The Bretton Woods system - a fiction held for many years

Someone who is attached to the current monetary system cannot assume that it will last forever. History knows many cases when monetary systems were born, reached their apogee, and then ended up in the dustbin of history. So it was with the bimetallic system, the gold standard and the Bretton Woods system.

Each time the collapse of the system raised concerns about "global catastrophe". As it turned out later, nothing of the sort happened. People got used to the new system, so that after a few years they could not imagine the possibility of the collapse of the new currency system. In the days of Bretton Woods, it was pointless to speculate on currencies. This was due to the fact that in the previous monetary system, currencies did not have floating exchange rates. The system did not have a long history. He didn't even last 30 years. At the time of the collapse of this system, many opponents of the United States looked forward to the coming “US and Dollar Collapse”. They've been waiting 50 years now.

Why did a new currency system begin to be developed?

In 1944, several dozen delegates came to Bretton Woods for a conference entitled “United Nations Monetary and Financial Conference”. The outlines of the new monetary order were discussed. post-war order. As you can see, politicians and economists began to share the skin on the bear. After all, the war was still going on, both in Europe and Asia.

The reason for starting work on the new system was that more and more people became aware of the inefficiency of the interwar monetary system. There was a perception that World War II broke out because economic and monetary problems after World War I had not been resolved. As a result, extreme political movements began to come to the fore that proclaimed the overturning of the world order. The attempt to overturn the order ended with the death of tens of millions of people around the world.

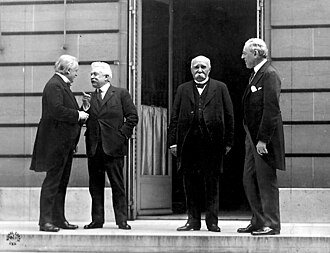

The main figures in the salons of Versailles. From left: David Lloyd George (UK), Vittorio Orlando (Italy), Georges Clemenceau (France) and Woodrow Wilson (USA). Source: wikipedia.org

What was the nonsense of the interwar period? On a network of mutual debtor-creditor relations, which were based on one factor. That one factor was Germany's ability to pay its war contributions. Very simplistically, it looked like this: Great Britain had war loans to the United States. With these funds, it financed its war effort and lent funds to other Allies (including France). The other Allies had their own commitments to the United States and Great Britain. They in turn financed their war effort with this debt. So there was a situation where: France could not pay its debts to Great Britain, which in turn could not pay its debts to the United States.

Reparations are a bone of contention between European countries

Raising taxes to pay off debts was out of the question. The people were already tired of the war. The Treaty of Versailles was supposed to solve the problem. Austria, Hungary and Turkey were in too difficult a situation to be able to effectively enforce payments. Recognized: Germany will pay for everything! The reason was that it was one of the strongest economies in the world. It was decided that “modest” 132 billion gold marks is punishment enough. Germany was then humiliated twice:

- They had to come to terms with significant territorial losses in the west and east (the beneficiary was, among others, Poland, which the Germans contemptuously called the "Seasonal State").

- They were obliged to pay war contributions.

Pursuant to the agreement, the debt tranches were divided into A, B and C. Tranches A and B were obligatory and their value was 50 billion gold marks. The remainder was interest-free and would only be paid if the Weimar Republic could bear it.

In this mechanism, if Germany does not pay its reparations, the countries of the winning coalition will have to find the means to repay their liabilities. At that time, there were situations when the coalition countries forced the payment of reparations by force. This was the case in 1923 when France and Belgium occupied the Rugby Basin (1923-1925). The difficulties of the Weimar Republic in repaying debts resulted in the appearance of agreements changing the payment period or reducing the level of debt. The most famous is the Young Plan from 1928. It reduced the amount of reparations to 112 billion gold marks. At the same time, the amount of payments was stretched until 1988. However, after 4 years, due to the disastrous economic situation in Germany, the repayment was suspended. After Adolf Hitler came to power, Germany refused to pay its debts. It is estimated that the Weimar Republic only repaid 21 billion gold marks. The debts were paid off for many years after the war. The last installment was paid only in 2010.

The Great Depression disrupts the world's monetary order

Queues outside the failing Bank of United States 1931. Source: Wikipedia.org

However, reparations were not the only problem for the world monetary system. It was a huge challenge The Great Depression of 1929 - 1933. Many of the countries, in order to become competitive on world markets, used tactics “beggar thy neighbor”. This involved deliberately devaluing its currency to make export products more price-competitive. Other countries affected by such policies also used devaluation. Of course, not all countries used this tactic. Countries belonging to the so-called "The Golden Block" (e.g. France, Poland) tried to maintain the value of their currencies.

In the early 30s, the so-called sterling block, which included British Commonwealth countries (excluding Canada). The block was joined by Scandinavian countries, Thailand and Iran. The block was created as a result of the devaluation of the pound and withdrawal from currency convertibility to gold. Under the system, the settlement currency was the pound, the other countries of the bloc fixed the value of their currencies by the pound. The block formally ceased to function in 1972.

The interwar monetary system was therefore very unstable. The gold standard that operated before World War I was replaced by various currency systems (so-called blocks). What's more, the period of dying international trade began. This was due to raising tariffs in the country to protect its market from foreign competition. World War II changed this state of affairs.

The Bretton Woods system was designed to create a new monetary order. It was not to be imposed, but to be the result of consensus. At least in theory. In practice, there were two concepts. One was from London, the other from Washington.

