Forex markets: Yellen steals the show, Powell ignored

The Powell-led Fed faces the impossible task of deciding whether to communicate moderate caution with a rate hike or greater caution with no rate hike; however, the task of identifying guidelines for future policy is even more difficult. Moreover, the function of market reaction to yesterday's FOMC decision and guidance may turn out to be far from simple.

Currency Trading: Fed hikes rates but clearly shifts to neutral stance after introducing new language to statement despite sticking to current monetary policy outlook. Treasury Secretary Yellen steals the show with remarks about not insuring all US bank deposits.

American Federal Reserve as expected, it increased interest rates by 25 basis points and this did not cause much surprise. A little more interesting was the introduction of a new language to the message FOMC, clearly expressing new concerns that the chaos in recent days may negatively affect the transmission of credit to the economy and thus economic growth/jobs. The following insert in the message can be read as a change of position to neutral:

“The US banking system is sound and resilient. Recent developments are likely to lead to tighter lending conditions for households and businesses and negatively affect economic activity, employment and inflation. The scale of this impact is uncertain.”

Changes in the communiqué and the conclusions that can be drawn from them outweighed the lack of any noticeable change in the Fed's policy outlook. If the Federal Reserve begins to see evidence of a sharp slowdown in the economy in the April and May data cycle (much higher risk), it will quickly change both its approach and forecasts. Also note that the Fed has lowered its GDP forecast for 2023 to 0,4% (down from 0,5% in December) and its GDP forecast for 2024 to 1,2% (down from 1,6% in December). XNUMX% in December).

However, Yellen's remarks during the congressional hearing, which coincided with Fed Chairman Powell's press conference, quickly caught investors' attention as the Treasury secretary stated:

"I have not considered or discussed anything to do with insurance or guarantees for all deposits."

This was not the language the market expected and bank stocks immediately went down, causing a sharp deterioration in overall market sentiment. This statement increases the risk of a wider and escalating run on distressed banks, and the pace of this is unpredictable. Of course, a systemic deterioration of the situation will be acceptable only up to a certain point, when intervention will take place, but the pace and path to the next intensification of the crisis are completely unpredictable. Most importantly, the related future tightening of credit conditions has likely already precipitated the recession in the US by at least 3-6 months and increased its potential severity.

Yellen's rhetoric belatedly revived the previously low dollar, even as the dollar fell again the following night (in part due to increased hopes of reopening the Chinese economy to the world). Yesterday, in turn, the dollar recovered a significant part of overnight losses in Europe. The crisis in the US is a hard nut to crack for currency investors: yes, it affects Fed interest rate expectations and, at first glance, has more negative effects, especially for the US, but the deterioration of financial conditions overseas will not be limited to America, as well as concerns about the future of the local economy. Of course, the USD may still find buyers if sentiment is very volatile, and there are legitimate concerns that certain types of banking dynamics are by no means confined to the US. This can be seen quite clearly from the impact of this situation on bank stocks around the world.

EUR/USD Chart. Source: Saxo Bank platform

After an impulse in the form of the FOMC communiqué pair EUR / USD shot from below 1,0800 to well above 1,0900. Then there was significant volatility due to Yellen's statement about not insuring all bank deposits, followed by a short strengthening overnight, and then leveling off of this move in Europe. It's a real no-holds-barred ride! European banks have not escaped the negative pressure and should also be watched in the context of the EUR/USD pair. For now, I am by no means convinced of any significant upside potential if new turmoil lies ahead. From a technical perspective, the rally needs to hit or close to 1,0750 to focus on 1,1000+ areas.

Decision Bank of England it is unlikely to matter much in the foreseeable future and will not be the main source of market interest. Sterling has been losing value against the euro over the last few days, even though the pair's chart GBP / USD impresses being a couple EUR / GBP is more convincing in terms of depicting the situation of this currency. I don't see any significant upside potential for sterling from any identifiable source here, and certainly not from a Bank of England tightening. It probably takes at least a few more months of hot inflation and possibly wage data for the discomfort of aggressive disinflation to rise to unbearable levels (the Bank of England is forecasting headline inflation of 1% in two years!). Downside risk prevails, if negative banking sentiment spreads across Europe and the UK, although the UK has the advantage of more aggressive regulatory/government action if this pressure intensifies.

In line with common expectations, Swiss National Bank increased interest rates by 50 basis points (no surprises), in hopes of maintaining the illusion that all systems are normal, just after avoiding systemic collapse by "assisting" a takeover Credit Suisse by UBS. The bank signaled that further tightening cannot be ruled out, although the SBN will most likely lag behind rather than be at the forefront of any changes in monetary policy. After a slight strengthening of the CHF, the EUR/CHF pair returned to the middle areas of the range on a daily basis.

