Swaps - Toxic Assets or an Effective Hedging Instrument?

In finance, there are a large number of instruments that play an important role in the financial market, but for the average investor they mean an undefined acronym. They are a very important instrument swapswithout which it is currently difficult to imagine the activity of investment banking and an effective way to manage currency and interest rate risk. Only references to instruments such as the CDS, Czy currency swaps. Most often it is brief information about these instruments tagged with "toxic". The reason for the bad opinion of swaps can be found in 2007-2009, when all CDSs, MBSs, CDOs and currency options were put together in one bag. These instruments came to be considered toxic assets, as if the very concept of securitizing assets or hedging risks were bad, not just human greed.

In today's article, we'll try to shed some light on this. Certainly the term swaps toxic assets it is exaggerated. We invite you to read!

READ: What are Credit Default Swaps (CDS)?

What is swap?

A swap contract is a type of contract that is entered into between two or more parties. Contract participants undertake to transfer payments according to strictly defined rules. It may sound strange, but it is actually a very simple relationship.

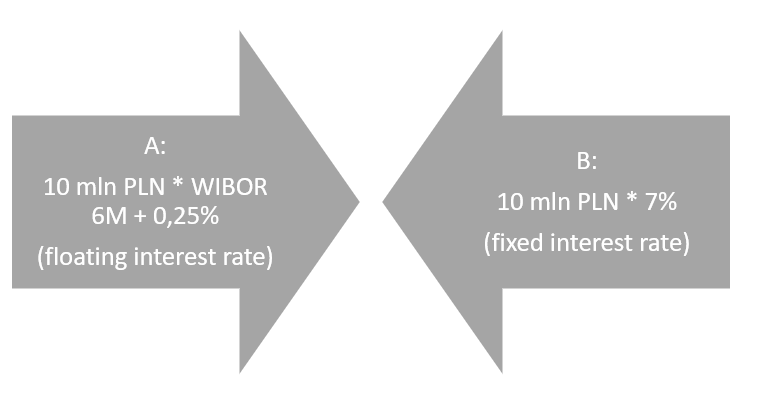

For example side A agrees to make payments at the WIBOR plus margin, while side B in return, it provides a payment calculated at a fixed interest rate of 7%. Therefore, side A assumes that WIBOR will decline, Side B, in turn, expects an increase in the market interest rate. Of course, there are many types of swaps and in theory they protect against changes in currency prices, interest rates, indices, raw materials or the occurrence of a specific credit event. The chart below shows that the nominal value of the contract was set at PLN 10 million. This does not mean that these funds have to be deposited in your account by the parties to the contract. Fixed and floating rate payments are converted from the nominal value.

Of course, there are a number of factors that lead different traders to enter into swap contracts. The two most common 'non-speculative' reasons for swap transactions are:

- Normal operating activities - the company's operational activity causes the company to generate revenues and costs in various currencies. As a result, the company is exposed to currency risk. As a result, entering into a currency swap allows you to hedge against the exchange rate risk. Another reason is, for example, financing yourself with a debt with a variable interest rate. Purchasing an interest rate swap allows you to hedge against the interest rate risk.

- A comparative imbalance - this is a situation where the entity has access to more preferential financing. The use of preferential loans can be used to enter into an interest rate swap to change the characteristics of the loan to suit your needs companies. This may, for example, concern the method of payment of installments, the type of interest, etc.

Swaps, while designed to lower risk, can themselves cause a number of problems. Investors should be aware of this prior to trading. The risk in swap contracts relates to such problems as:

- Market risk - change in market conditions affecting the valuation of the transaction

- Risk of additional collateral - as a result of market fluctuations, there may be a risk of submitting or supplementing the amount of security

- Liquidity - difficulty in the case of closing the position, i.e. entering into a position with opposite parameters

- Leverage risk - the possibility of large losses despite a slight change in the price of the underlying instrument

- Transaction mismatch - the risk arises when the hedging item has a greater value than the assets to be hedged. Then the flows do not match which causes the part position becomes speculative.

- Counterparty risk - the possibility of a situation where the other party to the transaction turns out to be insolvent. In such a situation, it will be necessary to look for an entity that will take over the obligations of the party that declared insolvency.

Types of swaps

Along with the development of the financial market, more and more swaps were created to meet the more and more sophisticated expectations of customers. There are several types of swaps. The most popular are:

- FX swaps - currency swap,

- IRS (Interest Rate Swap) - interest rate swap,

- CIRS (Cross currency interest rate swap) - currency and percentage swap,

- CDS (Credit Deflault Swap) - credit default swap,

- Equity Swap - equity swap.

