BIS report: Daily Forex trading increased to 6,6 trillion USD

Daily turnover on the Forex market increased to a record level of USD 6,6 trillion, the Euro-dollar gained in popularity, and currencies were most actively traded in… London. The Bank for International Settlements in Basel (BIS) has published a report on the currency market covering the period 2016 - 2019. What else will we find in it?

What is the BIS report

The BIS report is published every three years, continuously since 1986, and is considered one of the most important sources of information on the condition of the Forex and OTC market. This study illustrates not only its size and turnover, but also its structure. Triennial Central Bank Survey, because this is the name of the document, aims to increase the transparency of OTC markets and help central banks and other authorities and market participants monitor changes in global financial markets.

The latest report contains the results of a currency trading survey from 2019 that concerned central banks and other bodies in 53 jurisdictions. In total, data from nearly 1300 banks and brokers were collected and based on them, aggregated global data for the years 2016-2019 was calculated. Although the latest report appeared in mid-September, it includes data until April this year.

29% higher Forex turnover

In 2016, the results showed that market trends are not colored. Meanwhile, three years later, the data showed a strong increase in turnover - from USD 5,1 trillion to USD 6,6 trillion (an increase of as much as 29%). This is mainly due to banks, hedge funds, proptrading companies and companies using HFT ( High-speed trading - high-frequency trading), which increased their activity on the currency market.

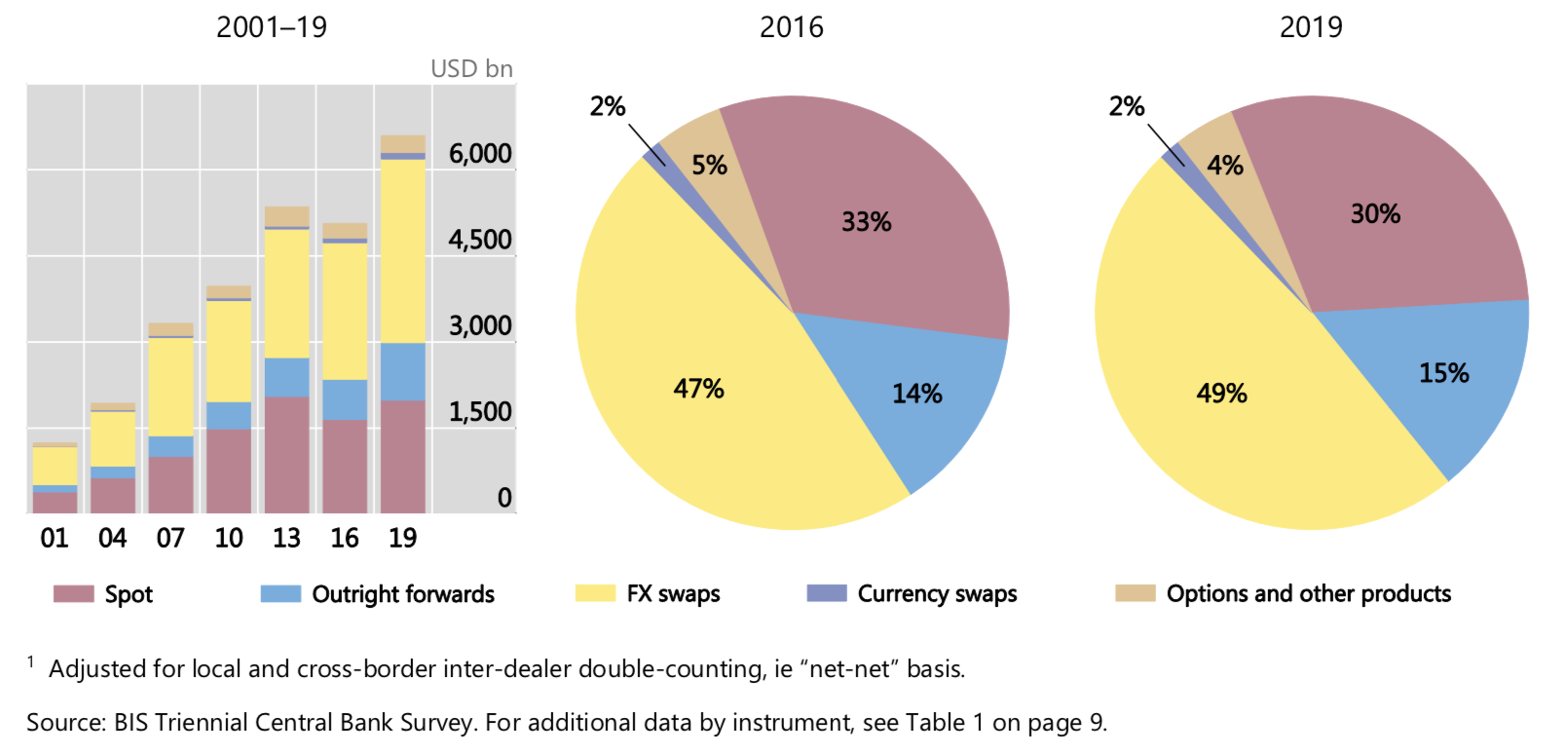

It is worth noting, however, that swap transactions are responsible for the increase in turnover on the currency market and it was they that mainly contributed to the improvement of statistics (49% of total turnover is swap transactions). Meanwhile, spot transactions on the cash market are still in a downward trend and account for approximately 30% of total daily turnover. This result is 8% worse compared to the peak reached in 2013 and 3% worse compared to 2016.

