Stagflation, Volcker Shock – is this a real threat now?

The rapid increase in interest rates in the United States was a surprise to virtually all market participants. After years of ultra-low interest rates, there was a rapid increase in interest rates in the United States and the European Union. High interest rates are intended to counteract high inflation. In theory, higher credit costs are supposed to slow down investment and consumption. This is expected to reduce demand throughout the economy. As a result, the economic situation will decline and financial problems will appear in some companies. This, in turn, will cause the demand for labor to decline. This will result in a weakening of wage pressure and an increase in unemployment. It is the concept of strangling inflation through worse economic conditions. In this article we will explain what it is Volcker shock and we will consider whether such a situation threatens the United States again. We invite you to read.

Stagflation turns the tables

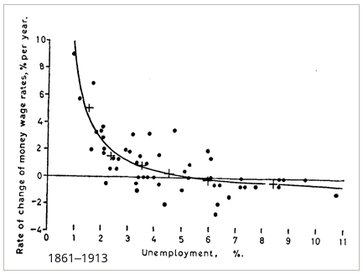

Volcker's shock can only be explained by going back to the 70s. The period of stagflation influenced the actions of politicians and central banks throughout the capitalist world. Until the 70s, economists believed that this was one of the economic rules. Therefore, if unemployment remained too high, it was enough to loosen monetary policy. As a result, economic prosperity returned. Then the unemployment rate dropped. When inflation was getting out of control, it was enough to introduce a slightly more restrictive monetary policy. At that time, the economic situation was cooling, economic activity was declining and the demand for labor was decreasing. Therefore, the inflation pressure was decreasing. According to this theory, high unemployment and high inflation could not exist at the same time. When it seemed that such a relationship was permanent, it appeared stagflation. It was a time when simultaneously there was high inflation and weak economic growth, which kept the unemployment rate high. That's when many economists believed in Philips curve. Interestingly, history helped with this. Data on the negative correlation between inflation and unemployment dated back to the second half of the XNUMXth century.

Philips curve. Source: wikipedia.org

Landscape before stagflation

B-52 air raid on North Vietnam. Source: wikipedia.org

The turn of the 60s and 70s in the United States was a very difficult period, both from a political and economic point of view. Some commentators unfavorable to the US mentioned the decline of America. Indeed, the situation did not seem interesting. In the early 70s, the Vietnam War was still going on and the costs were enormous. Both related to growing spending on weapons and significant losses in people and equipment. Disenchantment with the war slowly grew in the United States. Opponents of the Vietnam War mentioned that the United States had to resign "world gendarme" and start reforming its economy.

Moreover, the 70s also saw the development of the program Great Society, which was intended to help fight poverty and social exclusion in the United States. The project, although generously financed, was not a success. The combination of high military spending and extensive social projects meant rising costs. At the same time, the government did not want to increase budget revenues through a drastic tax increase. It was decided to finance part of the expenditure with a deficit. This began to increasingly undermine the credibility of the United States. Ultimately it ended in collapse The Bretton Woods system.

Signing of the Poverty Bill in 1964, one of the elements of the Great Society. Source: wikipedia.org

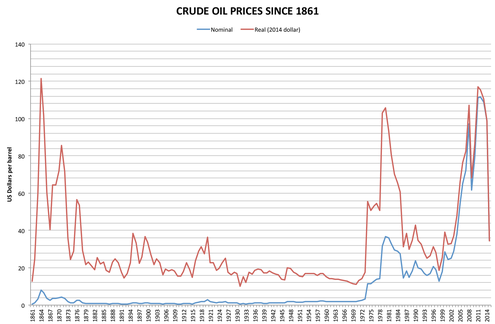

Another problem was prices oil. After World War II, the price of oil was relatively low. This meant that economies were used to these levels. As a result, transport and other industries using crude oil were not concerned about the high consumption of this raw material. It was the era of post-war, cheap energy, which allowed for dynamic economic development both in the USA and Western European countries. The situation changed in 1973. Then the countries associated with OPEC imposed an embargo on those who supported Israel in its war against Arab countries. This caused the price of crude oil to quickly increase by several hundred percent. Western countries simply did not produce as much "Black gold", how much they consumed. There was an oil embargo to the United States and several “unfriendly countries”. Moreover, there has been a reduction in production. In effect the price of oil rose from $3,35 to $12,00 in just a few months. At 2018 prices, this meant an increase from $17 to $61.

