Forex strategy "At the end of the day". Summary - week 17 and 18

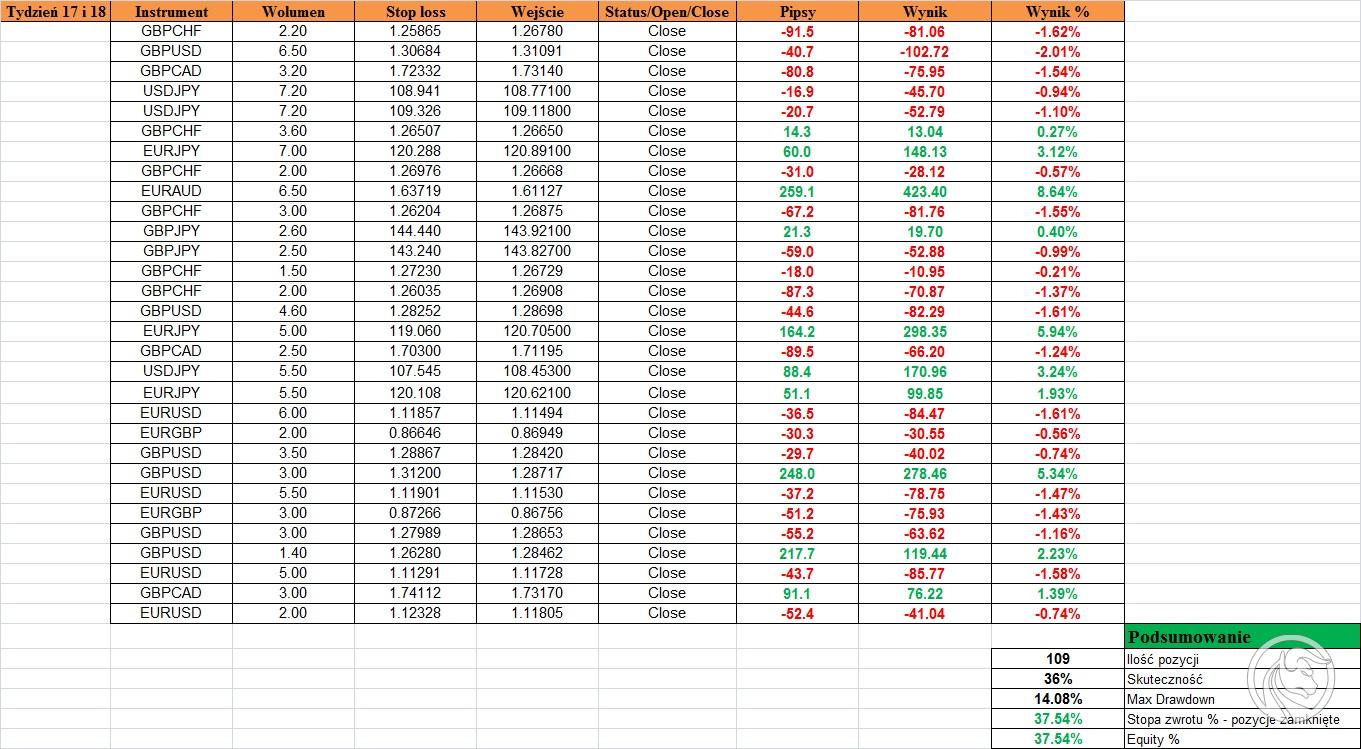

18 weeks of trading at the end of the day strategy are behind us. Weeks 17 and 18 are another 10 successful trading days that have allowed us to gradually increase the profit on the account. The past period, due to the slump in the entire market and a clear jump in volatility, resulted in large fluctuations in the account balance. Eventually, another 6% of profit was posted compared to the previous summary.

As always, in this article we will only discuss the most interesting profitable and lossy transactions and explain what can await us in the coming days.

