SyncTrading TeleTrade - First positions, first profits [TEST # 2]

First week of investing with SyncTrading TeleTrade is behind us. If you have just found this text, we invite you to read the description of TeleTrade social trading and the first part of the test, in which we describe in more detail all the conditions of our test and, importantly, we show exactly how to connect traders to our account.

Today we will focus on analyzing SyncTrading games that were copied to our three accounts. It is worth adding at the beginning that the degree of copying traders is set to 100%, which means proportional copying to our capital. If the trader has small positions (which we will show in a moment), they are additionally reduced (in proportion to the capital held) on our account. Without waiting any longer, we come to the point!

Safe Trader

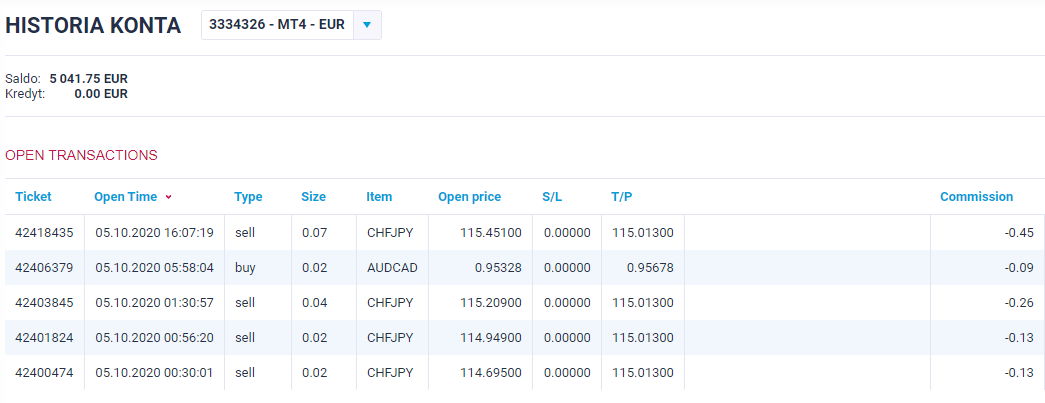

The safe trader we chose consistently made us profitable last week. Therefore, we can conclude that our assumption and expectations (so far in the first week) have been met. So let's take a look at the positions our trader had.

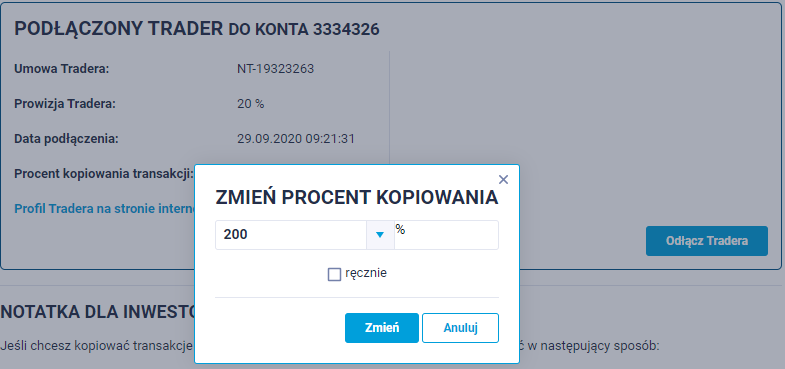

The trader mainly traded on the AUD / CAD, CHF / JPY, GBP / CHF, GBP / AUD currency pairs. As we can see, only the first position was one of the largest. The next ones were quite minor. Therefore, we decide to increase the degree of copying, so that the items on our account are slightly larger (they are in fact more profitable). Currently, we have every trader set to 100% copying. Thanks to the analysis of the included items, we will adjust the degree of copying to the capital we operate.

Due to the small items we contain, we will change the degree of our copying from 100% to 200%. Of course, this will only apply to the positions that the trader enters into subsequent trades. Let's check what we currently have open transactions.

From what we could see from the closed and open positions, the trader mainly trades quite volatile pairs, using machines. Has set TP ordersbut not too many stop losses. For this reason, we control our account more often to "manually" support risk management and, if necessary, disconnect from the trader.

A moderate trader

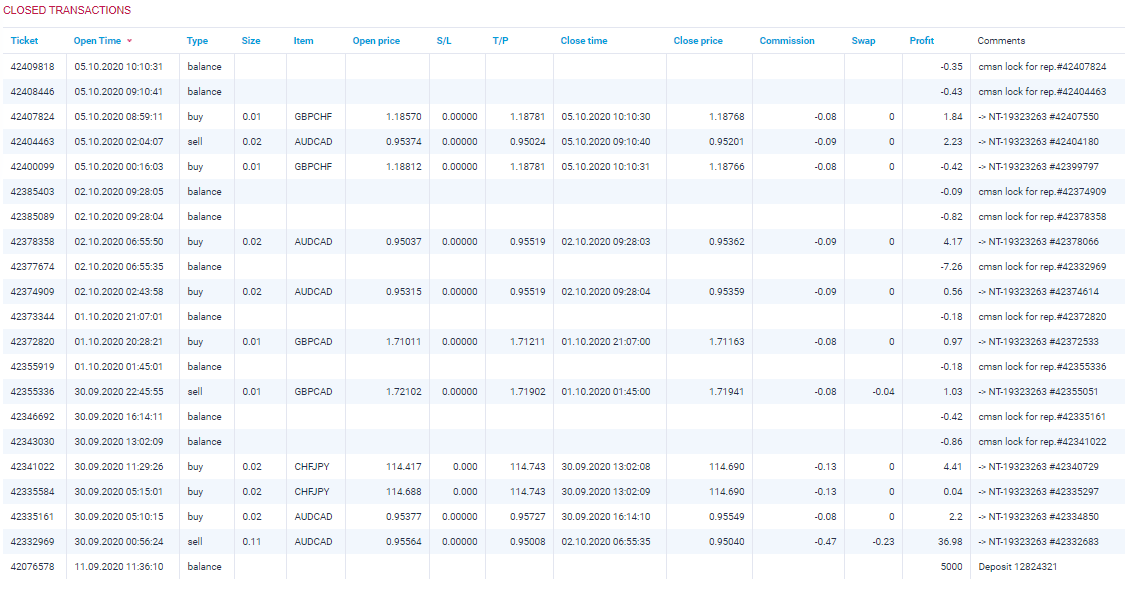

Our moderate trader, who is in the middle of risk, turned out to be the most active. Here, too, due to the number of items, we will not decide to copy twice as large. Let's start with the instruments he traded last week.

