Don't worry, the markets can slowly grow

The past week is the second consecutive quiet period in the financial markets. The long weekend in the US certainly contributed to this, but also the end of the year, which is often a seasonally positive period for the markets. It is possible that the markets will be calm until the new year, unless we see some surprises in connection with the US employment report for November (December 2), the FED meeting (December 13-14, and with further increases in the markets FED stock may be more hawkish) and US inflation for November (December 13).

The Polish stock exchange also benefits from such positive moods, which can make up for earlier starts. In Poland, next week we will know the key data, i.e. inflation for November (November 30).

Don't worry, the markets can slowly grow

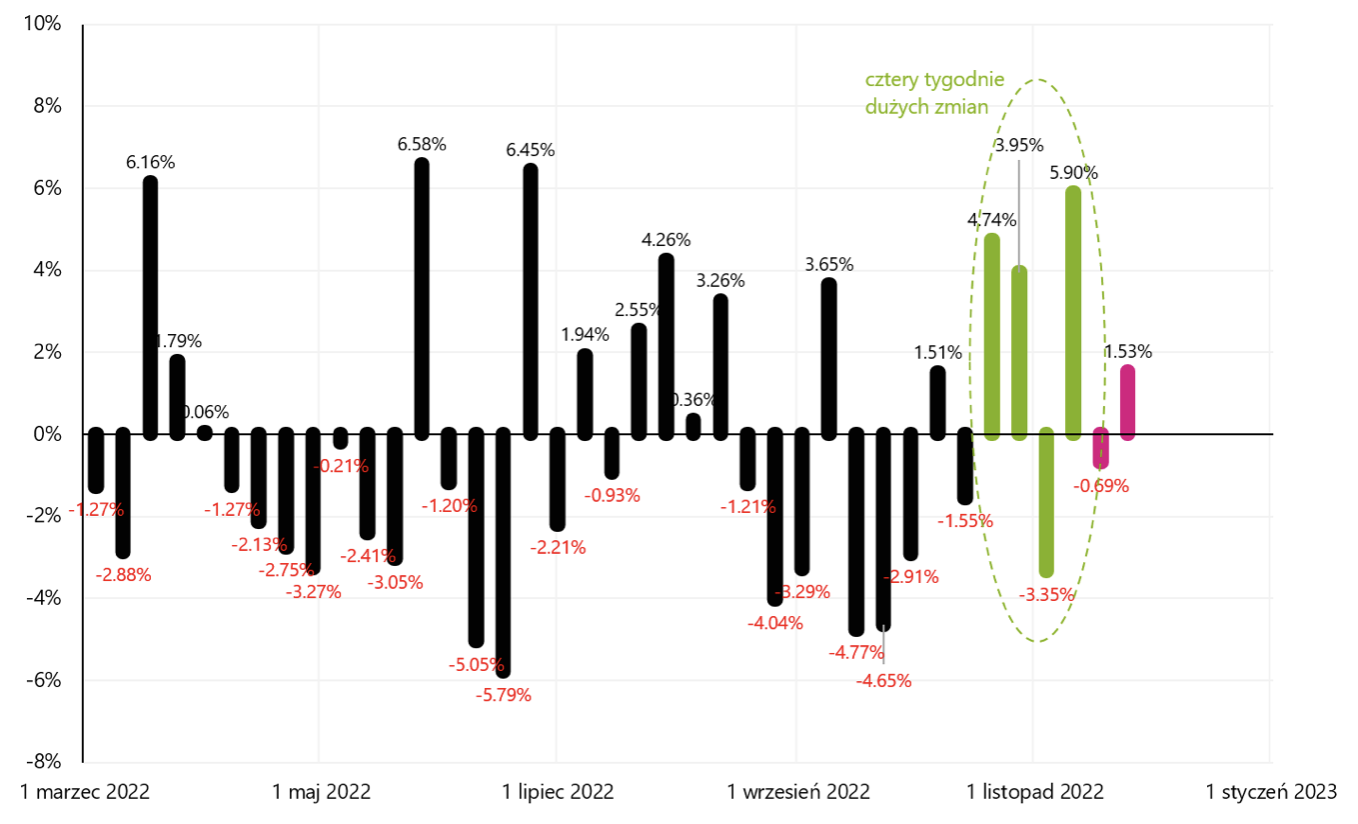

Last week the S&P500 index increased by 1,53% (in the previous -0,69%), which is a large drop in volatility after the previous four weeks, when the index changed absolutely from 3 to 6%.

Weekly index changes S&P500. Source: own study, stooq.pl

The S&P500 is practically at a new local high and 12,6% above the bearish low from October 12.10.2022, 16,1 and only 3.01.2022% below the peak of the last bull market on January 200, 31. Only 0,76 index points (XNUMX%) remained to the XNUMX-session average.

