We check the indicators from Trading Central - Week # 2

The second week is behind us, in which we test a package of indicators from Trading Central at full speed. In the previous cycle we performed 17 operations. Now there were many more good signals. Thus, the number of transactions performed more than doubled. How did this translate into the result? About it below in a short summary.

Be sure to read: Trading Central - Independent market analyzes [Review]

Trading Central Tools - Week # 2

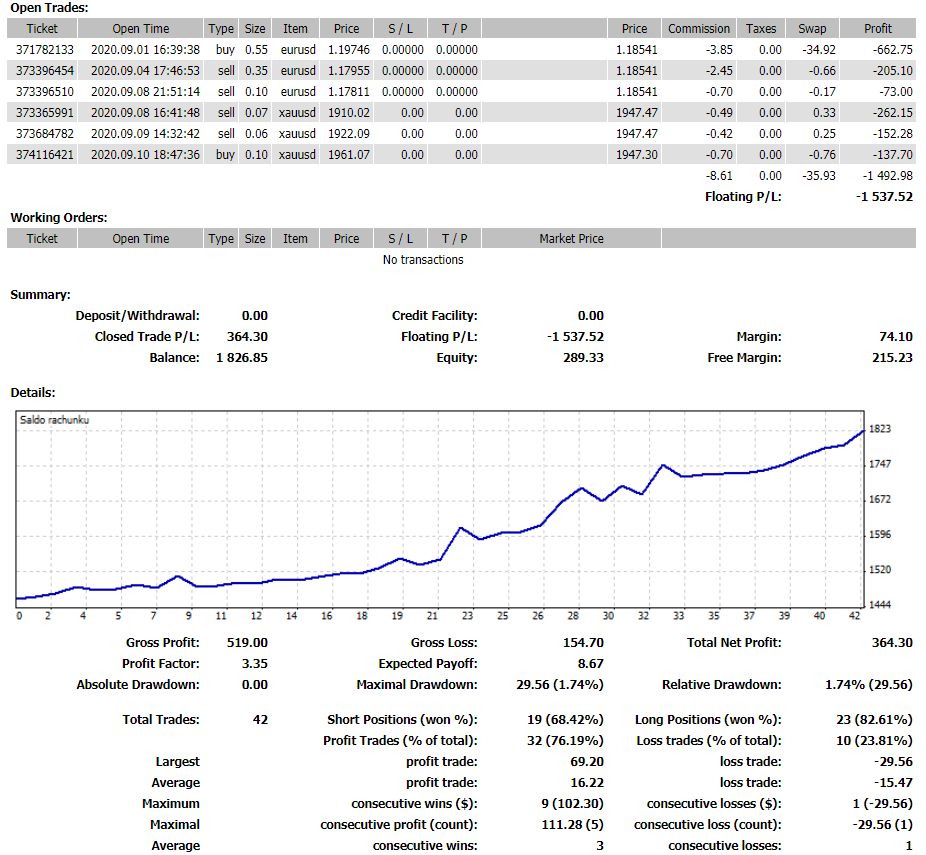

We managed to complete 42 items, which resulted in $ 364,30 profit. Despite a good result, transactions that are currently in the red have once again appeared. The reason for this is the signals that were generated (as it turned out later) at the end of the traffic. The market is turning back and thus the losses are increasing. Due to the low level Margin Level we operated with a volume of up to 0,10 lots.

Summation

Balance of closed positions in relation to open positions it is not satisfactory as it clearly shows negative result. This does not mean that the tested indicators are useless. We slowly come to the conclusion that their use could, however, constitute an additional element in the investment strategy. After the end of the test, it will turn out whether all of them will be worth using or whether only one of them will be the definite winner.

The result in the second week:

- 42 items completed, including 32 profitable and 10 lossy,

- Instruments: EUR / USD, XAU / USD, USD / CAD,

- Realized profit of 364,30 USD.

Account status since test start:

- 59 realized items, including 47 profitable and 12 lossy,

- Instruments: EUR / USD, XAU / USD, USD / CAD

- Total profit of 826,85 USD,

- Balance of active positions on a loss -1537,52 USD.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)