Average daily turnover broken down by transaction page. Source: BIS report

USD is the undisputed leader

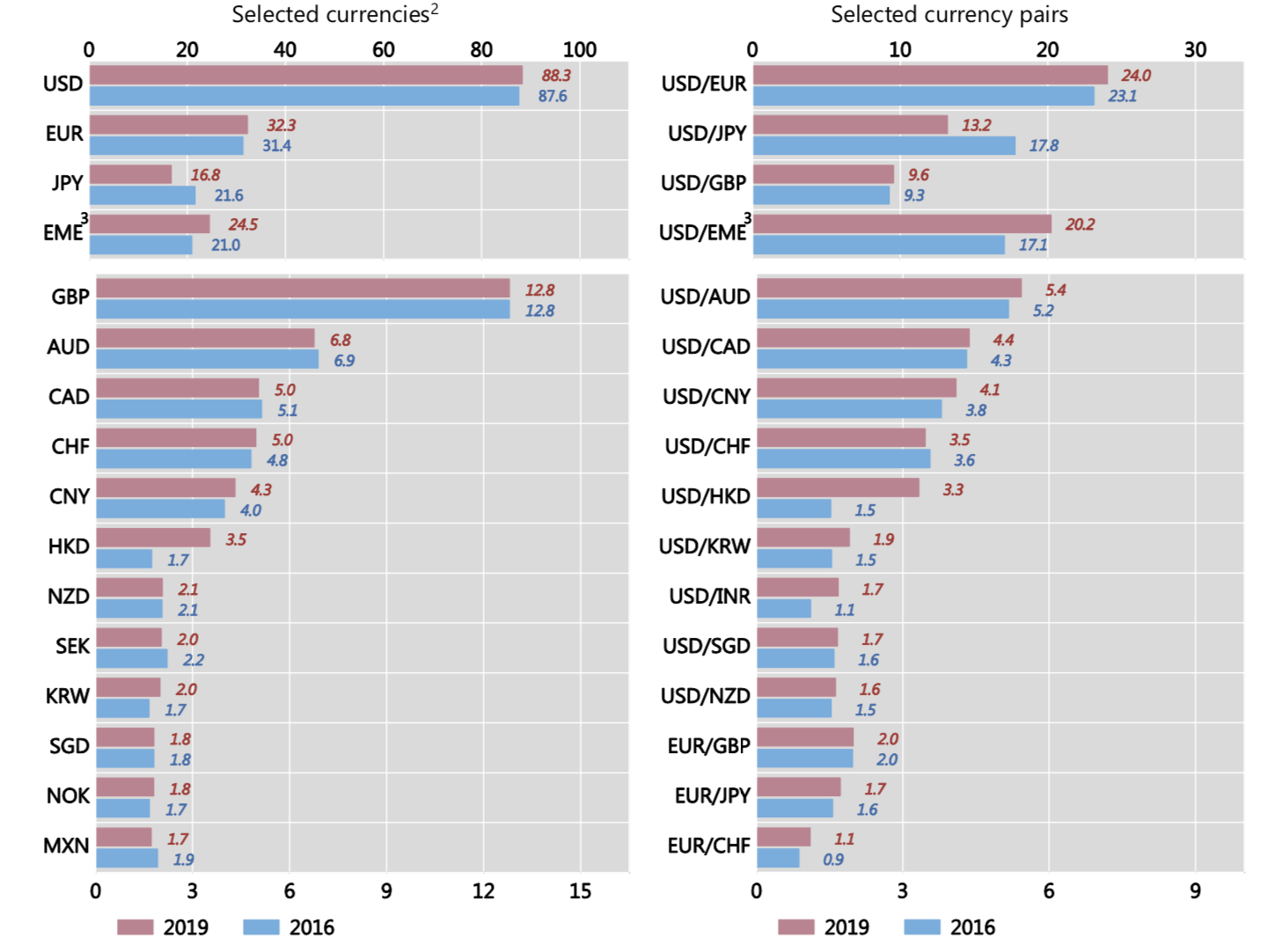

The US dollar has maintained its dominant currency status, being on one side of 88% of all transactions. The share of transactions with the euro slightly increased to 32%. In contrast, the share of Japanese yen transactions fell by around 5%, although the yen remained the third most active trading currency (17% of all transactions). The most important currency pair is eurodolar, which strengthened its position by less than 1%.

Turnover broken down into currencies and currency pairs. Source: BIS report

London world currency center

In April, 2019 was most actively traded in Great Britain, the United States, Hong Kong, Singapore and Japan. Institutions located in these countries provided 79% of all currency exchange transactions. Trading activity in Great Britain and Hong Kong increased by more than the global average. Mainland China has also recorded a significant increase in trading activity, making it the eighth largest currency trading center (rise from 13 from April 2016).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Raw Materials 2020 - Winners and Losers [Market Comment] Raw materials 2020](https://forexclub.pl/wp-content/uploads/2020/12/Surowce-2020-300x200.jpg?v=1608544280)