SyncTrading by TeleTrade, i.e. copying experienced traders

Is SyncTrading by TeleTrade a recipe for profits? Can duplicating other traders' games be profitable? There are many tests on copying entire investment portfolios for selected people on our portal. These solutions are more and more often available on the market, so we may have a problem choosing the right one for us.

Today we will start testing the Synchronous Trading solution from TeleTrade. In this text, we will present all the assumptions with which we will start in the coming weeks. Results just like the test eToro i ZuluTrade, we will publish soon on the pages of our portal.

What is SyncTrading

Before we move on to the assumptions, I will try to briefly present the most important issues regarding the synchronous trading project itself. It is a solution that allows investors to copy the transactions of experienced traders. In this test, of course, we will be on the investor's side. On this side there is usually a person who does not have time to trade for himself, is afraid to trade alone in the market or simply wants to diversify his investments. There may be many reasons why we decide to copy traders (or signals), but today this is not the case. Let's take a look at some of the technical sides of the copy itself that are relevant to our test.

First of all, apart from selecting the trader we want to copy and linking him to the appropriate accounts, these are the only "manual" actions that we have to do. Transactions, as in most platforms, are automatically copied to our account. I think that in this test we will not be tempted to do so, but it is worth mentioning that the transaction opened on the account can also be freely managed. By this I mean modifying transactions (setting Stop Loss and Take Profit, or closing it out of hand). However, upon our interference, the responsibility for closing the transaction passes to us.

De facto by engaging in SyncTrading, we choose whether we want to be copied or we prefer to copy others. Of course, no one defends doing both things simultaneously. However, due to the test, we will act on the Investor's (copying) side. We are therefore obligated to deduct commission (which also happens automatically) on profitable trades for our signal provider. What amount of earnings do we have to pay? This is an issue that is determined by the trader, and we will find it in the ranking at his specification. Obviously, good traders value themselves, therefore the commission level will be slightly higher.

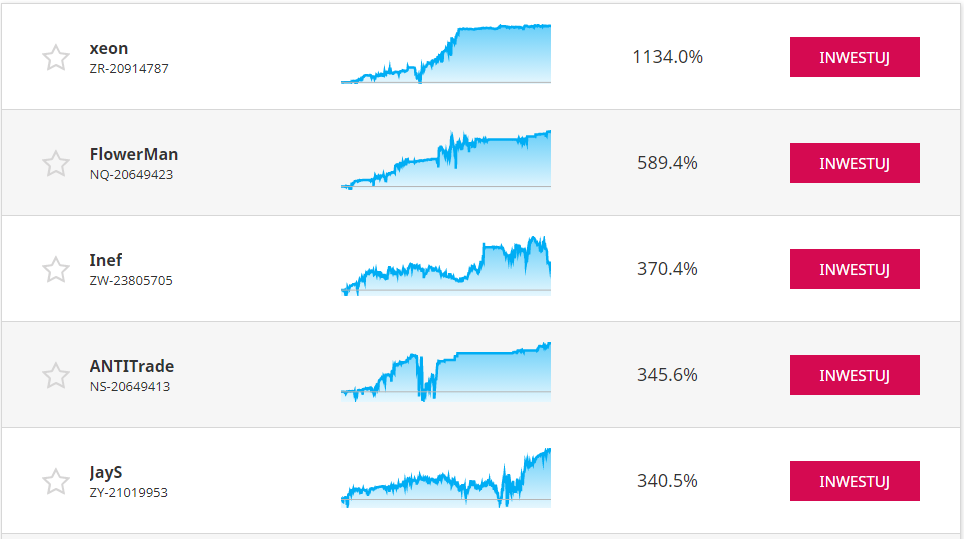

Traders ranking

The basis of our operation will be three accounts. We want more transparency of the test, so the diversification we will use will be based on the connection for 3 traders. The amount with which we are going to start the test is 15 000 USD ($ 5 for each trader). Of course, the basis for choosing a trader will be the ranking and the information and indicators related to the trader contained therein.

Traders ranking at SyncTrading TeleTrade.

In fact, having three accounts at my disposal, I decided to build (at least at the beginning of the test) a portfolio that will on the one hand be based on at least one trader with a low level of risk and two more with exponentially higher rates of return and, consequently, a higher possible loss. Given that anyone who decides to copy trades is eager to build up passive income for himself, he cares about his investments in some way. Therefore, we will follow a similar assumption in this test and we will actively analyze both traders and the transactions they conclude. It will be something like "being the boss" and "employing" traders who are supposed to work for us and our capital.

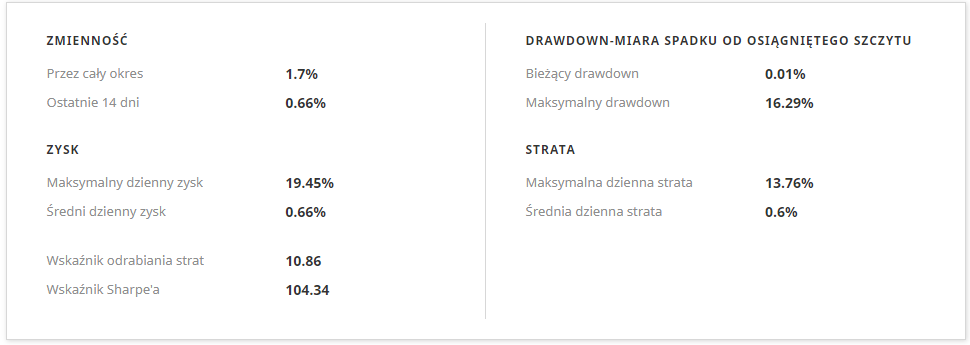

The above graphics show the basic indicators that are available with every trader. Our assumption will be to choose one with a risk level of 1, the other on finding a trader with a risk level of 2-3 and the third, the most aggressive in your trading style of 4-5. This information is available next to the trader's name. For now, we are not going to be particularly limiting ourselves with the level Drawdowndespite the fact that we should because of taking care of the risk. We will leave this assumption flexible, due to the fact that I include "hooking up" to another trader during the test. However, when selecting a trader, we will pay a lot of attention to the Sharpe indicator, which will allow us to assess the benefits of the investment through the prism of risk. Here, having at our disposal several traders with the same degree of risk, we will be guided by the size of this indicator.

Summary of assumptions

- Our test will run for 10 weeks. This is the time when we will be able to assess the effectiveness of concluded transactions, rebuild the portfolio at least once, if necessary, and learn about the technical aspects of copying itself.

- We are pinning on the capital of USD 15, diversifying it into three different traders from the ranking.

- The selected traders will represent different risk groups. We will analyze each of them in terms of the indicators provided. We will put great emphasis on selecting those whose accounts are characterized by a high premium in relation to the risk incurred.

- Depending on the actions of traders, we will update the test results every week or two.

- We do not modify the transaction.

- We select traders with a reasonable commission in return for the results offered.

The entire test will be carried out through the Personal Cabinet, which we receive with the creation of the account. It will be our "operating center" thanks to which we will synchronize with selected traders. Through the MetaTrader 4 platform (or MetaTrader 5, such are available on the website) we will be able to keep track of transactions concluded by traders.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)