Tug of war in the financial markets continues

On the day of the biggest attack on American democracy in modern history, the S&P 500 and Russell 2000 indices hit another record highs. We all know that it is difficult to follow the market narrative during the Covid-19 pandemic, as well as expectations for an effective vaccine and economic recovery. In this analysis, we attempt to summarize the advantages and disadvantages of the stock market at the current stage, after an intense boom on most global stock exchanges.

This list is neither final nor exhaustive, rather a set of guidelines based on my thirty years of market experience as a macro veteran, as well as on that of our younger millennial star, equity strategy specialist Peter Garnry.

About the Author

Steen Jakobsen, Chief Economist and CIO Saxo Bank. Djoined Saxo in 2000. As a CIO, he focuses on developing asset allocation strategies and analyzing the overall macroeconomic and political situation. As head of the SaxoStrats team, Saxo Bank's internal team of experts, he is responsible for all research, including quarterly forecasts, and was the founder of Saxo Bank's outrageous forecasts. Before joining Saxo Bank he cooperated with Swiss Bank Corp, Citibank, Chase Manhattan, UBS and was the global head of trade, currency and options in Christiania (currently Nordea). Jakobsen's approach to trading and investing is thought-provoking and is not afraid to oppose consensus. This often causes debate among the global market community. Every day, Jakobsen and his team conduct research in various asset classes, covering major macroeconomic changes, market movements, political events and central bank policies. With over 30 years of experience, Jakobsen regularly appears as a guest at CNBC and Bloomberg News.

This analysis is based on the US markets as they are the largest in size and liquidity and the US has the strongest fiscal and monetary potential. Please note that the Saxo team is not primarily concerned with predicting the next 10% of the market or swing trades, but providing information and feedback on pricing, fundamentals and market structure. We believe that at this point the market offers more risk than profits, however this is only our opinion and our timing and analysis may be wrong, so we present the arguments observed and heard on both sides of the market.