(Click on the picture to enlarge)

As you can see, the trader only trades on one pair. They are slightly inconsistent in terms of size in relation to reward / risk. It seems to go to the market, test trade first, then go in with more capital. After opening and closing a position, we can also see that it is a day trader. We also have several open positions on our account.

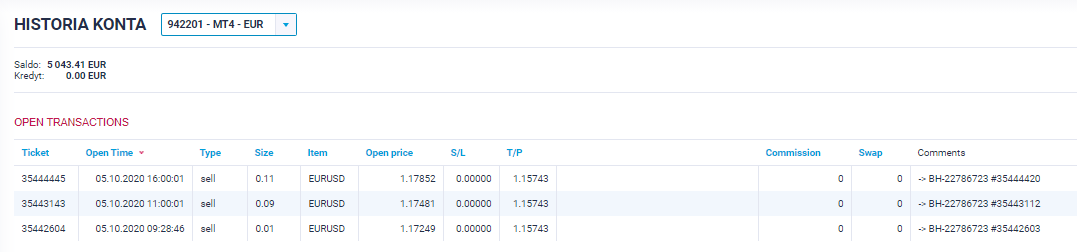

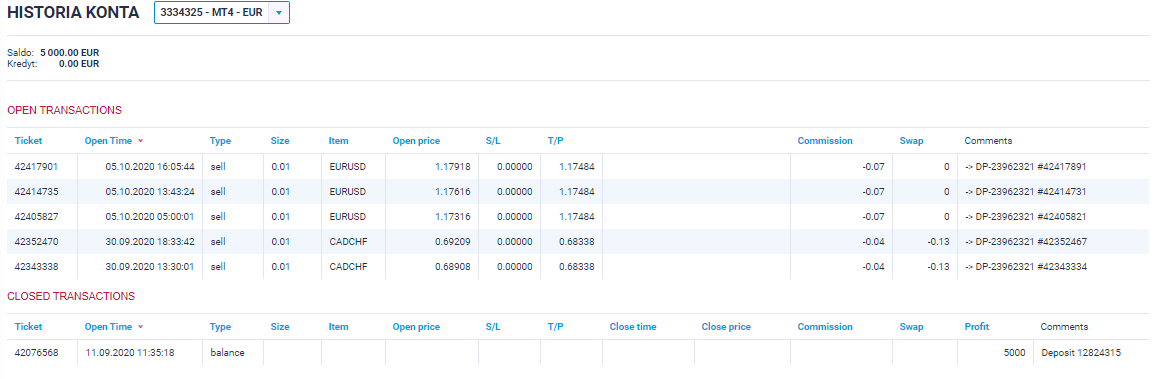

Aggressive trader

Let's move on to analyzing our most aggressive trader we have in our portfolio. So far, he has not closed any transactions yet, but, as we can see in the account, he has several smaller ones open.

Currently trading on EUR / USD and CAD / CHF. At the moment it is difficult to say anything about this trader's style as there are no closed positions. However, we can certainly say that he is not a day trader (he has been holding positions for some time). It makes small deals, but seems to be gently averaging the price on them. Here we will not decide to increase the degree of copying, due to the greatest risk we have taken and too few transactions to say how many are able to conclude them in a row. Our concern is mainly focused on the fact that we may not have enough capital to make consecutive, averaged and added positions.

Summation

When we add up our profits from last week, they are as follows:

- Safe trader: € 41,75

- Moderate trader: € 43,41

- Aggressive trader: 0 - open positions

With an investment of € 15, we currently have a weekly rate of return of approximately + 0,57 %. It is not a staggering sum. The changes we made this week (increasing the copy rate of a safe trader) should bring us a better return in a week's time.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![SyncTrading TeleTrade - First positions, first profits [TEST # 2]](https://forexclub.pl/wp-content/uploads/2020/10/synctrading-teletrade-test-2.jpg?v=1601987632)

![SyncTrading TeleTrade - Another week with profit [TEST # 3] synctrading teletrade test week 3](https://forexclub.pl/wp-content/uploads/2020/10/synctrading-teletrade-test-tydzien-3-300x200.jpg?v=1602656245)

![SyncTrading TeleTrade - We choose traders [TEST # 1] synctrading teletrade test 1](https://forexclub.pl/wp-content/uploads/2020/09/synctrading-teletrade-test-1-300x200.jpg?v=1601361410)

![SyncTrading TeleTrade - First positions, first profits [TEST # 2] The nervous October stock exchange](https://forexclub.pl/wp-content/uploads/2020/10/Nerwowy-pazdziernik-gieldy-102x65.jpg?v=1601971873)

![SyncTrading TeleTrade - First positions, first profits [TEST # 2] cfd for banned cryptocurrencies](https://forexclub.pl/wp-content/uploads/2020/10/cfd-na-kryptowaluty-zakazane-102x65.jpg?v=1601999524)