Commodity market: Gold shines through increasingly darker clouds

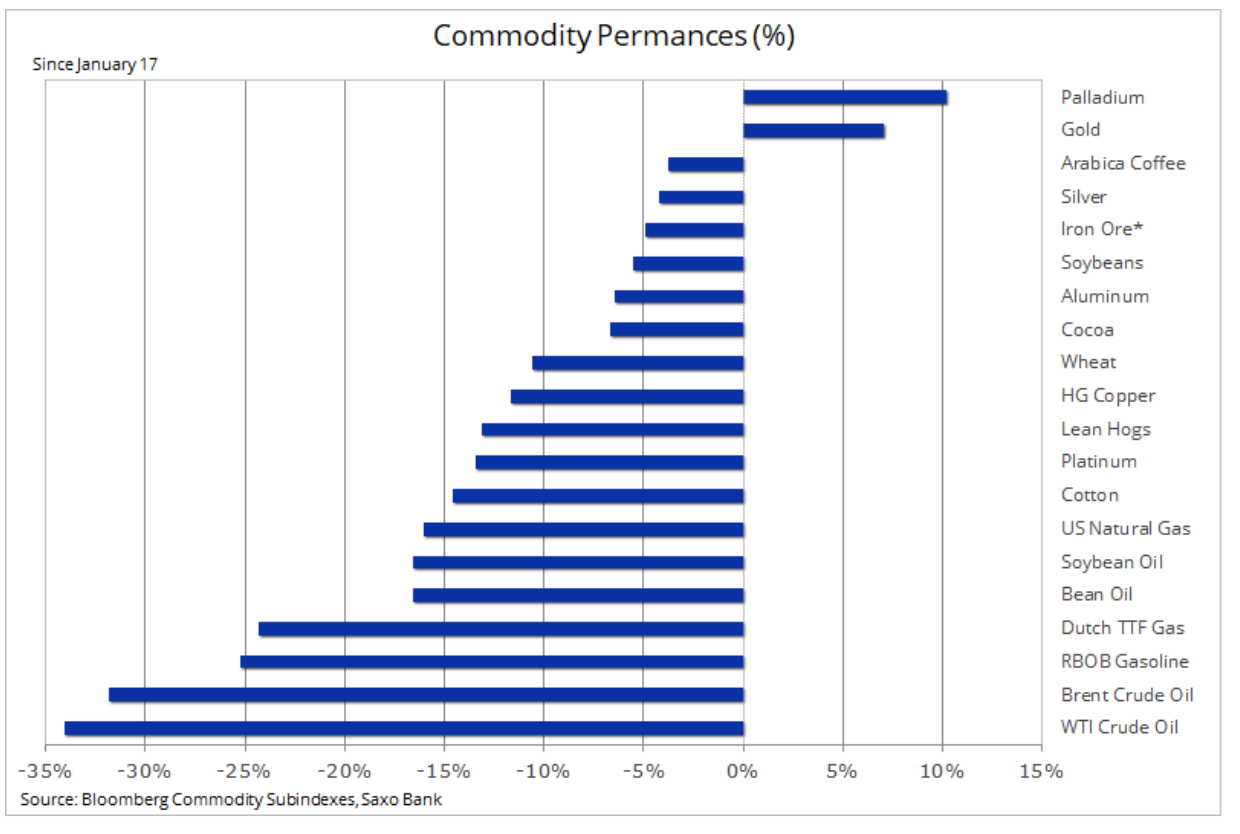

The negative economic impact of the coronavirus, signaled for weeks by the weakening of procyclical commodity prices, has finally spread like a fire to other market segments. Last week started with an emergency 50 basis point cut by the US Federal Reserve, which only exacerbated panic in the market. Within a few days, global government bond yields fell to record lows, the price of gold and volatility in the market went up strongly, while the dollar was under significant sales pressure due to closing long positions.

As a result of disruptions to global supply chains and a sharp change in the behavior of global consumers, the prices of airlines, restaurants, leisure and hotel companies have fallen sharply. On the market oil a separate crisis has prevailed: OPEC and Russia are seeking a common position to alleviate the greatest decline in global demand since the global financial crisis. While China is showing signs of gradual recovery, the focus is on the United States - the world's largest economy.

In the context of an inefficient healthcare system and an unhealthy work culture, there are growing concerns that America may be on the verge of a major epidemic.

Big uncertainty on the market

Amid rapid market fluctuations and increasing uncertainty, gold has once again proved to be a safe haven. After the biggest weekly increase since 2009, the metal's price hit levels not recorded in seven years, leaving both silver and platinum behind. The gold-to-silver ratio peaked in 40 years (96), while the platinum-to-gold discount hit a record $ 820 / oz before Anglo American platinum cuts rebounded.

