Calm morning of the zloty, markets are waiting for the Fed

Wednesday morning is marked by limited volatility on the zloty market. At 10:54 AM, the EUR / PLN exchange rate was at PLN 4,7049, and USD / PLN at PLN 4,7523. Investors are waiting for the evening decision Fed on US interest rates. It is the main event not only of the day, but also of the week, and one of the most important events of November in the financial markets.

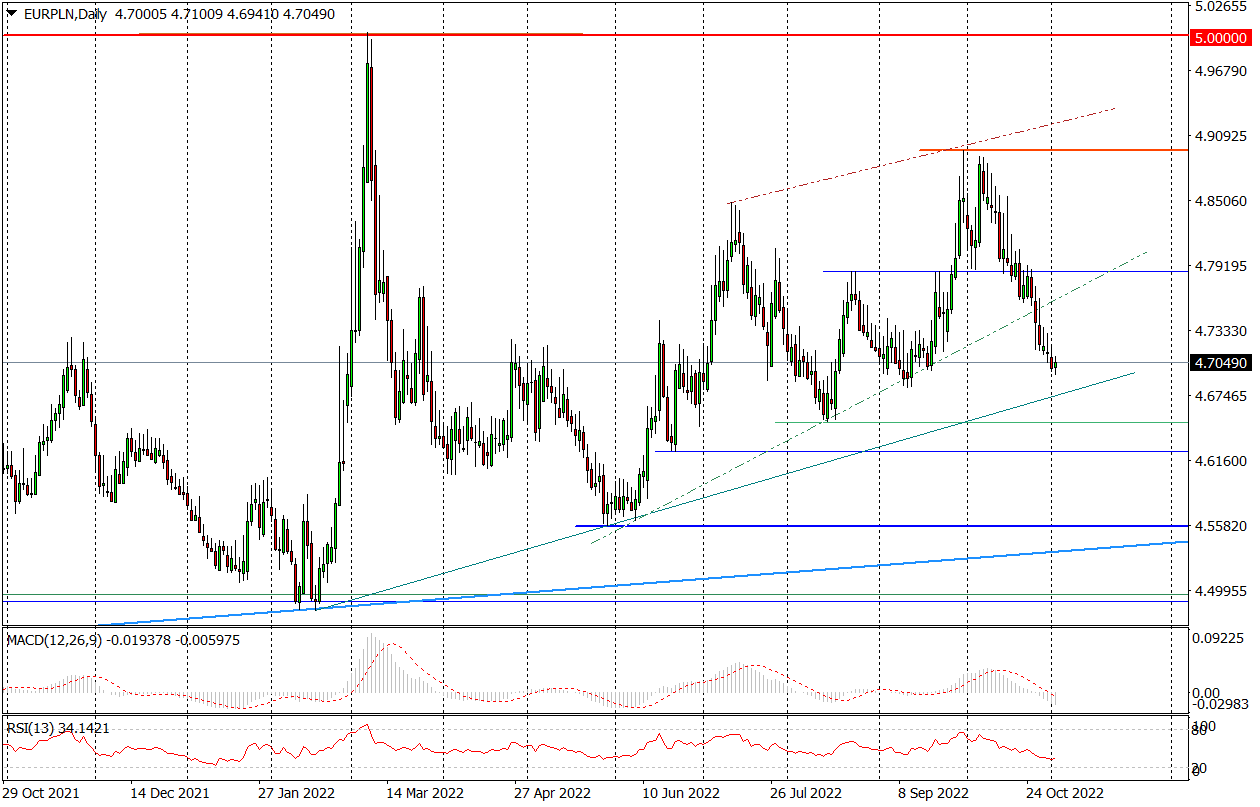

EURPLN daily chart. Source: Tickmill

USDPLN daily chart. Source: Tickmill

We are waiting for the FED

Investors will know the results of the meeting and the Fed's decision on interest rates at 19:00 CET. Half an hour later, a press conference by Fed chairman Jerome Powell after the meeting will begin.

It is expected that in response to high inflation in the US, the Fed will raise interest rates today by 75 basis points (bp). It will be the 4th next hike on this scale and the 6th hike since the beginning of the monetary tightening cycle in March this year. As a result, the federal funds rate will increase to 3,75-4 percent. from 0-0,25 percent in March. Such a decision should already be discounted. Hence, it is the reaction of the financial markets, and thus the Polish zloty, that will determine what suggestions regarding the scale of the December rate hike will be sent to the world by the Fed and Powell.

The market hopes for rate hikes to slow down

For some time the markets have been “playing” on the fact that, in December, the Fed will start to slow down with increases, in spite of high inflation, relatively good data from the US economy and still “tight” labor market, which hinders the decline in inflation. Describing it more vividly, investors hope that in a month the rates will be increased by a maximum of 50 bp. If these expectations are confirmed today, an improvement in market sentiment may be expected, followed by a strengthening of the zloty in the second part of the week. And vice versa. If fears of another aggressive rate hike increase after the meeting, the dollar will start to strengthen, risk aversion will increase and the zloty will depreciate.

The Fed meeting pushes all other developments into the background today. Including the PMI index for the Polish manufacturing sector, released in the morning, which unexpectedly plunged to 42 points in October. from level 43 points a month earlier, leaving the market forecasts behind (42,5 points). The afternoon shouldn't be too emotional either ADP report on employment change in the US private sector (forecast: +195 thousand). However, investors will surely recall these data on Friday, when the monthly US labor market data is released. Data being an important reference point for expectations regarding the next Fed's interest rate decisions.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response