Be sure to read: Summary of the 15th and 16th week of trading at the end of the day strategy

Profitable transactions

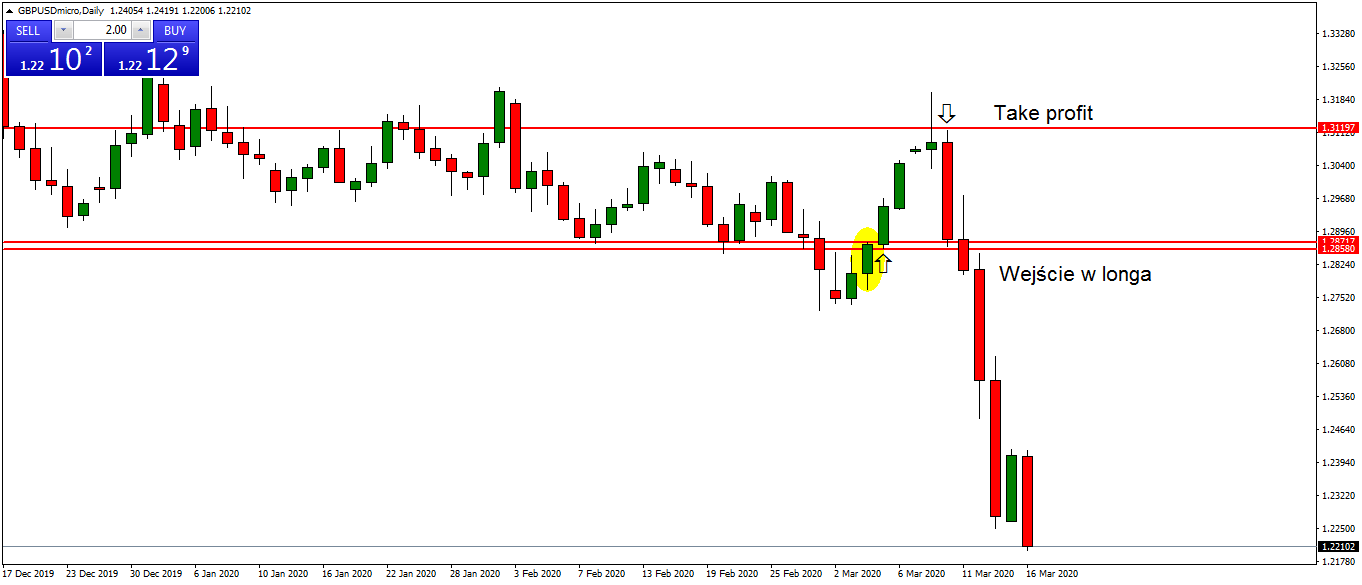

In one of the previous summaries I wrote that in general the pound has a lot of surprises and is "unstable" in recent periods. However, due to the fact that I always stick to my trading assumptions, I stated that I will not let go of this pair, only if a good signal appears, consistent with the script, I will look for an opportunity to enter. In this way, GBPUSD in the past two weeks has achieved the highest profit of all transactions opened on those days☺. Due to the fact that the price was constantly oscillating around the key zone for me around 1.28580, we had one long and one short position. I opened Long after breaking and closing a nice demand candle above the discussed zone, this time from hand, without a pending order. The price went up and realized take profit at the level of previous peaks (closing at 1.31197).