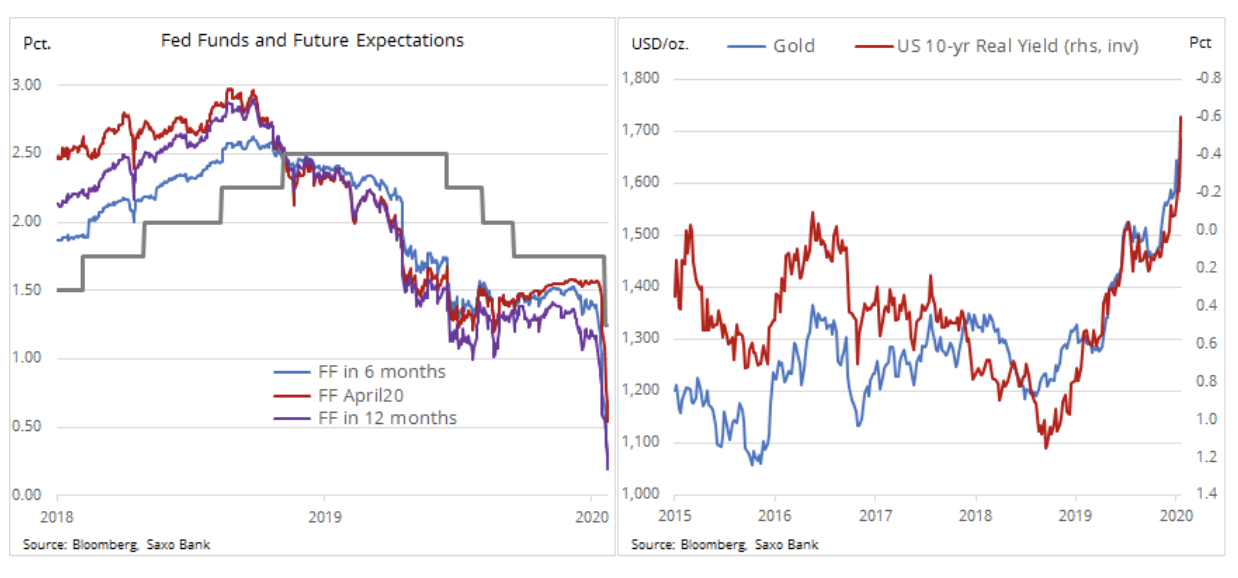

The bull market and the strong performance of gold were influenced by the factors that comprised the perfect storm. Leaving aside the demand for safe investments, the rise in the price of gold to $ 1 / oz was driven by a sharp fall in real US 700-year bond yields to a seven-year low of -0,60%, the unexpected weakening of the dollar - as yield spreads collapsed against other currencies - and continued market collapse.

Interest rates down. What's next?

According to market expectations, Monday's US emergency rate cut Federal Reserve to 1,25% is just the beginning and at the FOMC meeting on March 18 there will be another cut by 50 basis points. So far the minimum is 0,20% and it may be reached by the November presidential election in the United States.

