Gold maintains support amid doubts regarding the Fed's soft landing announcement

Gold's ability to maintain support despite numerous problems was once again evident on Wednesday after the American Federal Reserve announced a hawkish pause in its aggressive campaign of interest rate increases, while forecasting much higher rates in 2024 and 2025 due to the resilient US economy, strong labor market and persistent inflation, recently worsened by OPEC actions resulting in higher energy prices. The so-called forecast dotplot The Fed still allows for the possibility of one more increase before the end of the year, while the forecast for rate cuts in 2024 and 2025 was lowered by half a percentage point, signaling that the Fed anticipates higher rates for a longer period in anticipation of a soft landing.

These projections had a negative impact on the overall risk appetite - stocks depreciated, the dollar strengthened to a six-month high, and the yield on two-year US treasury bonds reached the 2006 maximum of around 5,2%. At the same time, traders in the short-term interest rate futures market have reduced the number of 25-basis-point rate cuts they expect in the first half of 2024 to just one from about three expected as recently as last month.

Gold responded to this negative price movement with a relatively minor correction, which has kept the price in a narrowing range, currently providing support around $1.

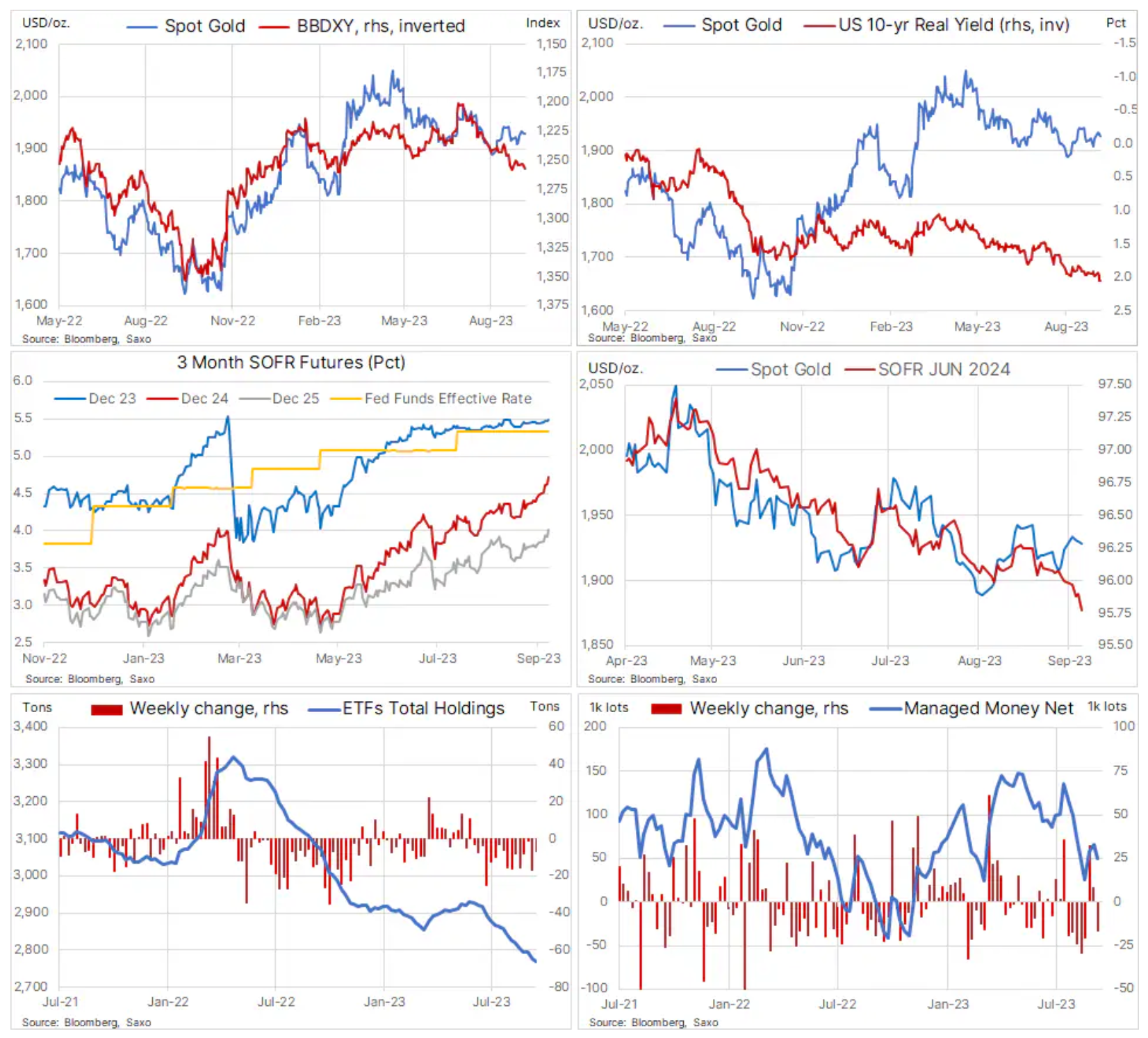

Our gold price indicator in the chart below highlights the current issues, while highlighting that the gold price has held up without major difficulty despite the recent and renewed strengthening of the dollar, rising yields and falling short-term interest rate futures prices (lower prices mean higher rates). Over the past month, gold has risen 1,7% while the dollar has strengthened 1,4% against a basket of major currencies, real 10-year US bond yields have risen 2024 basis points and expectations for a rate cut in XNUMX are rising .have been revised downwards. In addition, investors on ETF market have been reducing their positions over the last four months, as a result of which their total holdings in these funds decreased by 169 tonnes to 2 tonnes over this period, which is the lowest level in three and a half years. For the week ending September 761, the leveraged fund's net long position was $12. contracts (50 million ounces), only 5 thousand contracts above the lows in March and August.

The reason gold is holding strong in our view despite these headwinds, which also include the rising opportunity cost of owning a non-interest-bearing investment such as the yellow metal, is likely because the market is looking for a hedge against a situation in which the FOMC fails to provide a soft (as opposed to a hard ) landing. In a recently published article in WSJ titled "Why a soft landing could prove elusive Nick Timiraos, a reporter famous for obtaining reliable information from the Fed, emphasizes that almost every hard landing initially seems soft. He also draws attention to four factors currently hindering the implementation of the soft landing scenario:

- The Fed keeping rates too high for too long

- Overheated economy

- Increase in oil prices

- A split in the financial market

He ends his article with a rather poetic statement:

“Planes are landing. The economy doesn't.”

Demand for gold as a hedge against a soft landing failure is unlikely to disappear as the economic outlook for the United States in the coming months looks increasingly problematic. With this in mind, we patiently maintain a constructive view on gold, and therefore silver and platinum, and predict that the yellow metal will eventually reach a new record. However, the timing of the new growth impulse will remain largely dependent on US economic data as we wait for the FOMC to switch from rate increases to rate cuts; until then, just like last quarter, we will likely see further chaotic activity from traders in the market.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-300x200.jpg?v=1715055656)

Leave a Response