End of the Day Forex Strategy. Week 12 - quarterly summary

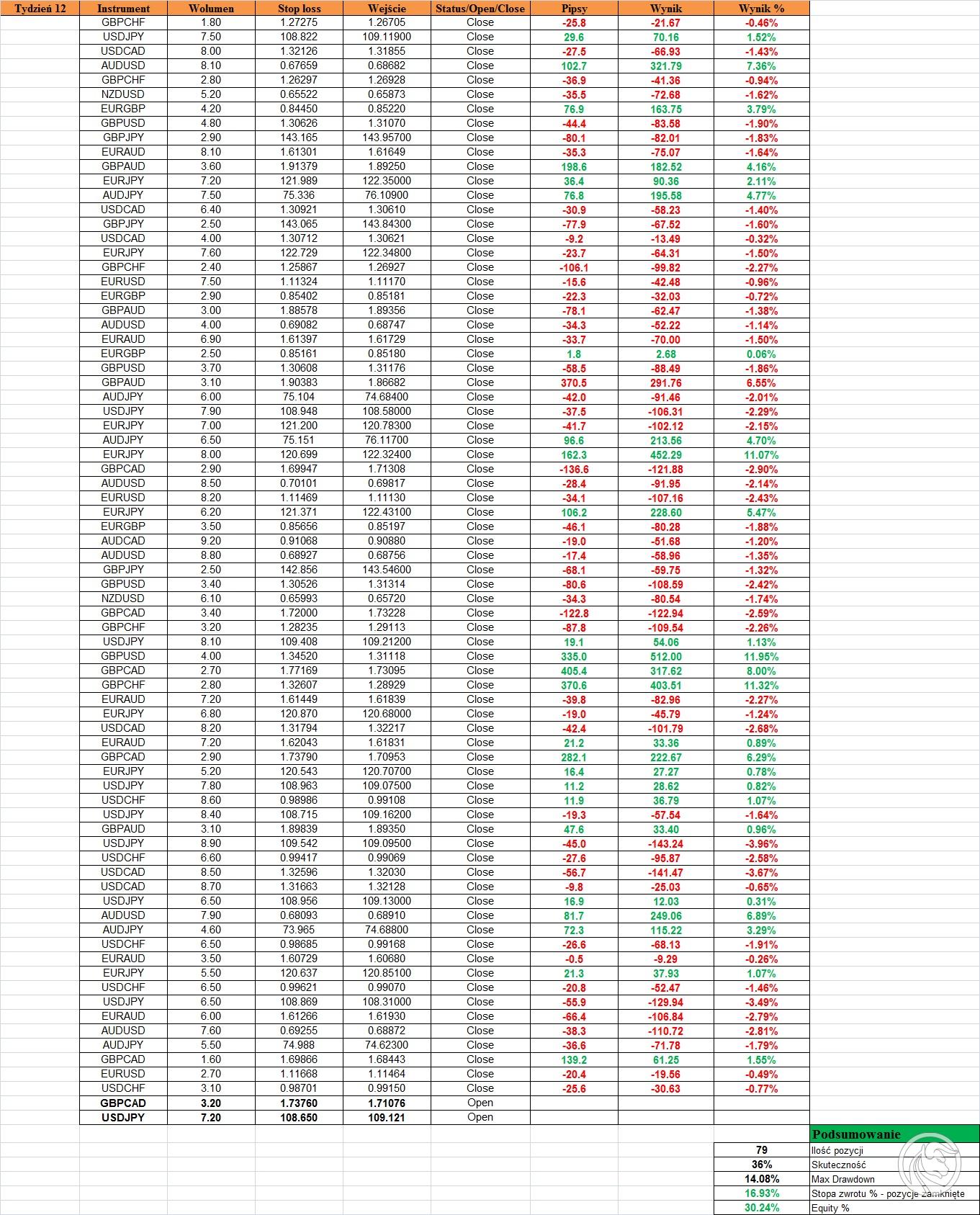

Behind us exactly 12 weeks of trading the strategy "At the end of the day", so it's worth doing another summary of the results so far. The week ending the quarter was great. I closed several positions with a nice profit and managed to "catch" key setups on GBPCAD and USDJPY. The most important items are briefly described below, and as always, at the end we will present a full list.