Arguments for a further bull market

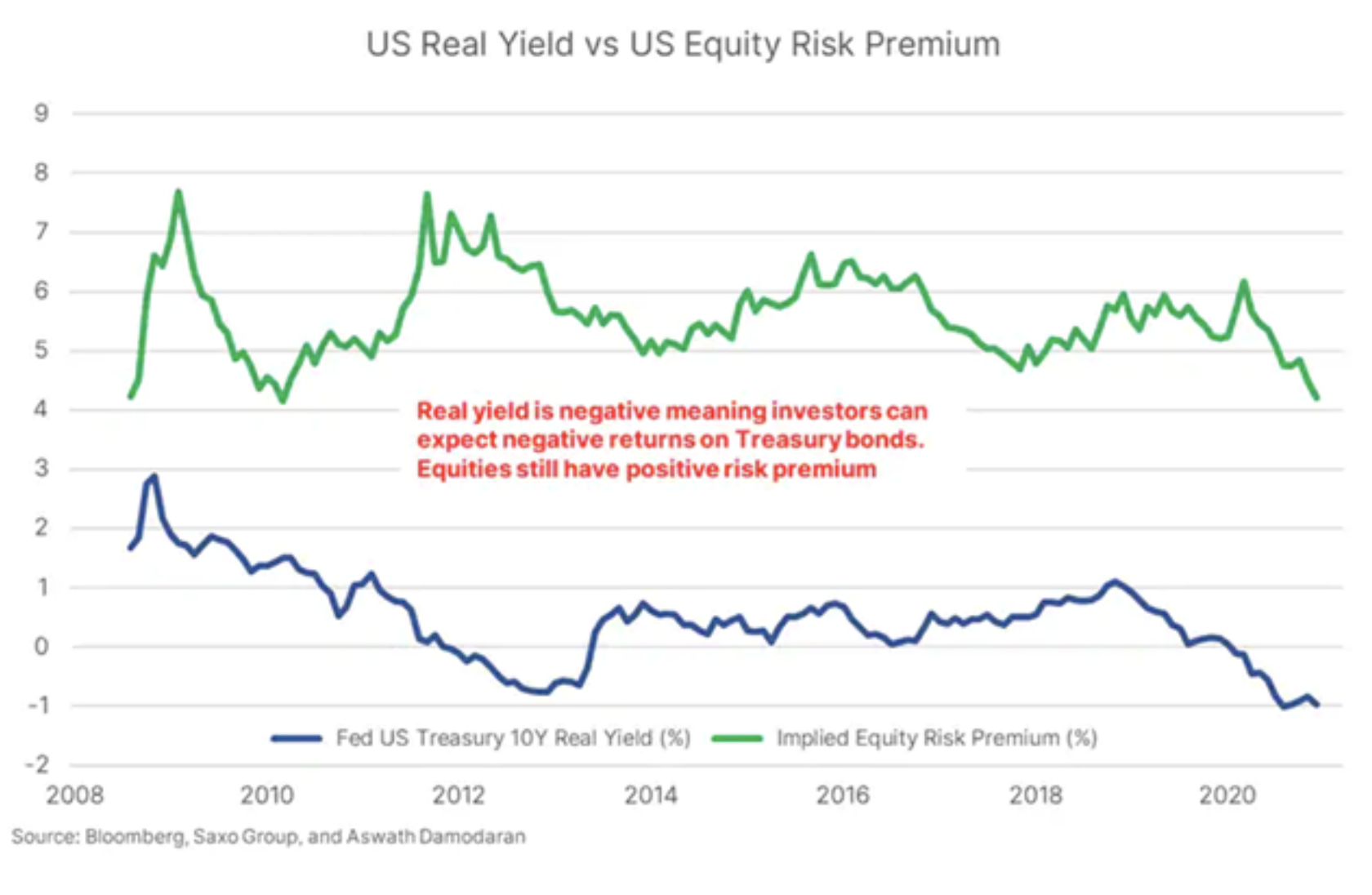

- Asset allocation: Only one asset class offers a positive risk premium: shares (and equity related instruments).

- Monetary policy: The Fed says the next rate hike will take place in 2024 at the earliest, and the scale of quantitative easing support is “all it is possible” until unemployment is minimized.

- Fiscal Policy: President-elect Biden speaks of $ 3 trillion in incentives; in this case, the current level of US fiscal spending (20% + GDP) will be sustained for at least the next two years.

- Insurance policy: Fed and the government will protect investors until unemployment is minimized, defined as at least the pre-pandemic level.

- Vaccination initiation: normalization in markets, engaging accumulated savings for economic recovery, profits and growth.

- Technical aspects: the market continues to rebound, finds support from technical levels such as the Well Moving Average.

