Saxo Bank Q3 Predictions: Nervous summer before elections in Germany

As we enter the third quarter, the market will increasingly focus on the risks of US stimulus decay, even though some consumer savings may contribute to a reasonable, albeit inhibitory, growth for this quarter. As a result, while awaiting what we believe will turn out to be the main macro event this year - the general election in Germany on September 26 - we are wondering whether the US dollar "swing" will end with a return of the USD to strengthening and persistently staying at a solid level after a weak second quarter.

About the Author

John Hardy director of currency markets strategy, Saxo Bank. Joined the group Saxo Bank in 2002 It focuses on providing strategies and analyzes on the currency market in line with macroeconomic fundamentals and technical changes. Hardy won several awards for his work and was recognized as the most effective 12-month forecaster in 2015 among over 30 regular associates of FX Week. His currency market column is often cited and he is a regular guest and commentator on television, including CNBC and Bloomberg.

The comparison with the swing stems from the fact that the USD hit a bottom at the very beginning of QXNUMX, then appreciated, and then remained on a sell-off for most of QXNUMX. All in all, dollar bears may remain tramped even into QXNUMX, provided things take my expected turn. At the same time, as the fourth quarter approaches, hope for new fiscal stimulus will grow in the United States; the more it will apply to Europe, as we are facing elections in Germany and decisions on the future of the European Union.

EUR: Can we already go to the fourth quarter?

In Q26, Europe will nervously follow German polls as the date of the key general election, September XNUMX, approaches. These elections will end Angela Merkel's era and usher in a period in which either Europe will slowly move towards a new crisis, or Germany will commit fully to a European project with a climate-driven solidarity agenda and wide-ranging fiscal stimulus, especially if the Greens win majority of votes, and their president, Annalena Baerbock, will become chancellor. The polls show great volatility: at some point in May the Greens gained a clear advantage and then lost it in June; however, there is still a lot of time before the elections.

For Europe, the stakes are exceptionally high due to the EU's lingering "original sin", a challenge of many sovereign countries linked by a single currency and a single central bank. Both the EU and EBC responded to the Covid pandemic by implementing a dramatic series of countermeasures and deviating from fiscal rules that de facto they were the glue of a whole specific EU project. We even witnessed the first real EU bond issue, even if its scale was relatively small. However, in addition to the initial wave of fiscal measures and the lifting of fiscal restrictions, as well as outside the new round of quantitative easing by the ECB under the Pandemic Fallback Program (Pandemic Emergency Purchase Program) pandemic emergency purchase program, PEPP), the EUR 750 billion reconstruction fund is pennies compared to what is needed to fully recover the strangling emerging economies, in particular in the EU periphery, and to allow them to dig out excess debt and sustain their willingness to engage into the European project. The strong commitment of all EU Member States, the resolution of traditional banking problems, harmonization of reforms and large fiscal expenditures combined with an increasingly high yield curve and positive long-term bond yields across Europe could trigger a groundbreaking recovery in the euro area after the German elections, as long as this path will be chosen.

USD: The dollar bears in limbo until Q4

As I wrote in my forecast for QXNUMX, the greatest hope for the dollar bears would be a slowdown in US long-term bond yields - as well as key real long-term bond yields - which marked most of the first quarter. In the forecast for the second quarter, we wrote: "(...) the fastest way to resume the depreciation of the USD would be a situation in which the yields of US long-term bonds would cool down for some time and not rise significantly above the cycle highs established in the first quarter, even if the risk appetite and an opening of the economy would still show solid economic activity and improvement in employment in QXNUMX ”. Such was the course of the depreciation of the USD; US long-term bond yields did not so much cool down as remained within the range throughout the quarter, while in the EU or UK, for example, yields tested new highs, causing the pound sterling and the euro to strengthen solidly against the dollar.

However, with the past few months, it's downright unbelievable that the US dollar hasn't plunged any further. We faced unprecedented US dollar liquidity as a result of bailout checks and the US Treasury's rapid reduction of the Fed account, which put US Treasury yields down as liquidity sought a starting point as banks wanted to avoid the associated expansion of their balance sheets. . Simultaneously Federal Reserve she seemed determined to ignore the white-hot economy and inflation. If the USD is no longer able to depreciate against the developed-market currencies under such conditions, when would it be?

In QXNUMX we are unlikely to see new bailouts or significant outlays to stimulate the economy, and infrastructure spending packages seem to shrink with each round of negotiations between the two parties after Biden's attempt to impress them with several trillion dollars "Plan for American families" i "American Jobs Plan".

