Saxo Bank Predictions Q3: Decarbonization is Europe's last chance

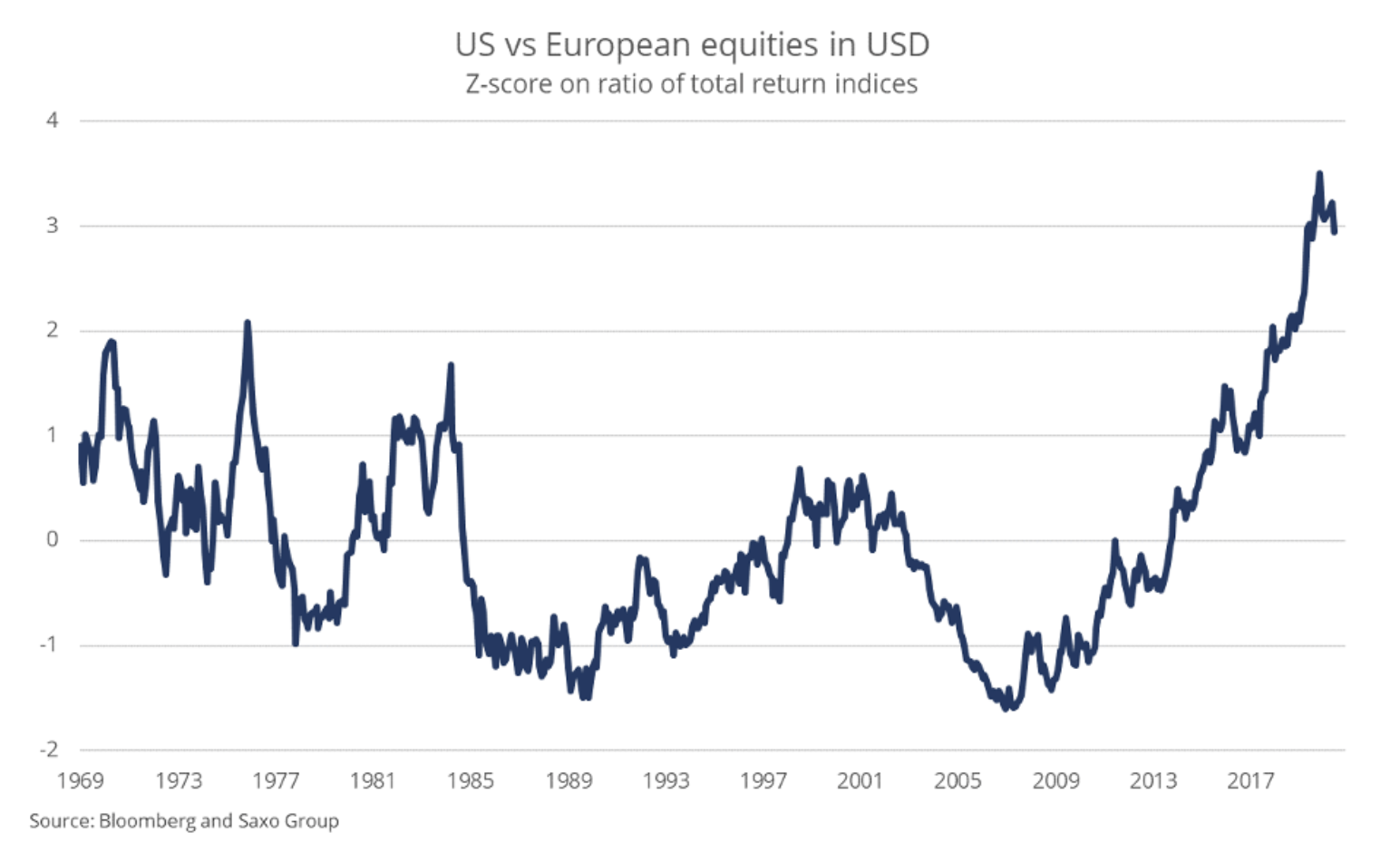

European equities underperformed US equities since late 2007, when two major trends began to take off. One was the digital snowball effect driven by US companies; the second was the 2008 global financial crisis, which hit Europe worst, leading to years of fiscal austerity and a severe crisis in the euro area.