The best transactions

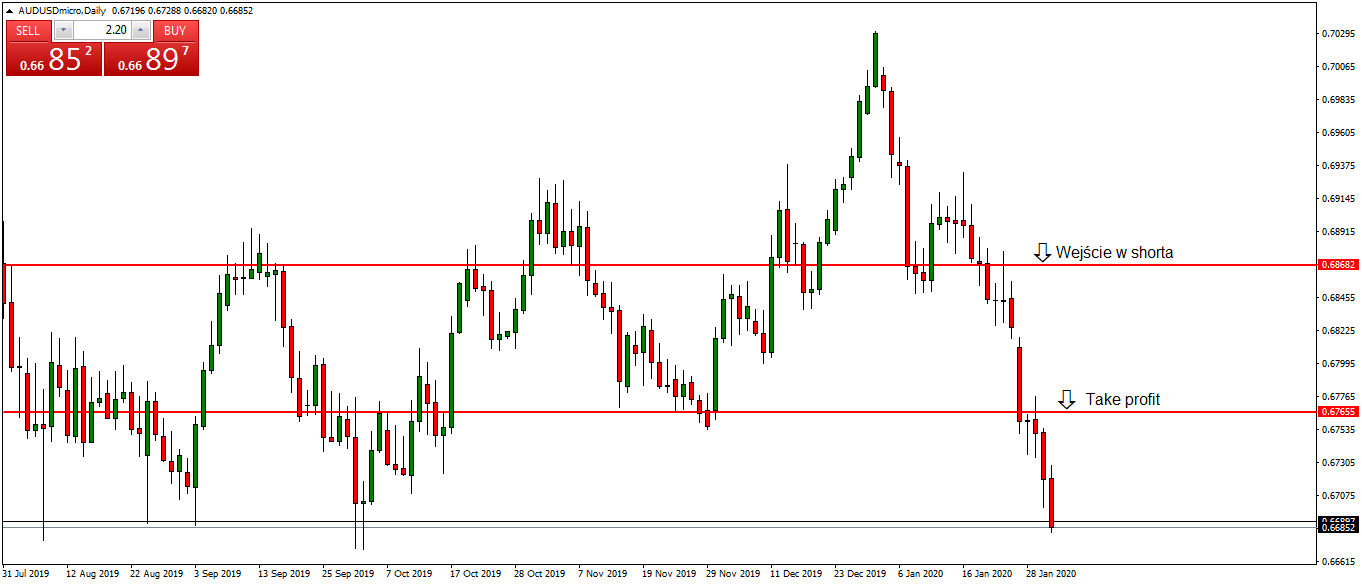

When it comes to profitable closed transactions, the short last week was the best last week AUDUSD. I have also described the transaction on the forum. The key zone I was observing was in the areas 0.68680-0.68700. It was defeated, after which the price did a re-test and activated the sell limit order. The downward movement was very dynamic. Take profit was realized at the level of 0.67655.