Norges Bank raised the deposit rate by 25 basis points, as expected, to 3,00%, and surprised with aggressive guidance for an increase to 3,50% in the summer, although it highlighted "significant uncertainty about future economic developments". Norwegian short-term interest rates have been rising dynamically for some time, but at the time of writing, they are only slightly above their current level. NOK was finding plenty of buyers and the EUR/NOK pair dropped from 11,33 before the announcement to 11,255 before rebounding.

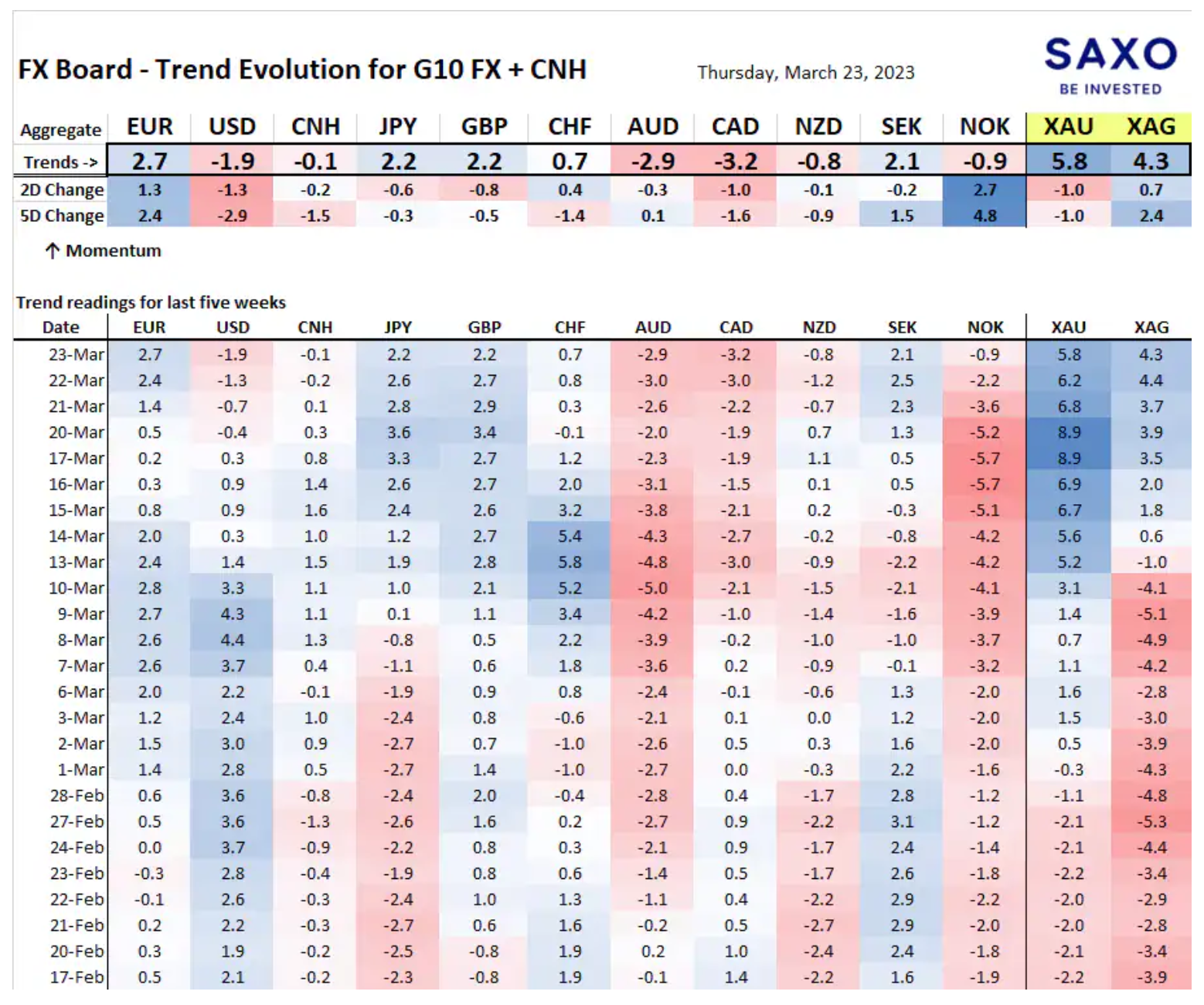

Changes and strength of the trend in the G10 and CNH currency markets.

We're still waiting until today's close to draw conclusions on the USD, as only then will we know the further ramifications of Yellen's statement. We are also watching the status of sterling after the Bank of England meeting.