14 years later, the world is at a turning point. Actions on containment have been delayed for several decades carbon dioxide emissions and the fight against climate change due to economic incentives, and the whole world is now forced to aggressively accelerate the decarbonisation process. This is both an opportunity and a challenge, not only for the community but also for equity investors.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

European green revolution

Europe has lost its digitization leadership to the United States as the world's largest companies in software, social media, search engines, e-commerce, cybersecurity and semiconductors had their headquarters overseas. The green transformation planned for the coming decades is the largest fundamental change in the structure of our society since the industrial revolution and will make our economies much greener and more sustainable in the long run. This is another significant technological vector - and also the last chance for Europe to stay ahead of the US and China.

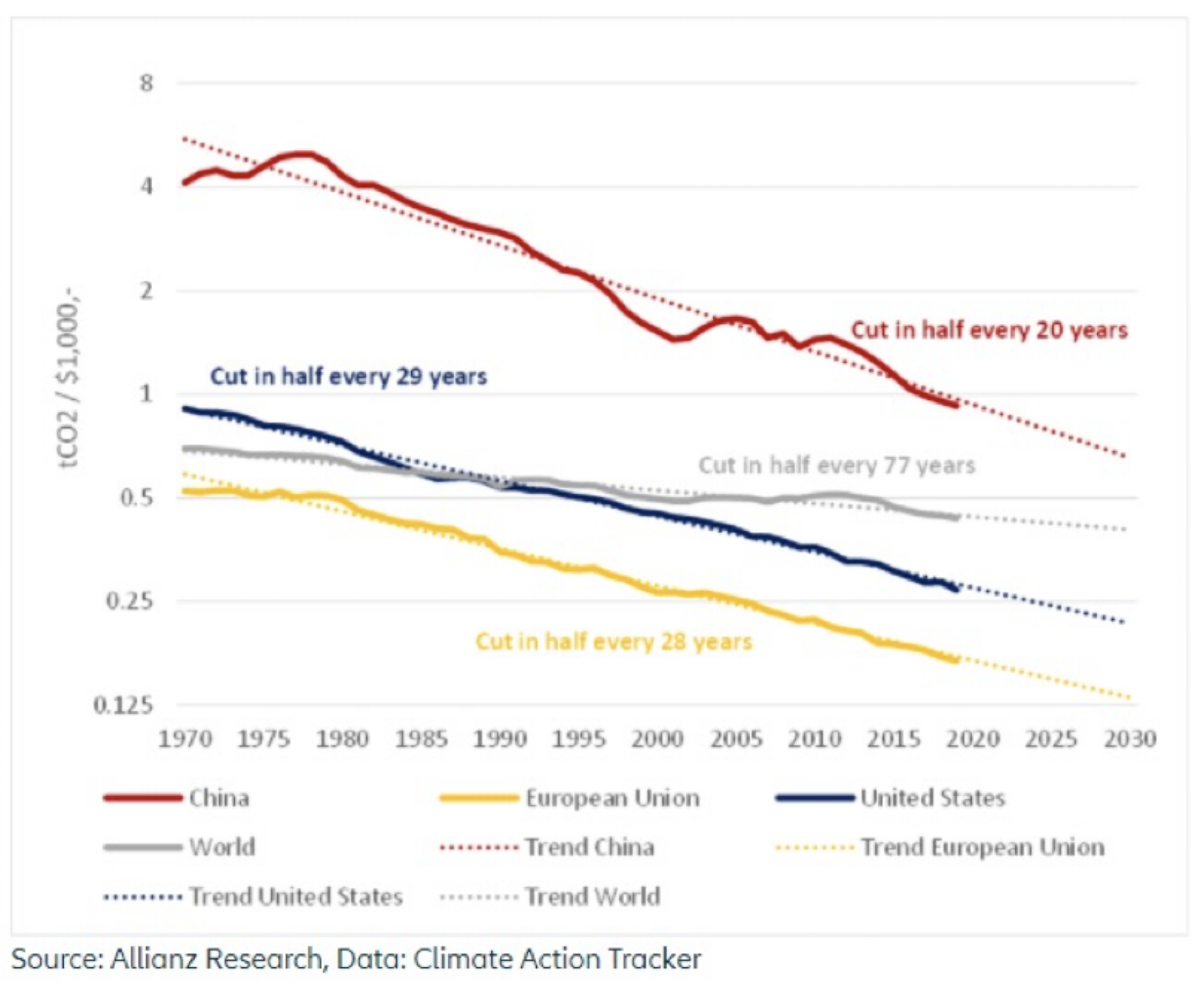

Since 1990, Europe has been the only continent to reduce its CO emissions2while in the United States the situation has not changed, although the recent trend is downward, China has significantly increased its emissions as the whole world began to use the enormous production potential of the Middle Kingdom. In terms of energy efficiency, it is estimated that the European Union generates a GDP of USD 1, with carbon dioxide emissions 25% lower than the United States and as much as 85% lower than China. Although Europe has been at the forefront in terms of installed renewable energy capacity for several decades, in 2014, it was overtaken by China, which began to prioritize technologies using solar energywhile the Old Continent continues to lead in the field of technologies using wind turbines. Europe is well placed to dominate the green technology industry as it has the world's largest internal market for green technologies and the greatest support from governments.