Nominal and real prices of crude oil. Source: wikipedia.org

The increase in oil prices ended the so-called “long summer”. The period from 1945 to 1973 was a time of rapid enrichment of society in Western countries. Cheap energy allowed for maintaining high production capacities. It was during these years that France and Germany attracted large numbers of workers to their factories. The increase in oil prices has changed consumer habits. American consumers have significantly reduced their purchases of American-made cars “gas guzzler”. Big American cars consumed a lot of fuel. As fuel prices rose, Americans became more enthusiastic about cars Japan or Europe. As a result, the slow decline of the American automotive industry began, which triumphed in the 50s and 60s. The increase in oil prices resulted in:

- firstly, a sharp increase in inflation,

- secondly, it hindered business activity in the USA and Western Europe.

Stagflation has set in in the US

The increase in energy prices made it appear price-wage spiral. Prices for goods rose, causing workers to demand pay increases. The increase in wages, in turn, resulted in pressure to increase the prices of products and services. The increase in production costs resulted in decreased economic activity. FED had to make a choice - whether to decide to fight the economic slowdown or fight inflation. It was decided to do the former. The reason was frequent recessions, which had an unfavorable impact on the labor market. This was a big problem for the government, because high unemployment means more dissatisfied voters.

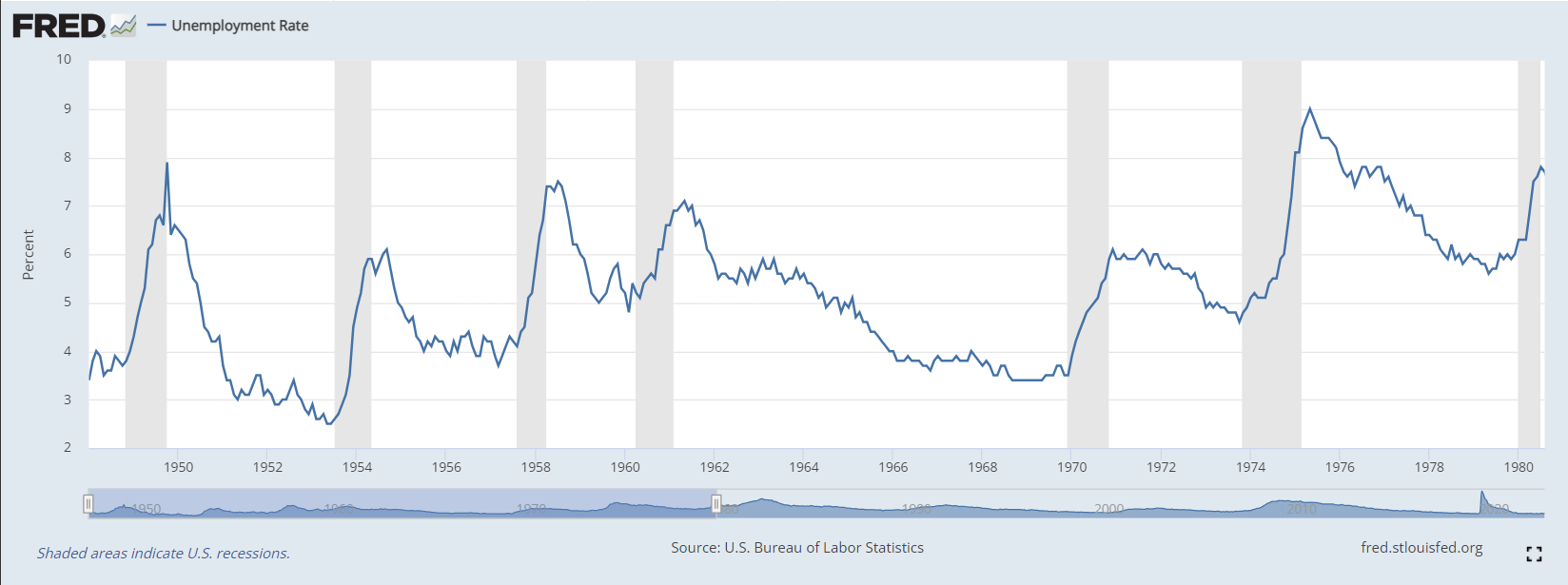

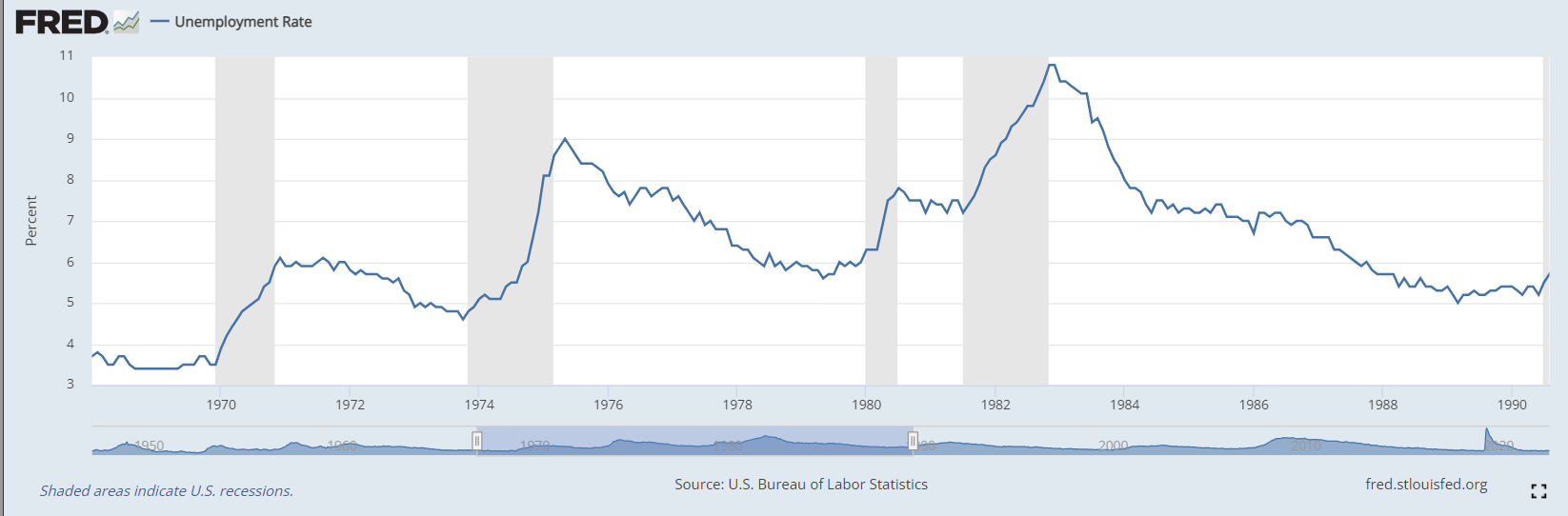

Unemployment in the USA. Source: FRED

You can see from the chart above that there were two significant recessions in the 70s. Both took a long time. The first one raised the unemployment rate to the highest in a decade, while the second resulted in unemployment above 9%, which was a result unheard of in the post-war history of the United States. It is worth remembering that there were strong trade unions in the United States at that time. As a result, frequent strikes were not uncommon. High inflation encouraged workers to call strikes. Organized trade unions reduced companies' flexibility to respond