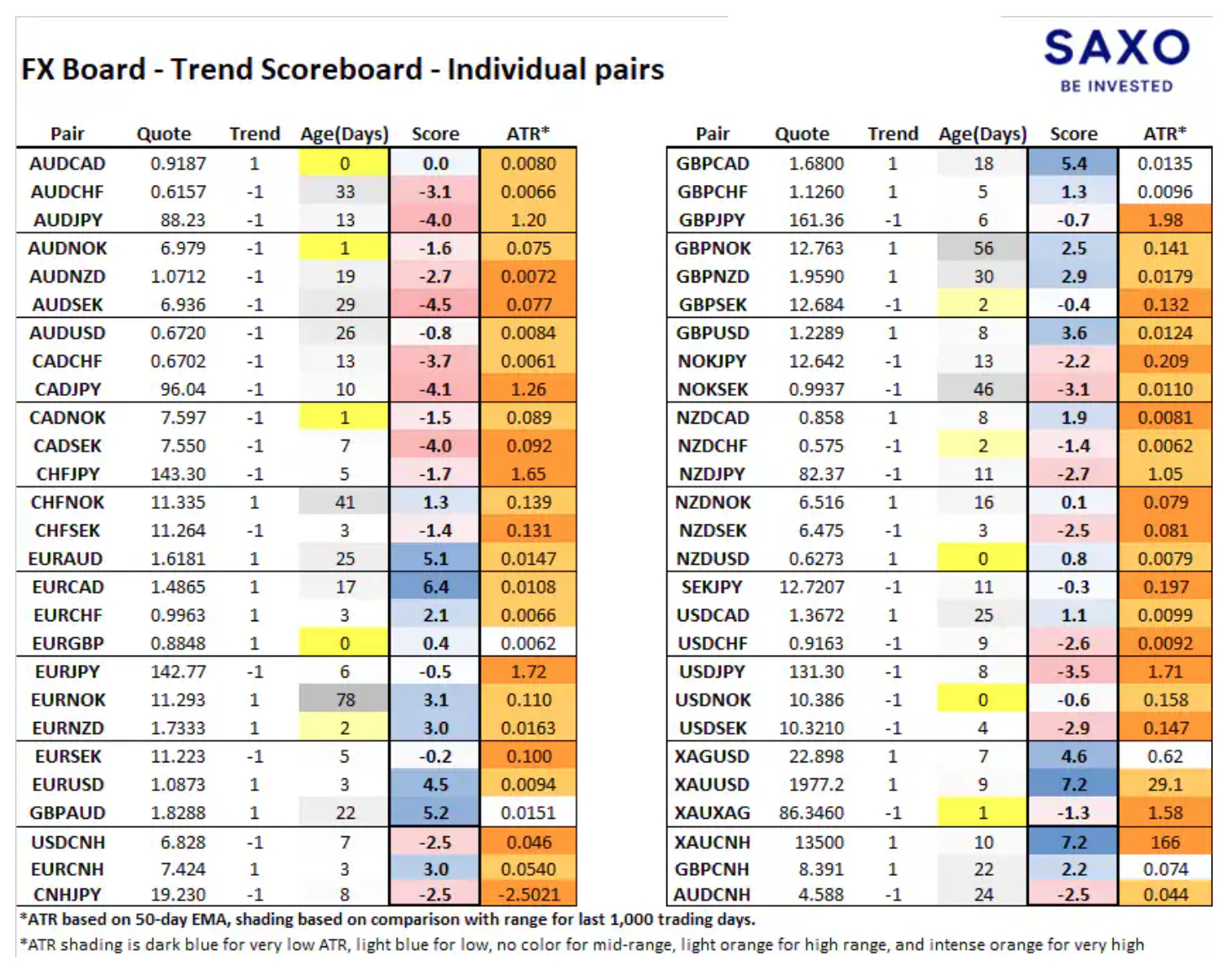

Performance trends of individual currency pairs.

The NZD/USD pair is attempting to break negative once again and the RBNZ guidance in two weeks at its next meeting will pose a clear risk to NZD. The EUR/GBP pair made a turn in the other direction and sought to strengthen.

About the Author

John Hardy director of currency markets strategy, Saxo Bank. Joined the group Saxo Bank in 2002 It focuses on providing strategies and analyzes on the currency market in line with macroeconomic fundamentals and technical changes. Hardy won several awards for his work and was recognized as the most effective 12-month forecaster in 2015 among over 30 regular associates of FX Week. His currency market column is often cited and he is a regular guest and commentator on television, including CNBC and Bloomberg.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)