Indeks S & P500 until 25.11.2022/XNUMX/XNUMX Source: own study, stooq.pl

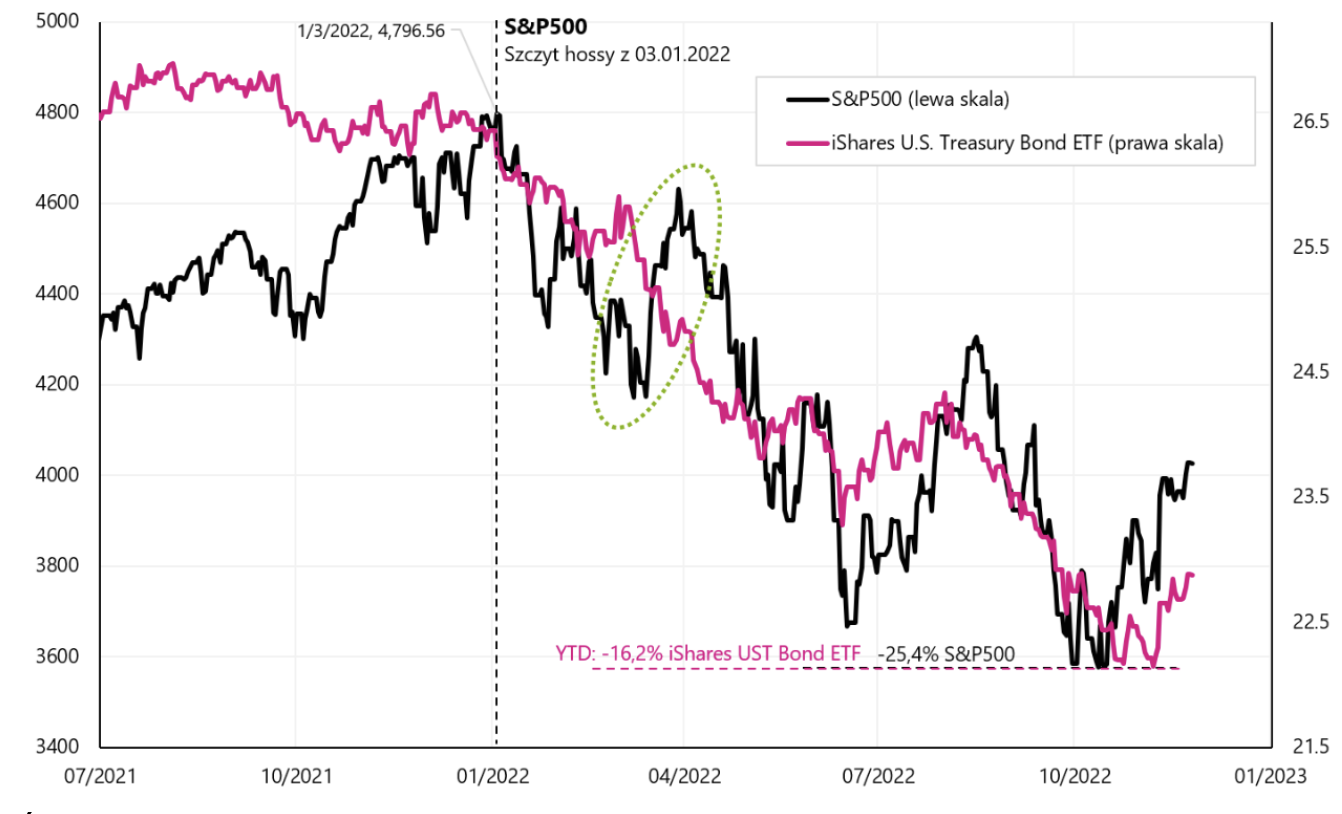

The stock market moves along with the bond market all the timewhich can be interpreted as still the main factor influencing the financial markets is inflation and the fight against it by central banks. When the stock market becomes more concerned about the upcoming economic slowdown, which means that corporate profits will automatically fall, then stocks have the right to fall together with rising bond prices (rising bond prices mean lower yields, also due to expected interest rate cuts by central banks).

Indeks S & P500 against iShares US Treasury Bond ETF – until November 25.11.2022, XNUMX. Source: own study, ishares.com, stooq.pl

WIG also ended the week in the black (+2,53%) and is now +23,4% from the bearish low of October 13.10.2022, 200. and above the XNUMX-day moving average. The chart below shows the details.

