Rising inflation and international conflicts top the risk list

Rising inflation and the international conflict topped the list of risks among Polish individual investors. This is due to Russia's invasion of Ukraine, which caused severe shocks to the global financial markets.

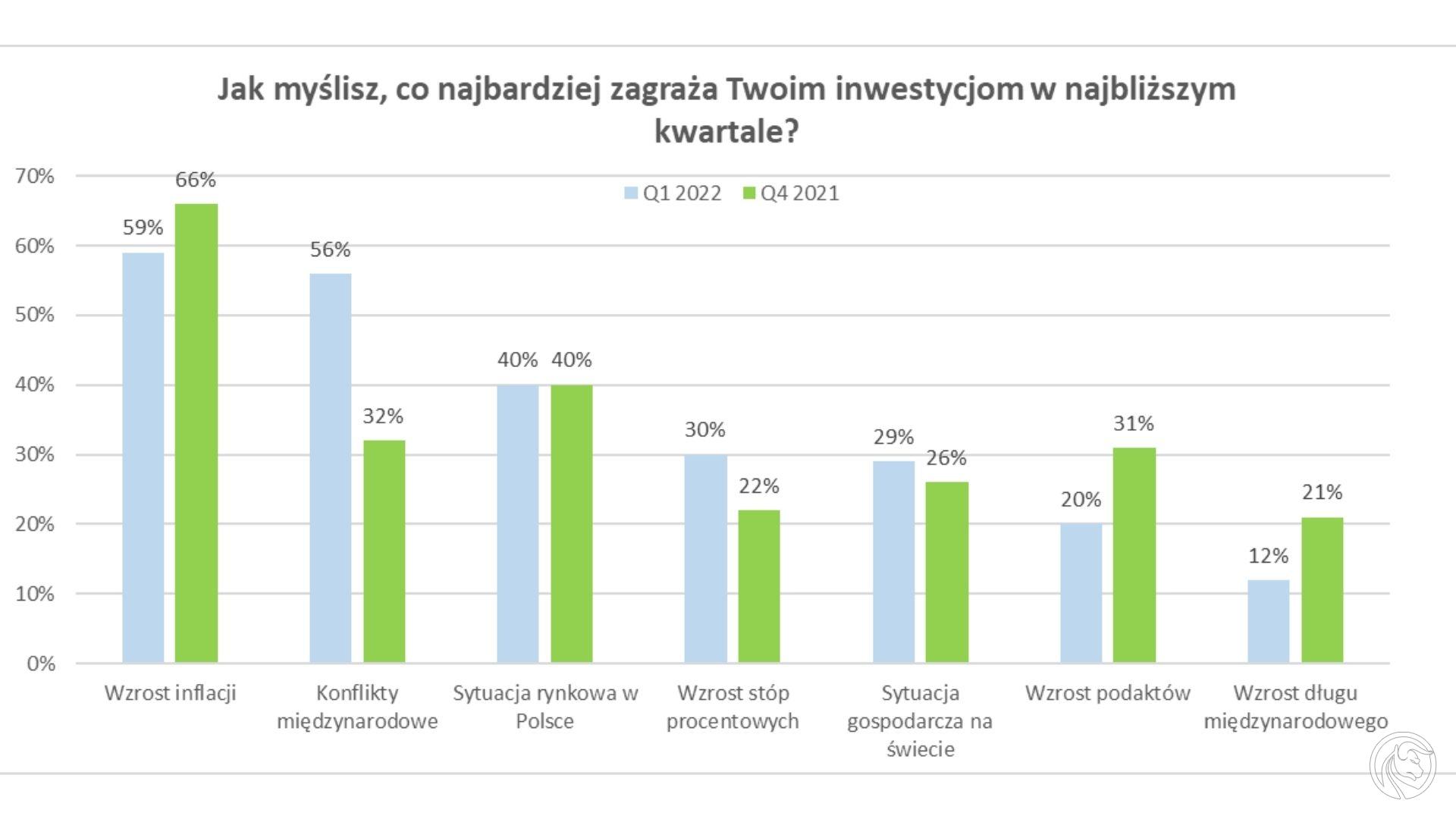

- Rising inflation remains the greatest risk for Polish individual investors (59%), even though it fell from 66%. in the fourth quarter of 2021

