Positioning on EUR / USD may indicate a deeper correction

It seems that the upward trend in the main currency pair EUR / USD has slowed down recently. The euro has strengthened steadily against the US dollar since March, when the pandemic hit financial markets hard. As a result, the EUR / USD exchange rate increased from around 1,06 to almost USD 1,24. Thus, the so-called crowded trade, which may adversely affect the trend that has been going on for almost a year. Despite the recent slowdown in the trend and a stop at 1,24 Citi EUR Pain index still shows a very significant long positioning in the single currency, close to the previous trends.

As you descend EUR / USD exchange rate, positioning began to reverse, which may suggest that profit-taking was at stake, according to information released by Bloomberg. And with the double recession in the Eurozone and growing concerns that the first quarter may show a recession, it is understandable that, at least in the near term, the EUR / USD pair could be traded on the upside. In the longer term, however, there are still strong arguments for the modest gains that the euro could record against the dollar in 2021.

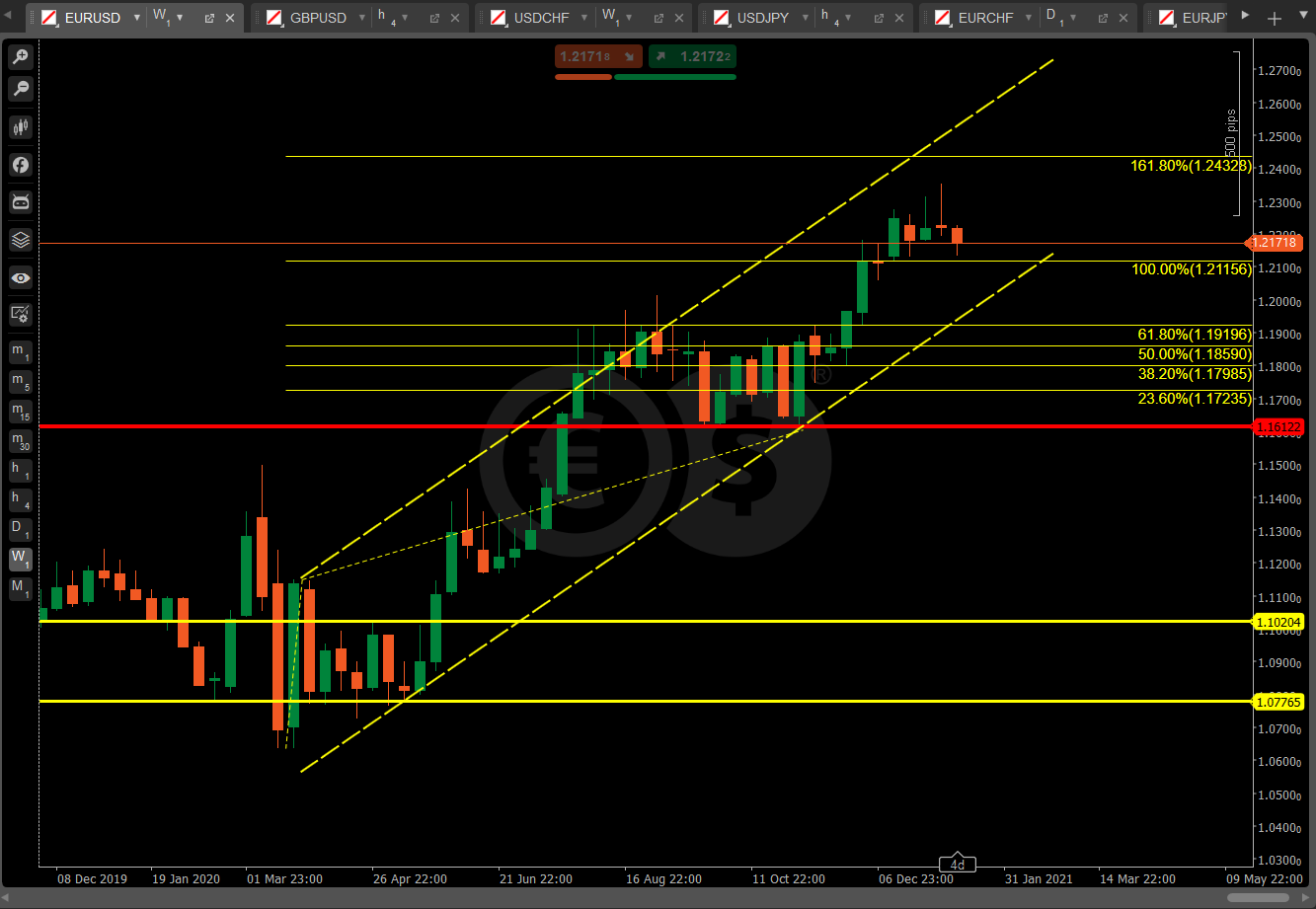

EUR / USD - the situation on the chart

Meanwhile, when looking at the EUR / USD rate chart, we can observe a potential pattern known from the Elliott wave theory. Since March, the quotes have formed a five-wave growth structure, where the potential range for the fifth wave is 161,8%. of the first wave falls in the region of 1,2430.

