The king dollar and its far-reaching repercussions – Saxo Bank forecasts for QXNUMX

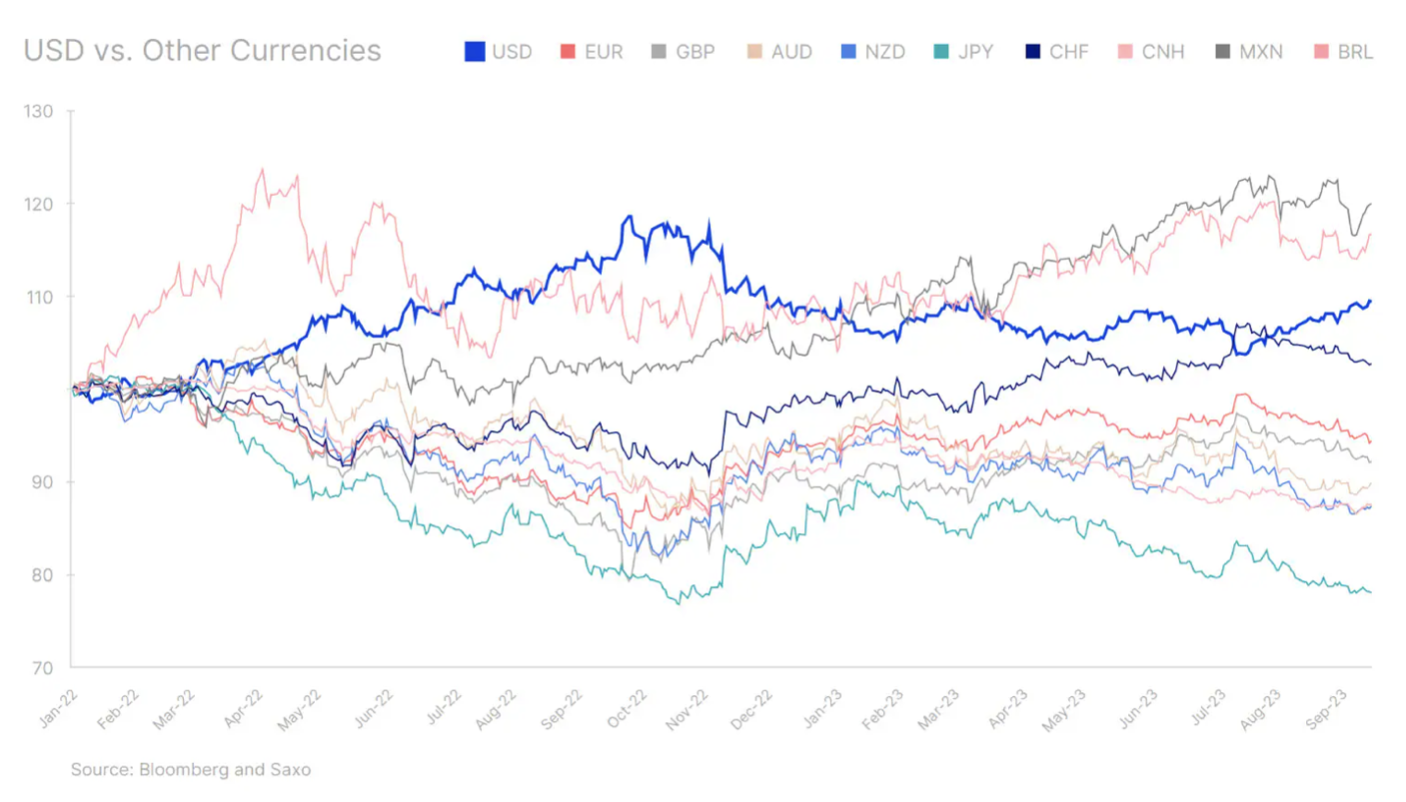

A strengthening of the US dollar seems far-fetched, but there are risks stagflation in Europe and the UK, as well as the continued weakness of the Chinese economy, continue to suggest that the currency may have further room to manoeuvre. While a strong dollar helps curb inflation in the United States, it may pose a threat to the domestic economy or investors with high exposure to international assets. On the other hand, it can make international exposure more accessible and attractive.