Each type of swap will be briefly described below.

Foreign exchange swap (FX Swap)

A currency swap is an agreement whereby both parties agree to exchange a specified amount expressed in one currency for a payment expressed in another currency. Such a contract allows you to hedge against the exchange rate risk. Of course, there are two different ways to settle a contract:

- Fixed-for-fixed,

- Fixed-for-floating.

Transactions made with fixed-for-fixed mean that both parties to the transaction exchange payments at a fixed interest rate.

Transaction made with fixed-for-floating converts a fixed payment in one currency to a variable payment in another.

The foreign exchange swap is the "child" of floating exchange rates. Fall the Bretton Woods system caused the period of fixed exchange rates to expire. The era of liquid currency regimes has begun. As a result, many enterprises faced a new type of risk - currency. Rapid changes in exchange rates made it difficult to run a business and calculate the prices of products intended for export. One solution was swap. First transaction the swap was arranged by Salomon Brothers. The bank brokered the transaction between the first currency swap between the World Bank and the American corporation - IBM. IBM exchanged the Deutsche Mark and Swiss Franc for dollars. Transaction took place in 1981.

Sometimes a foreign exchange swap is used to obtain a loan with a lower interest rate than a traditional loan. Sometimes governments also use swaps as a form of cheap financing. An example is 2008 when Federal Reserve allowed several developing countries to take advantage of swap transactions to limit the impact of liquidity problems. Dollar swap lines were used, among others, by Central Bank of Brazil or Central Bank of Mexico. The swap lines mentioned had a short "life time", it lasted a maximum of 3 months and then had to be renewed.

The most common FX swap is associated with LIBOR (London Interbank Offered Rate). Already in 2023, LIBOR will be replaced by SOFRMore (Secured Overnight Financing Rate). Due to the imminent introduction of SFOR, no swap transactions using the LIBOR rate have been concluded since the end of 2021.

As you can see, the currency swap may not only reduce the currency risk but also be an element stabilizing the global financial market. This was the case in 2008 and 2009 when swap lines allowed developing countries to receive dollars on favorable terms in a situation where the financial sector was unable to do so. So it's hard to consider this type of swap to be a toxic asset.

IRS

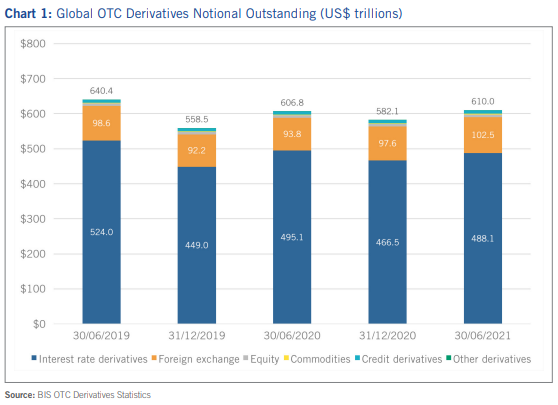

It is a type of Interest Rate Derivative (IRD). According to data prepared by ISDA, the IRD instruments had the contract value of $ 488,1 trillion. This amount is several times higher than the global GDP.

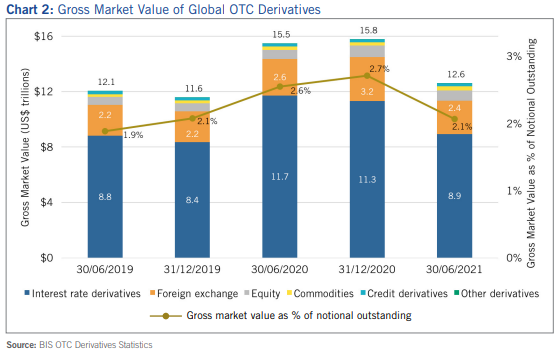

Of course, this is not a market valuation of contracts, but the nominal value itself. According to the same Interest Rate Derivative report, it had a gross market value of $ 8,9 trillion.

The Interest Rate Derivative market is dominated by contracts valued in dollars ($ 173,8 trillion) and euros ($ 140,1 trillion). The important currencies used for swap transactions include the British pound, the Swiss franc and the Japanese yen.

The IRD market itself can be divided into several product categories:

- Swaps,

- FRA contracts,

- Options,

- Other instruments.

Swap contracts are the most important in the IRD market. In mid-2021, swaps accounted for 76,3% (i.e. $ 372,4 trillion) of the notional value of all IRDs. The next largest FRA ($ 73,6 trillion) and options ($ 41,8 trillion).

