Forex strategy "At the end of the day". Summary - week 19 and 20

Week # 19 and # 20 are behind us, which allowed us to end another "round" test period. 5 months of trading have passed since the beginning of our experiment - it is worth trying to summarize more. Of course, the formula does not change, first I will discuss the best profitable trades as well as the losing ones, and then we will make a detailed summary.

Check it out: Summary of Strategy Results - Week 17 and 18

Profitable transactions

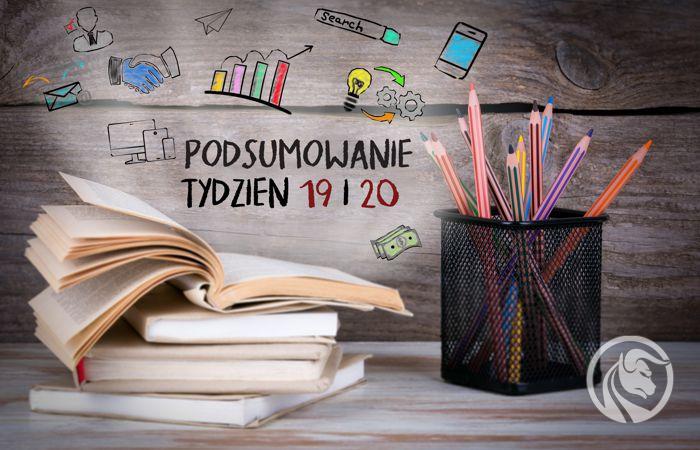

Sometimes it is so that when we observe a few or a dozen or so securities on the market, we trade more often on some, on others less often, it's quite normal. The market is volatile and we will never be able to trade at all with, say, equal proportions. It also never makes sense to seek a position by force just to proverbially play something "new". It is always worth watching, however, and when the even one signal we are waiting for appears, try to play a position. In the past two weeks, this description fits perfectly with the best transaction. Without a doubt, it was long on gold. I also wrote about this value in the previous summary, but at that moment the price departed very much from this zone. However, as sometimes happens on the market, the price returns to specific levels to be "checked" again. This often happens before strong movements. We had a candle with a very long bottom shadow, followed by another and then two candles, say supply. However, this was only a test for demand, and a very strong zone (why I highlighted the strong one in the chart) in $ 1460 has been invincible all the time. Already after the first candle, I had a pending order set up in these areas. It was successful and activated. The next candles are very strong growth swings.

Currently I am out of the market, the price has stopped a bit, but I'm still happy with the result. Of course, it can always be more, better, etc., but during these 7 years of trading I learned that profit is a profit and it doesn't make much sense to wonder how much more it could be, especially if at the initial rate of about 2%, it was a specific transaction around 11.52%, so R: R is 5.7: 1.

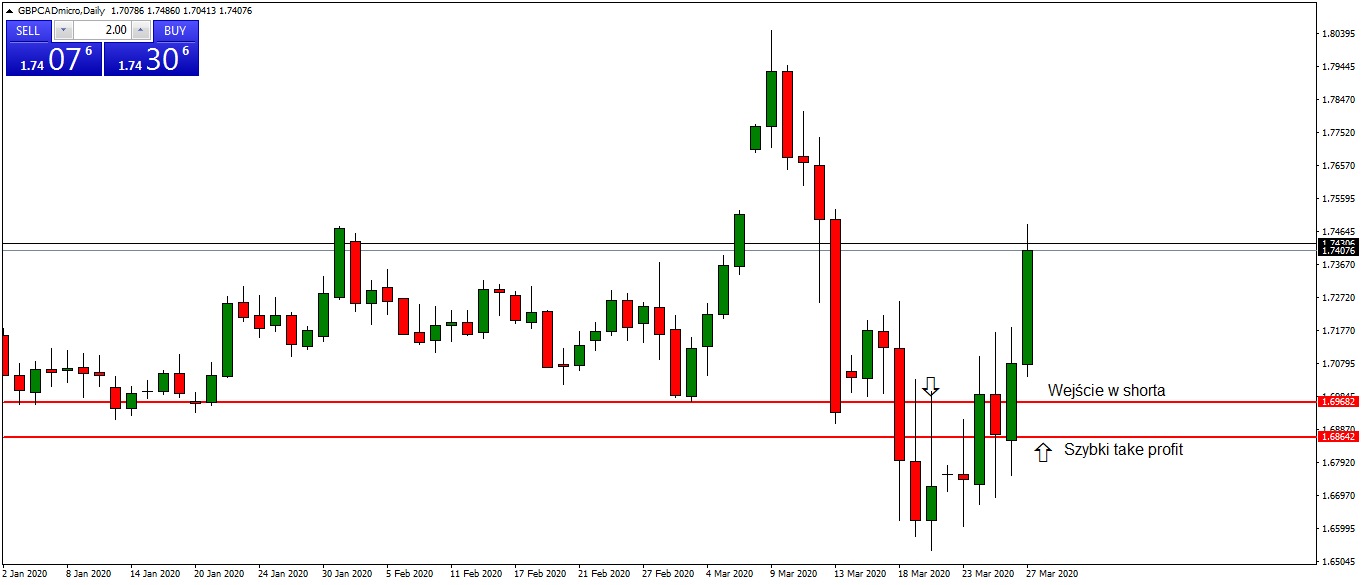

Apart from gold, there were still some nice items, e.g. two shorts on GBPCAD, here with less profit, or two longi on USDJPY. Unfortunately, in the case of these assets, there was no greater movement in the direction I played.