Indeks WEDGE until 18.11.2022/XNUMX/XNUMX Source: own study, stooq.pl

The number of unemployment benefits in the US on a new hill

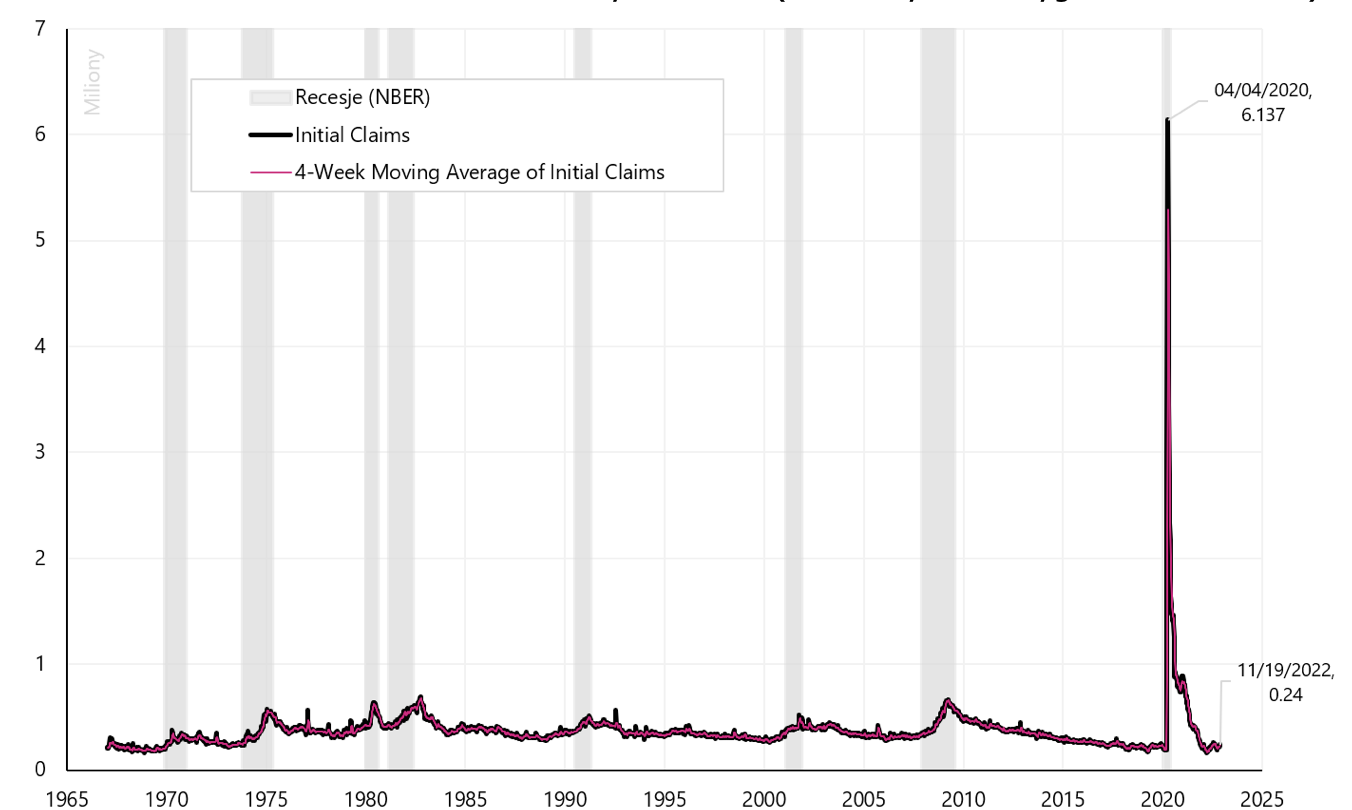

Unemployment benefits are one of the key leading figures in the US labor market. This series is also one of the components of the Conference Board's Leading Index (The Conference Board Leading Economic Index). Claims data is released weekly for both Initial Claims and Continuing Claims. The Initial Claims publication refers to data from the previous week, while in the case of Continuing Claim we have a two-week delay.

