A great reset, which will end with the maximum USD exchange rate

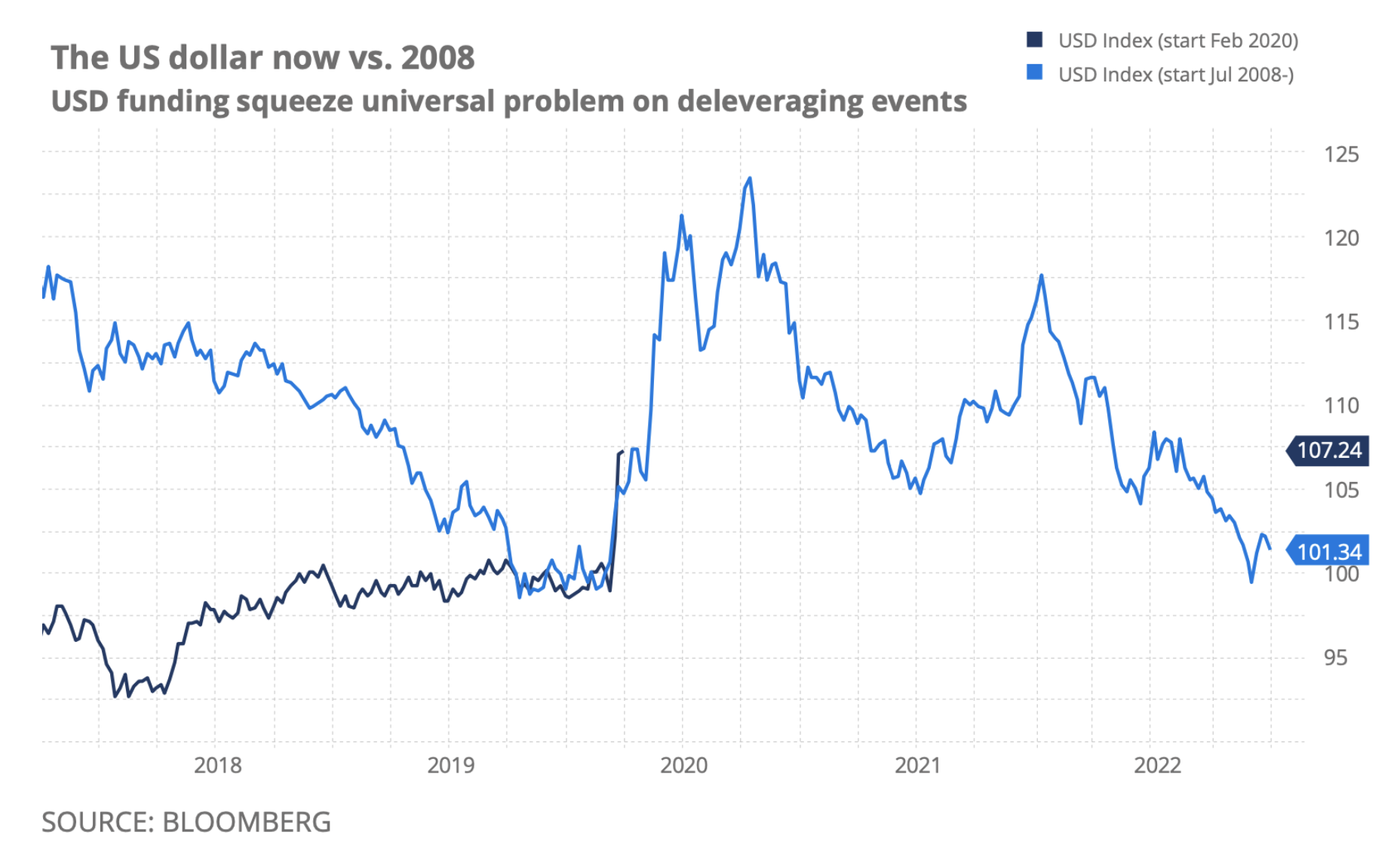

We are witnessing a great reset of the global debt bubble. The currency market has already felt the first effects of this situation, which are traditionally manifested in risk aversion and balancing numerous speculative positions. Emerging market currencies have gone down sharply and smaller G10 currencies have come under pressure. Interestingly, the US dollar was initially also under pressure against the Japanese yen and the euro as a result of initial deleveraging, but later began a stronger strengthening, as it did in the worst phase of the crisis of 2008-2009. The appreciation of the USD was not even affected by the fact that the Federal Reserve, as then, reduced interest rates to zero and launched all kinds of quantitative easing and liquidity mechanisms.

And like at the beginning of 2009, it is possible that it is impossible to determine the bottom in the markets or the peak moment of the crisis until the return of the dollar trajectory. In March 2009 simultaneously S&P 500 index it hit the bottom and the USD reached its peak. Given how much of the global debt and other instruments are denominated in USD, Fed she made efforts to overtake the process of contagion, while everyone began deleveraging in a crazy "pursuit of cash." This situation resembles almost 1933, i.e. the beginning of the end of the worst phase of the Great Depression after the devaluation of the dollar against gold by Roosevelt (delayed by about three years).

