Positive forecast for gold unchanged despite depreciation

Gold has returned to $ 1 / oz after another failed breakout attempt, leaving some investors worried that the metal's future is not shining so well anymore. Before starting the analysis of the current situation, I would like to clarify our position. In our opinion - in the context of highly uncertain economic and geopolitical forecasts - gold is a valuable diversifying asset. Taking this into account, we maintain our forecast of a further increase in the price of gold and - in the next 700-12 months - the final break to the record high of 24 (USD 2011 / oz).

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Growth forecast for gold

However, the recent price action has again highlighted the frustrating aspects of this metal and at the same time emphasized the importance of patience. It is also worth noting that the correction has so far been less than 5%, and therefore this is not a cause for concern, as long as positions are maintained at high leverage. The reason for the frustration was the recent inability of gold to take advantage of the general weakening of the dollar and the increase in tensions - both in the United States itself and in its relations with China.

Instead, the market focused on further bullish global stocks and easing coronavirus-related restrictions around the world. Despite better but still disastrous economic data, these events raised hopes for a V-shaped recovery in the coming months. Unfortunately, we do not share this optimism - when millions of employees are unlikely to return to work, corporate profits are likely to be disappointing. To this must be added the unfortunate risk of a second coronavirus wave in countries opening their economies too early.

In terms of products, the market slightly distrusted the further decline in the number of open contracts and speculative long fund positions in the CME gold contract in New York. Both these values have fallen to the lowest level in 12 months and although this may signal a weakening interest in gold, other events indicate that we are dealing with a problem concerning a specific product and not the underlying instrument.

The transatlantic discrepancy observed in March between futures contracts traded in New York and spot gold traded in London caused significant losses among many market makers. The link between the two markets is called EFP (Exchange for Physical, exchange for physical assets). When the spread between the immediate and forward price deviates too much from fair value, market makers enter the action and take over the other side of the transaction. However, EFP's turnover depends on the ability to freely transport gold from London to New York for arbitration.

The pandemic caused the temporary closure of transport routes and refining activities, which led to an excessive increase in spreads. It cost hundreds of millions of dollars to market makers in the form of both unrealized and ultimately realized losses. As a result, several market makers shut down while others lowered trading limits. Due to the risk of a repeat of this situation, many investors and traders focused on gold-based stock market funds.

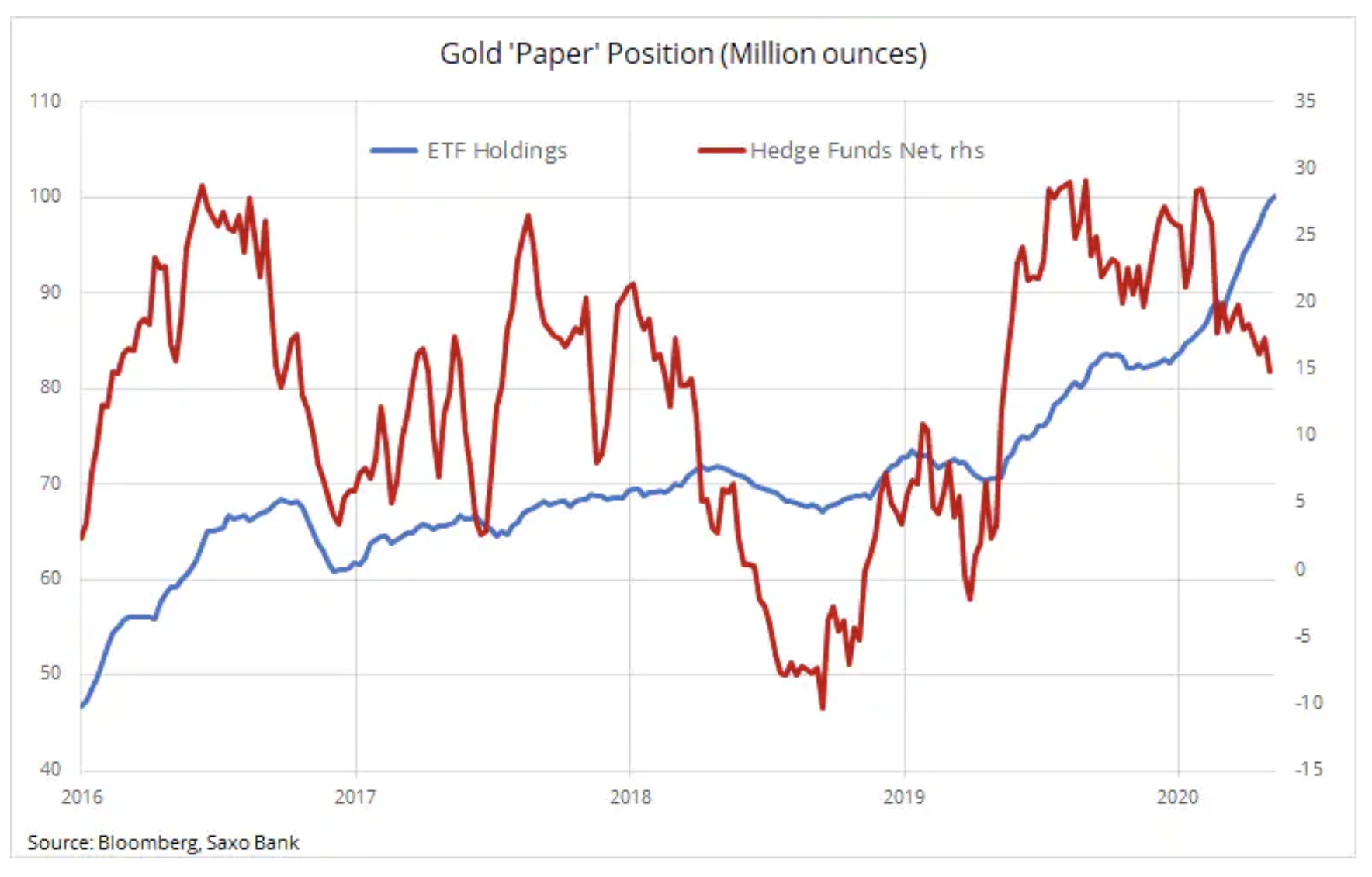

The volume of gold held by gold-based funds currently exceeds 100 million ounces after a steady increase over the past few years. 50% of these investments belong to the two largest funds: 36,4 million in SPDR Gold Shares (GLD), and 14,2 million in Ishares Gold Holdings (IAU).

The situation is completely different for hedge funds, which have reduced their long net position by half since February. We suspect that part of this investment has been transferred to the above listed funds.

Silver is chasing gold

One of the positive factors for gold up to this week was the further increase in the price of silver. After a decrease of 35% in the period from February to March, the ratio of gold to silver (ticker: XAUXAG) reached a record value exceeding 125 (ounces of silver to one ounce of gold). This level significantly exceeded the five-year average of around 80. Silver was strengthening from such a weak level and technical analysis shows that it can now try to outperform gold, at least in the short term, as seen in the XAUXAG chart below.

We are reiterating a positive forecast for both metals, primarily for gold after the current reduction in silver premiums. The main reasons why we cannot rule out another record high in the coming years are as follows:

- Gold used as collateral against central monetization of financial markets

- Unprecedented government incentives and the political need to raise inflation to support debt levels

- The inevitable introduction of yield curve controls in the United States, forcing a fall in real yields

- Increase in global savings in the context of simultaneous negative real interest rates and unsustainable high stock market valuation

- Increased geopolitical tensions related to shifting blame for the Covid-19 pandemic

- Increased inflation and weakening of the US dollar

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)