Arguments for the bear market

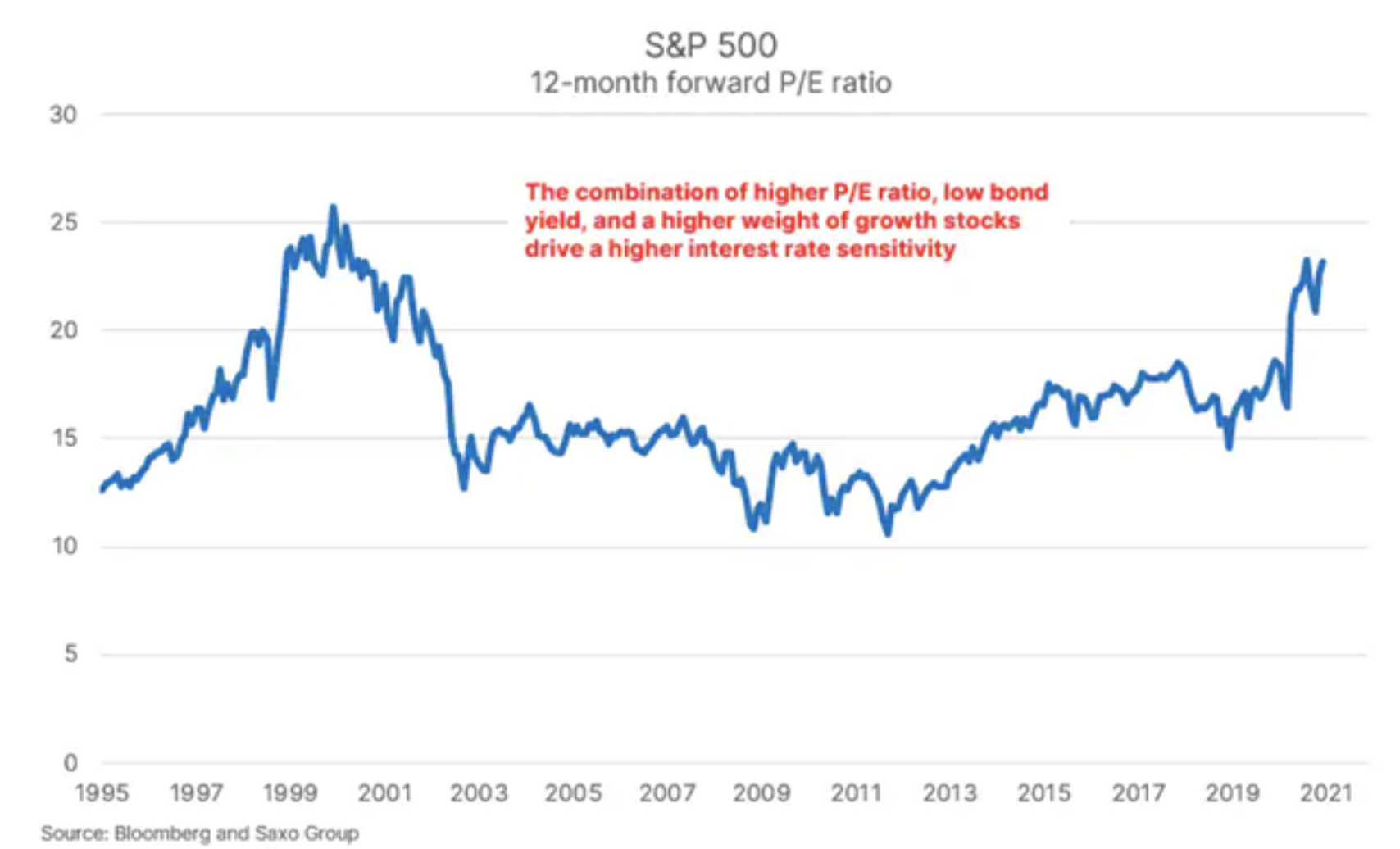

- Rate sensitivity: In a world of pandemic constraints, underinvestment in physical infrastructure and curbing inflation through monetary policy, there are risks associated with rising interest rates, even if it would originally only affect the longer end of the curve. The Saxo Strats team sees the risk of higher-than-expected interest rates greater than ever, and with it the threat to the equity market with the risk sensitivity of tech stocks and non-profit speculative stocks. The leverage-profit ratio has never been so high.

- Valuation: Previous measures are currently not applicable due to near-zero interest rates and unprecedented interventions by central banks. The valuations are high, extremely high. For some companies - astronomically high. The market "loves" companies with no profits or transparency, because compared to the "real world" of profits, they bear no consequences. It's just a narrative, or a story-telling, and who doesn't like Andersen's fairy tales?

- Real economy: The real economy mismatch with markets will become a problem. The stock market is a subgroup of overall GDP; it can outgrow it, but it is limited by the state of the general economy. We believe that inequality will be a political factor resulting in the misallocation of funds to government promoted projects such as renewable energy. Governments are renowned for being misallocated, and the government's share of the economy is growing everywhere!

- End of cycle. Time! Perhaps it is simply time to end the cycle - remember that the stock market boom in the last two years was not supported by profits or an improvement in productivity. Long-term payback is based on innovative productivity and profit. The market is only fed by cheap money.

- The assault on the Capitol on January 6, like the attacks on September 11, was a historic turning point for markets and the open fiat money model. A frontal attack on democracy seeks to undermine property rights and the rule of law, the foundations of our rich culture, education and society. 50 years ago - in the 70s - we moved away from the gold parity, China opened up to the world, we discovered our dependence on energy, we renounced excessive government involvement in the economy and terrible haircuts. Currently, we are striving to close our relationship with China, the fiat money cycle is reaching its terrifying end, we are replacing fossil fuels with renewable sources, and there is less and less hair on our heads.

A more detailed discussion of the most important arguments is presented below.

