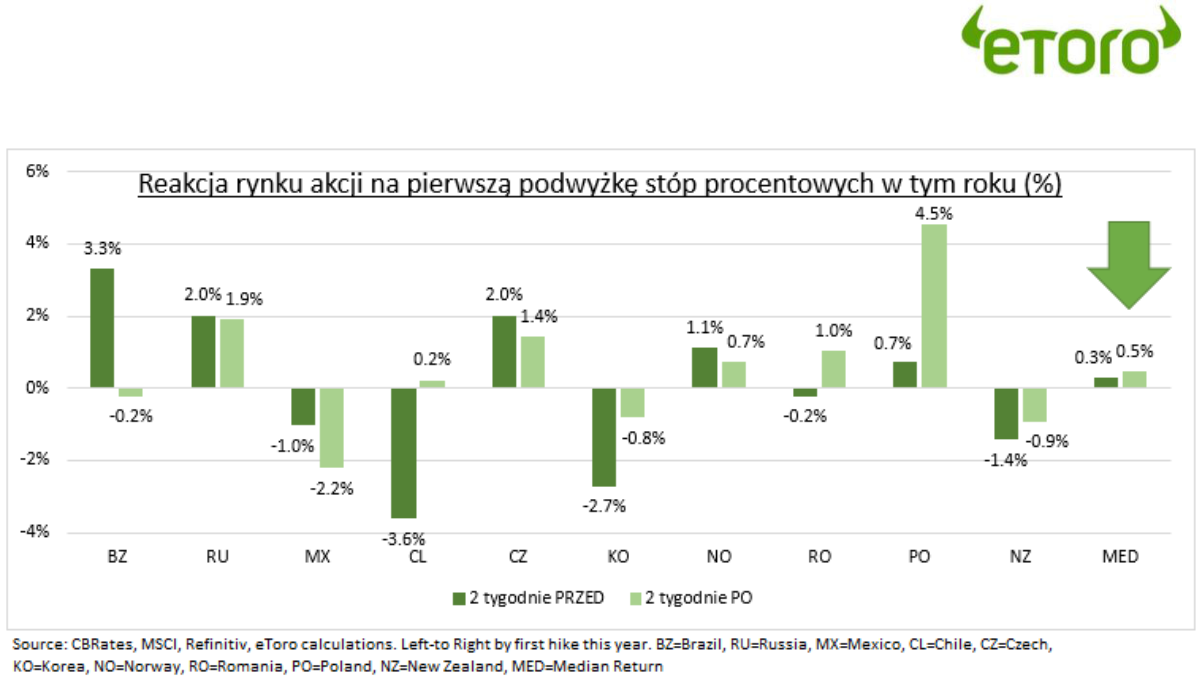

This year, interest rates have already been raised in almost 20 countries, we have included the top 10 markets where rates have increased. It turns out that Polish equities responded most positively to the first interest rate hike in all 10 countries we considered in our ranking (see chart). We examined how stock prices in a given country performed 2 weeks before and after the first rate hike. The median of the results for all countries is an increase of 0,3%. before and 0,5 percent. after the raise. This is, of course, an unusual situation in the context of what we said earlier. However, the overall positive result in the short term before and after the hike is precisely the effect of good information policy, which does not surprise the markets.

In this context, rate hikes in Poland brought the most positive reaction of all countries. Overall, before and after the first rate hike, which took place on October 6, Polish stocks rose by 5,2%. The increase, however, mainly concerned the period after the increase, during this period, share prices increased the most from all markets, by as much as 4,5 percent.

Why is this happening?

Such an effect results mainly from surprising the markets with the increase, as it had not been previously signaled, but rather there were assurances that it would not take place. On the other hand, inflation is currently 6,8%. y / y is seen by the market as a serious threat to long-term healthy growth. Therefore, due to concerns about the risk of inflation slipping out of control, the market reacted to a positive hike. That it is high time to do it.

The market reaction to further hikes may not be so positive, but a lot depends on what the information policy will look like NBP. Because there is no doubt that further rate hikes are inevitable.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)