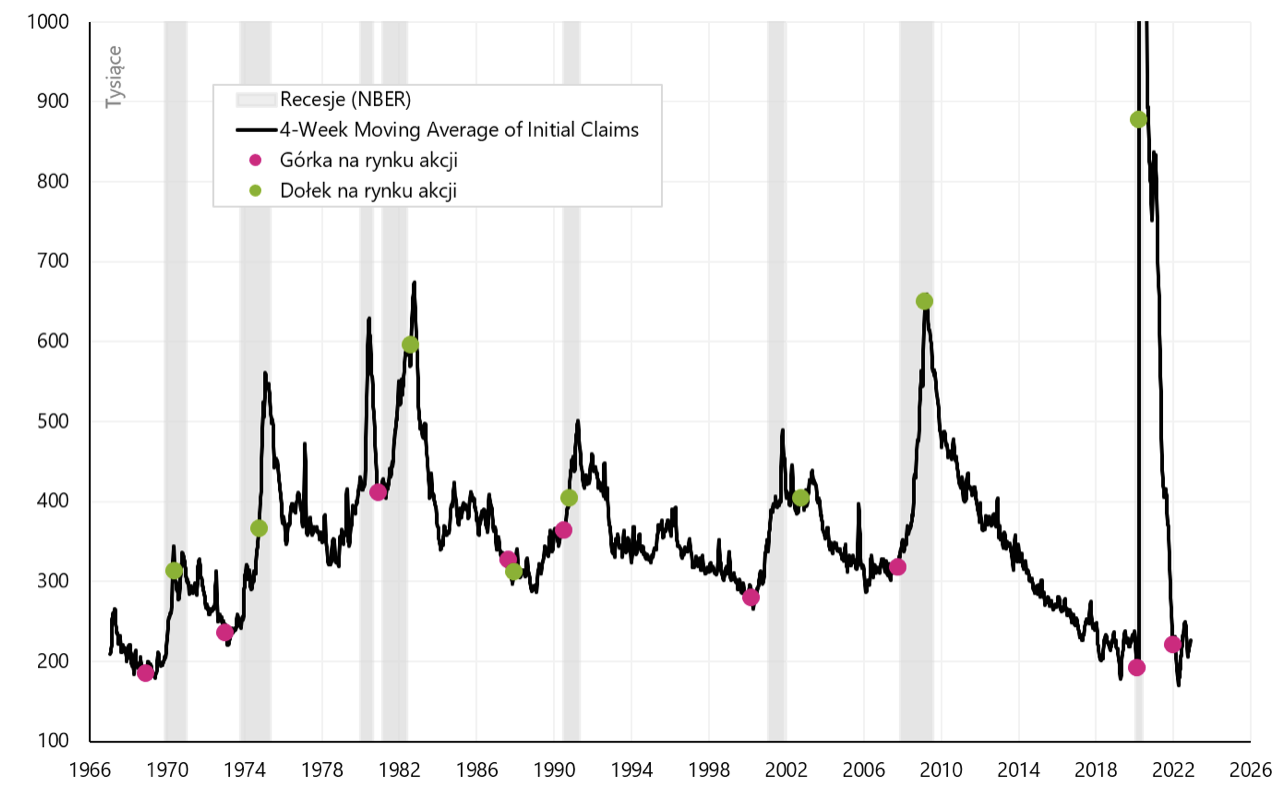

Initial Claims is the number of workers claiming unemployment benefits for the first time after losing their job. Latest data published last week is 240. first-time unemployment benefits and this is a new peak in the current mini-cycle. Historically, first-time unemployment benefits increase before an economic downturn or recession. The chart below shows unemployment benefits since 1965 (Y-axis in millions). Since the weekly series is very volatile, it is customary to also analyze the 4-week moving average (which smooths out this volatility). In 2020, the data was strongly "disturbed" by the pandemic, when in April 2020. the number of first-time unemployment benefits jumped briefly to 6,14 million.

US First-Time Unemployment Benefits (Regular Series and 4-Week Average). Source: own study, FRED

