Recipe for the Bomb: Near Zero US Bond Yields and Inflation

"The Federal Reserve is taking aggressive measures to stabilize our financial system and support economic activity. At some point, however, we will have to start withdrawing from the accommodative policy in order to prevent inflation from rising in the future"- Ben Bernanke December 6, 2009

When I returned to work, I saw the above quote in the latest presentation by our investment director, Steen Jakobsen, and I was immediately struck by its ironic tone. Policy implemented by the American Federal Reserve from the time of the global financial crisis to this day it does not seem to definitely solve the problems of the financial market. In fact, it gave rise to a new problem: the market became too attached to the Fed money - so much so that it became even dependent on it.

About the Author

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

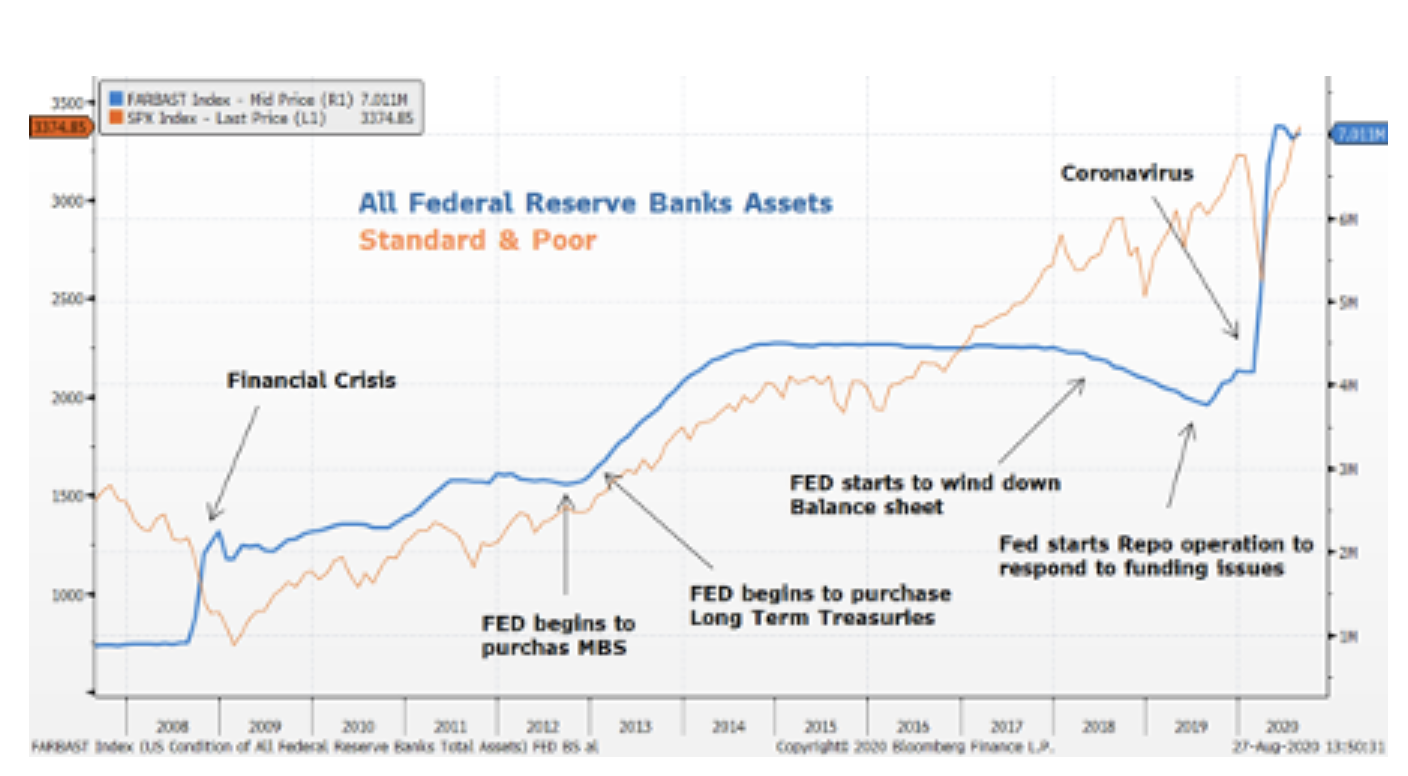

We can spend a whole day talking about balance sheet normalization; in practice, however, it can be seen that the Fed's balance sheet reduction a year ago was not, is not now, and most likely will never be feasible. In fact, just a few months after the Fed began reducing its balance sheet in 2018, liquidity problems arose in the market. The central bank was thus forced to turn 180 degrees and abandon standardization to lend support to the market again.

A pandemic broke out immediately after that.

Investor concerns, coupled with the Fed's expansion of the stimulus package, led to US government bond yields falling to historically low levels.

At this point, investors may ask themselves if it makes sense to buy US Treasury securities at near-zero yields.

