Euro on the verge of oversold? A look at the data from the COT report

Couple quotes EUR / USD although they have not been characterized by above-average volatility in recent months, they moved in a systematic downward trend, which eventually led the course to the lowest level in two years.

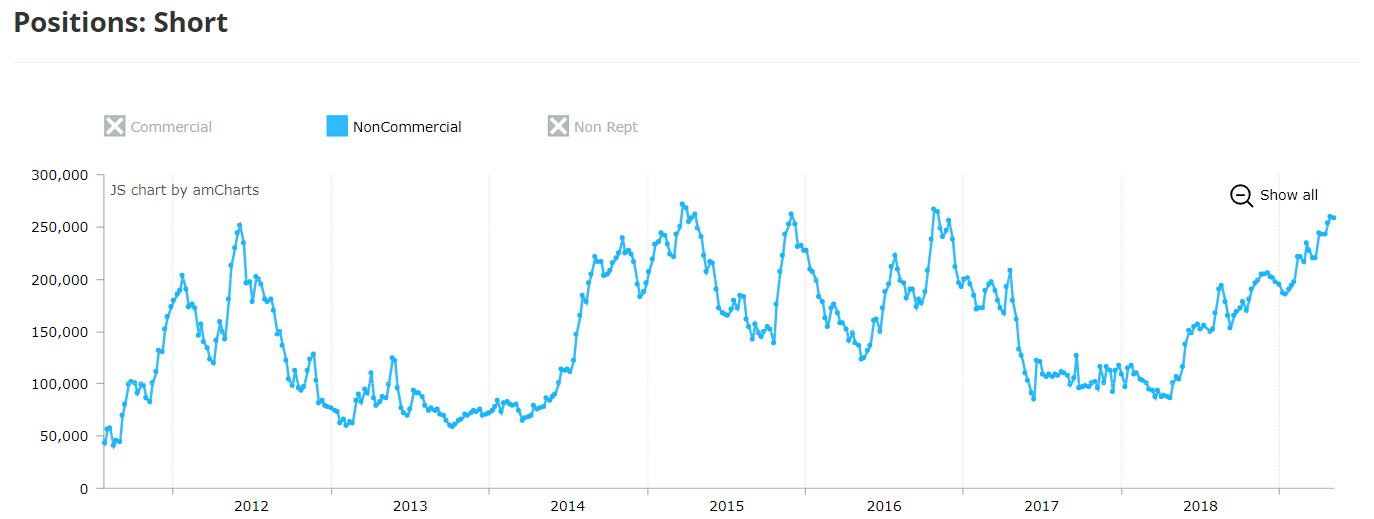

What is more, along with the systematic losing of the main currency pair, it seems that investors speculatively focused on the futures market for the euro increased their short positions. In short, this means that the trend is a healthy trend when the price increases with commitment to trade in the direction in which the price moves. In this case, this meant an increase in involvement in short positions in euros, which we observe on the basis of Commitments of Traders report published by the CFTC committee.

The situation on contracts

Looking back, short positions on euro contracts had their last local dip in April of the 2018 year. From that time to May, the number of "short" contracts increased from 86 350 to 258 738. It means tripling the "plants" that the euro against the dollar will continue to be depreciated. There would be nothing extraordinary in this, not the fact that such a number of short positions in recent years suggested the market is overtaking.

In 2012, 2015 and 2016, a similar level of short position was an extreme level, from which investors started to realize profits and close positions that earned when the euro depreciated. Of course, it is never that the market can not be sold out more, but it seems that the current levels can be alarming. If there are no new information that will not encourage you to buy the dollar for the euro, you may not want to trade for the EUR / USD rate drop. Then we could also go to the short squeeze phenomenon.

Short squeeze is nothing but a quick closing of short positions when the market stops falling and starts to grow. At that time, the long positions are quickly repurchased (to close the short position it should be bought back), which may generate a larger price increase.

From the point of view of the chart, the ending wedge formation is part of a large possible market sale. Theoretically, a larger short squeeze could appear here after crossing the line led over the tops.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)