Raw materials are headed for the strong end of 2021 again.

The second week of December usually signals the start of a quiet period as markets stabilize ahead of the coming holiday break and the new year. For now, it seems that this year will be the exception to this rule due to the considerable uncertainty that overshadows the market and thus increases the likelihood of volatility in a period when liquidity is beginning to run out.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

The original negative market reaction to the new omicron variant earlier this month faded out last week. Reports on the speed of infection spread and concerns about the effectiveness of existing vaccines triggered a wave of new restrictions, threatening economic activity once again. At the same time, the market has to deal with soaring inflation and the prospect of a return to a new, potentially aggressive, cycle of US interest rate hikes, which is now expected to start in June next year.

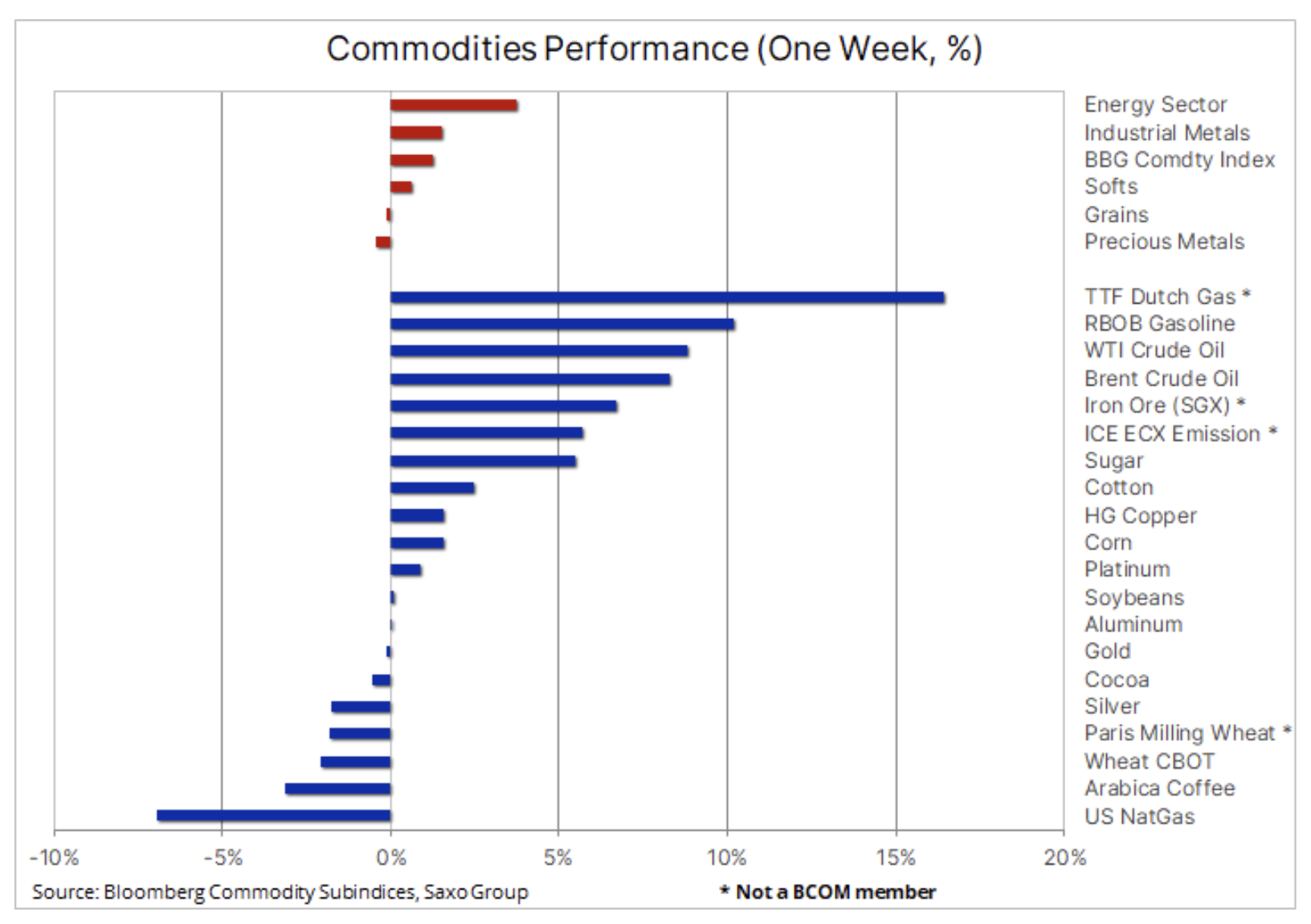

Commodity index Bloomberg, monitoring the basket of the most important raw materials broken down into energy, metals and agricultural products, has risen for the first time in eight weeks, thus consolidating the very strong result for 2021, now amounting to 25%, which is the largest annual increase since 2000 However, the bulk of this increase was initially due to the stabilization of the market after the omicron variant discount last week. Against this backdrop, it is by no means surprising that the energy sector was at its peak, with crude oil recovering half of the losses suffered from the October peak correction.