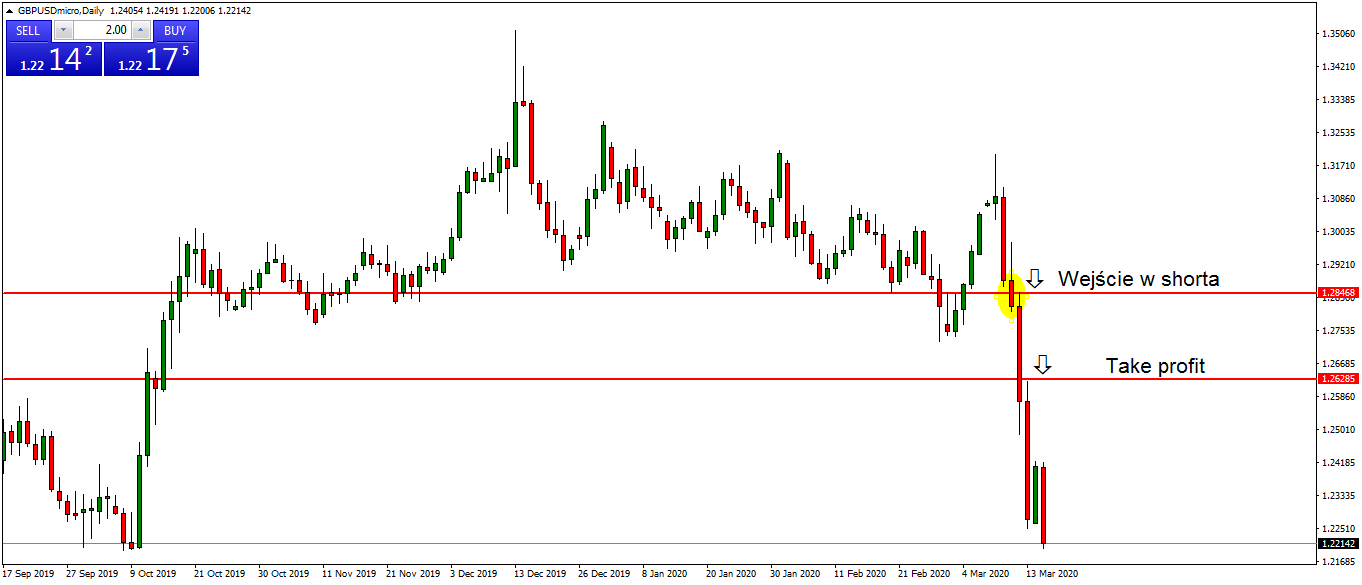

Then there was a sharp descent and the price was below zone 1.28580. At first I thought it was another retest, but the descent was very dynamic, after which another candle broke the level and closing didn't change the situation. I played a short with entry level 1.28468, and take profit was made at 1.26285.

Lossy transactions

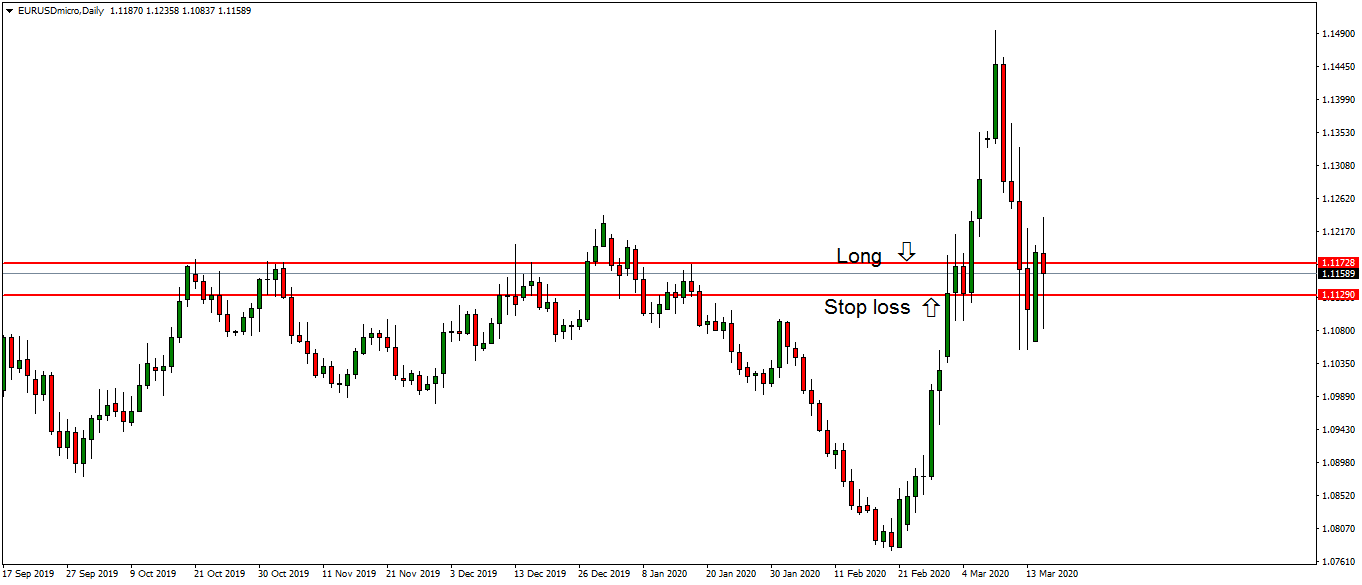

As for lossy positions, in the past two weeks there were not the "worst" that would lead to a terrible sliding on the account. I saw that many pairs are "hot", so the feet were slightly tighter than before. I played for example EUR / USD. Long position at 1.11728 and the transaction hit the rate already on the next candle (1.11290). As it turned out later, I was not mistaken about the move, but for the second time I did not play this position.