Short position. GBP / CAD chart, D1 interval. Source: MT4 XM

Lossy transactions

The paradox is that in the past two weeks I basically played only three pairs, so lossy transactions took place on the same pairs as profitable☺. As for GBPCAD, here after two profitable closed shorts I still had sell limit in the zone in the area of 1.70000. The price reached her, went down, stepped back and it lasted for a few candles. Unfortunately, one candle in turn was already a sign that demand took the initiative and my next short was stop loss. I marked the levels on the chart.

Short position. GBP / CAD chart, D1 interval. Source: MT4 XM

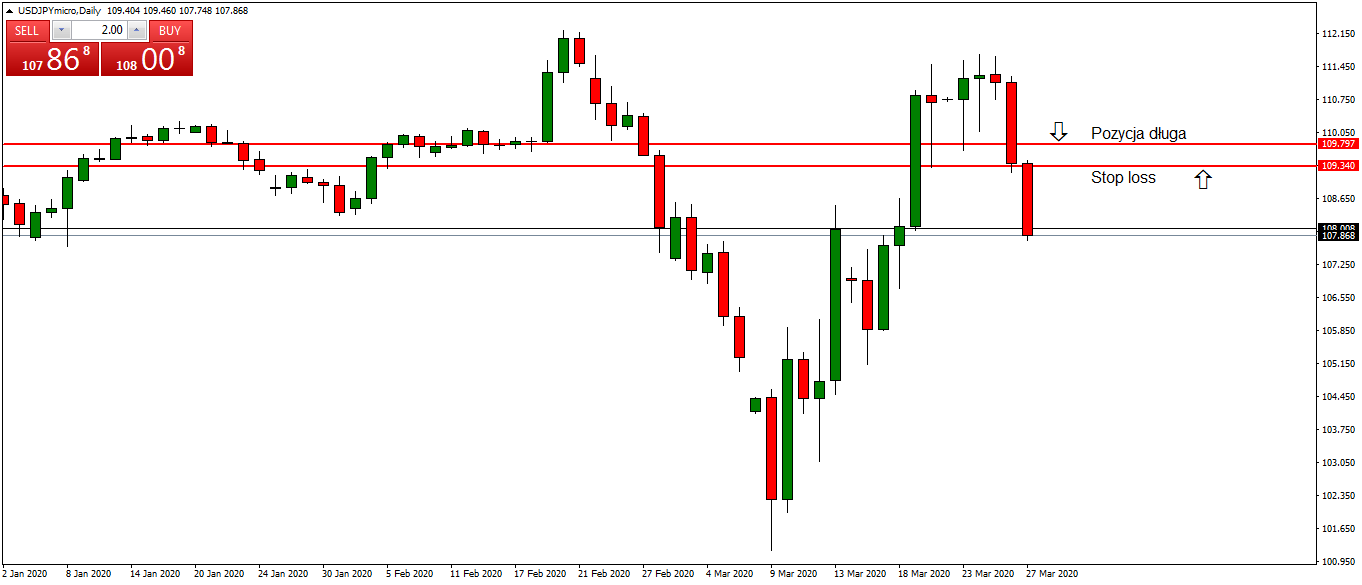

As for USDJPY, I was hoping that the growth rally, which has been going on for some time, would be able to overcome local highs. The price with a very strong demand swing broke the last strong zone of local resistance in the areas of 109.620. My buy limit has been activated at 109.797. Initial candles were in favor of demand, but eventually supply won, there was a break down and thus the position was closed.

As with the last summary, I also have no position open now. All transactions closed. A few pairs, however, look very interesting so I think it will happen in the coming weeks☺.

Summation

After 5 months of trading, the profit limit of half of the initial deposit is now exceeded. The rate of return on closed positions is +Present in several = 50.03%. This gives us an average of 10% profit per month.

The whole and the live results are available of course at MyFxBook profile. The current situation is presented on an ongoing basis forum.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![The Trader of the Month made $ 20 in December 600 [Forex Contest] trader of the month of December 2021](https://forexclub.pl/wp-content/uploads/2022/01/trader-miesiaca-grudzien-2021-300x200.jpg?v=1642612564)

![Three Custom AT Indicators - Practice Test [Week 4] indicators](https://forexclub.pl/wp-content/uploads/2020/07/niestandardowe-wskazniki-300x200.jpg?v=1594712711)