List "for"

Asset allocation

Analyzing the stock market from an asset allocation standpoint means asking yourself what is the potential return over time from owning an asset, a stock, and how does it rank against the alternative?

The risk premium on NASDAQ equities is 360 basis points compared to the "risk free" premium of -100 basis points real US XNUMX-year government bond yields. Negative real profitability is the way the US forces us to stay long in the stock market because stocks are the only asset class at the moment offering a positive risk premium. This is due in part to the fact that we currently have more savings than in previous cycles and we need to invest these resources. This means that stocks are becoming the preferred investment, and with them instruments related to shares, such as private equity, SPAC or corporate bonds. If you are in financial planning, the only way to ensure a positive return is to invest in the stock market.

Monetary and fiscal policy framework

Really, this means questions: what is the price of money and for how long? How much money will the government use to increase or protect demand? Finally, how willing are governments to save risk-takers in case things go very badly? The answers to these questions are simple: the price of money is de facto zero, and this will continue until 2024, if you believe the US central bank - the Federal Reserve.

In 2020, the government spent an average of 10-30% of GDP on supporting growth; in the years 2021-2024, this support will continue, but eventually it will drop to an average of 3-8%, although at this point the scale and time horizon of Fed intervention in the markets (the so-called Fed put) or risk-free guarantee are unlimited, at least until employment returns to pre-pandemic levels.

Vaccine

Everyone hopes that immunization against Covid-19 in 2021 will enable the real economy to normalize and increase profits, employment and margins. The risk comes with the possibility that new mutations in the virus will hinder our efforts to restore normality with a first-generation vaccine.

"Against" list

Sensitivity to the level of the feet

Some of the largest U.S. publicly traded companies now act as bond brokers due to earnings stability and low government bond yields. As US tech stocks dominated the stock markets during a period of low yields, sensitivity to interest rate levels increased. According to our simplified calculations, a 100 basis point change in US yields could mean a 15-20% drop in the market solely as a result of future cash flow revaluations. For technology stocks outside the Nasdaq 100 index, for which the level of speculation and valuation is higher, the sensitivity is even greater. The corporate debt-to-GDP ratio increased from 46,2% in December 2019 to 51,5% in December 2020, significantly exceeding the levels in the years preceding the global financial crisis. This means that the entire US private sector may come under financial pressure as a result of much smaller interest rate movements, creating chaos in the markets.

Valuations

Over the past decade, many concepts regarding macroeconomic policy, monetary policy and financial markets have been thoroughly reformulated. The thesis that the higher the value of an asset at the time of investment, the lower the value of its future return will be, the closest to the "law of investment". The valuation multiplier of US stocks for the next 12 months is currently 23,2. This level brings us closer and closer to the December 1999 peak valuation of Internet companies, which is the projected profit growth multiplier of 25,7 over the next 12 months. Monetary policy has forced financial markets to enter one of the largest bubbles in history, and although timing is difficult, history suggests future returns will be low and at some point the speculative feedback loop will lose momentum when investors stop buying. Knowing the valuation levels of the internet bubble and the low predicted returns may at some point reach a psychological turning point where the general public will turn 180 degrees, and then escalate.

Social inequality / disconnect with the real economy

For forty years, politicians and companies have optimized GDP growth and profits at the expense of society and the environment. This doctrine was at the root of globalization, lower prices, less union involvement and zero wage growth for the bottom 50% of society, and healthcare costs overwhelmed the middle class. This led to the rise of the "Trump movement" and to an epic boom in stock markets due to the enormous spike in globalization gains and advances in technology. At the same time, however, it caused a growing gap between the financial markets and "gray citizens". Inequality has been at its highest since 1929 and there is no end in sight. Unless politicians target the bottom 50% of the population in Western countries - most notably the United States - history shows that civil unrest will only worsen until wealth and income levels are equalized by force rather than by peaceful means.

Wnioski

There are many arguments for both a bull market and a bear market. We believe that 2021 will offer investors tremendous opportunities and profits, but you should be aware of what stage of the cycle you are in, carefully manage your funds, choose the size of your trades and remember that profits are, to some extent, a matter of luck. We wish you all the best in 2021

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)