According to the European Environment Agency, the three key industries in terms of carbon dioxide emissions in Europe are energy, industry and transport. Europe has ambitious goals for the popularization of electric cars and clean energy subsidies. These targets are favorable for decarbonisation, but experts say they are also the same as following the path of least resistance. Steel and concrete are important building materials, but they are very difficult to produce in a non-carbon-intensive way. Thanks to future technologies, this may change, but until then, the only solution for our industry is carbon dioxide sequestration technology. It is currently expensive, therefore imposing regulations on the implementation of CO sequestration2 would cause the production costs of many items to rise excessively and thus run the risk of inflation.

EU Emissions Trading System (ETS) aims to encourage companies to reduce their carbon footprint, but the EU itself has realized that it cannot act in isolation. European companies could simply move production outside the EU and import capital and finished goods, which is why the EU is developing the so-called border tax. Under this mechanism, goods produced in countries with high CO emissions2 would be taxed, forcing other countries to adopt greener methods or risk losing production.

In times of civil unrest, when democracies come under pressure, developed countries need a common identity. Decarbonization and nationalism could turn out to be gripping ideas of the left and right, respectively, that could combine to create a shared identity and push society in a new direction - without so many riots and with success for Europe.

European companies benefit from moving away from coal

At the end of 2019, in a commentary on the green transformation, I wrote that this would be one of the most important topics on the stock markets in the coming decades. Although the largest companies of today rely on digitization, I anticipate that some of them will find solutions to our environmental problems in the future. This is a huge and very costly challenge that will most likely stimulate the creation of green technology companies on an unprecedented scale. This is due to the fact that our problems with carbon dioxide emissions are global and occur in the real world.