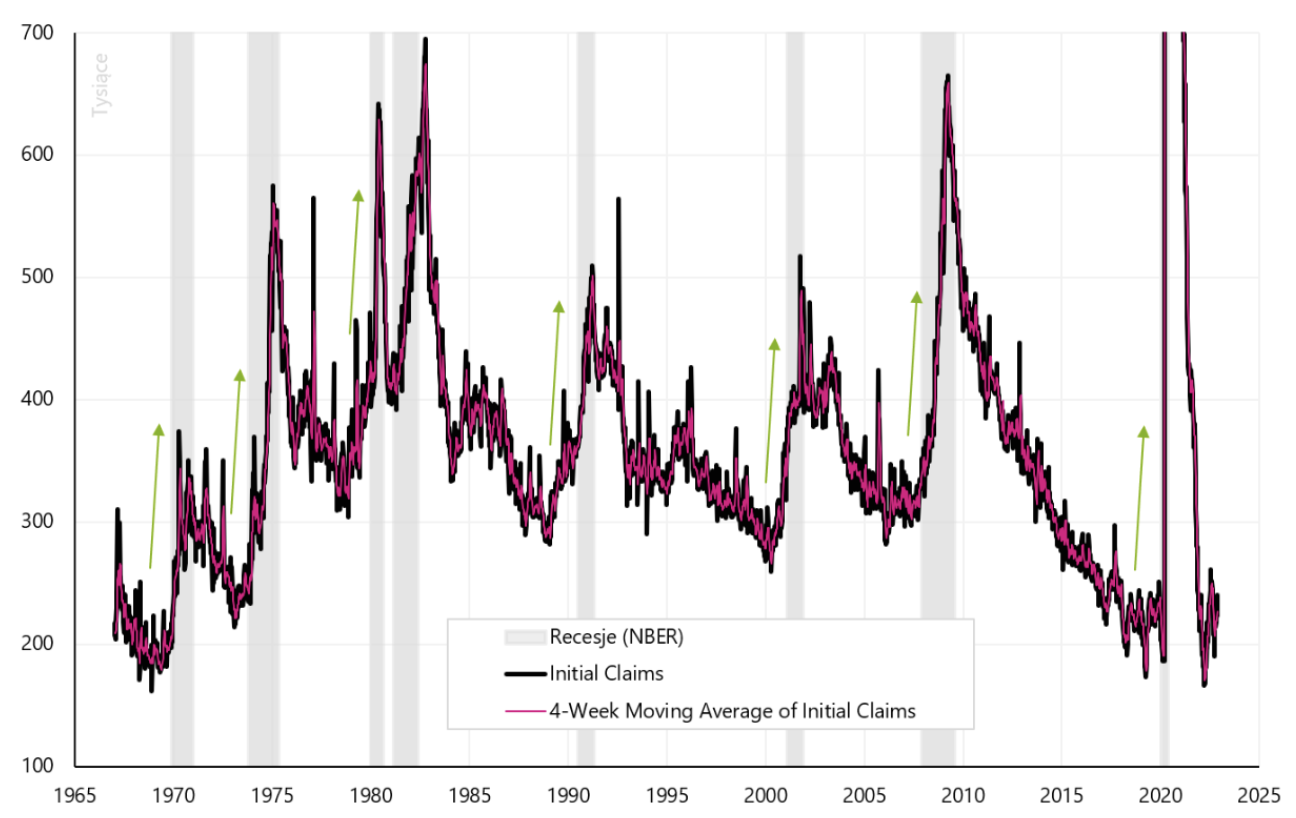

The next graph shows the same series, however we changed the y-axis by cropping the data spike during the pandemic (in this graph benefits are in the thousands, not millions). Evidently, unemployment benefits usually start to rise even before a recession, but in fact we see a significant increase only during a recession (although this is a leading indicator from the labor market, it is unlikely to be ahead of the stock market).

US first-time unemployment benefits (ordinary and 4-week average series), Y-axis in thousands and was truncated at 700 benefits. Source: own study, FRED

Unemployment benefits are not "ahead" of the stock market's uptrend, but more likely to be a clue to the downtrend in the S&P500 index. As a rule, we have quite a large increase in the number of benefits earlier, which is in line with the commonly accepted rule that, on average, the stock market bottoms out after about 2/3 of the recession is over.

First-time unemployment benefits in the US (4-week average), and the "highs" and "lows" of the S&P500 index in individual cycles. Source: own study, FRED

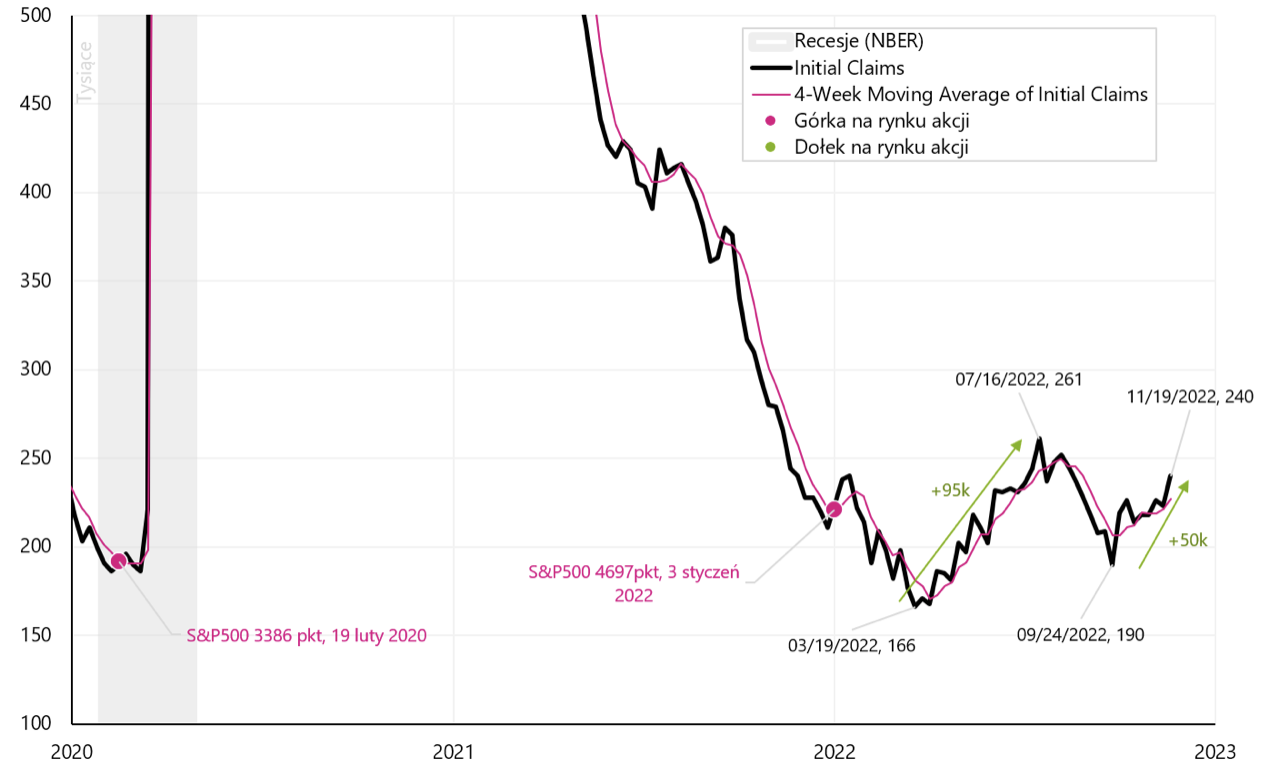

Sometimes benefits during economic expansion increase by tens of thousands for various reasons, so their increase within such limits does not necessarily mean a recession. In 2022, we had an increase of 95. in the period from March to July to the level of 266 (such an increase is a potential recession signal), but later the benefits returned below 200. We are currently experiencing another upward wave of 50 in total. (but since the lows in March this year, it is already 74 - also a potential recessionary signal).

