Bear trap - how not to get caught in it

The bear trap is one of the most important formations, which we often deal with on the foreign exchange market. It happens that traders can be caught in this type of play, and consequently they lose their capital. Formation of this type tempts unconscious traders to enter the short position, followed by a violent reversal against them. In this article, we'll take a closer look at it and present some tips to avoid falling into the bear trap.

Be sure to read: Bollinger Bands - How to use them in everyday trading

Genesis of formation

In order to understand how a bears' trap is created, it is necessary first of all to look at the flow of orders on the market, how individual traders plan and how they perform their transactions. The next step is putting yourself in the situation of a layman, who in most cases can be caught on specific market events:

- The price moves in a long downward trend, without major adjustments. The price moves in a long downward trend, without major adjustments. Beginners usually assume that they have already missed a given trend. There is frustration and nervousness, which results in the fact that they are looking for a way to enter the position at all costs.

- The second type of situation is swing movements. Very many traders use them directly to plan their entry time. During the downward trend they enter the short position immediately after breaking the designated, key (according to them) level.

The main problems and causes of falling into the described trap is that trying to catch a long-lasting trend, traders simply in the world they enter the position too late. In such cases, we are dealing with the age-old law of moving the market. Inexperienced beginners invest in a short position, and professionals do nothing else to buy, absorbing sales orders. In the presented example, if the trader realized what is currently happening on the market, it was still possible to join re-test. Often, however, the price shoots sharply up, knocking out sellers' defensive orders and there is no way to connect to traffic.

An example of a bear trap, ROPA D1. Source: xNUMX XTB

Tips to avoid formation

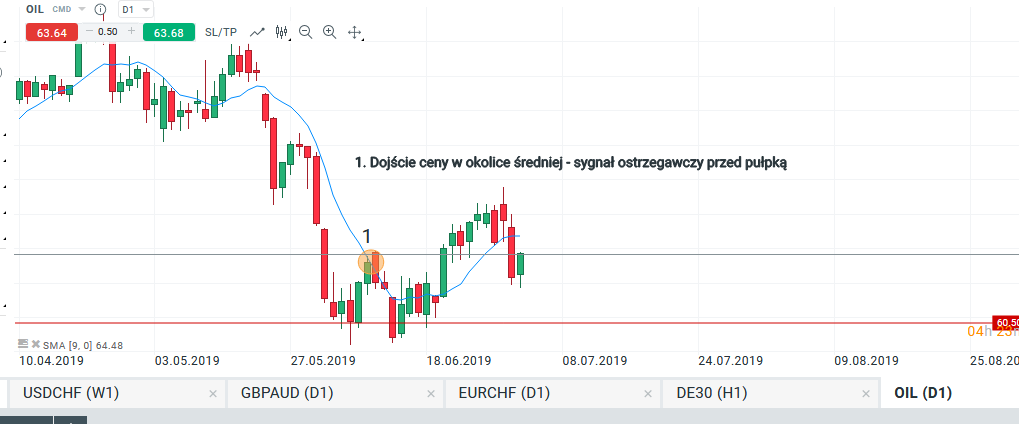

The key to not falling into this type of market event is above all avoiding late entry into a mature trend, and chasing the price. Of course, one should keep a certain balance. It is not said that all breakouts by swing candles are worth nothing and are not a good opportunity to trade. It should be remembered that after long periods of the trend, be careful and properly read the warning signals coming from the market. One of such signals, which often appears before the discussed the trap is the growth impulse. It raises the price strongly up, possibly leading to the middle moving area.

Example of a warning signal, ROPA D1. Source: xNUMX XTB

It is also worth, no matter whether in relation to the discussed formation, try to seek a market advantage, to always be this "good" side of the market. Everything comes with experience. As time goes by, when analyzing charts, it is much easier to pick up certain things, the ground is consistency and determination.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Wyckoff's three laws on current charts - Mieczysław Siudek [Video] Wyckoff's three laws on current graphs](https://forexclub.pl/wp-content/uploads/2023/05/Trzy-prawa-Wyckoffa-na-aktualnych-wykresach-300x200.jpg?v=1684310083)

![Grzegorz Moscow - Ichimoku is not everything. On trader evolution and market analysis [Interview] gregory moscow ichimoku interview](https://forexclub.pl/wp-content/uploads/2022/12/grzegorz-moskwa-ichimoku-wywiad-300x200.jpg?v=1671102708)