Reversing the US dollar is proving difficult

Most central banks appear to be at the end of their tightening cycle, but the current cycle of rapid rate increases has resulted in a sharp strengthening of the US dollar. Higher yields and the continued strength of the US economy strengthened the "king of the dollar", and previous mentions of rate cuts turned out to be premature. At the time of this writing in mid-September, 2024 Fed Funds rate futures are projecting a final rate of 4,5%, with the first full rate cut expected in June. Let's compare this with the valuations from the beginning of the third quarter, when the rate at the end of 2024 was 4,1%, and the first full rate reduction was to take place in May 2024.

Note: Indexed to 100 as of January 3, 2022.

From then on, currency markets will begin to focus more on which central banks will be the first to ease monetary policy and how aggressive the rate cuts will be in relative terms. As we approach Q2024 and 2024, yield differentials may become a secondary factor in the currency space. With August core CPI inflation remaining high in the United States, the market remains focused on the Fed's announcement of higher rates for an extended period of time, but weakening U.S. economic momentum in the fourth quarter may change this rhetoric. Higher interest rates and tighter financial conditions may continue to impact the economy, negatively impacting businesses. We also anticipate risks for consumers in the fourth quarter as pandemic savings erode and student loan repayments begin, which will strain household budgets. The weakening of the US economy may cause expectations for a rate cut to be postponed from mid-XNUMX to a later date, which will negatively impact the US dollar.

However, the relative strength of the US economy compared to Europe and China may still provide support for the US currency. The risk of stagflation is highest in the euro zone and the UK, suggesting that any weakening of the USD against the EUR and GBP may be difficult. Given the heavy weighting of the EUR in the Bloomberg USD Cash Index (Bloomberg Dollar Spot Index) this means that the overall downward trend in the dollar may only emerge once fears of stagflation become clear in the United States.

At the same time, China's economic recovery remains uninspiring, with loose monetary policy continuing to weigh on the yuan against the US dollar. Despite some early signs that China's economic data is starting to improve, with August credit data and a CPI reading suggesting an exit from deflation, seasonal factors may come into play. For the yuan's strengthening to be lasting, a more robust economic recovery is needed. For now, the weaker yuan allows China to keep its exports competitive, competing with the weak Japanese yen.

