The TerraLuna project is collapsing? The LUNA cryptocurrency has already lost 99,7% of its value

It was supposed to be to the moon, and the course was at the bottom. TerraLuna (LUNA) won't get up anymore? A disaster in the cryptocurrency market. It was supposed to be a revolutionary project, allowing for passive income and expanding the blockchain world to the fields of the traditional economy. And it seemed that it would be like that for a long time, until an unexpected crash came - Luna tokens worth $ 119 a month ago can be bought today for 4 cents. And their price keeps falling. The project's Stablecoin also seems to be impossible to save, despite the emergency that USD 1,5 billion was pumped into it.

Eldorado - this is what some traders called the Terra environment, which for many months allowed for above-average profits. The possibilities were endless. Let's start with the fact that the price of the project's flagship token itself was growing - MOON FABRIC. In the peak on April 5, 2022, it was paid $ 119,56. When this text is written, there are few takers who give 8 cents apiece.

You could also make money from the liquidity pools - interest rates of 70-100% per annum were not uncommon there.

Plus my own stablecoin - EarthUSD (UST) - which could be secured and downloaded some 20% in the Anchor protocol - also with its own utility token. For dessert, cryptocurrency loans - for those who want to take them and earn money on the market, as well as for those who provide and take certain interest.

And everything burst like a soap bubble in literally a few days.

READ: Rafał Zaorski earned USD 10 million on the decline in cryptocurrencies, incl. sorting Luna

How did the attack on TerraLuna come about?

OnChainWizard, which tracks the biggest bloopers on blockchain market, has just published an analysis which shows that Behind the downturns and shattering of the entire system is an attack that has been planned for months.

It was supposed to start at the end of March. Then the Luna Foundation Guard (LFG), the entity responsible for maintaining the stability of the network, started buying Bitcoinyto support UST. The accumulation of BTC allowed to accumulate over $ 1 billion in Bitcoins in just a few days.

On April 1, however, liquidity in the market decreased, and at that time the attacker was to borrow 100. BTC at an average price of 42 thousand. USD. And immediately set up a huge short of around $ 4,2 billion. Previously, he collected UST - and he had them for around $ 1 billion.

When the market - similarly to the stock exchanges - started to turn red, he launched the final attack. He started selling UST because it had approx. 1/17 of the total market capitalization, which translated into a decline in the peg (i.e. the 1: 1 rate to USD), and, as a result, into panic and further sales. In short: he pushed a snowball from the very top, which took a real avalanche with it. And he left it, according to unofficial calculations, with a profit of about $ 815 million.

The biggest ones managed to escape, the street was hit - as usual

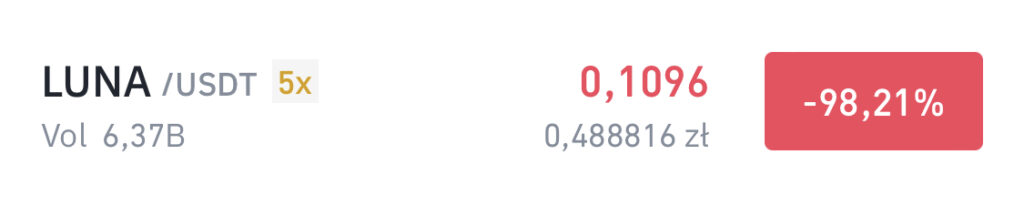

We know the rest of the story: the network has been overloaded, UST withdrawals have been suspended (on Binance Stock Market this cannot be done until now), stablecoin ceased to be a stablecoin as its price was unsustainable and fell to $ 0,45. Luna's valuations also dropped dramatically, and the rest was completed with Stop Losses and algorithmic trading. Algorithms chased the trend, accelerating it to absurd proportions. As a result, Luna lost even 98% of the price during the day. This caused the same reaction to virtually the entire market, all cryptocurrencies were hugely discounted.

Interestingly, millions of dollars were paid out of the Anchor Protocol by the biggest players literally right after trouble started and before the biggest drops.

TERRA chart (CFD on LUNA token), interval D1. Source: XTB xStation.

Today, there is talk of the complete withdrawal of Luna tokens and all associated with it from the Binance exchange. A week ago, you could buy them with one click from a Polish credit card. Currently, there is no such possibility.

The chances of digging out from the bottom are also not conducive to laconic announcements To Kwona, the creators of the system who first wrote that he liked chaos, then that he was close to announcing a recovery plan, and recently that "in a moment". During this time, Luna's price plunged by another tens of percent. So maybe the point is that the tokens will be for free in a moment. It is a pity that the entire cryptocurrency market suffered due to the carelessness (a gentle word ...) of his team, and trust in him may have to be rebuilt for years.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)