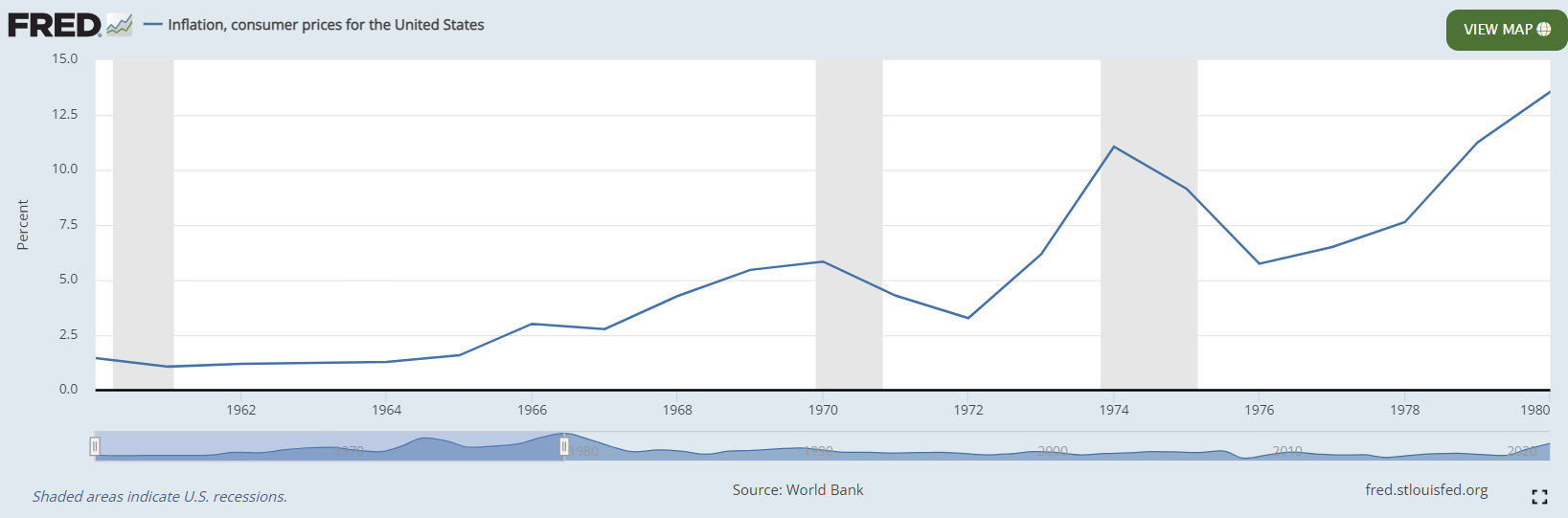

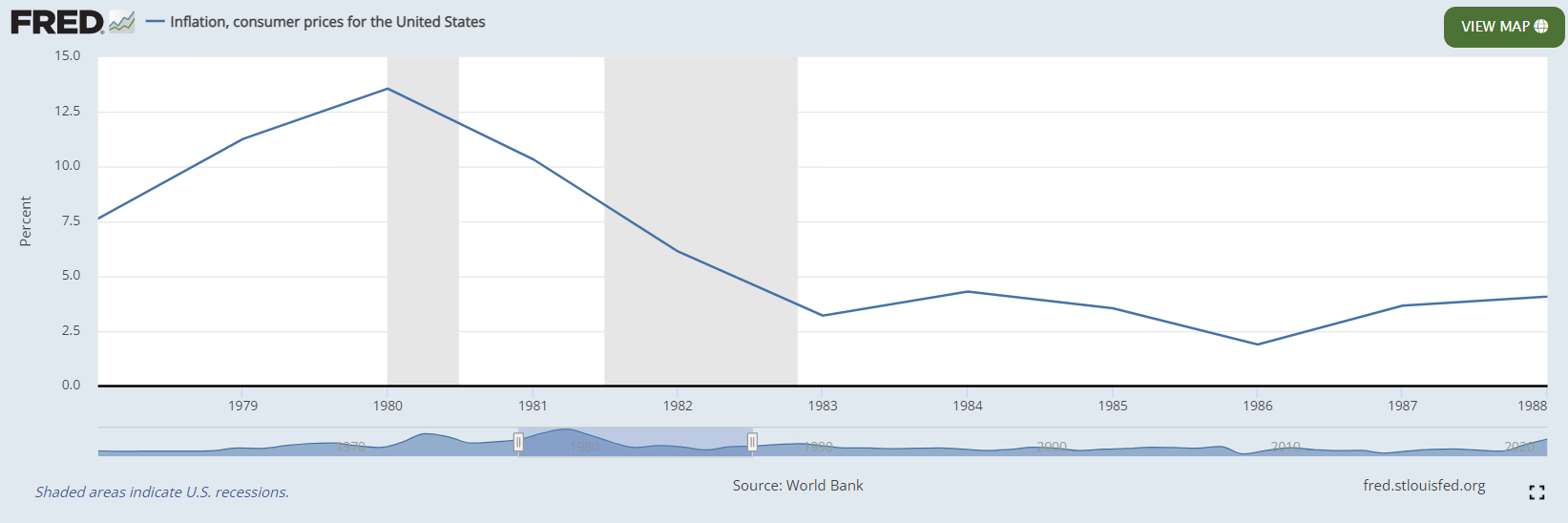

Importantly, in 1974 both high unemployment and high inflation prevailed. Only when the situation on the oil market normalized did inflation decline, but it was still higher than the previous inflation peak in the early 1970s. So the issue of high inflation has not been resolved. Despite the initial decline in inflation, it did not return to its long-term average.