Agricultural commodities

In the agricultural market, the situation was mixed: profit-taking struck a blow to coffee, which recently hit its highest price in a decade, while cotton and sugar attracted buyers again after a recent correction of + 12%. The cereals sector recorded a decline for the second week in a row; This was especially true of wheat, which fell to a five-week low after the US Department of Agriculture raised its forecast for global inventories. The fall in the Chicago stock market also triggered the recent successful Kansas and Paris consumer wheat futures contracts. In its monthly supply and demand information, the US government raised its projected global wheat stocks at the end of the 2022-2023 season as a result of increased production in Russia and Australia, while US exports slowed as high prices curb demand.

Industrial metals

Industrial metals attracted buyers amid signals of an upward trend in demand in China, despite continued concerns about the Chinese real estate sector. The forecast for the industrial metals sector for 2022 continues to be associated with great uncertainty due to the difficulties of forecasters in reaching consensus; this uncertainty also explains why a colored metal such as copper has not been outside the range for almost six months.

Annual price forecasts and projections from leading commodity banks have started to flow in, and while the outlook for energy and agricultural products is broadly positive and negative for precious metals due to the expected hike in US short-term rates and the rise in profitability in the US. long end of the yield curve, for industrial metals they vary. Despite the predictions that the energy transition towards less dependence on coal in the future will generate strong and steadily growing demand for many key metals, the outlook for China, in particular for copper, is currently the great unknown, as the real estate market is responsible for a significant part of Chinese demand. .

In our opinion, copper has posted relatively good results over the past few months, given the aforementioned concerns about the economic outlook for China, and in particular for the Chinese real estate sector. An additional handicap is the stronger dollar and central banks are starting to focus more on inflation than on fiscal stimulus. In order to counterbalance concerns about Chinese economic growth, the government is increasingly openly announcing increased support to enterprises.

Against this background - and given the scarce supply of metals mined - we believe that the current negative macroeconomic factors related to the slowdown in China's real estate market will begin to weaken in early 2022, and with both copper and aluminum stocks on hold. at a low level, this may cause prices to return to or even exceed the record highs from the beginning of this year. The months-long sideline has reduced the speculative long position to an almost neutral level, thereby increasing the prospects for attracting new buyers as soon as the technical forecast improves.

Gold

Not very impressive results gold it holds for the fourth week and while the metal managed to consolidate above last week's low of $ 1, it did not find enough strength to threaten the resistance of $ 761, the 1-day moving average. Gold has struggled with problems since Fed chairman Jerome Powell signaled a clear shift in the approach of the FOMC - from an emphasis on job creation to a drive to fight inflation.

Market expectations for future US interest rate hikes have increased in response to the recent spike in inflation, now pricing in three 0,25% hikes in 2022, the first of which is expected in June at the latest - a year earlier than expected a few more weeks ago. As a result of these expectations, analysts have lowered their forecasts for the price of gold for 2022, and some even predict that the metal may lose its popularity and its price may be lower next year.

