The risk of the Bank of Japan takes the lead

The market is nervously watching whether today's meeting FOMC will bring the expected rate hike by 75 basis points - the largest since 1994 - and will it respond to expectations regarding the monetary policy trajectory for the current and next year in the form of the so-called forecasts dotplot and forecast economic data. Moreover EBC unexpectedly called an emergency meeting today to address peripheral bond spreads. However, in the context of high-risk events this week, the Bank of Japan meeting took the lead and asked if and to what extent it is ready to capitulate on the yield curve control policy.

About the Author

John Hardy director of currency markets strategy, Saxo Bank. Joined the group Saxo Bank in 2002 It focuses on providing strategies and analyzes on the currency market in line with macroeconomic fundamentals and technical changes. Hardy won several awards for his work and was recognized as the most effective 12-month forecaster in 2015 among over 30 regular associates of FX Week. His currency market column is often cited and he is a regular guest and commentator on television, including CNBC and Bloomberg.

Is the market ready for a Fed rate hike by 75 basis points?

Today I was surprised by the Newsquawk Twitter poll about today's Fed decision: almost a third of respondents believed that Federal Reserve will raise rates by just 50 basis points, even though the market fully priced in the increases by 75 basis points with regard to today's and July's meetings. Is the market not fully ready for more movement? The change in the US dollar this week suggests that there has been a significant correction, but we will be certain in this regard only after the meeting. Basically, I believe the Fed only wants to do what the market has already priced in and will not opt for a larger hike of 100bps, but my belief has weakened significantly after the revaluation accelerates suddenly amid a large shift in inflation expectations which are new and possibly new. a more intense source of concern for the Fed. Tonight one should also pay attention to changes in the forecast dotplot: the market currently forecasts 3,6% at the December meeting and almost 4% at the end of next year, compared to the median of 2% in the March projections at the end of 2022 (!) and 2,75% at the end of 2023.

Chart: EUR / JPY

Before Friday's meeting of the Bank of Japan and after the meeting, all currency pairs with JPY will be of key importance, and in the case of EUR / JPY pairs an additional factor will be the spread of bonds of the peripheral countries of the EU and the actions of the ECB in this regard. Will the successful crushing of the yield spreads turn out to be positive for the EUR (reduction of existential tension) or negative (virtually- quantitative easing for part of the euro area, even if the overall ECB balance sheet does not expand and the ECB decides to raise rates)? If the market reads it as a soft policy of the ECB towards the implications of potential interest rate hikes in the future (which does not follow from the statements of individual ECB representatives who are in favor of possible larger increases after the July meeting), the euro may weaken much more; otherwise, the EUR / JPY pair may just follow more or less in the same direction as the other JPY pairs in the event that the Bank of Japan capitulates on Friday's yield curve control policy. From a technical point of view, the area of 140,00 should be observed.

The ECB called an ad hoc emergency meeting due to the "current financial conditions" after yesterday's significant speech by ECB board member Schnabel, suggesting an unrestricted effort to ensure that there are no "chaotic" interest rate movements, in particular with regard to the EU peripheral economies. It has always been known that ending quantitative easing will not be easy for the ECB, but the mere fact that the central bank is already calling an extraordinary meeting - just less than a week after the regular meeting - shows panic.

The ECB called an ad hoc emergency meeting due to the "current financial conditions" after yesterday's significant speech by ECB board member Schnabel, suggesting an unrestricted effort to ensure that there are no "chaotic" interest rate movements, in particular with regard to the EU peripheral economies. It has always been known that ending quantitative easing will not be easy for the ECB, but the mere fact that the central bank is already calling an extraordinary meeting - just less than a week after the regular meeting - shows panic.

