SyncTrading - Have we managed to earn money on copy trading? [Summary]

Another week of testing is behind us and, according to our assumptions, also the last one. It is worth summarizing the results so far and analyzing the actions of traders. We also have some conclusions that came to us during testing SyncTradingthat can be used successfully for the future. Is synchronous trading a profitable solution? Yes, but you need to spend some time analyzing, selecting traders and having time to supervise and calibrate suppliers and our degree of copying. Some of the basic and helpful parameters are included in the first text that analyzes our suppliers. We invite you to a short summary.

Check it out: What is SyncTrading TeleTrade and copy trading

Safe trader

We selected our safe trader in terms of a low drawdown and stable, historical profits. We also found one and… as it turned out, we were also the most losers on it. Nevertheless, it is some kind of cost that we incurred in return for "connecting" to the historical results. Relatively using the trader's signals in the long run, we would have a high degree of probability.

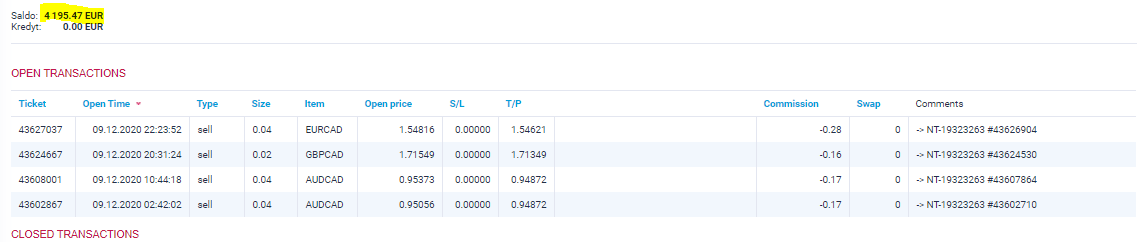

The result we achieved is 4195,47. The trader started to recover from the loss three weeks earlier. Summarizing investing in a trader with a low risk level, using an automated strategy, it is worth bearing in mind the risk of a larger decline and a relatively slow exit to the straight. We have come to exactly this period, so our account is connected to this provider at the moment of making up for the loss (although the trader is generally still profitable).

A moderate trader

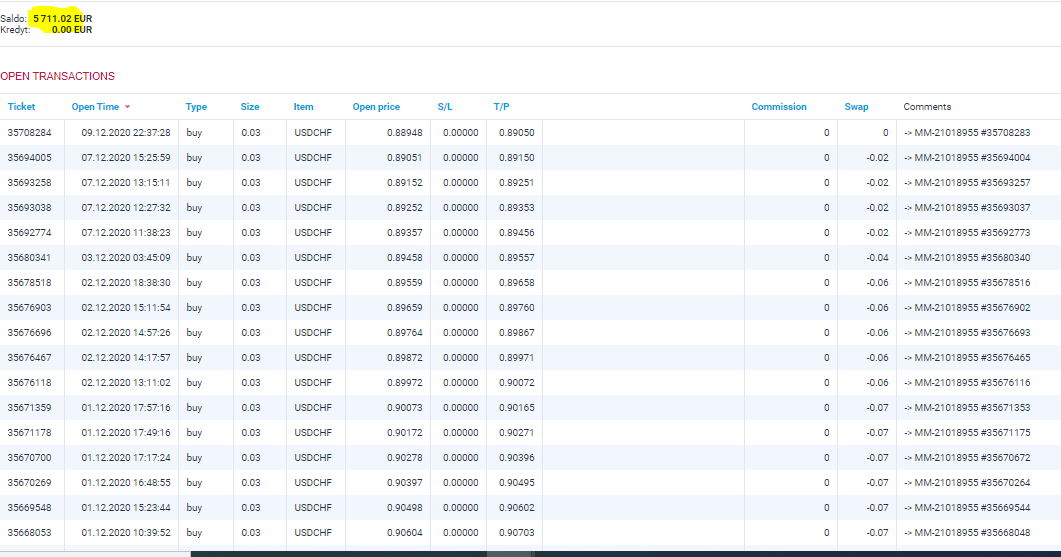

According to our eight week summary, we had to replace the trader in our wallet. The previous supplier, unfortunately, did not check our test until the end and after making a profit, he simply withdrew from the market, taking a break. We were not able to do such a pause, but we also cannot fully state the "quality" of our supplier. After the transactions he concludes, he opens a grid of a large number of orders (about 50) of the same value. The entire position is 0.03 lots and is opened at USD / CHF.

The trader has made a profit in recent days. Therefore, he continued the good streak of his predecessor and this account can be considered successful. We made a profit here of 711,02and there is now an amount on the account itself 5711,02.

Aggressive trader

The aggressive trader was the provider who earned the most for us. They will not close any of the previously opened trades in the last two weeks. Therefore, we are on this account all the time with open and quite long-held transactions. However, we only calculate profit from closed positions.

The capital on this account is exactly 6344,62. This is our best result, which covers the loss on a safe trader's account with some margin.

Summation

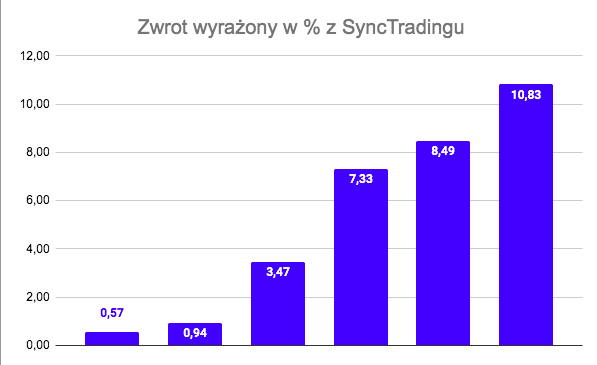

Below, as for each summary, we present a bar chart. Overall, we are on + 8,34 % profit. The result is no coincidence. We wisely selected not only traders, but also the associated risk parameters.

Here are some tips and conclusions for copying transactions:

- We must have more capital. Not knowing the style of trading completely traders, we risk the possibility of not copying all transactions due to lack of funds.

- We have to spread the risk over several suppliers. We cannot entrust all funds to one trader.

- Constantly supervising our "Employees". The fact that we do not trade does not absolve us from responsibility and control of our funds. In the case of a disturbing trade (other than the one that the trader presented at the beginning), it is worth disconnecting from such a provider until he starts trading again according to his own rules.

- We are fully responsible for our resources!

- Before hooking up to a trader, it is worth examining their trade indicators carefully and choosing traders with the lowest possible drawdown and a slightly longer trading history.

The return from 10 weeks of SyncTrading testing is:

16 - 251,11 (initial investment) = 1251,11 EUR

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![SyncTrading - Have we managed to earn money on copy trading? [Summary] synctrading teletrade summary](https://forexclub.pl/wp-content/uploads/2020/12/synctrading-teletrade-summary.jpg?v=1607886647)

![SyncTrading - Have we managed to earn money on copy trading? [Summary] toxic-options](https://forexclub.pl/wp-content/uploads/2020/12/toksyczne-opcje-102x65.jpg?v=1607961834)

![SyncTrading - Have we managed to earn money on copy trading? [Summary] industrial metals](https://forexclub.pl/wp-content/uploads/2020/12/metale-przemyslowe-102x65.jpg?v=1607953311)

Leave a Response