Bovespa - How to trade the Brazilian index? [Guide]

Brazil is Latin America's largest economy. For this reason, investors wishing to have exposure to the South and Central American markets should monitor the equity market of the largest economy. Exposure to the Brazilian market can be achieved by investing in the local capital market. The flagship index grouping the largest and most liquid companies listed on the stock exchange is Bovespa (Indice Bovespa)which is sometimes called Ibovespa. The index represents about 70% of the value of the Brazilian market (in terms of capitalization). As of February 15, 2021, the index consists of 81 components. Ibovespa was created in 1968 and is one of the most important indexes in the world.

To be included in the index, a company must be traded on the Brazilian stock exchange (B3) and must have a turnover of at least 95% of the session during the year. At the same time, the company cannot be a penny company ("Penny stock"). Companies traded via BDR depository receipts (Brazilian Depositary Receipts). Index weights are calculated based on capitalization multiplied by the free turnover factor (free float adjusted weighting). The index is quoted in Brazilian Real (BRL). The composition of the index is updated three times a year (January, May, September).

BRAComp chart (CFD based on the Bovespa index), MN. Source: xNUMX XTB.

Index composition

The index is quite well diversified by sector. Unfortunately, Bovespa does not have much exposure to the new technology market. As of February 15, the share of this segment was approximately 0,76%. There is only one company in the sector (TOTVS SA). Below are the key sectors of the Bovespa index:

- Finance - 18,2%

- Raw materials - 12,7%

- Clothing, gas, biofuels - 13,6%

- Cyclical consumer sector - 7,3%

The largest companies included in the index were:

- Vale - 12,1%

- Itau Unibanco - 6,0%

- Petrobras - 5,9%

- B3 - 5,3%

- Bradesco - 4,9%

Some of the companies included in the Bovespa index will be listed below:

Brasil, Bolsa, Balcao (BB3)

It is the largest stock exchange in Latin America and one of the largest in the world. The company's history began in 1890 when Bolsa Livre was founded. A milestone in the company's development was the merger between the São Paulo Stock Exchange (Bovespa) and BM&F (Brazilian Mercantile and Futures Exchange), which took place in 2008. As a result, a stock and derivatives trading platform was established. The company BM & FBOVESPA was established. In 2017, the company took over the largest Latin American clearing house Cetip for $ 3,9 billion.

| B3 | 2017 | 2018 | 2019 |

| revenues | BRL 3 million | BRL 4 million | BRL 5 million |

| Operational profit | BRL 1 million | BRL 2 million | BRL 3 million |

| Operating margin | 48,4% | 50,5% | 54,2% |

| Net profit | BRL 171,3 million | BRL 197,7 million | BRL 205,1 million |

JBS SA

It is one of the largest producers of meat in the world (beef, pork, chicken). JBS is the largest beef producer in Brazil, Australia and North America. The company is also the second largest pork producer in the United States. The main directions of export of the company's products are Asian countries, which account for 52,6% of total exports (including China - 29,8%; Japan - 10,8%; South Korea - 9,5%). The company's brands include: Pilgrim's Pride, Primo and 1953 Friboi.

| JBS SA | 2017 | 2018 | 2019 |

| revenues | BRL 163,2 billion | BRL 181,7 billion | BRL 204,5 billion |

| Operational profit | BRL 6,6 billion | BRL 6,6 billion | BRL 13,0 billion |

| Operating margin | 4,0% | 3,6% | 6,4% |

| Net profit | BRL 0,5 billion | BRL 0,03 billion | BRL 6,1 billion |

Petrobras

The company was founded in 1953. Petróleo Brasileiro SA, better known as Petrobras, is a company whose main shareholders are the Brazilian government. In 2020, the company took 70th place on the Forbes Global 2000 list. The company deals with the extraction of crude oil and natural gas. Other activities include refining services, transport and distribution of petroleum products and biodiesel. Most of the production is located in Brazil, but Petrobras also operates in Africa, Asia, Europe and North America.

| Petrobras | 2017 | 2018 | 2019 |

| revenues | BRL 88,83 billion | BRL 95,58 billion | BRL 76,59 billion |

| Operational profit | BRL 12,06 billion | BRL 21,53 billion | BRL 18,50 billion |

| Operating margin | 13,6% | 22,52% | 24,2% |

| Net profit | -0,1 billion BRL | BRL 7,2 billion | BRL 10,2 billion |

AmBev

The full name of AmBev is Companhia de Bebidas das Américas. It is a Brazilian brewing group owned by Anheuser - Busch InBev. The company was established in 1999 as a result of the merger of two breweries: Brahma and Antarctica. The company operates in several markets in Latin America (including Argentina, Chile, Brazil, Bolivia) and Canada. The company owns such companies as Brahma, Presidente, Bohemia, Skol and Labatt. AmBev also has several brands of non-alcoholic beverages, incl. Guaraná Antarctica or Soda Antarctica.