The scale and pace of the sell-off of Italian government bonds (BTPs), coupled with the sharp spike in global yields, contributed significantly to this move - perhaps the ECB assumed it would wait until fall, but the US yield curve immediately began to put considerable pressure. As noted above in the commentary to the EUR / JPY chart, the market response was interesting in the form of a strong increase in the EUR / CHF pair due to the improvement in the spreads of peripheral countries' bonds, however, narrower spreads will positively translate into the euro exchange rate only then, when the ECB is able to find a way to reduce spreads so as not to generally hinder a faster pace of interest rate tightening - which is somewhat inconsistent, even if the ECB's balance sheet is so large that technically it could eventually even reduce overall assets by shifting existing assets to the periphery to reduce volatility in spreads. To this end, however, it would have to deviate even more aggressively from the existing rules of the "capital key", which made the size of the assets held dependent on the relative size of the economy of individual members. Depending especially on the last of these aspects, it does not have to translate into the euro, provided that the forecast for interest rates is maintained.

In addition, I discussed extensively the risk associated with the Friday meeting of the Bank of Japan (on the night of Thursday to Friday for those of us who do not live in Asia), and last article I presented the concepts of the potential play out of this situation on the market, mainly assuming that the Bank of Japan will have to somehow give way, in particular in the face of an unequivocally aggressive meeting of the FOMC, which will cause a further increase in US yields.

Additionally, the pressure on Bank of Japan It grew even further as speculative investors aggressively sell off Japanese JGB (JGB) futures, thus putting the implied yields on these bonds far above the nominal 25 basis point cap imposed by the Japanese central bank on 50-year JGB yields and overnight XNUMX-year yields on a scale of year significantly exceeded XNUMX basis points in the futures markets.

Be careful of the risk of chaotic changes as well as suggested Steven Jakobsen, for a scenario where Kuroda and Co. may attempt a sort of step-by-step approach - for example, shifting the goal of the yield curve control policy by 50 or 100 basis points. Sooner or later, the Bank of Japan will break.

