US rates: Will it be possible to reduce inflation while saving economic growth?

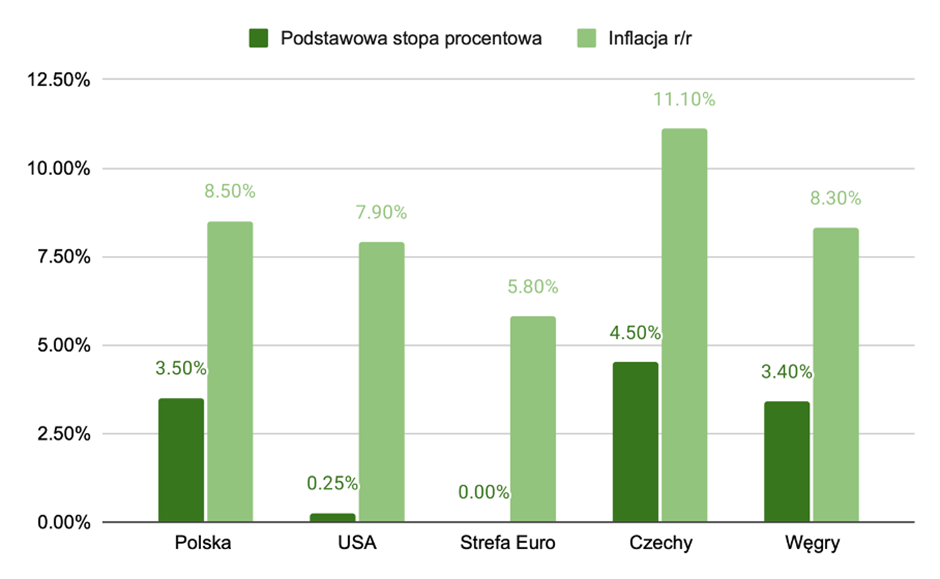

On Wednesday FED made the first interest rate hike in 4 years. It is also the first change in foot height since the outbreak of the coronavirus pandemic. As of 2020, the interest rate in the US was 0%, now it has risen to 0,25%. Everyone is wondering whether it will be possible to bring down inflation without a significant decline in the level of economic growth.

About the author

Pawel Majtkowski - analyst eToro on the Polish market, which shares its weekly commentary on the latest stock market information. Paweł is a recognized expert on financial markets with extensive experience as an analyst in financial institutions. He is also one of the most cited experts in the field of economy and financial markets in Poland. He graduated from law studies at the University of Warsaw. He is also the author of many publications in the field of investing, personal finance and economy.

Pawel Majtkowski - analyst eToro on the Polish market, which shares its weekly commentary on the latest stock market information. Paweł is a recognized expert on financial markets with extensive experience as an analyst in financial institutions. He is also one of the most cited experts in the field of economy and financial markets in Poland. He graduated from law studies at the University of Warsaw. He is also the author of many publications in the field of investing, personal finance and economy.

US rates may exceed 2%

This is the beginning of a series of hikes, as it cannot be ruled out that interest rates in the US, like in Poland, will rise at each subsequent FED meeting (the next on May 4). Members FOMC (they decide on the level of interest rates) they assume that the level of interest rates at the end of the year will amount to 1,9% (median of expectations). Similarly, US interest rate contract prices show that the most likely scenario is end-of-year rates in the range of 2-2,25%, and scenarios where rates will fall in the range of 1,75-2% are less likely (probability 29,8 , 2,25%) or in the range of 2,5-17,7% (probability XNUMX%). This means even 7 rate hikes by the end of the year.

For many months now, economists had been debating inflation and its transient or more permanent nature. The FED's decision means that inflation may remain high for some time. At present, the biggest challenge for the Fed may be to bring down inflation without harming economic growth. At the same time, there is a risk of stagflation on the horizon, i.e. a phenomenon that combines high inflation and low economic growth. Stagflation occurred in the USA in the 70s, when, like today, there was a sharp increase in commodity prices.

Are there worse times coming?

The FED prepared the market for a long time for the first rate hike and a change in monetary policy. Some of these calculations were spoiled by the outbreak of the conflict in Ukraine, which increased the level of uncertainty on the market. However, the Fed remains confident that the economy can cope with the tightening of policies. And the first hike rarely capsizes the market or puts the economy into recession. The market, as I mentioned, predicts the entire sequence of rate hikes, but it will depend on the outlook for economic growth in the US.

For investors, rate hikes always herald more difficult times. However, as the rate hike was expected, the market priced it in earlier, as well as the likely path of further rate hikes. The market is currently struggling with increased volatility and rates are just one factor contributing to this. In the coming days, the market will expect the most forms of de-escalation of the situation in Ukraine.

Currently, it is worth being prepared for two scenarios: one is the rate hikes according to the path currently envisaged by the markets, the other is a smaller scale of increases related to the weakening of economic growth. In the first scenario, the largest beneficiaries will be companies and cyclical sectors. In the second, we can see the boom in growth and technology companies, whose valuations are now lower than a few months ago. As always, but especially now, it is important to diversify and select a portfolio adjusted to the investment time horizon.

Source: NBP, FED, ECB, Eurostat

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)