Since it is already known that swaps have dominated the interest rate swap market, it is worth finding out what exactly IRS (Interest Rate Swap) are. According to the basic definition, it is a contract in which two parties to the contract agree to exchange payments based on different interest rates. Interest Rate Swaps themselves are often called "plain vanilla swaps" because they are the simplest type of swaps.

Contracts are traded on the unregulated market. As a result, these are not standardized contracts, but contracts tailored to the needs of customers. Swaps are used by companies to convert standard credit into a more "flexible" form of debt. Interest payments can be divided into those based on a fixed or variable interest rate. Contracts can be divided into:

- Fixed-to-Floating,

- Floating-to-Fixed,

- Float-to-Float.

Fixed-to-Floating is a situation where one of the parties wants to convert a fixed interest rate into a floating rate. For example: a company has entered into liabilities with a fixed interest rate. The financial conditions were so attractive that the company's management board agreed to the offer of the financial institution. The finance department expects interest rates to decline over the lifetime of the debt. For this reason, it signs contracts with a counterparty (e.g. an investment bank), where the company pays at a variable interest rate and receives a fixed payment. As a result, the ultimate firm pays only the floating rate. If the scenario of a drop in market interest rates materializes, the enterprise will incur lower financial costs.

Floating-to-Fixed is the opposite of the above. In this case, the company took out a loan with a variable interest rate. The finance department expects market rates of return to rise in the near future. For this reason, the company signs contracts with a counterparty (e.g. a hedge fund) where the company pays at a fixed interest rate and receives payment in a variable. As a result, the interest rate on the debt changes from floating to fixed. Thanks to this, in the period of rising market interest rates, the company will not incur additional financial costs.

Float-to-Float is a situation when a company intends to change the type of floating interest rate. This strategy is known as a so-called "basis swap". For example, a company changes the LIBOR interest rate from 3-month to 6-month. Another solution is to replace, for example, the LIBOR rate with another floating rate, such as the interest rate on 10-year US government bonds.

The IRS is used to hedge against the risk of changes in interest rates, to reduce financial costs or to speculate. Certainly, entering into contracts significantly exceeding the amount that the company wants to secure is a high risk. The use of high leverage can cause even a small change in market interest rates to generate significant losses. For this reason, this very useful instrument can be a toxic asset if not used for its intended purpose.

CIRS

Cross-currency Interest Rate Swap is otherwise a currency-percentage swap. In the event of such a transaction principal and interest payments are exchanged at different interest rates and in different currencies. In many cases, an interest rate swap is simply the exchange of the face value of a loan in one currency for the value of a loan in a different currency and interest rate.

Why does this kind of swap even exist? The main reason is that some companies have long-term liabilities in a currency that is not desirable from the point of view of currency and interest rate risk management. For example, a company has liabilities in PLN with a fixed interest rate. The company is an exporter and generates most of its revenues in euros. In such a situation, the company may decide to use CIRS in which it transfers the bank swap payments in Polish zlotys calculated in fixed interest rates. In turn, the bank pays out payments in euro at a variable interest rate (EURIBOR). Thanks to this strategy, the company can compensate capital installments with generated revenues in euro.

CDS

The Credit Default Swap is a derivative instrument that transfers the credit risk of specific debt instruments between the parties to a contract. The CDS buyer secures itself against the risk of specific credit events of a given debt (e.g. a specific series of bonds). Currently, it is not necessary to have a bond that you want to hedge. As a result, CDS has become one of the speculative instruments that allows you to "earn" on increasing the risk of bankruptcy of a given enterprise. The CDS itself is not a toxic asset as it was intended to protect against the risk of the issuer's insolvency. However, if the issuer of a CDS who undertakes to cover the loss takes too much risk, then the deterioration of the issuer's condition may turn the CDS into a toxic asset.

equity swaps

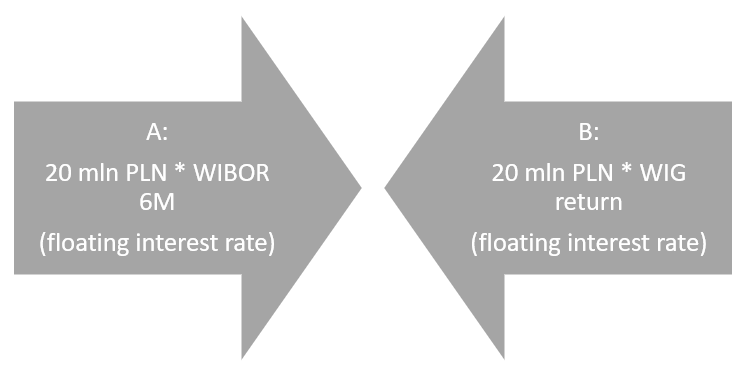

It is a derivative that transfers the risk of market rates of return between the parties to the contract. The swap consists of two legs. The first leg is, for example, a variable interest rate, eg WIBOR 6M. The other leg is the rate of return generated by the WIG in the analyzed period.