First-time unemployment benefits in the US, 2000-2022. Source: own study, FRED

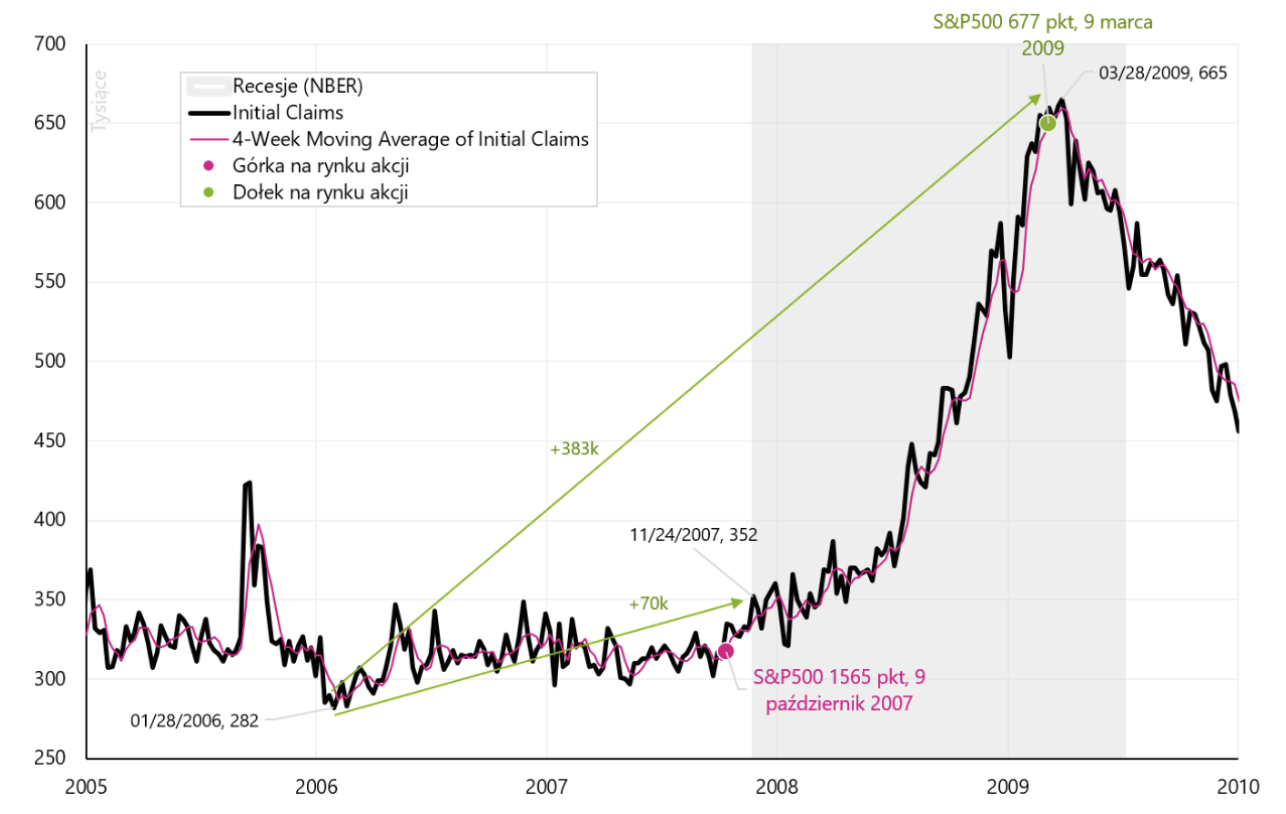

In the years 2006 - 2008 benefits until recession increased by 70 thousand. from their lowest level in 2006. Benefits had to increase by another 300 to the bottom of the stock market. The next chart shows the details.