Inflation in the USA. Source: FRED

In the late 70s, entertainment began again. Both the unemployment rate and inflation began to rise. The second oil shock caused by the Iran affair certainly did not help in curbing inflation.

An interesting example that well illustrates the atmosphere of the 70s was the year 1974. The United States found itself in a severe recession that began in November 1973. The peak of the economic depression dates back to the winter of 1974/1975. At that time, inflation exceeded 10%, while unemployment approached 9%. The Fed responded to rising inflation by increasing interest rates, which reached double-digit levels. It was a shock for many companies that were significantly in debt or had liquidity problems due to contractor problems. However, this allowed inflation to be stopped. However, the political costs were too high to keep rates high for long. It was decided to quickly reduce them to around 5-6%. As a result, inflation continued to remain high, exceeding 5%. Until the end of the 70s, inflation in the USA was rising slightly. The second oil shock only showed once again that more radical action is necessary.

The 70s also saw the increasing importance of OPEC countries. Previously, these countries were dominated by Western mining companies, the so-called Seven Sisters. Western companies signed long-term contracts for the supply of oil at low prices. Thanks to fragmented supply and lack of cooperation, buyers had the upper hand in negotiations. The first embargo showed that OPEC countries can also play an important role on the oil market. The United States was helped to reduce oil prices by Venezuela's policy, which increased production and benefited from the increase in market prices of crude oil. At that time, Venezuela was one of the richest countries in the world. The collapse of Venezuela is a topic for another article.

In 1979, the second oil crisis occurred. This time the reason was the revolution in Iran and the subsequent start of the war between Iran and Iraq. Because two countries exporting large oil deposits were fighting, and the conflict area was close to oil fields, the market panicked. Oil purchases doubled the price of oil in a very short period of time. This led to a renewed increase in inflationary pressure and a repeat of the first half of the 70s. Only in this case, inflation started from a much higher level.

Economic policy in the 70s

Po Great Depression Keynesianism began to celebrate its triumph. Supporters of this theory believed that monetary and fiscal policy could alleviate or even prevent potential crises. She was very popular Philips curve. She said that there is an inverse relationship between unemployment and the inflation rate. Keynesians believed that they could adjust the business cycle to their own expectations through budget deficits or surpluses and changes in interest rates. However, the problem was the expectations of politicians. No politician wants a recession because it hurts his voters. For this reason, the Fed's mandate was not only to control inflation, but also to promote economic development.

Arthur Burns, Fed chairman, who was born into a Polish-Jewish family in Stanisławów (now Ivano-Frankivsk). Source: wikipedia.org

At that time, the situation was different from the "standard" post-war years. The world monetary system was facing big changes. The agony of the Bretton Woods system was already taking place. What's more, it happened supply shock. The increase in energy prices helped to increase inflation, which significantly hampered the Fed's ability to act. Of course, some of the interest rate increases were high, but they were followed very quickly by rate cuts. The Fed didn't want to “kill” economic growth through a long restrictive monetary policy.

Chairman of the Fed, Arthur Burns, in the early 70s, believed that he could not bring down inflation with restrictive monetary policy because inflation was caused by factors that were beyond the Fed's influence. The president of the American central bank had in mind the oil shock and strong trade unions. What's more, social pressure was also a problem. Politicians did not want unemployment to return to the levels of the 20s and 30s. For this reason, they tried to influence the central bank so that monetary policy was not too restrictive. The government did not agree to lower inflation at the expense of double-digit unemployment. Only when the situation got out of control was the decision made "shock therapy", which he made Volcker. This is further proof that politicians only behave rationally when all other methods fail.