In addition, on June 9, the weekly settlement of the general treasury account amounted to just $ 674 billion, compared with over $ 1,7 trillion in mid-February, so the process is roughly 80% complete. However, in QXNUMX, as economic recovery slows down, hopes for new fiscal stimulus will rise. By QXNUMX, Fed talks to curb asset purchases may even turn towards admitting that the Federal Reserve may actually be forced to increase asset purchases to fund U.S. government operations if a new series of regular bailout checks are turned into a kind of unconditional basic income. (BDP), possibly already in the fourth quarter.

Our aid check forecast could be either too aggressive or too cautious, hard to say. American policy from the beginning of Biden's term of office is definitely complicated. Former President Donald Trump was the epitome "Help Lord" and in the last days leading up to the November elections, he tempted potential voters with the idea of $ 2 bailouts - this project was in fact implemented in the first months of Joe Biden's presidential term as part of the American rescue plan, when Biden increased the current value of bailouts ($ 000) by another $ 600. And now the Republicans turn out to be in favor of curbing the fiscal stimulus? I do not think this position of the Republican Party is sustainable - if there is something to be won in the fight against taxes, opposition to fiscal stimulus when the economy slows down is doomed to failure. A probable narrative justifying another significant weakening of the USD may be the awareness that "permanent incentives" will contribute to an even greater reduction in US real interest rates, possibly even in Q1.

