Frank is crazy, brokers are counting losses

SNB intervention

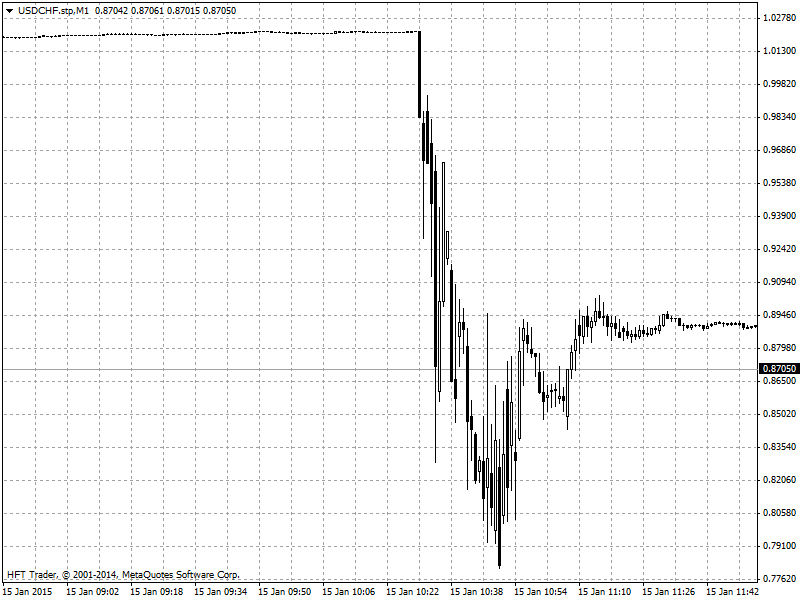

Yesterday's events on the Swiss franc became so loud that it does not even make sense to quote them. What happened yesterday was extraordinary. Similar movements in currencies were recorded over 40 years ago. This is so surprising that some of us have a hard time believing it. But let's focus on how it actually affected us - traders and the institutions in which we hold our funds - that is, brokers.

_________________________

No quotes

Such strong movements have caused that many brokers have been hooked up with quotes and their servers. Some interruptions in access were also caused by liquidity providers who probably did not even know at what price to quote CHF pairs. This is confirmed by the fact that each brokerage company on USDCHF and EURCHF pairs has a different minimum price. Discrepancies reach hundreds of pips. This is something amazing, considering that the monthly range of fluctuations on EURCHF until recently did not exceed several dozen pips. Since there are no quotes, and the servers hang, there is nothing you can do with open positions, active pending orders, and the more you want to react to entering the market.

_________________________

What actually happened with the orders?

The vast majority of brokers execute orders at the first possible price. The price gap means that in this range there was no price at which a given security could be bought or sold. In the event that the client had a long position on pairs XXX / CHF, it was highly probable that the Stop-Out defense mechanism was activated, which is to close all positions and protect the client against overdraft. However, it closes these positions at the first market price… Which was, in most cases, 1600-2000 pips lower.

_________________________

Painful consequences

Traders from the so-called longami fell into huge debits. There are already known cases where people with an account balance of $ 10 ended the day with $ 000 in debt. Certainly this is a shocking case, but I am sure that there are bigger, disgraceful "record holders". The scale of losses and resulting debits is certainly huge and everyone could feel it to a greater or lesser extent. And it's not just the Market Maker that is the party to the transaction. Problems also apply to STP and ECN brokers. Some will ask "why if it's just an intermediary?" Well, such powerful debits do not mean that the broker does not have to pay these liabilities. This should be done by the customer. But how to recover a debt from a trader from the other side of the world, whose funds allocated to investments were 250 times smaller than what he had to pay?

At least for the moment, it can be considered a broker's loss that will be difficult to 'compensate' for.

Therefore, some companies suspended trading on CHF pairs (eg FxPro), and most increased their capital requirements.

_________________________

Does the debit have to be paid back?

Well… yes and no. It all depends on the provisions of the contract that we have signed with the broker. Polish brokers usually reserve that it is a normal debt, subject to statutory interest, which must be settled. However, there are foreign companies that reset their debts just like that. So if this problem applies to you too - start reading the regulations.

_________________________

Who are the problems?

From messages collected by Leap Rate:

- Alpari UK announced bankruptcy,

- FXCMone of the largest retail brokers lost 225 million USD,

- IG Group lost £ 30 million,

- London Capital Group lost £ 1,7 million,

- Excel Markets went bankrupt,

- Swissquote due to negative balances, 25 million CHF lost.

This is probably not the end and this list will be extended. They are also relatively good news.

_________________________

The other side of the coin

There are also companies that are already beginning to calm their clients, informing about the stabilized financial situation.

- IronFX claims that a strong risk management mechanism saved them from the severe damage caused by the strong movement on the franc,

- FxPro informs that he felt the effects of debates, but the situation is stable,

- Trading on CHF customers Plus500 did not affect the company's situation,

- company condition LMAX it was not disturbed, just like Pepperstone i Gain Capital,

- IG Group, despite losses, is looking for brokers with financial problems to take over.

Reports from Polish brokerage houses, for the time being, do not have much more than information about the suspension of trade and reduction of margins for CHF couples. However, one native company deserves recognition.

HFT Brokers, which is a relatively new player on the Forex market, was one of the few that did not record any breaks in quotes yesterday, which makes it an interesting and admirable thing under the circumstances. Admittedly, price gaps occurred, but the exchange rate was constantly changing and transactions could be made on all the franchise pairs.

source on the situation of brokerage companies:

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)

Leave a Response