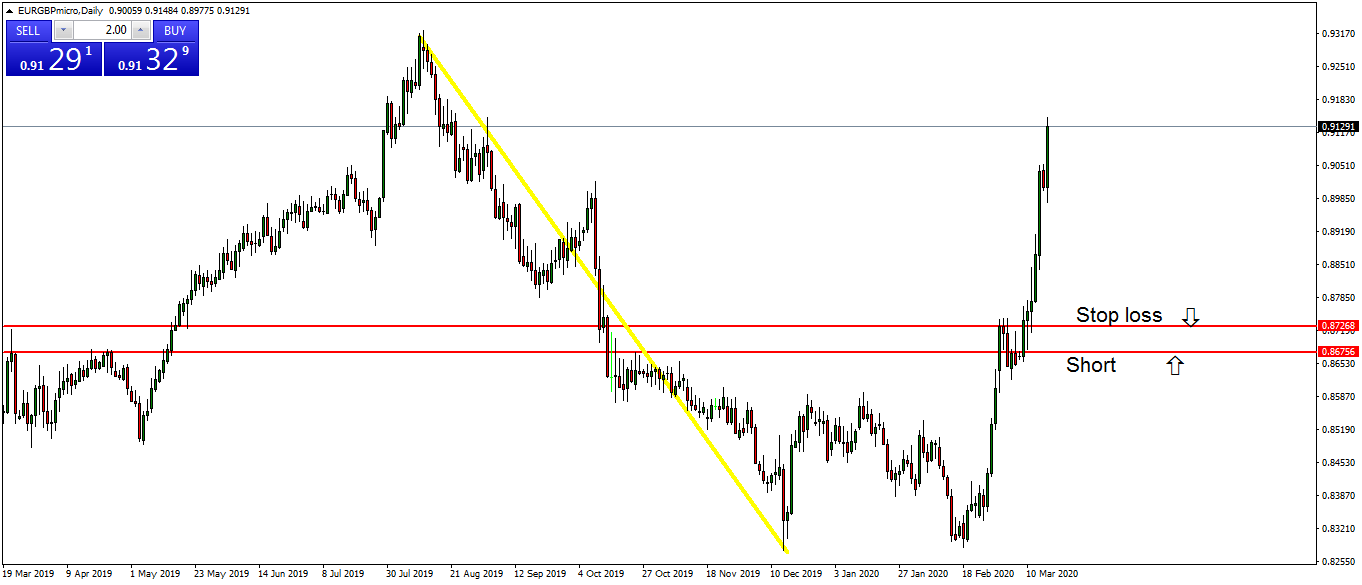

The second short, which did not work out, was played on EURGBP. The movement marked with the yellow line was the main impulse for me and in my opinion it showed a downward trend. I tried to join the 0.86756 move, but the price went up realizing stop loss.

Currently all positions are closed. Given the upcoming days, several couples look really interesting. One of them is e.g. GBPCAD. Strong descent and instability of the pound make me approach it with caution, but at Monday's opening we have a growth gap and in addition a very interesting zone is defended around 1.70000. He watches the closing of the candle, we'll see maybe something interesting will be played here. The second asset I look at is gold. Until now, due to a very strong trend and in fact no corrections, it was not possible to open the position, but the last exit stopped in a very interesting zone around the level of 1460. At this moment I see that the price has gone up significantly, but still I will watch the situation.

Summation

All positions are currently closed and the rate of return is at the level + 37.54 %. The whole and the live results are available of course at MyFxBook profile. The current situation is presented on an ongoing basis forum.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Stop Loss hunting - who is hunting our SLs? [Video] stop loss hunting](https://forexclub.pl/wp-content/uploads/2021/10/stop-loss-hunting-300x200.jpg?v=1632996842)