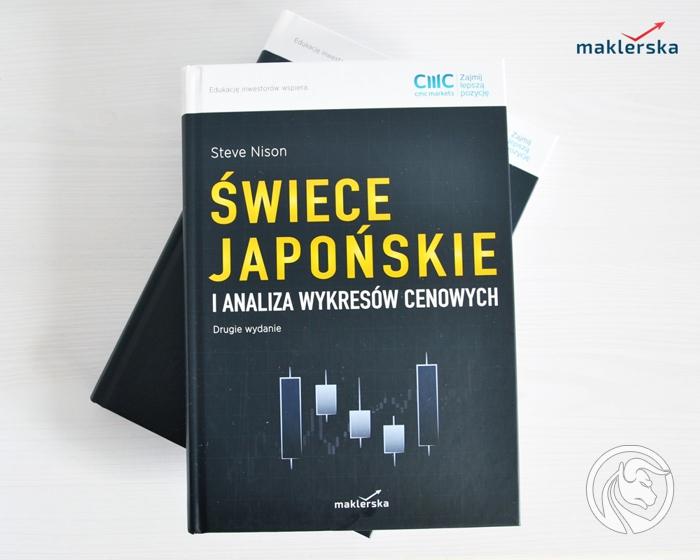

Review of the book "Japanese candles and analysis of price charts"

We can present the price of each instrument graphically in various ways and, importantly, also in various configurations. The most popular types of charts are undoubtedly line, bar and candlestick. I invite you to a short review of Steve Nison's book "Japanese Candles and Price Chart Analysis".

"The beginning is the most important"

Japanese candles is the world's oldest method of technical analysis. Its origins date back to the XNUMXth century, and it was first applied by the Japanese to rice prices in one of the world's first futures markets. The history of the candle-based trade is shrouded in mystery, and many messages sound like a myth, but we know for sure that we owe this technique mainly to the legendary trader Homma from the port city Sakata.

READ NECESSARY: Sokyu (Munehisa) Homma - the trader of all time

He discovered, among others dependence between supply and demand, and noted the impact of emotions of market participants on the level of rice prices. His original ideas and concepts have been modified over the centuries, but the early definition of lights paved the way for further refinement.

"Even the longest journey begins with the first step"

"It's hard to believe, but Japanese candles, so-called claws of Japanese technical analysis "were for a long time completely unknown in the countries of the Western world. Everything changed in 1989 due to the fact Steve Nison, a world-renowned technical analyst who presented this great technique, and then in 1991 described in detail in his book Japanese Candlestick Charting Techniques. This publication very quickly became the basis for other works devoted to this issue. This is one of the most famous commercial publications of all time.

I'm holding in my hands second edition of this excellent work, which has been published on the market by Maklerska Publishing.

"A careful warrior has more than one arrow in a quiver"

It goes without saying that this book is considered the most important Western work on Japanese candlestick charting techniques, and is often referred to as the "bible" of these techniques.

Nison combines Japanese art candlestick chart with more extensive use of Western indicators such as trendlines, retracements, moving averages, and oscillators and volume. In the following chapters, he discusses how to exit trades using measured movements and the concept of signal convergence. Moreover, it presents many useful strategies that can help any trader (not only beginners) perfect their own systems and trading style.

Nowadays, we find a lot of publications on the internet on the Internet, and transaction platforms can automatically find and mark the vast majority of schemes on the chart, but it's difficult to find all analyzed and referenced in one place here are the patterns.

"Everything that's best comes to those who wait"

This is one of those books, after immersing yourself in which you realize that it is the necessary gap in the handheld library.

Steve Nison was not only the pioneer who brought candlestick to America through his in-depth research into their use in Japan, but also wrote the best book on the subject.

There are of course other publications about candlelight, but for some reason this has become the gold standard and deserves it.

"Take advantage of the opportunities"

"I recommend" is not enough to write about this book. On more than 300 pages, the reader will find more than necessary to know everything about Japanese candles. From history and basics to a detailed description of the formation and linking them with other indicators and analyzes on specific examples. The whole is completed by a dictionary of terms and explanation of the dates in the field of Western technical analysis.

Obligatory reading for each investor, especially since the price, compared to the first edition (about 100USD), is very attractive.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Books that every trader must read - TOP5 [Video] forex investment books](https://forexclub.pl/wp-content/uploads/2021/06/ksiazki-inwestycyjne-forex-300x200.jpg?v=1623996031)

![Win the book "Japanese Candles and Price Chart Analysis" [FB Competition] candles for the Japanese contest](https://forexclub.pl/wp-content/uploads/2018/02/swiecejaponskie-300x200.jpg)