- 56 percent individual investors say that the international conflict poses the greatest external risk to investment. This is a significant increase from 32 percent. from the fourth quarter of 2021

- Most of the Polish retail investors surveyed are confident in their portfolios (76 percent), and 56 percent. it performs repositioning in the face of this risk.

- "Your home is where your heart is" - Polish individual investors show greater interest in domestic stocks (35%) and bonds (26%) compared to foreign shares (22%) and bonds (11%).

Inflation as the source of the greatest risk

According to a recent study "Individual Investor Pulse"conducted by a social network eToro's investment platformrising inflation is the biggest risk for 59 percent. Polish investors. In the last quarter, 66 percent indicated inflation as the greatest threat to investments. respondents, which is surprising in the light of constantly rising inflation in Poland.

Paweł Majtkowski, eToro market analyst, comments:

“Poles' concerns about inflation are not surprising, as in March its level was as high as 10,9 percent. Not only that, there are potentially further increases ahead of us. This is the second study in which - of all the nations surveyed - it is Poles who fear inflation the most. Interestingly, the Czechs, whose inflation is even higher than in Poland, fear it less. It is also worth noting that the survey was conducted in March, when the inflation reading for February indicated a decline to 8,5%. So you can see that concerns about inflation are deeply rooted in the DNA of the Polish investor. "

More than half (56%) of Polish respondents said that the international conflict is the second largest external risk to their investments, which means a large increase compared to the data recorded in the fourth quarter of 2021 - then it was 16%.

Poles are afraid for the economy ... but they are investing in Poland

As much as 40 percent. investors are still concerned about the impact of the Polish economy on investments, and then they mention: rising interest rates (30%), the state of the global economy (29%), rising taxes (20%) and an increase in public debt (12%).

EToro Global Markets Strategist Ben Laidler comments:

"The tragic events in Ukraine are a triple blow to investors in the form of an unhealthy combination: increased market uncertainty, higher inflation from soaring commodity prices, and lower economic growth due to the lifting of sanctions."

While the increase in volatility creates a difficult environment for any investor, the majority of Polish retail investors surveyed remain faithful to their portfolios (76%), with only 56% of the investors. decides to reposition them under the influence of risk. Over ⅓ of the respondents (36%) plan to consistently invest the same amount of money over the next 12 months.

“History shows that geopolitics often does not have long-term effects on world markets. Foundations remain solid, corporate profits are rising, economies are reopening after the pandemic, stock market valuations of companies are now cheaper and markets fully expect central banks to raise interest rates significantly "- adds Laidler.

Increasing geopolitical tensions have led some individual investors to prioritize domestic markets over foreign investment and seek solace in assets they know better. Individual investors in Poland are more willing to invest in domestic stocks (35%) and bonds (26%) compared to foreign shares (22%) and bonds (11%). When asked what drives them when choosing domestic shares, 56 percent. of respondents replied that they understand these markets better. And 20 percent. believes that foreign markets are too risky, not least because of political instability and currency fluctuations.

Surprisingly, despite the current geopolitical situation in the world and the economic situation in Poland, 35 percent. local individual investors feel even more confident when it comes to job security (88% vs. 86% in Q2021 12) and expects it to be even greater in the next 35 months (29% vs. 2021% in the fourth quarter of 76). Nearly 77 percent feels confident when it comes to their investments (vs 12% in Q36), but is less positive about their future in the next 45 months - 2021%. vs 51 percent in the fourth quarter of 56. The number of Polish investors who repositioned their portfolios increased from XNUMX percent. in the fourth quarter to XNUMX percent. This confirms the growing need to protect investments against external risk.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)