EUR / USD CFD chart, interval W1. Source: cTrader Conotoxia

Two weekly candles with relatively large upper shadows may also speak of a potential trend depletion. Nevertheless, the confirmation of a possible trend reversal would be only breaking the lower bound in the main trend channel. If this line were to be crossed, the road towards 1,17-1,16 could be opened.

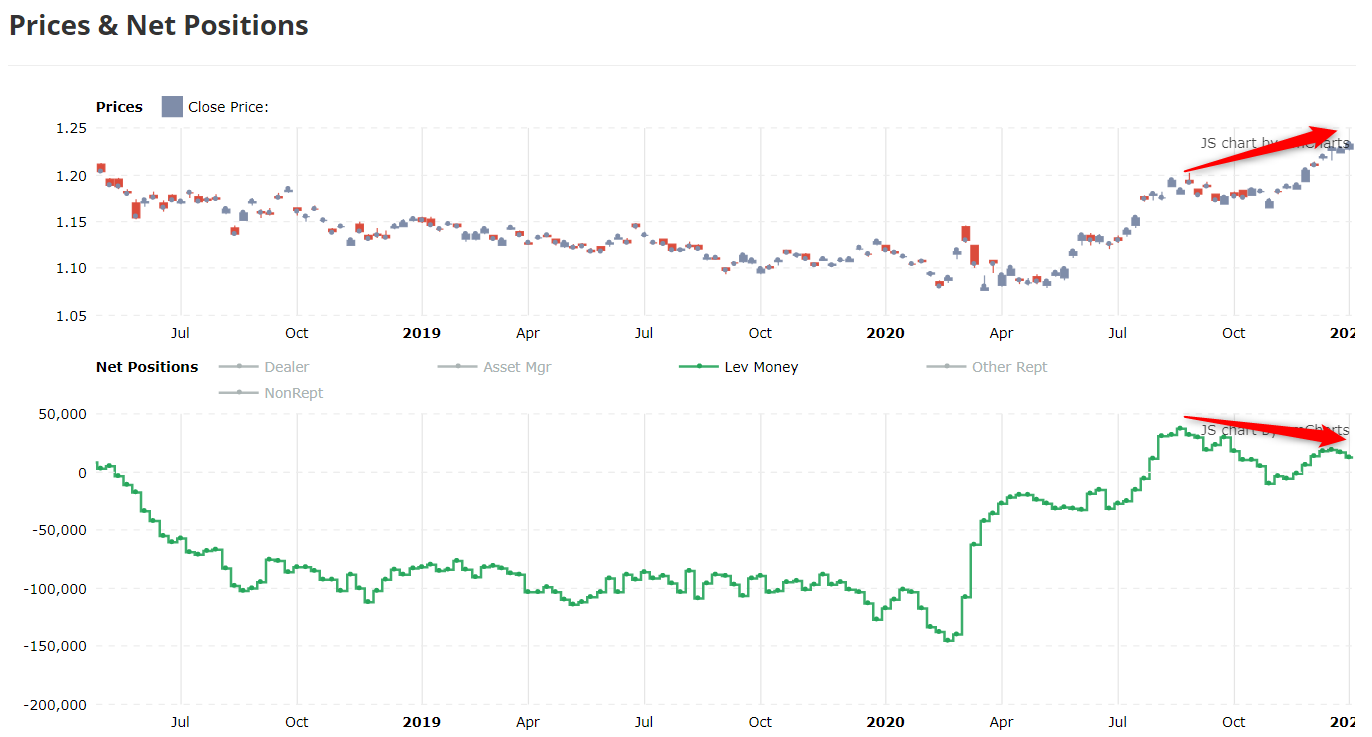

Net long positions of leveraged funds on euro futures. Source: tradingster.com

Wnioski

Coming back to positioning, this time on the market of futures contracts listed on the CME exchange, there was a significant divergence. It may illustrate the discrepancy between the rate and the scale of funds' involvement in euro long positions. Well, the CFTC data shows that with the recent wave of growth in the euro, long positions failed to break the previous peak. This may mean that there may be less and less people willing to buy the euro as it becomes more and more expensive and less attractive under the current conditions. This may also be a factor in favor of a correction on the EUR / USD pair.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)

Leave a Response