EToro's recessionary basket, or actions for hard times

Markets have rebounded, but recession risks remain high for the economies of the world. Team eToro prepared a basket of US stocks that performed better in previous declines but continued to perform well in rises.

Information at a glance:

- eToro created a "recession basket" for US equities, which it then indexed against S&P and Nasdaq during the global financial meltdown and the decline in Covid disease.

- This basket reached 41 percent. better results than the S&P 500 during the global financial crisis and by 5 percent. better performance during a short-term recession during the covid epidemic

- The basket consisted of discount stores like Walmart, DIY brands (including Home Depot) and auto repair companies (including Autozone).

Recession basket of stocks

Developed by eToro "US recession basket" outperformed the S&P 500 by 41 percent. during the global financial crisis and on 5 percent during a shorter downturn during covid. His all-weather results are equally impressive - the basket increased by 833 percent from the eve of the global financial crisis to the first half of 2022, compared to "only" 170 percent. for S & P 500 and 360 percent for NASDAQ.

Pawel MajtkowskieToro market analyst:

“Losing less money is one thing, finding opportunities for recession is another, but they clearly exist. Many of the stocks we selected benefited from previous recessions where consumers bought cheaper products, saved money by doing more home and car repairs, prioritized 'cheap' luxuries - from eating out to toys - and kept key spending on healthcare.

While past performance obviously cannot give us any promise for the future, looking at past recessions and reflecting on how consumers and businesses have changed their purchasing behavior in response can help investors make more informed decisions and cope better with these recessions. slowdowns ".

Table 1: How a recession basket eToro outperformed the markets during the global financial crisis and the decline in covid.

| Indeks | Results during the global financial crisis | Results during Covid decline | Increase from 01/01/2007 |

| S & P500 | -20% | -5% | 170% |

| Nasdaq | -5% | 10% | 360% |

| EToro Recession Cart (US) | 21% | 0% | 833% |

* Global financial crisis 01/01/2007 - 28/12/2009. Crash Covid 30/12/2019 - 29/06/2020. Increase from 01/01/2007 - 04/07/2022. Price results only. Excluding dividends.

Representative segments in the equity basket include discounters and low priced retailers such as Walmart, Ross Stores and Dollar Tree, along with McDonalds also benefiting from "trading down" consumers. DIY home brands such as Home Depot, Lowe's and Autozone and O'Reilly auto parts stocks are also included.

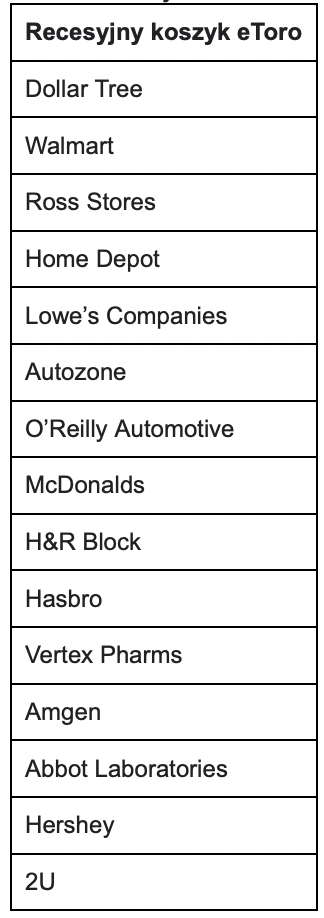

Table 2: Stocks included in eToro's US recession basket

eToro is a multi-asset platform that offers both stock investing and CFD trading.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Past performance is not indicative of future performance. The trading history shown is less than 5 full years and may not be sufficient as a basis for an investment decision.

Copy Trading is not synonymous with investment advice. The value of your investment may go up or down. Your capital is at risk.

eToro USA LLC does not offer CFDs and does not make any representations or be responsible for the accuracy or completeness of the content of this publication, which was prepared by our partner using publicly available information about eToro that is not specific to entities.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)