Company A undertakes to pay for the year a payment of 7,35% (WIBOR 6M) from PLN 20 million, in return it will receive from partner B an amount corresponding to the WIG rate. If the rate of return on WIG is 20% next year, company A will receive PLN 4 million and will have to pay PLN 1,47 million. As a result, company A will receive PLN 2,53 million. However, if the WIG rate is -20%, company A will have to pay PLN 5,47 million (-4 million - 1,47 million).

Thanks to such an instrument, many financial institutions can provide ETFs with exposure to illiquid assets. Sometimes the equity swap also includes exposure to more liquid indices. An example is the Lyxor S&P 500 UCITS ETF, which is listed on the Warsaw Stock Exchange. According to the data contained in the product sheet, the fund is not replicated directly, but through an equity swap. The OTC swap partners are Morgan Stanley and Societe Generale.

Why the swap was considered a toxic instrument

To answer this question, you need to be specific about exactly what toxic assets are. In the simplest definition, it is one that cannot be sold at any price because the demand for it has collapsed. The lack of buyers is due to the fact that buyers are aware of the fact that buying an asset is agreeing to a guaranteed loss. Due to difficulties in selling, the owner of a toxic asset may run into liquidity problems. In 2008, the assets classified as toxic were CDO (collateralized debt obligations) and CDS issued for MBS (mortgage-backed securities). The problem of toxic assets was solved by, inter alia, TARP program (Troubled Asset Relief Program), which was introduced in 2008. He bought assets worth $ 426,4 billion and provided a profit for taxpayers of $ 11 billion (up to 2013).

The swap is very often considered a toxic instrument due to a misunderstanding of the subject. A distinction must be made between the very specification of the instruments and risk management. The swap itself is not a problem as long as both parties to the contract reasonably manage the risk. However, if one of the parties takes a greater risk than it is able to bear, a problem arises. The fall of one of the partners causes the counterparty risk to be realized. As a result, the other party to the contract does not receive the promised payments. The problem with swaps is that they are traded on an OTC market. The more non-standard the swap is, the more difficult it is to find a counterparty for the transaction. Then the swap may become a toxic asset that one of the parties to the transaction will not be able to liquidate.

Application of a swap in the financial market

The swap market is very large. The nominal value of interest rate swap contracts alone was over $ 2021 trillion in mid-372. Of course, the size of the IRS market itself after gross market value is much lower, amounting to around a few trillion dollars. The swap is a relatively old instrument (it is over 40 years old) and for a short period it posed a real threat to the stability of the global capital market. Currently, swaps are used, inter alia, down:

- Hedging currency risk,

- Minimizing the interest rate risk,

- Exchange of the rate of return on various asset classes (stocks, bonds, commodities),

- Creating more flexible loans,

- Obtaining cheaper financing,

- Protection against the risk of insolvency of the bond issuer,

- Speculation in the market.

The very application of the swap shows that it plays an important role in the current capital market. Like any instrument, a derivative "tempts" managers to take advantage of high financial leverage. If the risk department of a financial institution fails to respond in a timely manner, managers with a high risk appetite may turn swaps into toxic assets.

Summation

Swaps are clearly not in good standing. This is because it is a boring instrument that interests the media only when some reckless financial institution takes too much risk than it can bear. Then the headings of Fr. toxic IRSs, CIRSs or CDS. This is comparable to the opinion in 2008 about the "toxicity" of currency options. In fact, it was an ordinary instrument to limit the currency risk that was badly used by many financial directors of Polish exporters. Currency options are a safe instrument if used properly.

It is similar with swaps, which are not a shadowy financial instrument but a response to the needs of business partners. Most of the time, these instruments fulfill their functions to reduce currency risk and interest rates in developed financial markets. Therefore, it cannot be said that the instrument itself poses a systemic risk. However, it should be remembered that currently a large percentage of swaps are not used to hedge transactions but for speculation, which may create risk in the financial market if financial institutions do not control the risk.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Swap points - What are they and why do they exist? [Video] swap points](https://forexclub.pl/wp-content/uploads/2021/10/punkty-swap-300x200.jpg?v=1635433636)