First-time unemployment benefits in the US, 2005-2010. Source: own study, FRED

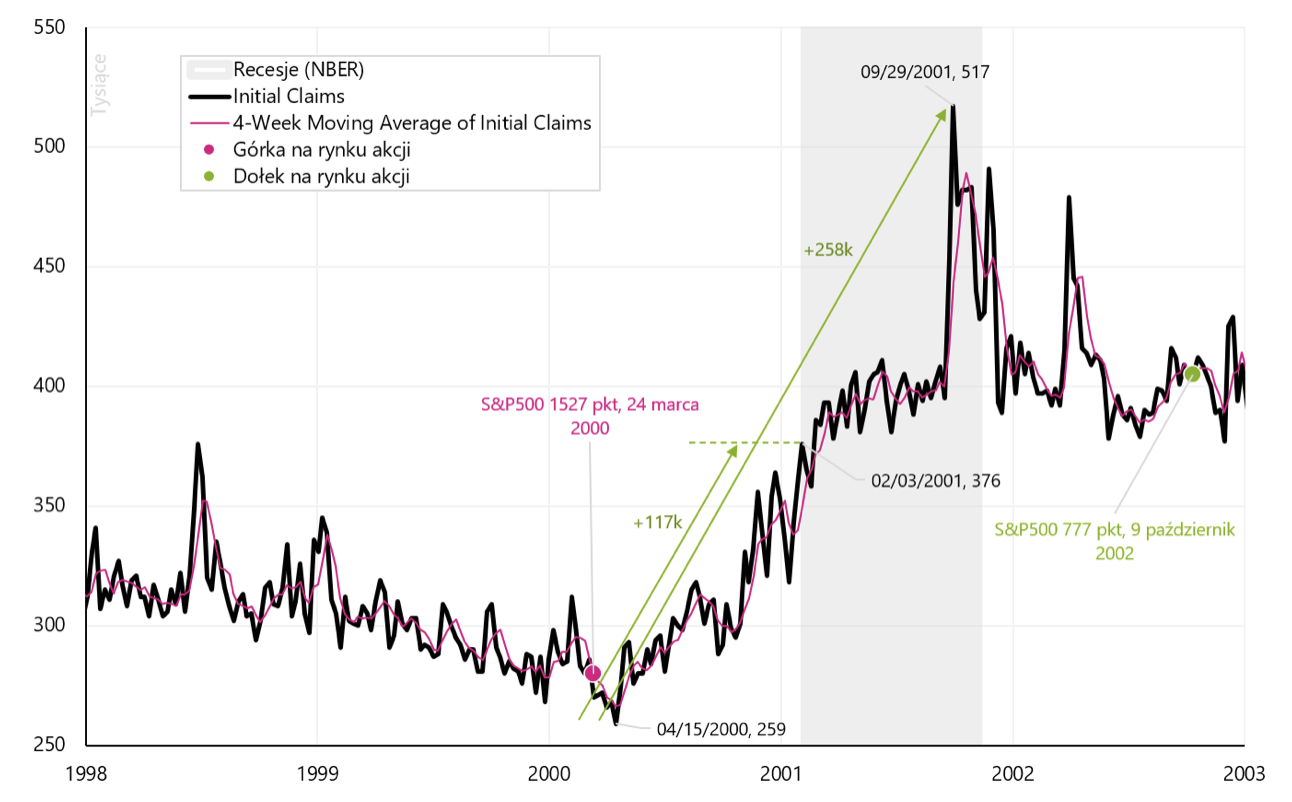

Between 2000 and 2002, until the recession entered, benefits increased by about 117. counting from their lowest level in 2000 (at that time, the formal recession started "late" compared to the stock market cycle, when the stock market peaked practically a year earlier). Benefits still had to rise a bit before the stock market bottomed out, but in this case it was the longest post-World War II bear market and we had to wait a long time for the stock market to bottom, even after the September 2001 peak in the number of benefits.