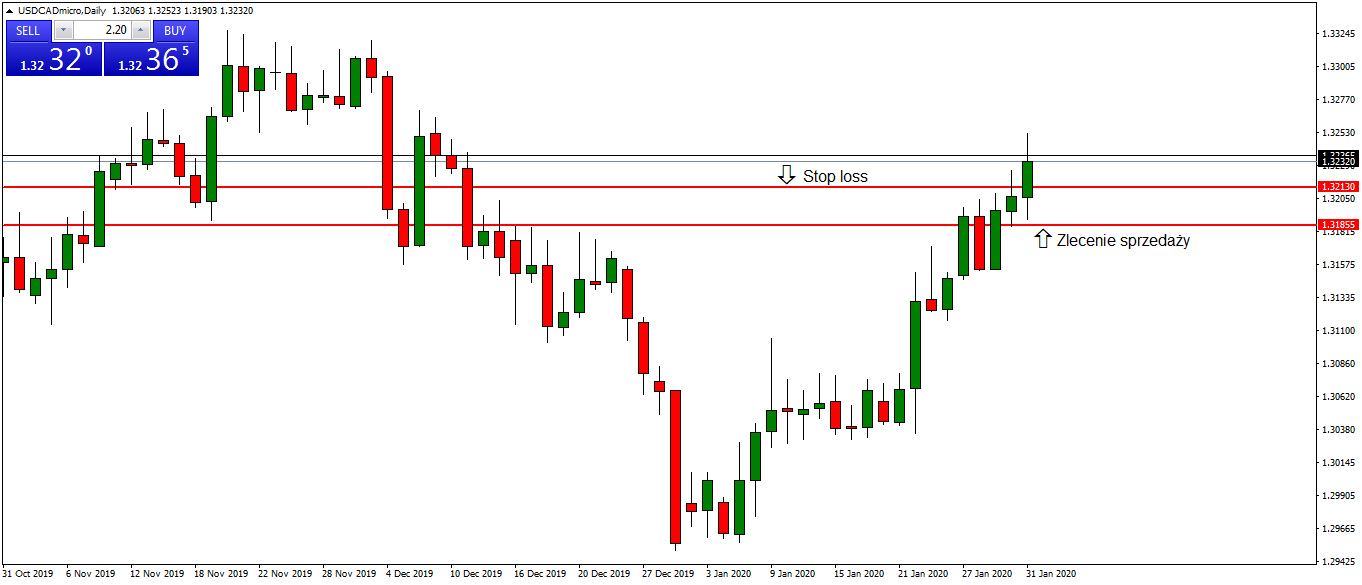

Worst deals

As for lossy transactions, this also happened. Specifically, I'm talking about a short position on USDCAD. The price last week reached the zone that I observed for a long time, namely around 1.31900. The Monday candle gently struck this level, so I abstained from position. The Tuesday candle, however, was already heavily in supply, which prompted me to set the sell limit at 1.31855. Unfortunately, the next candles again overcame the assumed zone and there was activation stop lossa.

Open positions

I currently have two positions open. These are long on GBPCAD and short on USDJPY.

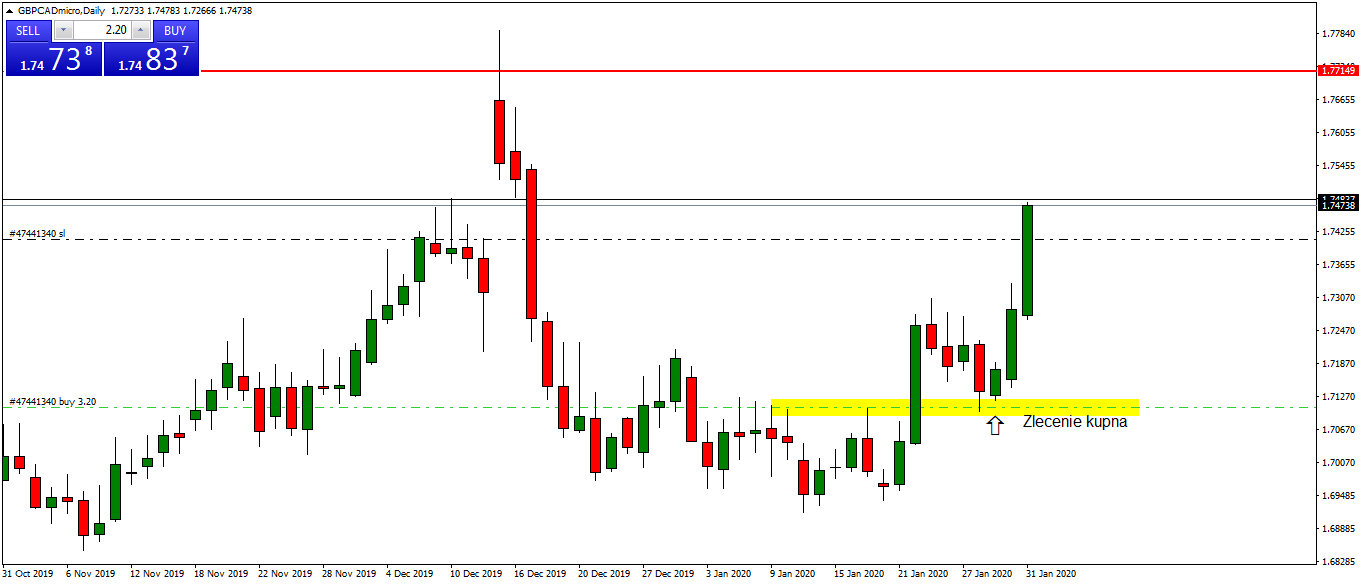

GBPCAD - the key demand level on which I focused my attention is the zone in the regions 1.70900 - 1.71220. In my opinion, this is very strong support, combined with 38.2% fibro confluence and 61.8% of the previous major upward movement. After activating the order, there was a beautiful swing up. The position is already partially secured, but of course it is still in the game.