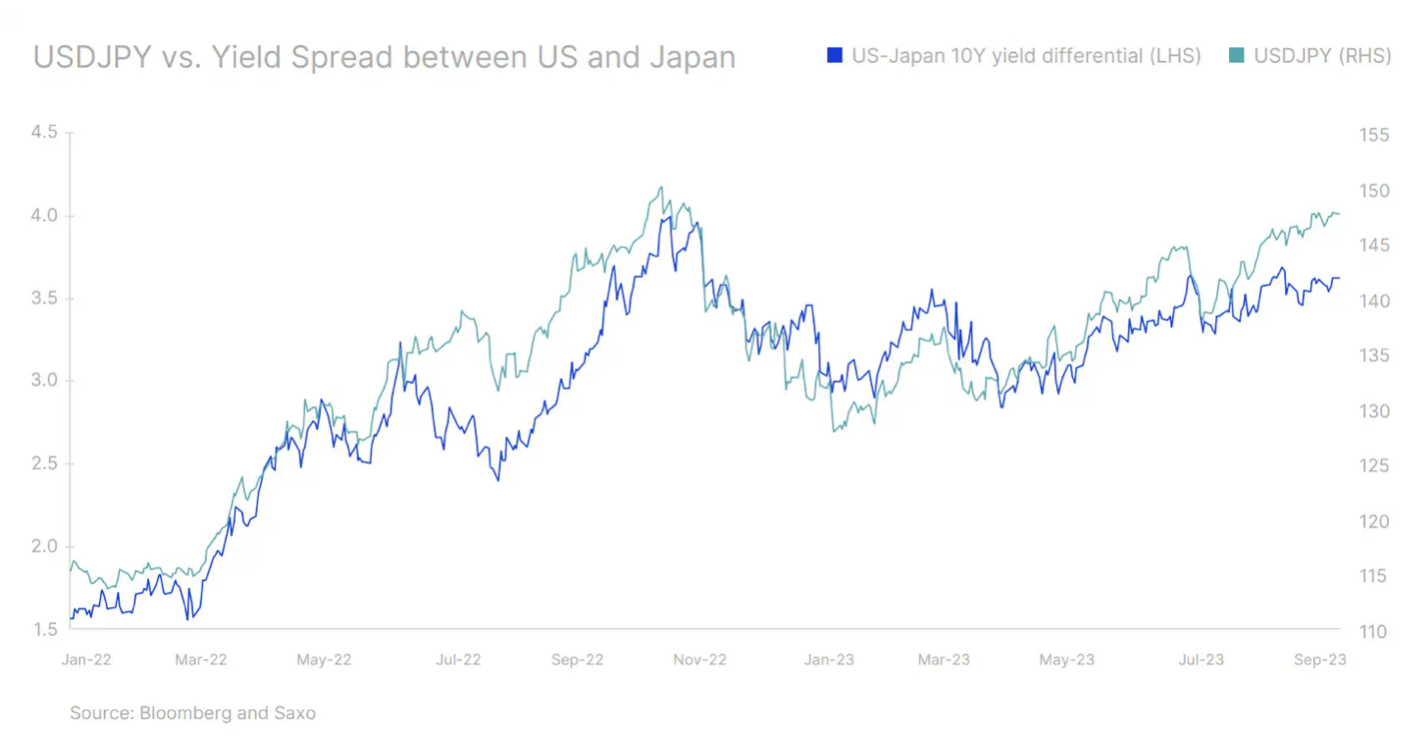

Bank of Japan in the third quarter, he defended the yen quite actively and also suggested accelerating the deadline for leaving the negative interest rate environment. But until there are clearer signs of policy change, the fundamentals will remain misaligned with the rhetoric. This means that any appreciation trends in the Japanese yen will be temporary.

Such poor results on currency markets still indicate further strengthening of the dollar. However, any further increases will be more difficult. AUD and NZD will exert some downward pressure as long as support for commodity prices and risk appetite continues. High-beta currencies such as the Swedish krona may also show some momentum. The Chinese authorities are also increasingly striving to stabilize the yuan. Meanwhile, continued tight supply in the oil markets may push the price of Brent crude to USD 100 in the short term, which could result in a strengthening of the CAD.

At the same time, a cycle of rate cuts in emerging markets began, quite aggressively. Brazylia, Chile and Poland started cutting interest rates in the third quarter, and the pace of cuts was surprisingly fast. While such sharp rate moves could destabilize emerging market currencies, subsequent cuts could be more moderate if the Fed continues its "higher rates for longer" rhetoric. This may mean that transactions carry in emerging markets will continue to be interesting, in particular for Latin American currencies, and will also contribute to the strengthening of the BRL and MXN. Mexico may also benefit from economic growth in the United States, but some pressure on the currency in the near future may be exerted by Banxico's planned liquidation of its forward currency portfolio, which would mean a wave of dollar buying. Asian currencies may remain under pressure until CNY appreciation loses steam; after the currency hit a record low in September, the INR may strengthen thanks to strong domestic growth and increasing capital flows, provided that sharp increases in inflation prove temporary.

When the dollar rules, everything else fails

A strong dollar makes already difficult market conditions even more difficult. In Q1985, there were some warnings from policymakers in countries whose economies and currencies were hardest hit by the strong dollar. Both China and Japan appear concerned about the depreciation of their currencies because they are not at a point in the business cycle where their monetary policies and yield patterns are able to track those of the United States. For other areas, such as the eurozone and the UK, the appreciation of the US dollar negatively affects their ability to fight inflation and forces them to further raise interest rates, pushing their economies towards recession or stagflation. But is a coordinated intervention by central banks possible, such as the Plaza agreement of XNUMX? We believe not, because at that time the United States sought to weaken the dollar and joined a coordinated response due to the fact that a strong currency impaired the competitiveness of its exports. However, now the scenario has been reversed and the strong dollar is helping Federal Reserve in the fight against inflation, and therefore coordinated action to weaken the US currency is unlikely.

At the same time, expectations related to the abandonment of the dollar have also been postponed by several years, in particular due to BRICS expansion from next year, which raises the question of whether this will result in greater coordination or chaos. Any alternatives to the US dollar may remain at best viable for trade within the enlarged BRICS group, but it is still difficult to see any real threats to the USD's role in global trade and its status as a reserve currency in the foreseeable future.

Investors should be aware of the impact of a strong dollar on their portfolios. Here are some things to consider:

- The strong US dollar affects the profits of American companies present on international markets. S&P 500 companies generate approximately 30% of their revenues outside the United States. This partially explains why the dollar is inversely correlated with U.S. stocks or with high-risk assets more broadly.

- Also from a macro perspective, a strong US dollar may mean reduced exports and therefore lower economic growth in the United States.

- Many emerging markets may also become destabilized as their USD-denominated debt burden increases, increasing the default risk of more vulnerable emerging economies such as Sri Lanka.