The answer is simple: it all depends inflation.

1. Yes, it makes sense to invest in US Treasury bonds at current yields.

Supporters of US Treasuries express the view that the consequences of the pandemic will be deflationary pressures, not inflationary pressures. At this point, the only option for the Fed is to take a more aggressive approach and further stimulate the economy.

There are many indications that investors who believe in lower or negative government bond yields may be right. For example, even if "Positive news" cause a temporary spike in the stock market, there are signals in the fixed income market that investors are on the verge of breaking. As you can see in the chart below, US XNUMX-year swaps are still in high demand, even though their price has remained in a tight range since the high volatility in March / April this year. A larger spread of Treasury swaps signals a risk aversion, which translates into an increase in demand for securities that are a safe investment, and this ultimately contributes to a decline in US Treasury yields.

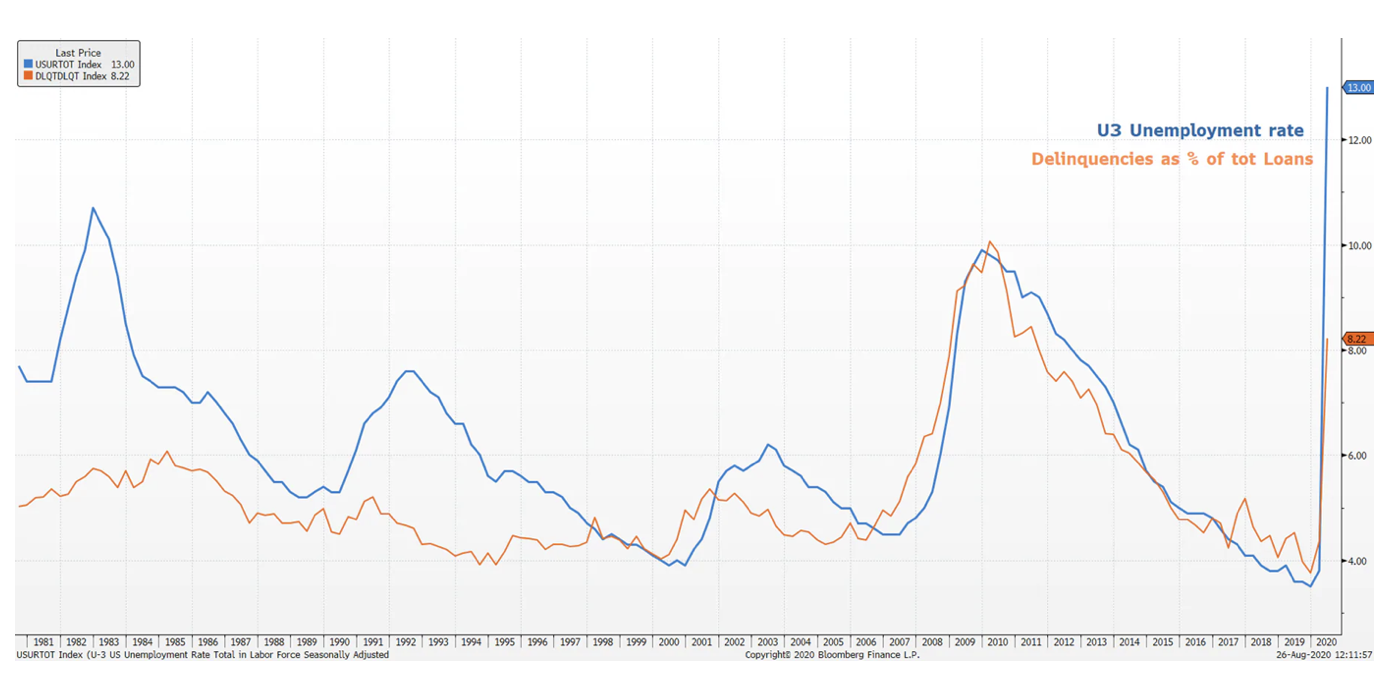

There is nervousness in the marketplace; worse, you can expect negative news. As can be seen in the chart below, during the global financial crisis, the growth rate of credit arrears was in line with the growth rate of unemployment. However, after the outbreak of the current pandemic, credit arrears have not increased as fast as unemployment. It could be argued that the Fed's response to the coronavirus has sufficiently limited the shocks to the system. However, it is possible that the arrears growth rate is lagging behind. In this case, as the arrears increase, investors will rush to safe investments, which will further lower US interest rates.

With regard to European government bonds, it can be said that in many cases interest rates are negative. Therefore, taking into account the uncertainty in the market, the decline of US yields to negative values is only a matter of time.

But what if inflation gets out of hand?

2. No, it doesn't make sense to invest in US Treasury bonds at current yields.

In our opinion, one should take into account the possibility of a sharp increase in inflation. As Steen Jakobsen recently explained, what distinguishes the current situation from the 2009 Fed stimulus program is that one central bank's role today is to finance the fiscal deficit. This puts pressure on an increase in inflation, and in combination with other tools already implemented, this effect is even more pronounced.

