Markets are coming back to Earth. Stock market decreases

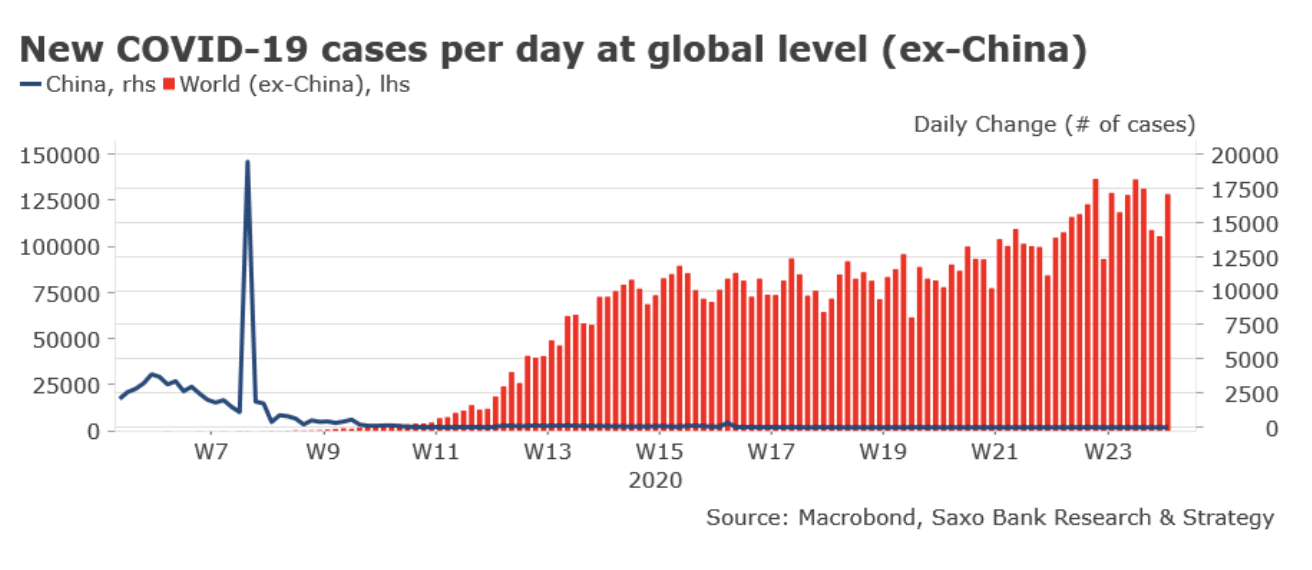

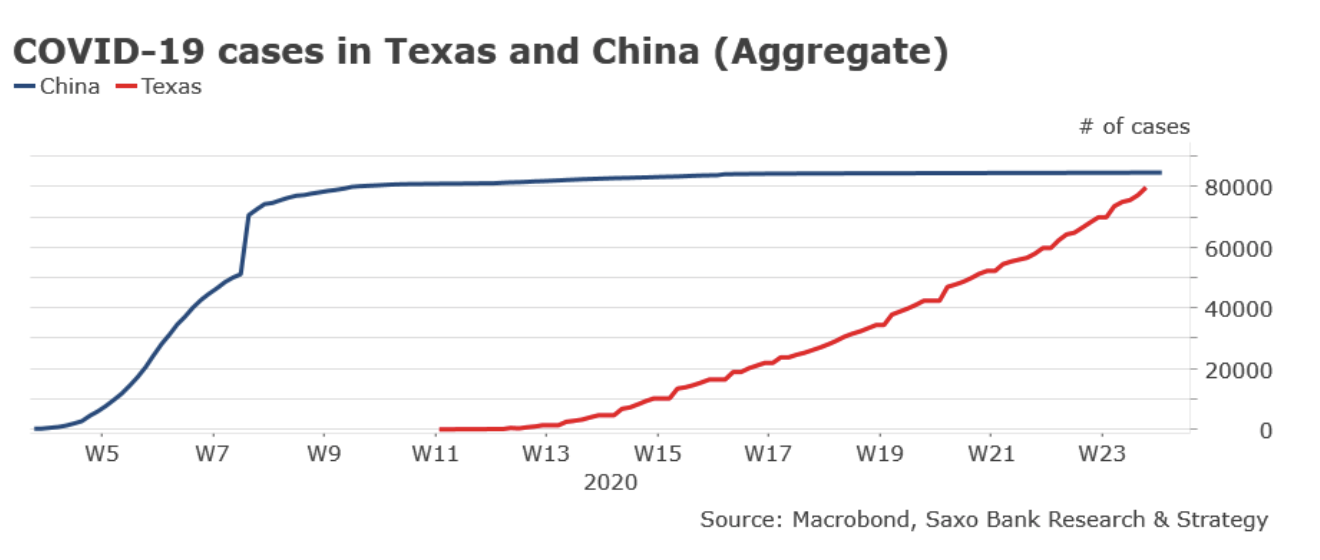

A growing body of evidence indicates that the United States will not escape a second wave of infections. Recent Department of Health statistics confirmed that many states loosened restrictions too early. In California, Georgia, Texas and Florida, the seven-day average increase in the number of newly detected cases is record-breaking or near-record, while Arizona and Oregon have increased significantly over the past month. The case of Texas is very interesting because it was one of the first states to lift the restrictions. According to official data released yesterday, Texas has seen 2 new cases of infection - the highest daily number since the start of the pandemic. The overall number of patients increased by 504% compared with the seven-day average of 3,2% to 2,2 cases - almost the official number of infections in China (today 79). Other countries also face the risk of a second wave, such as Israel, where the number of new cases of Covid-757 among foreign workers has increased significantly in recent days, forcing the government to strictly isolate certain neighborhoods. Although in Europe - with the exception of the UK - the pandemic appears to be under control, it continues to spread globally: yesterday there were 85 new cases, one of the highest daily values since early March. In the coming months, the uncertainty surrounding the pandemic will be one of the main downside risks in the stock market and will have a very negative impact on many sectors, primarily the tourism and aviation industries.