| AmBev | 2017 | 2018 | 2019 |

| revenues | $ 47,90 billion | $ 50,23 billion | $ 52,60 billion |

| Operational profit | $ 16,26 billion | $ 16,77 billion | $ 16,24 billion |

| Operating margin | 33,9% | 33,4% | 30,9% |

| Net profit | $ 7,331 billion | $ 11,02 billion | $ 11,78 billion |

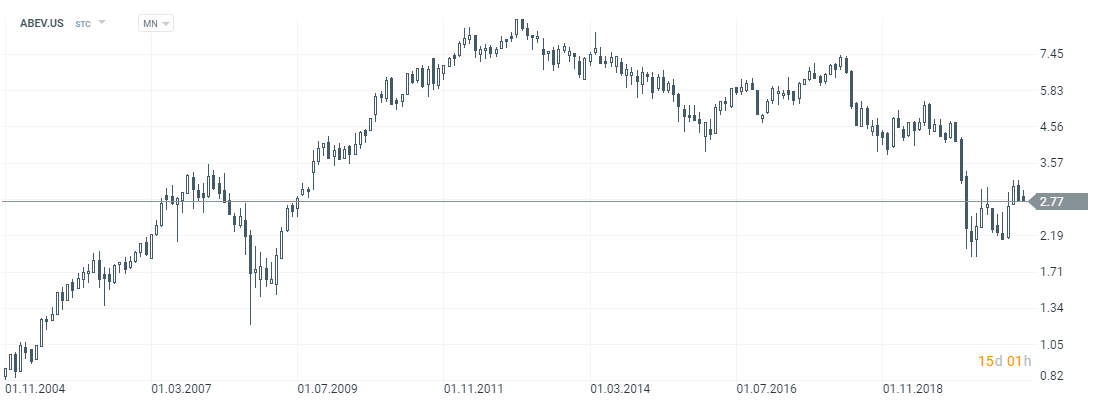

AmBev stock chart, MN interval. Source: xNUMX XTB.

Telefonica Brazil

In the 90s, the company was called Telebras and was a state monopoly on the telecommunications market. After dividing into 12 divisions, the companies were privatized. Telefonica Brasil was created as a result of the acquisition by the Spanish company Telefonica of one of the "Baby Bras", namely Telesp. The Brazilian Telefonica branch is the largest telecom in the Land of Coffee. The market share is around 33%. The company also offers FTTH (Fiber-To-The-Home) internet. Another business segment is the pay TV offer.

| Telefonica Brazil | 2017 | 2018 | 2019 |

| revenues | BRL 43,20 billion | BRL 43,46 billion | BRL 44,27 billion |

| Operational profit | BRL 8,00 billion | BRL 10,87 billion | BRL 6,81 billion |

| Operating margin | 18,5% | 25,01% | 15,4% |

| Net profit | BRL 4,61 billion | BRL 8,92 billion | BRL 5,00 billion |

What can affect the value of the Bovespa index?

The condition of the Brazilian and world economy

The index includes both companies operating mainly on the Brazilian market (GPA, Lojas Americanas, Sabesp) and international corporations whose products are sold mainly on foreign markets (JBS, Ambev). For this reason, the index is influenced both by the condition of the world economy (for the most part), but some companies are more exposed to the domestic condition of the economy.

Inflation and the impact of the exchange rate

Another factor that influences the valuation of stock prices is inflation and the exchange rate of the Brazilian real. Inflation is a problem for companies having difficulty transferring rising costs to customers. In turn, companies with "pricing power" can easily pass the rising costs onto their customers. Another factor is the exchange rate. The weakening of the exchange rate is especially beneficial for exporters, as their products become "cheaper" on the global market, but the downside of the decline in the exchange rate is the lower profitability of investments in the domestic currency.

Financial results of companies

In the long term, the company's improving financial results are the most important. Increasing revenues, profits and free cash flow (FCF) are solid arguments for long-term increases in stock prices. For this reason, it is worth following the financial results of companies included in the index. Especially those that have the greatest impact on changing the index value.

The inflow of foreign capital

Another factor influencing the index value is global capital flows. When developing markets are "in fashion" there is an inflow of capital, which raises the valuation of companies and translates into an increase in the index value. It was like that in the years 2002-2008, when the IBOV index increased by several hundred percent.

How to trade the Bovespa Index?

One of the easiest ways to invest in the Ibovespa Index is to buy a futures contract. However, due to the large notional value (1 point equals 1 BRL), many investors are forced to look for an alternative with a lower entry threshold. One of them is the ETF with exposure to Ibovespa companies.

One of the most important ETFs with exposure to the biggest Brazilian companies is the iShares MSCI Brazil ETF (EWZ). The issuer of the ETF is BlackRock. As of February 12, 2021, assets under management (AUM) totaled $ 6,4 billion. The index is priced in US dollars and therefore the rate of return is "adjusted" for the Brazilian Real against the US dollar. TER (total expense ratio) is 0,59% per annum.

CFDs on Bovespa

Another possibility is to take advantage of Index CFDs Bovespa, which are offered by a handful of forex brokers.

| Broker |  |

|

| End | Poland | Poland |

| Bovespa symbol | BRAComp | BRACOMP.pro |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

PLN 0 |

| Min. Lot value | price * 2 USD | price * 1 USD |

| Commission | - | - |

| Platform | xStation | MetaTrader 5 |

| - | ||

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Where to invest in ETF

More and more forex brokers have a wide variety ETFs in its offer. For example on XTB today we can find over 400 instruments of this type, in Admirals almost 397, a Saxo Bank almost 3000.

| Broker |  |

|

|

| End | Poland | Denmark | Great Britain |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFDs on ETFs |

3000 - ETF 675 - ETF CFDs |

397 - ETF CFDs |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 5 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

MetaTrader 5 |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Bovespa - How to trade the Brazilian index? [Guide] bovespa index](https://forexclub.pl/wp-content/uploads/2021/02/indeks-bovespa.jpg?v=1613637631)

![Bovespa - How to trade the Brazilian index? [Guide] Experienced forex client](https://forexclub.pl/wp-content/uploads/2021/02/klient-doswiadczony-forex-102x65.jpg?v=1613583371)

![Bovespa - How to trade the Brazilian index? [Guide] the pacifica group reviews scam](https://forexclub.pl/wp-content/uploads/2021/02/the-pacifica-group-opinie-scam-102x65.jpg?v=1613647141)

Leave a Response