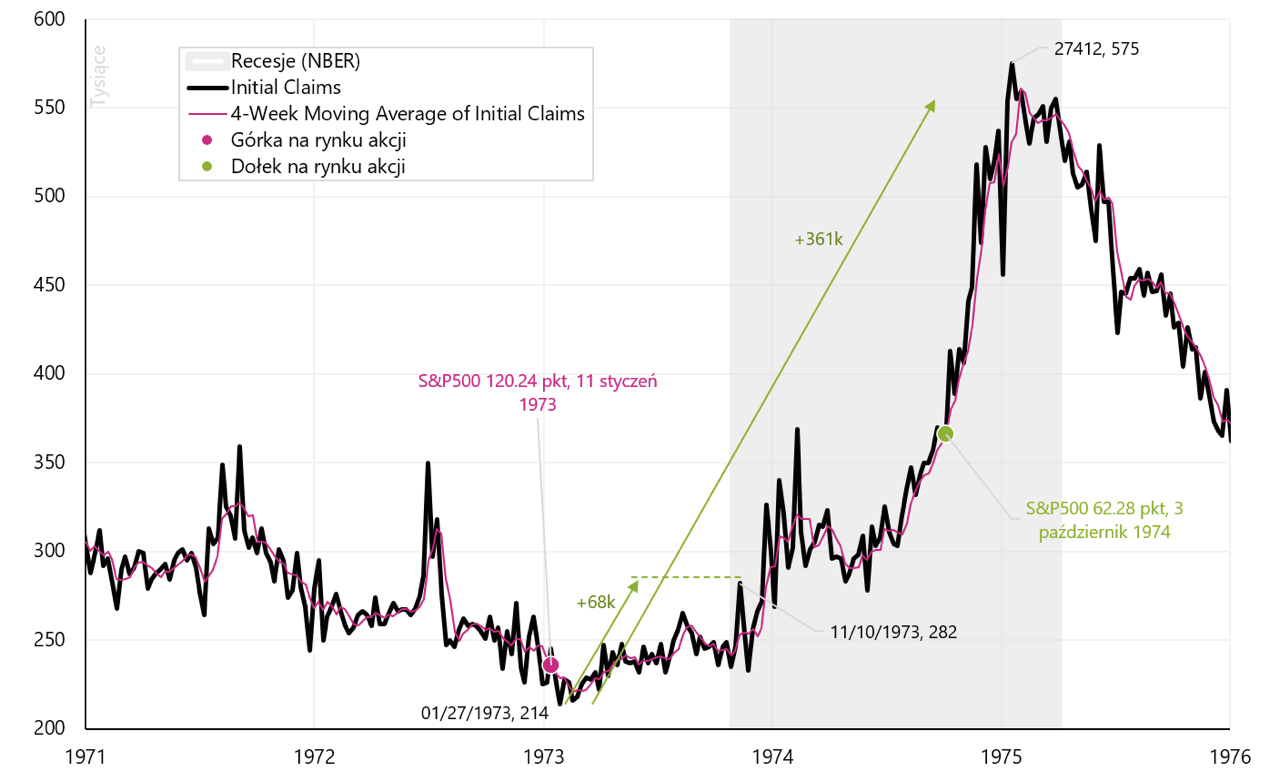

In the inflationary years 1973-1975 by the time the recession entered, benefits had increased by about 70. counting from their lowest level in early 1973. Benefits still had to increase by about 100 to the bottom of the stock market. Low on S & P500 index occurred around 2/3 of the then recession. The next chart shows the details.

US first-time unemployment benefits (4-week average), 1971-1976. Source: own study, FRED

It is possible that the currently rising benefits for the first-time unemployed indicate a greater change in the labor market in the coming months. On the one hand, it's good because FED it could raise interest rates less (in the current market regime, this is the most important thing), but on the other hand, it may mean an upcoming recession and declines in corporate profits (currently, this is not the main concern of the stock markets, but it does not necessarily have to be so in a few months).

Summation

The past week was very calm in most capital markets. The markets are still in the inflationary regime (inflation and the FED's fight against inflation are the main factor influencing the behavior of the markets). At the same time, the markets are not "afraid" of the upcoming economic slowdown/recession and the related decline in corporate profits.

The current calm moods in the markets may persist even until the end of the year, unless we have a big negative surprise on inflation data (for November) or from the US labor market (data for November will be released next week). If nothing extraordinary happens here, only the Fed could spoil the mood before Christmas. The FED does not like rising stocks too much, because to some extent they reverse the effect associated with interest rate increases. Looking at the current conditions, inflation level and market sentiment, it can be assumed that the real FED pivot could take place only in the second half of 2023. The S&P500 is only 16% up from the previous bull market. It can also be assumed that the FED will not like too early increases in the stock markets. Anyway, this year we have already had a lot of "interventions" from the FED, as a result of which the shares went down.

About the Author

Jaroslaw Jamka - Experienced fund management expert, professionally associated with the capital market for over 25 years. He holds a PhD in economics, a license of an investment advisor and a securities broker. He personally managed equity, bond, mutli-asset and global macro cross-asset funds. For many years, he managed the largest Polish pension fund with assets over PLN 30 billion. As an investment director, he managed the work of many management teams. He gained experience as: Member of the Management Board of ING PTE, Vice-President and President of the Management Board of ING TUnŻ, Vice-President of the Management Board of Money Makers SA, Vice-President of the Management Board of Ipopema TFI, Vice-President of the Management Board of Quercus TFI, Member of the Management Board of Skarbiec TFI, as well as Member of Supervisory Boards of ING PTE and AXA PTE. For 12 years he has specialized in managing global macro cross-asset classes.

Jaroslaw Jamka - Experienced fund management expert, professionally associated with the capital market for over 25 years. He holds a PhD in economics, a license of an investment advisor and a securities broker. He personally managed equity, bond, mutli-asset and global macro cross-asset funds. For many years, he managed the largest Polish pension fund with assets over PLN 30 billion. As an investment director, he managed the work of many management teams. He gained experience as: Member of the Management Board of ING PTE, Vice-President and President of the Management Board of ING TUnŻ, Vice-President of the Management Board of Money Makers SA, Vice-President of the Management Board of Ipopema TFI, Vice-President of the Management Board of Quercus TFI, Member of the Management Board of Skarbiec TFI, as well as Member of Supervisory Boards of ING PTE and AXA PTE. For 12 years he has specialized in managing global macro cross-asset classes.

Disclaimer

This document is only informative material for use by the recipient. It should not be understood as an advisory material or as a basis for making investment decisions. Nor should it be understood as an investment recommendation. All opinions and forecasts presented in this study are only the expression of the author's opinion on the date of publication and are subject to change without notice. The author is not responsible for any investment decisions made on the basis of this study. Historical investment results do not guarantee that similar results will be achieved in the future.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)