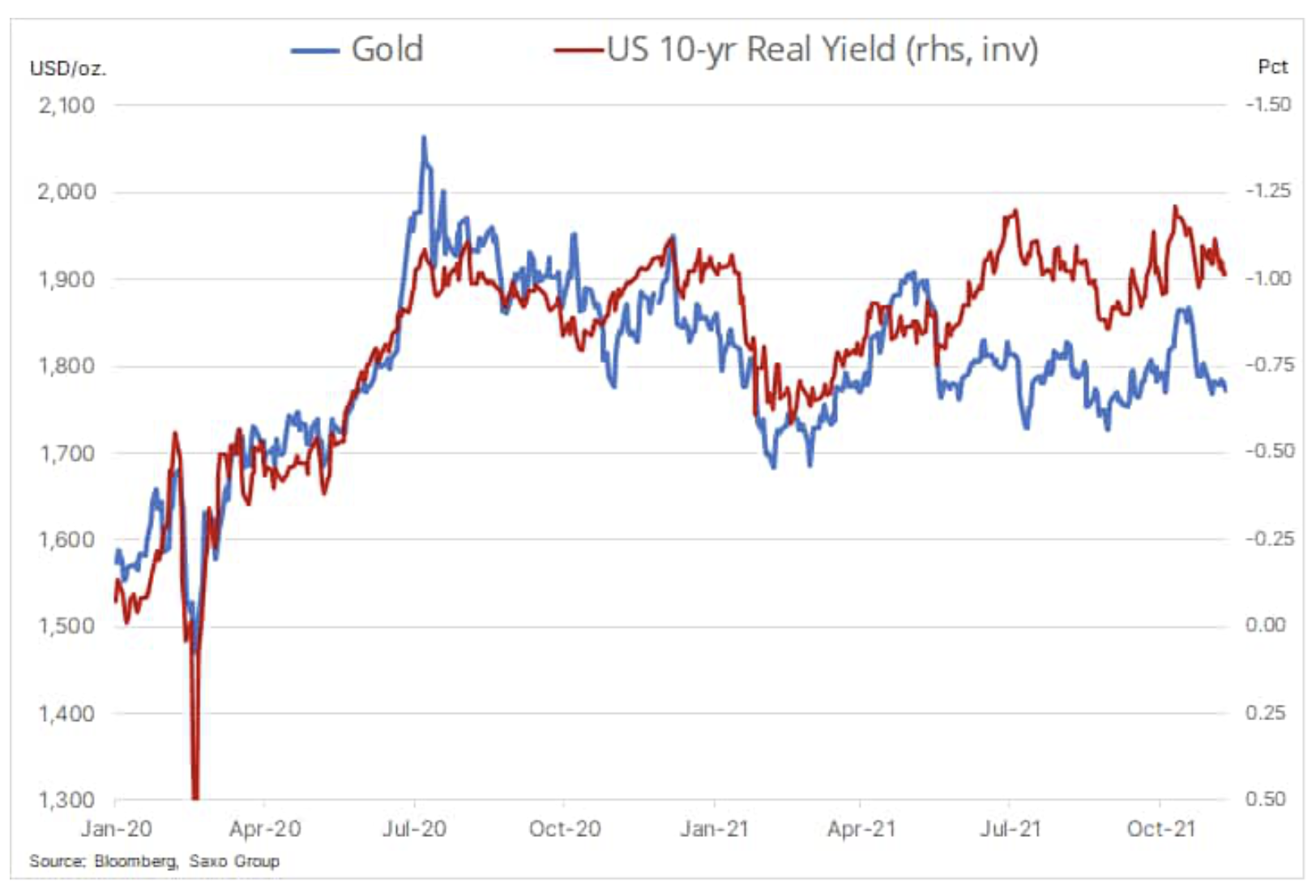

We do not share this view and still predict that the price of gold will be higher at this time next year. However, we fully understand the motivation of this position: first of all, the expectation that bond yields will go up, which will result in an increase in real yields, which have been negatively correlated with the price of gold for many years. The correlation shown below indicates that gold should deal with the initial rise in real yields to around -0,75% from the current level below -1%.

An increase in interest rates is likely to increase risk in the stock market as many of the high growth unprofitable stocks may be subject to a major revaluation. Moreover, the factors that may offset the negative effects of the increase in bond yields include concerns about the persisting levels of government and private debt, increased asset purchases by central banks and the strengthening of the dollar in the coming months.

For now, gold needs an appropriate impulse, and after the November CPI reading was 6,8%, the highest level since the 80s, the market focuses on the meeting scheduled for December 15 FOMC and additional guidance on the pace of cuts in asset purchases and the timing of future rate hikes. With silver still underperforming after the last correction of 14%, the potential for growth before the end of this year appears limited. Speculative investors cut most of their long open positions in the futures market in an attempt to break out in early November, but to get them to buy again, a significant improvement in the technical forecast is needed.

Petroleum

A recovery that has been going on for a week oil After the recent crash caused by the omicron variant, it slowed down as a result of the publication of a study stating that the new variant was 4,2 times more contagious than the delta variant, with an increase in the number of infections and the re-introduction of restrictions on movement across a number of countries. The short-term negative impact on travel in response to new variants of the coronavirus has weakened with the introduction of vaccines to protect the healthcare system from collapsing. For the time being, the market expects the same to be true for infections caused by the omicron variant, despite its high contagiousness, avoiding a significant drop in mobility and fuel demand.

Despite a potential shift of several quarters, we maintain a long-term positive outlook for the oil market as it faces long years of potential underinvestment - major players are losing their appetite for big ventures, in part due to uncertain long-term outlook for demand, but also, increasingly, , due to credit constraints on banks and investors due to ESG (environmental, social and governance issues) and the emphasis on green transition.

Chart: The short-term outlook depends on Brent and WTI crude oil building strong foundations above the two-hundred-day moving averages at $ 73 and $ 69,80 respectively. There is no doubt that the main risk for this support is still related to the concerns about the virus and the possibility that it would pose a greater threat than the delta variant.

Natural gas

While American gas market tried to recover from a two-month decline of more than 40% due to mild weather in the center and east of the United States, the natural gas and electricity market in the European Union deteriorated even further. An unplanned failure temporarily cutting off supplies from the gigantic Norwegian Troll field, geopolitical risk related to Ukraine, stable winter supplies from Russia, frosts and rapidly shrinking inventories caused the price of the Dutch benchmark monthly TTF gas contract to return above EUR 100 / MWh, i.e. 34 USD / MMBtu.

As rising coal demand pushed the cost of EU emissions to a new record above EUR 90 / t, before a 12% adjustment to remove speculative longs took place, electricity costs also increased. In Germany, the price of the one-year baseload contract hit a record EUR 192 / MWh, more than five times the long-term average. Due to the current trajectory of gas consumption and the lack of announcement of additional supplies from Russia, the risk of full inventory use before spring is a significant threat to the European market and the main reason why gas prices are high enough to counter the demand.

It is expected that the EU will decide by 22 December whether investments in natural gas and nuclear energy are considered green. Investors from around the world are closely following the draft EU green investment classification scheme; it has the potential to attract billions of euros from the private sector to support a green transition, especially given the need to reduce the use of carbon, the biggest source of pollution.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)