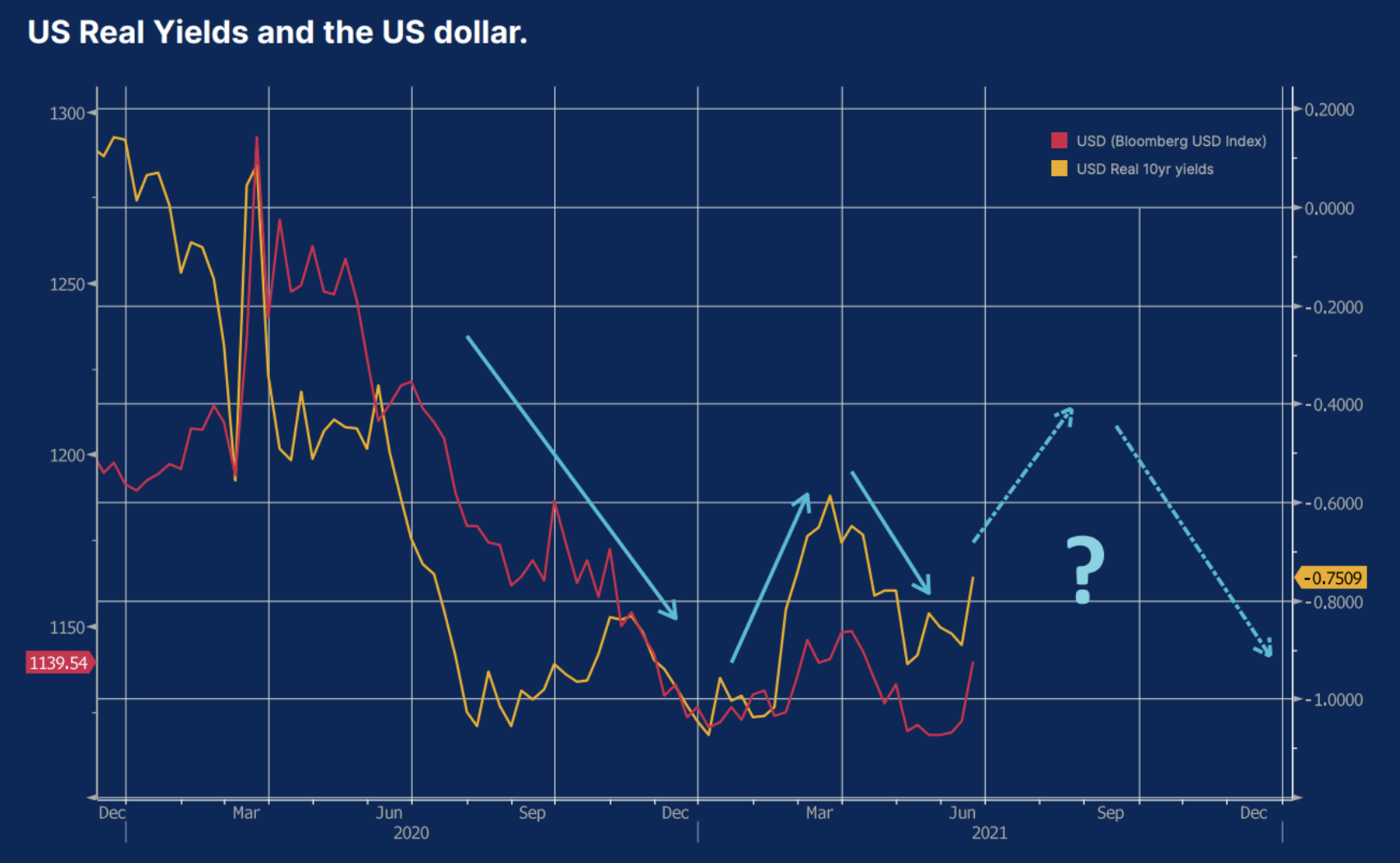

From the second half of 2020, the US dollar exchange rate was one of the factors influencing real yields - presented in the chart below as real yields on ten-year US bonds (benchmark in the form of US ten-year government bond yields minus the market valuation of ten-year inflation expectations). In late 2020, as the market priced in real yields even lower amid the eventual sharp rise in inflation as a result of generous US monetary and fiscal stimulus, and after showing promising vaccine results in early November, the US dollar depreciated. USD rose in QXNUMX on the anticipated opening of the economy and the fact that nominal yields grew even faster than inflation expectations. In QXNUMX, the USD depreciated again, as inflation expectations were surprisingly dropping faster than nominal yields, while actual core inflation reached the highest levels in several dozen years. However, as we highlighted, low yields can be a misleading sign of excess liquidity in the US financial system; its reduction may begin in QXNUMX, even before the reintroduction of fiscal stimulus in QXNUMX, which is likely to lower real yields and weaken the dollar.

Other currency issues in the third quarter

JPY: Could real yields even matter?

In Q18, we highlighted the risk that low yields in the EU and Japan could jeopardize the EUR and JPY as these currencies may remain weak due to the control of the yield curve - in Europe indirectly through extensive asset purchases by the ECB, while in Japan more directly as the country continues to pursue its yield curve control policy. However, the performance of these two currencies in the second quarter turned out to be radically different. The fact that US yields stopped growing and yields in the EU even attempted to increase despite the ECB's hard control over the market significantly strengthened the euro. At the same time, the JPY remained relatively weak in Q19, despite the fact that US government bond yields remained within the range or fell after the Japanese central bank decided to adopt a clear corridor following a less dramatic policy review at its March 0,25-XNUMX meeting. profitability (within XNUMX%, both positive and negative for ten-year treasury bonds). Meanwhile, the QXNUMX CPI reading continues to show that inflation in Japan is non-existent and therefore real yields are stable - solid fundamental support given that worldwide real yields are plunging, particularly in the United States, where there was a sharp an increase in inflation. A variation for traders of the Japanese currency may be higher yields in other areas and very strong credit spreads for emerging market currencies with higher yields in QXNUMX, but we hope that at some point in QXNUMX the JPY will start to be popular again and eventually become more popular. maybe even more in QXNUMX due to continued solid real yields.

AUD, CAD, NZD and NOK

Here, it may be necessary to revise the narrative of economic recovery for most of the third quarter. These currencies may perform neutral or downright as only the CAD managed to initiate a solid rally in the wake of a further rebound in oil prices in QXNUMX, even though the Canadian central bank's decision to limit asset purchases was a key factor in much of the recent appreciation. The potential appreciation of the AUD is hampered by tight monetary policy and deleveraging in China, not to mention the direct confrontation on geopolitical issues, as a result of which the Middle Kingdom stopped importing some goods from Australia, including coke.

Emerging market currencies - much more selectivity

Emerging market currencies have provided a breath of fresh air in recent months as performance varied considerably. The ZAR has been the strongest emerging market currency in the last 12 months, in part due to a significant increase in platinum production along with a significant increase in the price of the metal. MXN also performed well, and the current accounts of both countries have clearly turned positive in recent quarters, moreover, during the elections in QXNUMX, the mandate of the left-wing president Mexico was limited.

In the case of other currencies, government action or fear of such action deterred investors, despite strong support from commodity prices. CLP, and PEN in particular, reported weak performance due to concerns that the planned comprehensive taxation of copper producers would halt investment inflow. The BRL and INR reacted idiosyncratically to the rise in Covid infections, with the Brazilian currency still appearing attractive in terms of valuation compared to MXN or ZAR, even after a very solid rally from the lows. TRY, on the other hand, is ridiculously cheap and could be ready for a rebound if Turkish political leaders and central bankers are able to renew confidence in their policies.

All in all, emerging market currencies may face further problems in QXNUMX as US yields are likely to rise as a result of weaker liquidity and talks on limiting asset purchases, which could mean a strengthening of the US dollar. QXNUMX reminded us, however, that emerging markets are dominated by various topics and specificities - as opposed to monolithic transactions carry in emerging market currencies many years ago.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)