Another problem was also price regulation. In 1971, Nixon introduced price regulation on selected products. The American government consulted the price level with enterprises and only when it was convinced by the business side's arguments did it agree to change the price list of goods and services. This allowed inflation to be maintained "on paper", but made it difficult to properly allocate capital in the economy. Over the years, price control became more and more difficult. As a result, in April 1974, Nixon agreed to end price controls. In the short term, this contributed to an increase in inflation, but on the other hand, it helped to better use available resources in the economy.

Change in the Fed's position - monetarists gain the advantage

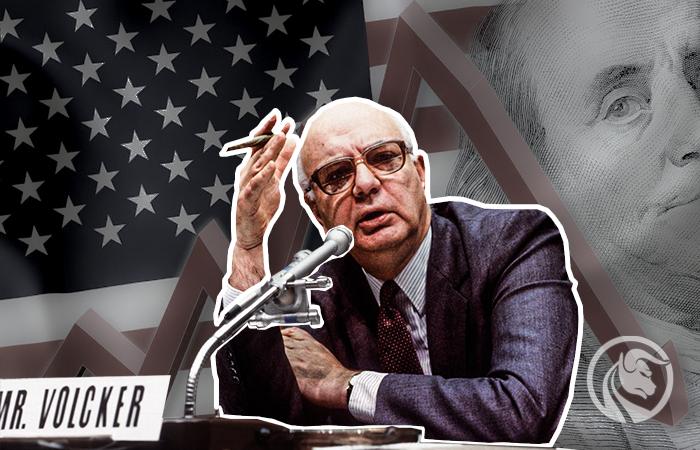

Fed Chairman Paul Volcker. Source: wikipedia.org

The 70s showed that a more severe approach to the fight against inflation was necessary. In 1978, Arthur Burns ceased to be chairman of the Federal Reserve. He took his place Paul Volcker, who was closer to monetarism than Keynesianism. Monetarism gained great popularity at the turn of the 70s and 80s. The leading representative of this trend was Milton Friedman. He argued that inflation is always a monetary phenomenon. He believed that an increase in the money supply would sooner or later lead to higher prices. For this reason, he postulated that the source of the inflation problem should be fought, not its effects. Paul Volcker decided to fight inflation with sharp increases in interest rates and limit the money supply. This certainly allowed for a reduction in inflationary pressure, but resulted in a very deep recession. Certain factors also helped to keep high inflation out of the headlines for many years.

The macro- and microeconomic environment also began to be favorable. It's the 80's the triumph of neoliberalism, which resulted in a decline in the importance of trade unions in the United States. The reduction in energy prices also helped, reducing inflationary pressure. The process of deregulating economies and reducing barriers to the flow of products and capital has also begun. The West was slowly opening up to China, which produced more and more cheap goods, which also (for now only slightly) helped reduce the inflationary pressure.

Volcker declares war on inflation

Let's take a closer look at the conditions under which Volcker took office. In 1979, inflation rose to a level 11,25%. At the same time, unemployment remained at the same level 6%, which was a result well above the lows from the economic peaks. For example, in 1969 unemployment was 3,5% and in 1973 4,6%. So the 6% level was high and suggested that economic growth in the United States was not very strong. This is not surprising, because the FED has been fighting inflation for two years, but without much success. The effective interest rate increased between spring 1977 and December 1978 from 4,75% to over 10%.

The processes created during the work of the previous Fed president fueled inflation. By force of momentum in March 1980, inflation rose to 14,8%. Paul Volcker decided to act and started raising interest rates dramatically. They increased to 20% in June 1981. Back then, few understood how the central bank worked. The opposition thundered that it was killing the American economy and being a gift to the USSR. Borrowers complained about the huge costs of mortgage, car and consumer loans. This significantly slowed down consumer demand. In 1980, a wave of layoffs began in the automotive sector. The poor economic situation in this sector lasted until 1982. At that time, the unemployment rate among those formerly employed in this sector was over 20%. A similar level also concerned construction workers. It is no wonder that high interest rates on loans have significantly cooled down consumer spending (e.g. on cars) and investment projects (e.g. building a house).

In a nutshell Volcker decided to reduce the money supply, which resulted in banks having less funds available for lending. Therefore, liquidity in the financial sector decreased. Money became valuable, which increased the cost of loans. More expensive loans discouraged investment activity. As a result, there was a decline in global demand in the economy.