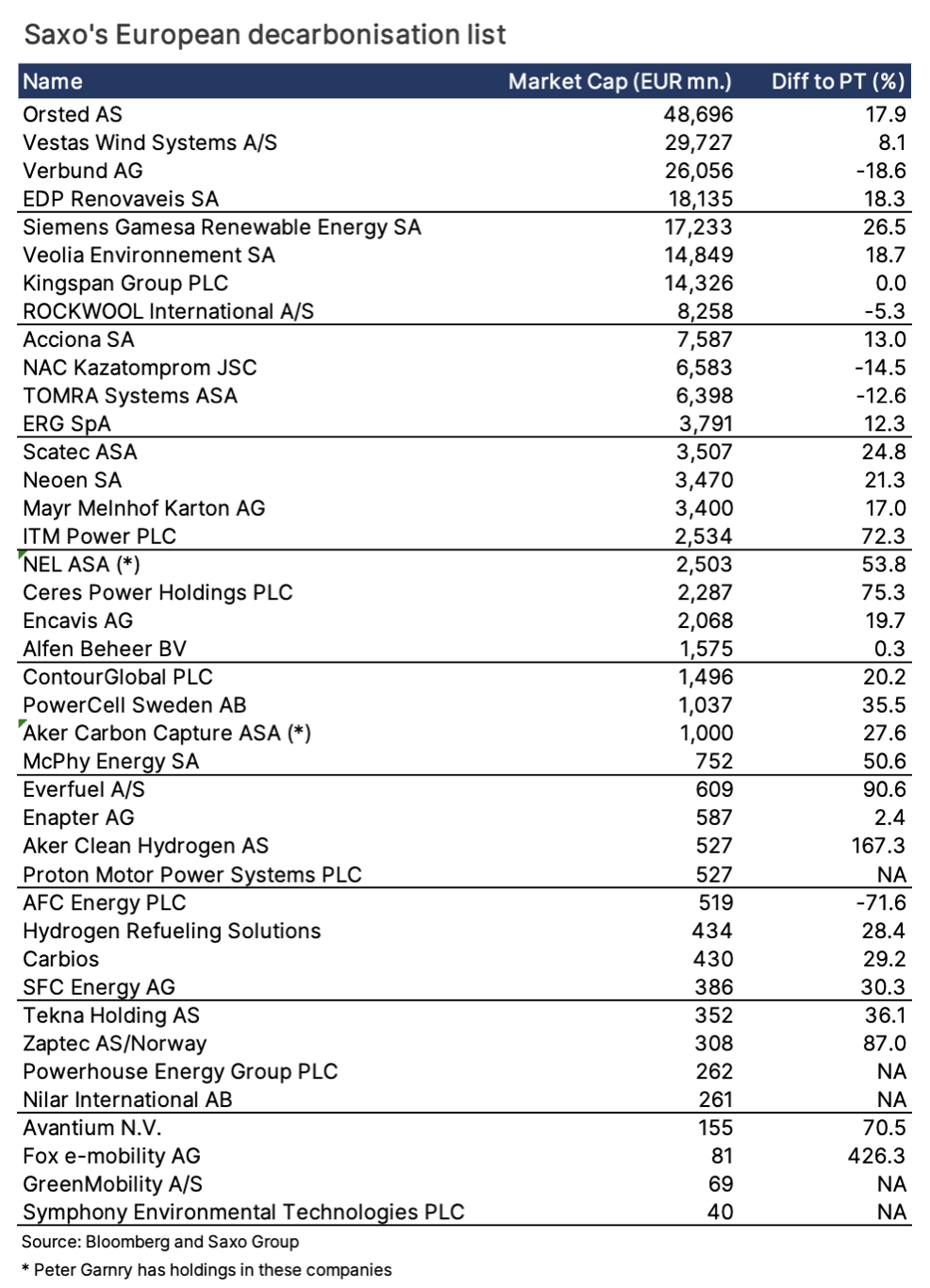

For investors, open access green technology opportunities are still limited, but many start-ups are accelerating their initial public offerings to raise the capital needed to develop such solutions. I found 40 European companies in the green technology industry that offer exposure to the EU's decarbonisation policy by 2050 in a variety of ways. wind energy, sunny, water, links fuel, bioplastic, car-sharing services in the field of electric vehicles and pcharging stations, as well as recycled materials, insulating materials for better energy efficiency in housing construction, uranium mining (assuming the EU recognizes nuclear energy as a green technology) and energy storage.

I am not expressing any opinion or offering any investment recommendation with respect to companies from the list "Decarbonization". Instead, I show a percentage difference to the current consensus on target prices; due diligence in this respect it belongs to the investors themselves. It is worth noting that the stocks of companies focusing on green transformation in the current year have experienced significant volatility, therefore such an investment is of a long-term nature, and investors should be patient and be prepared for a possible increase in volatility.

The main risk to European plans to move away from coal is primarily equity valuations, as investors aggressively rejected the growth of any green technology companies. High stock valuation at the very beginning of an investment is usually associated with a lower return in the future, so investors should be careful when investing in a green transition. While many of the green technologies are already fine-tuned, it is still uncertain which one will ultimately be the winner; Investors should therefore take into account that many companies will not be able to achieve growth or live up to expectations. High commodity prices and high interest rates also pose significant risks to green transition equities as they potentially reduce profitability unless green companies fail to pass the higher input costs to consumers.

European equities will benefit from inflation and the weakening dollar

The accelerated path to an ecological society in all respects will force the real world and technology to maximize their efforts. The green transition will be the biggest driver of inflationary pressures in the decades to come, coupled naturally with the relocation of production out of Asia and with urbanization in developing countries. Moreover, the response to large wealth and income inequalities will be policies favoring labor markets at the expense of capital markets, which will lead to a higher increase in the median earnings and demand, which in turn will also exacerbate inflationary pressures.

The main driver of higher inflation will be the fiscal stimulus in the United States, which is likely to weaken the dollar. In previous USD depreciation cycles, European and emerging market equities outperformed US equities, but there are other reasons for particular exposure to the European market. Valuations are more attractive, and US equities have never shown the advantage they have been over European equities since 2007. This period coincided with a time when growth proved more valuable than value and cash-flow discount rates are falling rapidly.

European stocks began to surpass US stocks in early November 2020, when Pfizer made public the effectiveness of its mRNA-based vaccine. This information marked a turning point for interest rates, inflation expectations and stocks. These trends benefit European equities as their cash flow times tend to be shorter than US stocks, which are more relevant to the financial and other cyclical industries. However, all of these factors can turn out to be wrong; what would then be the driving force behind the results of European action? The green technology revolution is an opportunity for Europe to dominate an important vector of the future and regain its position in the global stock markets.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)