Chart: USD in 2008-2009 and now

We entered this crisis, which still has no official name, in a definitely different situation than in the case of the global financial crisis. At that time, the USD was relatively weak, because the previous Fed's easy money policy of 2002-2004 turbocharged USD liquidity and investment banks' balance sheets, and carry transactions in JPY and CHF further contributed to an increase in global liquidity. This time, the rush to carry transactions before the outbreak of the COVID-19 pandemic was greater. Strong appreciation of the dollar shows that in a crisis situation the world is throwing itself on the American currency. Most likely, the USD must depreciate before the end of the bear market in the risk and equity markets can be announced.

Chart Source: Bloomberg

The impetus for this credit crisis on an unforeseen scale was of course the coronavirus pandemic. The weight of consistency, however, is the result of a finalized global system whose incredible fragility is associated with leverage, which was encouraged by a policy of negative / zero interest rates plus a medicine for all evil in the form of quantitative easing, which was used to solve problems after the recent crisis.

At this point, determining the market minimum cycle and the maximum USD exchange rate may take up to several quarters - even despite the fact that the competent authorities set about to act with more determination than we have ever seen. This time, due to the seriousness of the situation, policy makers did not hesitate to abandon orthodoxy and print an unlimited amount of money to accuse them of the economy. Let's contrast it with the restrictions in the United States, which stopped full healing of the system from 1929 until joining World War II in 1941 after the attack on Pearl Harbor. Business cycles have become shorter since the Great Depression; during the global financial crisis the market went from top to bottom in only about 18 months.

Compared to the global financial crisis, this time the remedy will be much more money from the helicopter and much less quantitative easing. Real GDP may grow slowly - but money from a helicopter will allow nominal GDP to revive at some point.

Now a few words to cheer up in worrying times: long-term investors know that crises are also the greatest opportunities for those with reserves. Over the next six to twelve months, the value of various over-sold assets, regions and currencies will increase exceptionally, even if the market bottom cannot be determined. Below, we are exploring new aspects of the currency market that we believe may lead the way as the situation draws to a close, which may turn out to be a U-shaped recovery with a bumpy bottom in 2021.

The following aspects and factors are different from those that applied in the times preceding and following the global financial crisis, when carry transactions and investment flows in the globalized financial system were in the center of attention.

Fighting deflationary fires = inflation?

We are convinced that the drug in the form of Modern Monetary Theory (MMT) will eventually be used, and its scale will avoid deflationary effects. In this case, and if inflation increases sharply and even begins to overheat, in the context of the relative strength of the currency, many people will most likely focus on the real interest rate - how much the CPI exceeds the reference rate at individual points on the government bond curve. In the case of countries over-printing money and facing bankruptcy, negative interest rates will ultimately weaken the local currency instead of allowing the initial impulse to implement fiscal incentives.

This is a de facto traditional pattern for emerging market currencies. Look out for this inflation change in the coming months, because the demand crisis is a risk of capital destruction and thus the availability of key products once the economy is back on track. In addition, as the dust settles in the coming quarters, investors should watch the purchasing power of individual currencies, as it turns out that some proverbial children will be poured out with a bath, as is usually the case in times of crisis. These currencies may include SEK, CAD, and (with some patience) GBP and AUD.

Autarkia and new deglobalization

The coronavirus pandemic and the preceding China-US trade conflict are likely to intensify the impetus for deglobalization - a process that began before the outbreak of the pandemic. Countries and economic blocs, such as the EU, will focus on ensuring that key products related to safety and health - such as medicines, surgical masks and respirators; certain basic goods; defense-related products and electrical goods - they will be produced more locally. This will translate into investment and current accounts and will prove crucial for currency foundations, and traditional finalized capital flows will be less frequent.

This can hit sensitive countries in terms of current accounts (if this is the end of the financial era, e.g. the UK should prove that it is able to balance its current account). On the other hand, traditional export powers such as Germany (EUR and eventually DEM?), Singapore (SGD), Sweden (SEK), Switzerland (CHF) and others may find this environment less favorable for their currencies due to for less access to international markets - it all depends on the purchasing power mentioned above.

Exposure to raw materials

With the likely end of the era of over-financialization, there may be a real renaissance of hard assets and raw materials that are difficult to produce or replace at local level, which can translate into significant profits for individual currencies. The winners in this category will probably include AUD, NZD and CAD (as soon as they solve the problem of domestic credit bubbles). BRL and even RUB may be in a similar situation, starting from an extremely low output level.

USD will also win, but it needs significant depreciation in the coming years to allow global recovery. The US dollar may also struggle with the above-mentioned real interest rate hardships. JPY will prove fragile in the event of an increase in imports of raw materials and a threat to export markets due to deglobalisation, ignoring long-standing problems such as shrinking workforce and the huge proportion of pensioners in society.

End of dependence on USD

In addition to the factors mentioned, the most interesting topic in the coming years will be looking for an alternative to USD. The current crisis shows even more clearly than the previous one that the fiduciary USD as a system of the world reserve currency is dysfunctional and cannot be saved. The search for alternatives is hampered by the fact that in a deglobalizing world it will be difficult to reach agreements in the style of Bretton Woods.

All Saxo Bank forecasts for download at this address

source: John J. Hardy, director of currency markets strategy at Saxo Bank

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)