About the Author

Christopher Dembik - French economist of Polish origin. Is a global head of macroeconomic research at a Danish investment bank Saxo Bank (a subsidiary of the Chinese company Geely serving 860 HNW customers around the world). He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to a report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

Christopher Dembik - French economist of Polish origin. Is a global head of macroeconomic research at a Danish investment bank Saxo Bank (a subsidiary of the Chinese company Geely serving 860 HNW customers around the world). He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to a report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

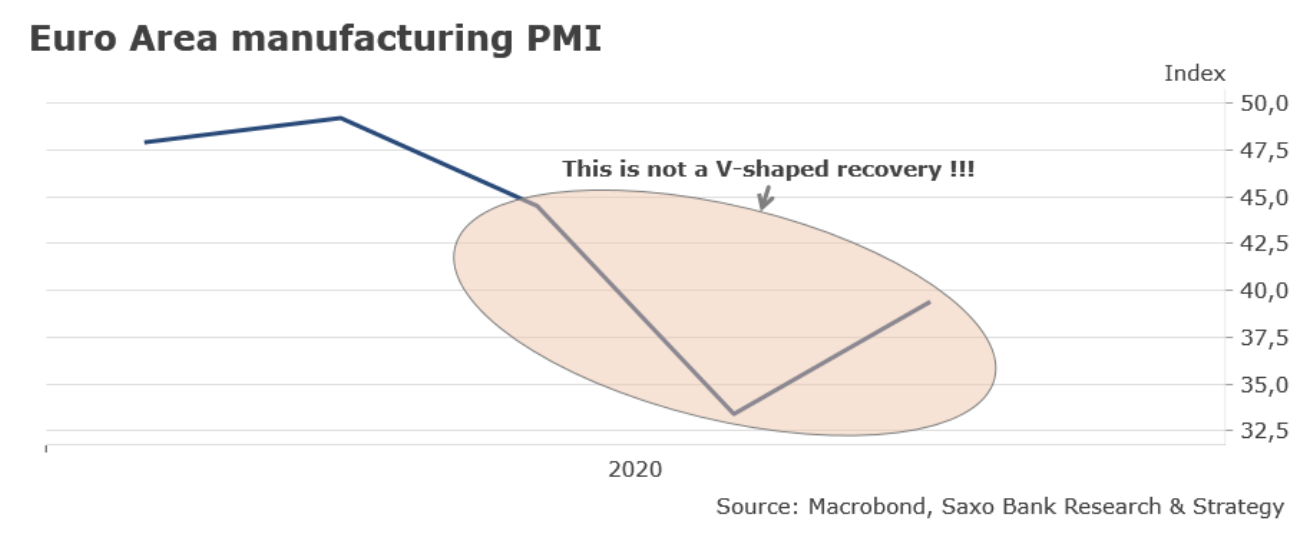

In addition, there are still a lot of misunderstandings with the interpretation of economic indicators. Many investors have misinterpreted the V-shape on a chart - for example, the PMI chart below in the manufacturing sector in the euro area - as a V-shaped recovery. This is a completely wrong interpretation. The straight line below, which goes down in connection with isolation and then up after lifting the restrictions, simply means that PMI is getting worse at a slower pace. Naturally, this is a much better scenario than rapid deterioration, but it does not mean that we are dealing with actual improvement or recovery.

The same interpretative problem arises with simple dispersion studies such as the German ZEW study. Over the past few weeks we have seen a strong increase in expectations in the context of various studies. This leap is not the same as restoring trust. Investors should remember that respondents are only asked to compare their expectations with those of last month. Expectations are rising, but this is only due to the fact that they cannot worsen - improvement occurs in the context of stagnation!

Uncertain times, uncertain future

Investors will have to learn to navigate in a more uncertain economic environment than before. During the pandemic, economic forecasting turned out to be very difficult. This explains the significant discrepancies between individual projections. For example, the current spread for this year's forecasts for Brazil is -1,8% to -8% (based on the 36 available GDP forecasts), while for China it is -3% to + 3,5% (based on 74 available GDP forecasts).

The same problem can be seen with the forecasts for the United States. For as long as I can remember, the spread of FOMC members' forecasts for 2021 has never been so great. According to the worst pessimist, the economy will go into recession (-1% of GDP), while the greatest optimist foresees growth of + 7%. The same spread applies to projected unemployment: next year it could reach as much as 4,5% as well as 12%.

I am not saying that the market has paid particular attention to economic data in the last ten years, but in fact it is usually based on these that monetary policy is shaped, which is probably one of the main stock market drivers. The significant discrepancies are mainly explained by the fact that economic models are not able to take into account the factor of a pandemic and its inevitable economic impact, which is enormous. In other words, economists are not epidemiologists, and since we have not witnessed such a large global pandemic since World War II, we do not know how it will affect consumption and investment behavior (e.g. whether there will be a hysteresis effect). We know that the forecast for the coming months is very pessimistic - GDP in QXNUMX was terrible, but the worst is yet to come with the publication of QXNUMX GDP. However, we do not have too much data on the shape and speed of the recovery, which will depend on the consequences of the second wave and the effectiveness of monetary and fiscal policy. Finally, over the long term, the only factor that may be of concern to equity investors may be liquidity, which has so far been growing rapidly.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)