In the event of a spike in inflation, investing in Treasury securities at near-zero yields is a fatal mistake, as inflation would quickly eat away any gains and savings.

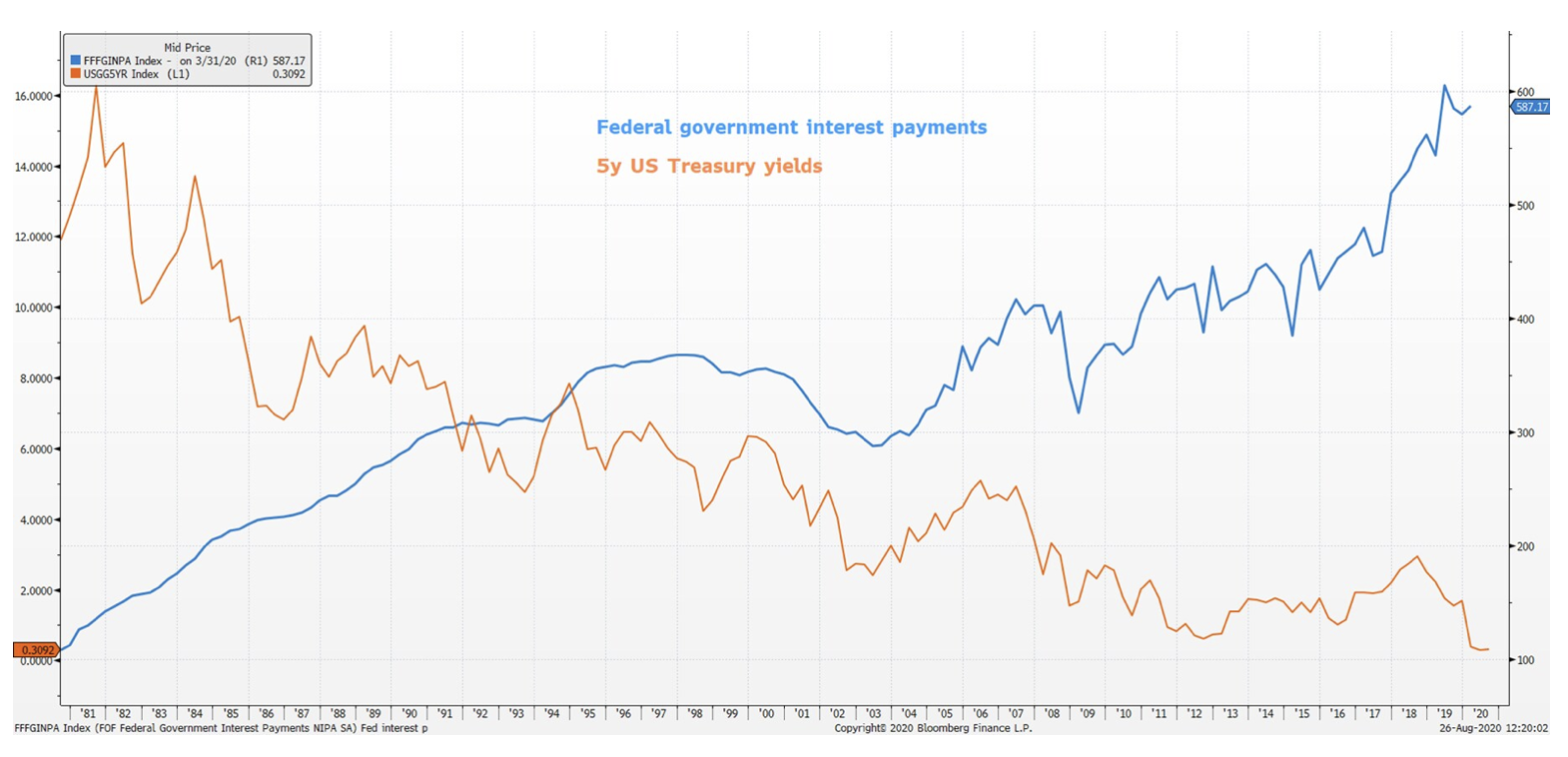

I would like to point out an interesting fact. If inflation gets out of hand, you might think that the only solution for the Fed would be to raise interest rates. However, you can see in the chart below that the Fed may not be able to raise interest rates at all! Indeed, while US Treasury yields have fallen steadily since the 80s, the cost of servicing the federal government debt has increased due to the greater amount of debt securities issued by the government and accumulated over the years. In other words, the US Treasury may not be able to afford higher interest rates!

Summation

I believe investors should consider their investment horizon and investment objectives before investing in Treasury securities at such low yields. In the short term, as long as inflation remains moderate, an investment in Treasury securities may make sense, but for long-term investments, diversification with inflation hedges is key.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)