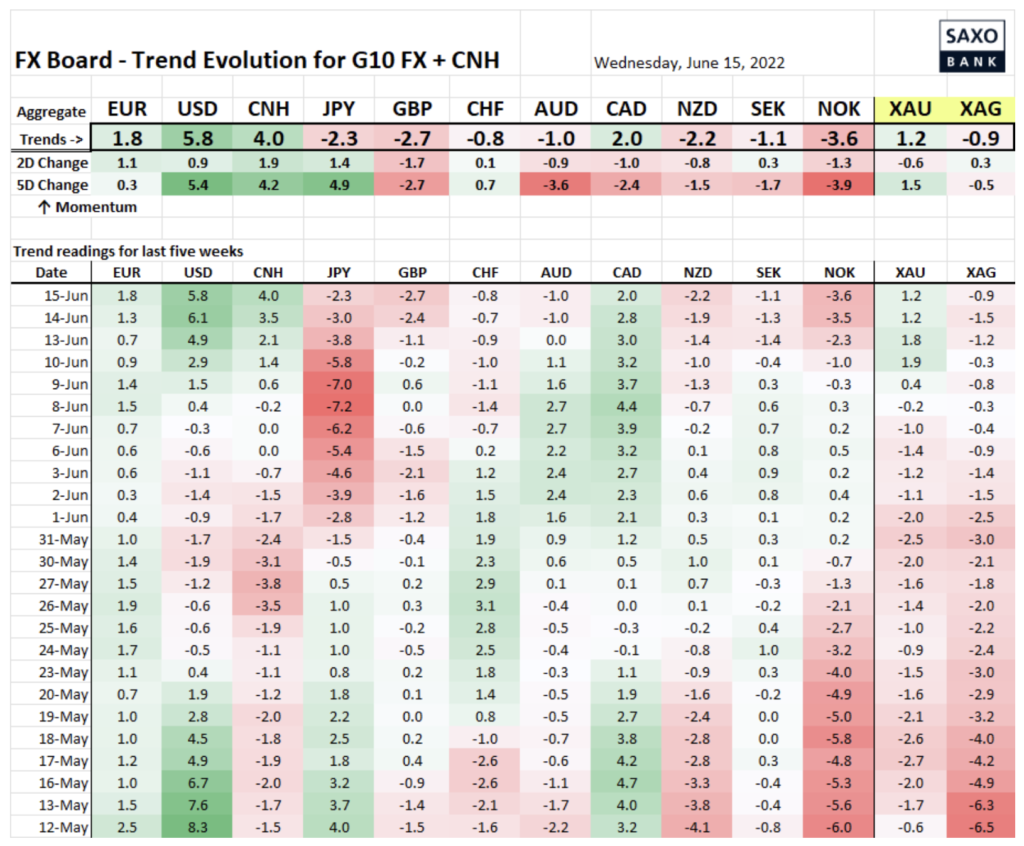

Table: Changes and strength of the trend in the G10 and CNH currency markets

Risk of chaotic moves in pairs with JPY in connection with Friday's meeting of the Bank of Japan. In addition, the general weakening of the pound is worth noting - the GBP / USD pair briefly fell below 1,2000 at one point.

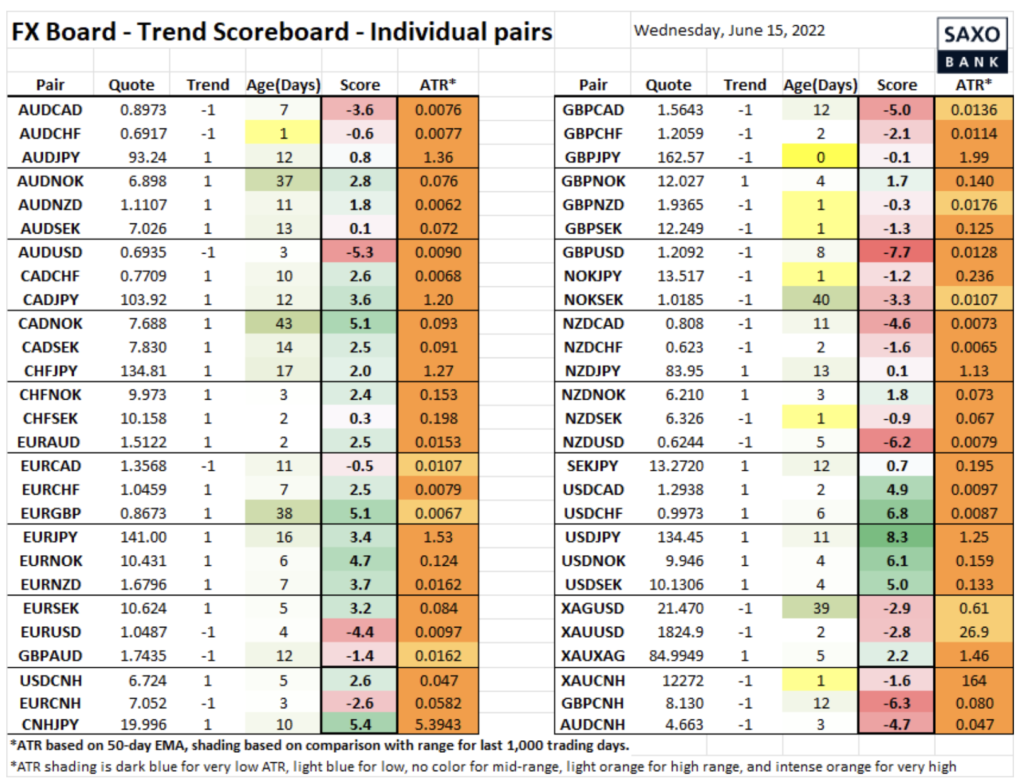

Table: Performance trends for individual currency pairs

First of all, you should monitor the situation in the JPY pairs in the next few sessions for new developments, and also monitor the trends in the USD pairs after today's FOMC meeting.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response