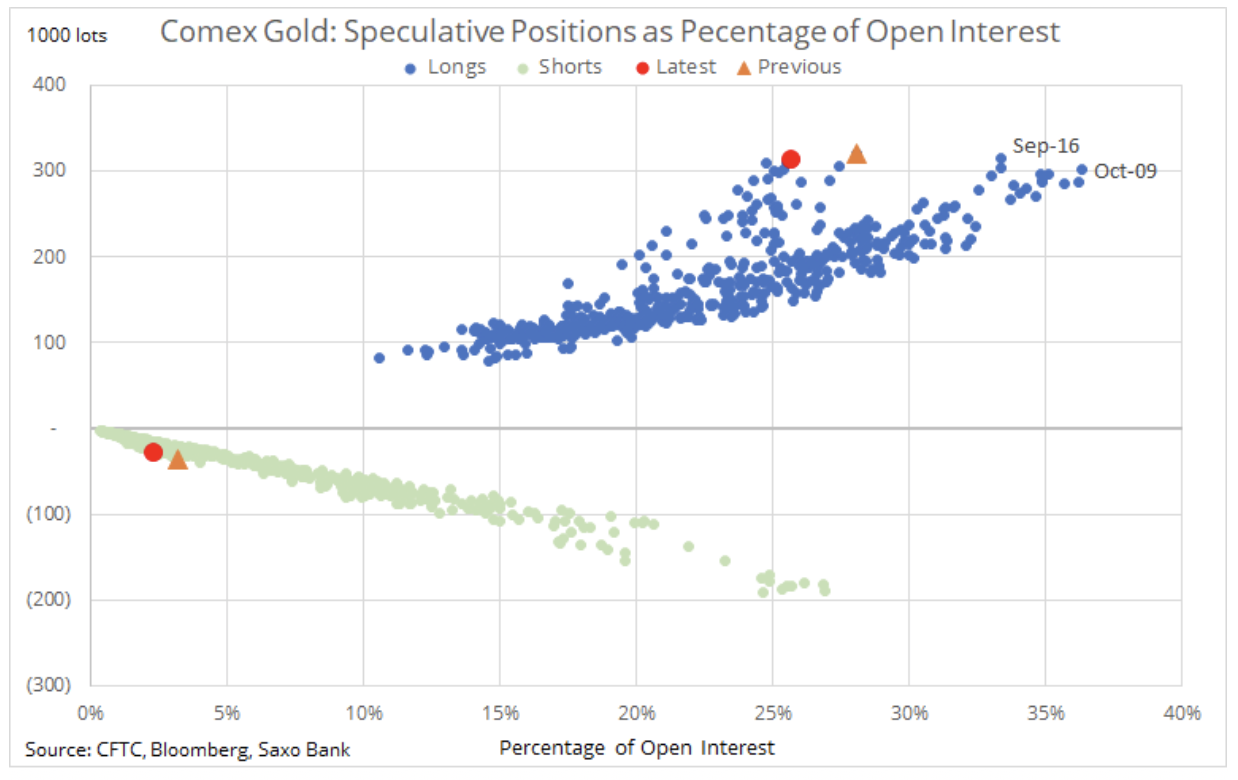

The increase in the speculative position of the funds raised some concerns about a strong correction in the event of a rebound in volatility, as was the case two weeks ago. The rapid increase in volatility forces funds that target a certain level of portfolio volatility to reduce exposure to all assets. That's what struck the gold blow last week when Cboe VIX index has risen sharply to 40% (currently it is at 37%).

Leaving aside the spike in volatility, some concerns are also raised about the possibility of maintaining an almost record long position. In the week ending February 25, it hit 285 lots before the above-mentioned rise in the VIX pushed some of the longs out of the market. However, if we look at the ratio of long positions to the total "pie", ie the number of open contracts, we will see that this position is not yet elevated compared to the levels of the last 000 years.

Spot gold was tending to its seven-year high at its daily close, around $ 1 / oz. Given the valuation of another 700bp rate cut, the prospects for additional gains depend on continued demand for safe investments. From this point of view, the performance of the US stock, dollar and bond markets is the key to further gains.

As a result of over a week of slump in oil prices, the price of Brent crude oil reached its lowest level in 32 months, falling below 50 USD / barrel. While for copper, which is now in a clear range, half of the demand comes from China, the energy sector reflects changes across the global economy. The spread of the Chinese coronavirus poses an increasing threat to global growth and a blow to fuel demand as a result of an exit ban and disruption of supply chains.

OPEC meeting

Faced with the worst demand shock since the global financial crisis, the OPEC + group of producers met in Vienna to agree a joint response to the current collapse in demand. Talks to cut 1,5 million barrels a day have proved problematic due to Russia's resistance to postponing the decision until June to get a better picture of the implications, not only on demand, but also on the possibility of a slowdown among the rest producers, mainly shale oil producers from the United States.

40 or 60 USD for Brent crude? Only producers from OPEC + can answer this question. This answer was given only after the publication of this article.

Before the virus crossed the Chinese border in mid-January, OPEC, the US Energy Information Administration, and the International Energy Agency estimated the increase in global demand in 2020 to be around 1,2 million barrels per day. In the context of this forecast, as well as the prospect of a 2,3 million barrels / day increase in non-OPEC production, OPEC + producers decided in early December to cut production to restore the market balance.

After adjusting downward growth in demand to unchanged and sometimes even negative levels, the gap between supply and demand has potentially increased by over a million barrels a day. Hence the urgent need for another production cut by OPEC +; failure to make this decision is a risk of a drop in oil prices in the lower reaches of $ 40.

Non-OPEC production, in particular American shale oil, may also slow down due to falling prices and worse credit conditions. Real effects, however, may become noticeable only in a few months, and given the current and potentially growing demand shock, just time is something that OPEC does not have in excess.

Source: Ole Hansen, head of department of commodity markets strategy, Saxo Bank

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)