Edward Gierek, he was behind the failed policy of indebting the country in order to raise the economic level. Source: wikipedia.org

Developing countries had problems repaying dollar loans. Conspiracy theories appeared about deliberately causing crises in developing countries. Poland was also hit hard as it was unable to even repay the interest on loans it took out in the 70s to modernize its economy.

The scale of the FED's monetary policy had a particular impact on the industrial, construction and agricultural sectors. Companies with high financial leverage or large investment needs (e.g. heavy industry) also had problems. Political attacks on Fed policy were the strongest since 1922.

While the Fed was tightening its monetary policy, fiscal policy was significantly loosened. The Reagan administration introduced Reaganomics, which resulted in significant tax cuts. At the same time, the United States spent large sums of money on modernizing its troops and imposing an arms race on the Soviet Union. Such actions increased the budget deficit. In addition, there was also an increase in imports of goods to the USA. As a result, twin deficits appeared. The states had a current account deficit and a fiscal deficit.

Volcker shock - consequences

Ultimately, the 80s were a triumph for the United States. This concerned both the economic, political and cultural situation. The final result of the success of the 80s was triumph Washington Consensus and the so-called Pax americana.

Reducing inflation to 3% is Paul Volcker's undoubted success. However, this did not come without costs, and large ones at that. High interest rates have significantly contributed to the beginning of the deindustrialization process in the USA. Companies looking for savings chose countries with lower employee costs. This caused many bustling cities and towns to fall into ruin. A slow process of deterioration of the financial situation of blue-collar workers also began. The times when an employee could support his entire family on one salary are gone forever.

US inflation in 1978 – 1988. Volcker shock. Source: FRED

In 1982, at the peak of the economic recession, inflation reached 10,8%. It is worth remembering that this is the number of people actively looking for a job. However, some people stopped looking for a job due to difficulties in finding a job. This may not seem like much, but it was higher than during the US subprime crisis, when the unemployment rate was 10%. In the early 80s, employees were particularly affected by the economic downturn “industrial belt”. Over the years this area has been named "rust belt", as production in these regions has shrunk dramatically. Permanent unemployment is not only statistics, but also social problems, such as an increase in crime, alcoholism and broken families. Clearly, the economy needed several good years to bring the unemployment rate down to the levels of the late 70s.

US unemployment in the years 1969 - 1990. Volcker shock. Source: FRED

Higher interest rates in the US resulted in an outflow of capital from developing markets. Latin American countries that borrowed large sums of money to modernize their economies experienced particularly large problems. However, due to the institutional weakness of many governments in these countries, funds were wasted or even stolen. The crisis in Latin American penalties has begun August 1982 in Mexico. High debt, an overvalued exchange rate and economic problems in the USA have caused economic problems in Latin American countries. Moreover, companies also had problems with high interest rates and drying up liquidity in the global capital market. Countries had problems with loan rollovers and high interest costs. The crisis was resolved only in 1985 and 1989, with the introduction of the so-called Brady's plan i Baker's plan. Many commentators call it the 80s in Latin American countries "lost decade".

Is the current situation similar to that of the 70s and 80s?

NO. The current situation in the US is completely different than it was in the 80s. The reason is that For now, the United States has no problems with stagflationand. The Volcker Shock was a response to a decade of trying to combat inflation and low economic growth. We are now in our second year of relatively higher price levels. However, monetary authorities are currently taking the inflation threat much more seriously. This can be seen in the current policy of the FED, which has raised the interest rate very sharply.

The role of central banks is also completely different. In the 70s, in addition to price control, the FED also had to support economic growth and minimize unemployment. Often the goals were mutually exclusive. It is known that economic growth and low unemployment were more important to politicians at that time than price stability. As a result, for a long time the higher level of inflation did not alarm central banks. Currently, inflation targeting is normal practice at central banks, they were not so widely used then.

Also Currently, there are no such significant supply shocksthat would force the largest economies to control prices or limit the amount of goods purchased. Oil prices have not increased by several hundred percent recently. Russia's aggression against Ukraine severely disrupted activity in some markets, but it was not as strong a blow to the world economy as OPEC's decision in the first half of the 70s.

Of course, this does not mean that you should approach the current situation with calm. You should diversify your investment portfolio, both geographically and in terms of asset structure. Keeping cash in your account is the worst choice an investor can make.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response