Long position. GBP / CAD chart, D1 interval. Source: MT4 XM

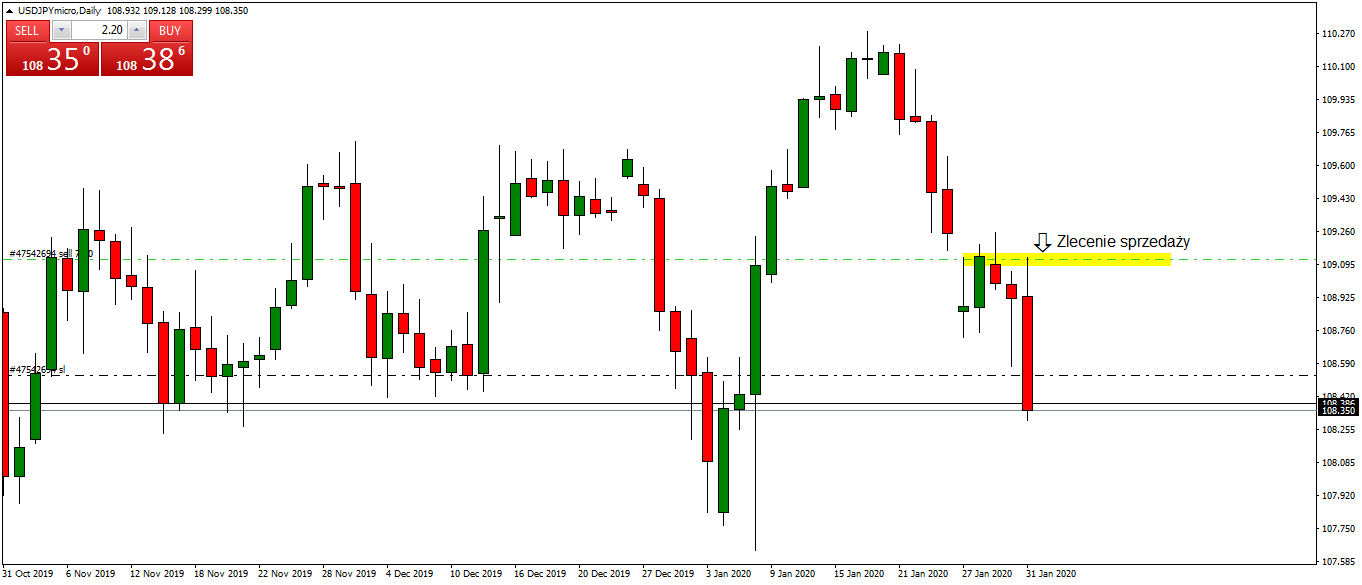

USDJPY - here the main level where I wanted to enter positions were around 109.160. Despite the strongly demanding candle from Thursday, the zone was already defeated earlier which for me was a signal that the main direction is downward movement. As on GBPCAD, the descent was very dynamic. I have already partly secured the position.

Short position. USD / JPY chart, D1 interval. Source: MT4 XM

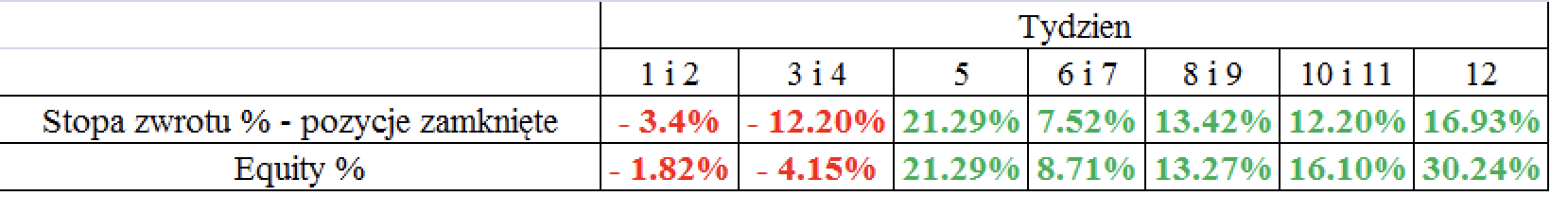

Summary after 12 weeks of trading

After 12 weeks, the equity level has now reached a record level and exceeded 30%. Breaking it down into 3 months, this gives an average of 10% profit per month. Of course, two items are still in the game, but they are already secured if there was a reunion or sentiment reversal.

When it comes to the number of transactions, after three months we reach about 80. Considering that the system is based on daylight candles, I think that the strategy generates a lot of potential signals. In the table below I also summarized the level of return and equity in particular weeks. Every system has better and worse periods. As for the "At the End of the Day" strategy, definitely the beginning of the test, i.e. the first 4 weeks looked the least optimistic. Since week # 5, the system has been generating profit all the time.

I will continue to look for interesting opportunities to trade. The current situation is presented on an ongoing basis forum. Finally, I publish a list of all items, along with statistics after week 12. Feel free to comment and follow the results live on MyFxBook.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Forex training - hit or kitty? [VIDEO] Forex Training - Hit or Kit?](https://forexclub.pl/wp-content/uploads/2021/03/szkolenia-forex-v3a-300x200.png)

![New features on the xStation 5 platform from XTB [September 2020] xstation 5 xtb](https://forexclub.pl/wp-content/uploads/2018/12/xstation-5-xtb-300x200.jpg)

Leave a Response