Rally on GameStop - it was close to bankruptcies of brokerage houses

Hearings are underway about the stocks of small investors driving the price up insane GameStop shares, contrary to what the financial institutions, which were betting on declines in stocks, expected #GME. Thomas Peterffy, founder and president of Interactive Brokers Group, has just admitted that his company - and several others - were close to bankruptcy.

As a reminder: when the news came out that large funds were betting on drops in the GameStop share price, which began to have liquidity problems due to the pandemic, there was an uproar on the Reddit online forum. However, it did not end only with complaining and reconciling with fate as well as with the information that large capital rules the world. Small investors decided to take the matter into their own hands and by buying stocks to raise the selling price of the company's video games and beat the big players' noses in the process. And everything indicated that they succeeded.

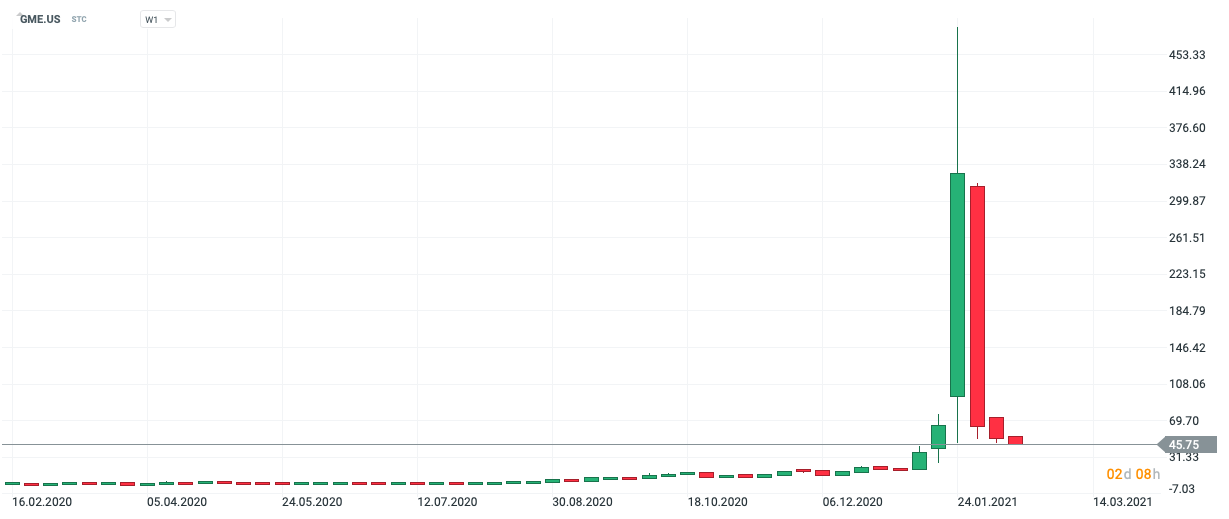

In September 2020, GameStop shares were traded at $ 11. After the Internet users' action, the price shot up and even broke the barrier of USD 480 per share. Half the world shook their fingers and cheered on individual investors who managed to win with the big fish. But is it really successful? During 6 sessions the rate from the established peak fell by ... -89,51%. And then news came out that there was more and more evidence that it was the Wall Street bigwigs who were pulling all the strings. The investigation into this matter has already been initiated by the American financial supervision and thanks to it, other interesting facts have come to light.

There could be bloody dominoes in the industry

Investigation SEC It started with an interview of representatives of brokerage houses, investment and hedging funds by the US Financial Services Commission. And on the very first day, a real information bomb was detonated. It turns out that we were just one step away from the great chaos and the disgusting financial crisis that followed.

“We come dangerously close to the collapse of the entire system. And I do not mean only my company, but even the entire industry " Thomas Peterffy, president of Interactive Brokers Group, told the committee. “- Many brokerage houses may have gone bankrupt because they had to immediately raise margin requirements. This translated into the limitation of trading in some instruments, and, as a result, chaos in the entire market. If it took longer, the bankrupts would start the industry's bloody dominoes " - told Thomas Peterffy.

In three days to bankruptcy

The president of Robinhood, Vlad Tenev, is of a similar opinion:

"What we experienced last month was extraordinary and the trading limits we introduced on GameStop and other stocks were necessary to enable us to continue to meet the deposit requirements to the Clearing Houses that we pay to support clients trading on our platform" - admitted Vlad Tenev.

It turns out that the daily risk factor at Robinhood has increased sixfold. While on January 25 this year it amounted to USD 202 million, three days later it was estimated at ... USD 1,4 billion! Vlad Tenev, when asked what would happen in the next three days if the growth continued, only shook his head.

There were funds that were earning

Not all Wall Street bigwigs have lost to GameStop, however. There were also those who made money. For example the Senvest Management fund, which in January earned ... USD 700 million on GameStop shares. GameStop bought shares four months earlier, paying an average of $ 12 per share. Recall: in January they could be sold for 400 or even 480 USD. Now the fund managers say it was just one of many successful investment decisions. Currently, the stock is valued at around $ 45.

GameStop stock chart, interval W1. Source: xNUMX XTB.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response