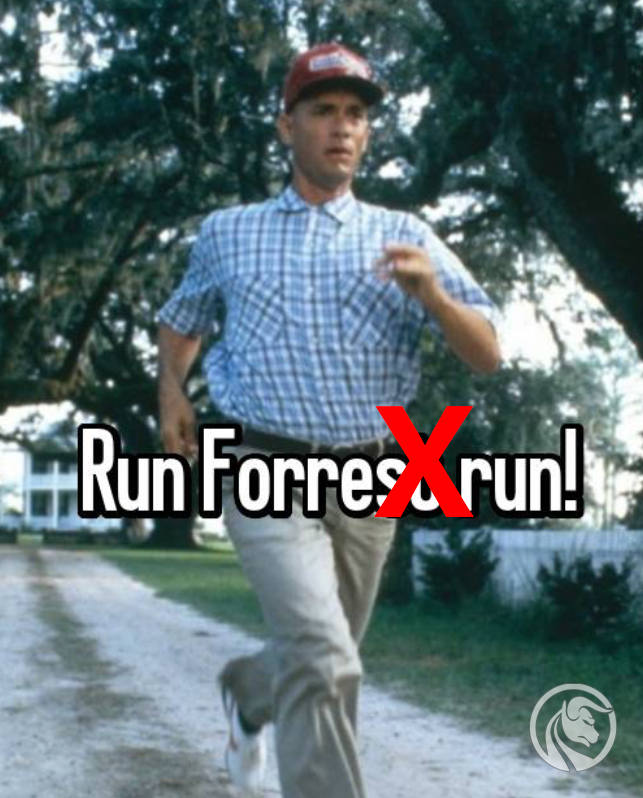

Forex run, Ruuuuun! When does this strategy make sense?

One of I devoted the last articles to the subject of fashion - Forex mods. Like any other area of life, there are certain periodic tendencies in crowd preference. In the case of the Forex market, we are talking primarily about the investment strategies or tools used, instruments traded, trading platforms or brokers (or a specific type of them) whose services we use. In this article, I would like to focus on the first element - investment strategies, and one specific element - RUN, which has recently become trend-y.

Run on Forex - Basics

2-3 years ago, mainly due to the spectacular success of the group's founder Trading Jam Session, the so-called "Runes". What is this type of strategy?

The concept itself is simple and de facto nothing new. The nomenclature is new. In the past (and maybe all the time) it was called pyramiding positions. It's just that in the case of runes, we are talking about a micro scale in the day-trading system and in a more extreme edition. The basic concept is to take a certain direction and use the moment of increased volatility. As a result of a single, clear "jump" of the rate in a given direction, the trader opens a series of transactions multiplying the income from one move.

READ NECESSARY: Pyramid in FX trading

In other words, on the change of the 50.0 pips, we want to earn a total of eg 150.0 pips, however, taking into account the total profit from several transactions.

Potential benefits

As you can quickly deduce from the previous sentence, the main advantage of the strategy is the way to quickly multiply your capital. With a relatively small amount, you can make a large amount in no time. Or else - a large amount can be made even more :-).

One series of transactions can lead to a spectacular rate of return, without the need for a market trend to develop. Additionally, you don't need to follow the market all day long. It is enough to know when to watch over it and in case of an opportunity - work. This is an exceptionally tempting vision, especially for beginners. But let's get to the risk.

Main threats

You might think that the biggest problem is "feeling" for the market, identifying a turning point or point of increased volatility, and taking the right direction. Yes, it is extremely important, but not the most important thing. Many stories show that even by choosing the right market, time and place to trade, runes end in a loss. How is this possible? There are two problems, although most often they result from the same - greed.

You might think that the biggest problem is "feeling" for the market, identifying a turning point or point of increased volatility, and taking the right direction. Yes, it is extremely important, but not the most important thing. Many stories show that even by choosing the right market, time and place to trade, runes end in a loss. How is this possible? There are two problems, although most often they result from the same - greed.

If you want to earn as much as possible, the trader has a problem with telling yourself "enough". The moment of closing the transaction is overshadowed by fast growing profit, until this profit is transformed into a loss.

The second problem is capital management. What positions to open? How often? About what volume? How many% to risk for the entire run and how much for a single transaction? Should you reduce part of the position during the move or close in bulk at the end? These are many dilemmas that affect your result. And to illustrate the scale of the changes, I present a hypothetical situation below.

Example of risk scale

- By opening a long position at the bottom of move 1.0 with a lot on EUR / USDIf you earn 50.0 pips, your account has a profit of $ 490.

- The spread cost is 10 $ per position.

- If you add another 10.0 pips to your 50.0 pips, then there is 1440 $ on your account.

- In total, you have an open 6 position.

- When the price is moved back by 25.0 pips, your account has ... -60 $.

- You have chosen the direction well and the first position still generates 240 $ profit.

- Every next pips withdrawal costs you another 60 $.

- When do you close the transaction?

This shows the scale of the risk that must be properly managed. Of course, both of the aforementioned problems can be easily dealt with by specifying a detailed action plan. But we come back to the psychological component of greed. Will you be able to strictly stick to the prepared plan in a stressful situation? You must answer it to yourself.

Who are RUNs for?

Going to the merits. As you've probably noticed, this type of strategy gives you huge potential for profit, but it also carries a lot of risk. The threat is primarily due to the increased exposure on a given market over a small traffic. A small change in the rate will cause a big change in your account balance. Can you stand it mentally? Resistance to stress turns out to be crucial. Keeping your emotions in the background and a sober look at the situation is something that can outweigh the balance in your favor.

In contrast to position trading, where the transaction takes several days, and you can easily analyze the situation from different angles, here you will have hours, minutes, and sometimes seconds for the entire decision-making process in leading the position. The ability to quickly analyze the situation, act according to the plan, flexibility. Do you feel prepared? If not, let it go.

For inexperienced market enthusiasts

Wanting to bring you down to earth, you would not read between the lines after reading this article that "Run on Forex" to "Run for easy cash". I strongly encourage you to follow the log of one of the users of the Navigator forum. This diary has almost 500 pages and has been in existence for 5 years. The author of the journal all this time tries to use the variance of the run strategy, wanting to turn a small amount into a "multi-digit" one. Unsuccessfully. But admiration is due for persistence.

It is a long, but exceptionally instructive reading from which you can learn many lessons, including:

- what mistakes you can make with runs,

- how important the plan is (or how destructive it is),

- what trap you can fall into,

- with what emotions you can have contact with.

More and faster means better. But only if you're ready for it.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Forex Tester 5 - combine for testing strategies [Review] forex tester 5](https://forexclub.pl/wp-content/uploads/2023/04/forex-tester-5-300x200.jpg?v=1679423429)

![4-5 and exit. Highly effective strategy [Video] Trading strategy: 4-5 and exit](https://forexclub.pl/wp-content/uploads/2022/06/4-5_i_wyjscie-300x200.jpg)