- Most commodities, such as crude oil, are denominated in USD. A strong dollar may therefore cause a decline in commodity prices.

To secure or not to secure?

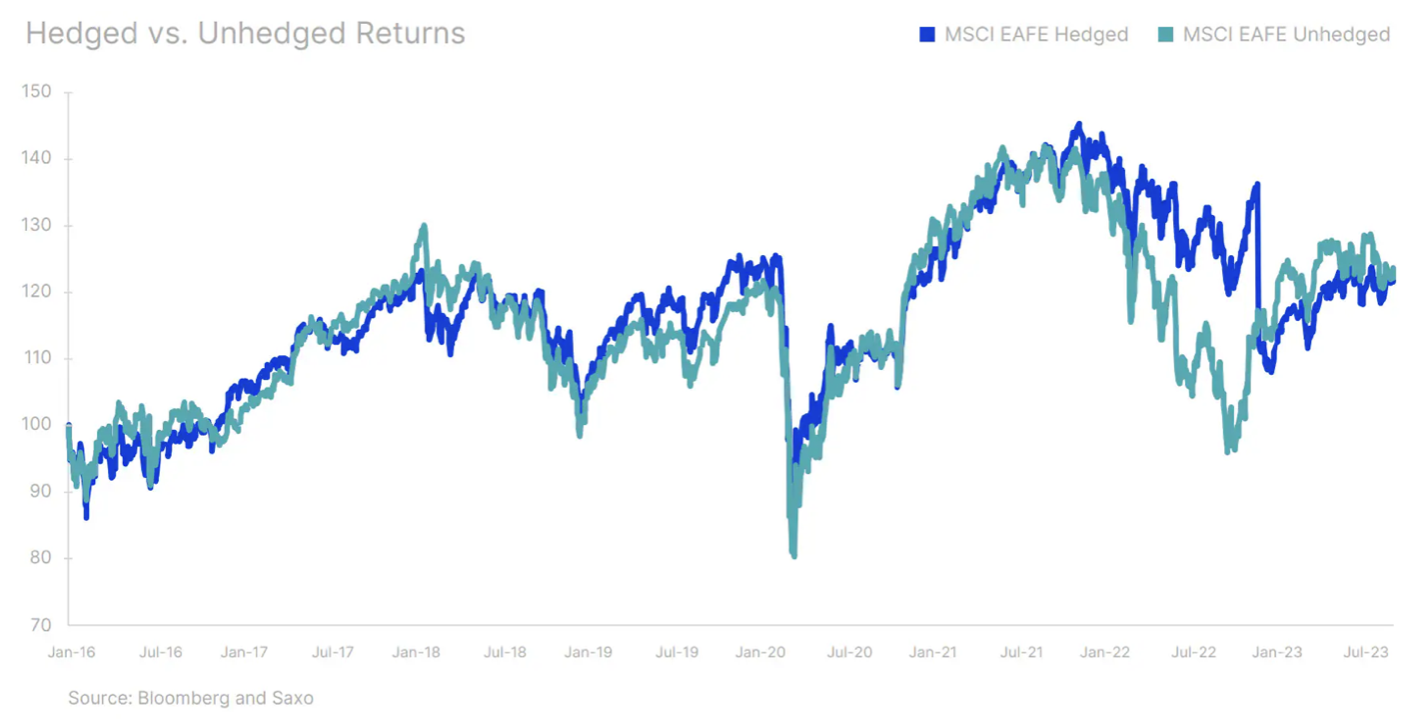

Market participants with high exposure to USD assets who have adopted a bearish approach to stocks and want to protect their portfolios may consider a long position in the US dollar, which is the so-called safe haven. It is worth noting, however, that this may be more suitable for traders operating on a short-term horizon, as the return on hedged and unhedged products is usually the same over the long term. It is also worth emphasizing that large differences in interest rates between the dollar and other currencies currently make hedging expensive for Asian and European investors. The decision to invest in international assets as part of a well-diversified portfolio may be more impactful for portfolios than the decision to hedge the investment.

Investors based in the United States may see the performance of their overseas investments deteriorate. This may mean that they will focus on US companies with exposure to the domestic market, primarily small and medium-sized enterprises or sectors such as real estate or utilities, at the expense of large-cap companies and technology or consumer goods companies that have greater exposure. international.

For non-US investors, increasing exposure to the US market will become expensive, and local opportunities may be more attractive and affordable, which could reduce the flow of new investment in US assets.

About the Author

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)