The Bretton Woods system - a clash of concepts

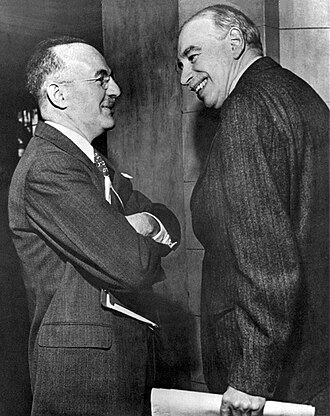

From left: Harry Dexter White and John Maynard Keynes. Both were representatives of different visions of the post-war monetary order. Source: Wikipedia.org

The United Nations Monetary and Financial Conference was held in the first three weeks of July (1-22) 1944. The place of the meeting was the Mount Washington Hotel in the state of New Hampshire, in the town of Bretton Woods. The meeting was attended by 730 delegates representing 44 Allied countries. On the part of Poland, the government-in-exile in London represented Gustaw Gottesman as secretary of the Minister of Industry and Trade, Ludwik Grosfeld.

The conference began in 1944 and there were two main concepts for the development of the system: American and British. The Americans pushed for a currency system base on the dollar. The British, on the other hand, were more inclined to accepting an independent accounting currencywhat the bancor was supposed to be. In the end, the American concept won out. No wonder. He was the undisputed winner of World War II.

The Bretton Woods system was based on the dollar. More specifically, the convertibility of the dollar to gold at the price of $ 35 per ounce of yellow bullion. Participants in the system could exchange dollars for gold. Institutions were also established to supplement the system: International Monetary Fund and the Bank for Reconstruction and Development.

The system was built for the United States and initially performed very well. The US was a creditor to the world and had a very large trade surplus. This was due to the fact that the main economic competitors (European countries) committed mass economic suicide as a result of World War II. At the beginning of the post-war period, it prevailed "dollar hunger". Countries economically devastated needed literally everything: machine parts, consumer products. The United States exported goods and invested in countries "free world". In 1948, European currencies were devalued. This was not unusual, countries needed resources for development, but had to contend with large trade deficits. Currency adjustment was natural.

The first problems of the system

Europe's economic recovery was proceeding at a very fast pace. In effect trade deficits turned into surplusesi. Germany, the Netherlands and Italy began to export more and more to the USA. As a result of this The United States had an increasing trade deficit. There has been an increase in the obligations of the system gatekeeper. This was not a problem at first, as gold reserves were substantial. However, the emergence of large deficits in the US undermined confidence in the US dollar. Of course, this was not a problem as long as the U.S. government kept an eye on its credibility. The potential of the United States was enormous then, and it was enough to ensure confidence in the dollar.

The problem, however, was that it is difficult to maintain constant exchange rates between countries connected to the system. Each country has a different level of deficit or inflation. This should lead to adjustment mechanisms through exchange rates. But changes in currency values were very rare. The most important thing was that the guarantor of the system should have a stable fiscal and monetary policy. However, this was impossible during the Vietnam War and the introduction of the program "Great Society". The second program meant an increase in spending on social purposes. The premise of the program was to combat the progressive pauperization in part of American society. These two commitments meant a large deficit in the US. Under normal circumstances, there would be a devaluation of the dollar. However, it would undermine the prestige of the United States. Therefore, efforts were made to pretend that an ounce of gold was worth $35. It was fiction, but until no one said: "checking"the system could last.

The trade deficit is becoming a bigger problem

The United States was the guarantor of the system. After the end of the war, The US had about $40 billion in foreign exchange reserves, of which $26 billion was in gold. At the beginning of the 50s, the economic reconstruction of Europe took place. Despite the increase in trade, US gold reserves increased by only a few percent. However, with sometimes there was an outflow of gold due to higher US imports.

During Eisenhower's presidency, there was an attempt to improve the trade balance. Import quotas for oil or introduce difficulties in the outflow of funds from the USA. Why was the US trade deficit dangerous to the entire system?

As the United States began to import more, more and more dollars were in circulation outside the United States. It was up to the will of the countries whether they wanted to use the dollar or prefer to convert dollars to gold. The exchange for gold caused its reserves in the US to decrease. Of course, it wasn't a problem if no one wanted to change where the gold was stored. Most of the gold was in vaults located in the United States. As long as nobody wanted to transport gold across the Atlantic or the Pacific, the system was stable. It was only necessary to believe in the solvency of the US. How did the US finance its deficit? By issuing dollars. So there was a paradox. The supply of dollars was greater than gold, but its price remained unchanged. The greater the difference, the more difficult it was to hold the dollar to gold pegged. A devaluation of the dollar would have helped, but it would have been a prestige problem and no administration wanted to do it.

London Gold Pool: an ineffective system keeper

The first delicate breach in the system was the creation of the London Gold Pool (LGP). It took place on November 1, 1961. Interestingly, LGP was established to protect the Bretton Woods system. It was an organized place for gold trading by the central banks of the United States and 7 European countries. The London Gold Pool was intended to ensure the stability of gold prices. The rise in gold prices was to be corrected by the sale of gold by members of the system. On the other hand, the drop in the prices of the bullion was to be offset by intervention purchases. Already after 4 years, the system experienced problems with stabilizing prices. The Vietnam War was also a problem. It wasn't about moral issues, it was about rising inflation in the United States. This began to undermine the already weakened trust in the dollar. The payment deficit of $3 billion did not help either. The real blow was France's withdrawal from the gold price stabilization deal. At the same time, France demanded the transfer of its gold reserves from New York to Paris. The system began to waver.

The devaluation of the pound with the first domino

Although the Bretton Woods system was a dollar system, there was also the so-called pound sterling block. The system included the United Kingdom and former dominions and some former colonies. The central currency used for settlements was the pound sterling. The currency of the former Empire was under constant pressure. The crisis in the Suez Canal, which ended in a defeat for the image of France and the United Kingdom, is considered a turning point.

The market assumed that the UK currency was overvalued. Bank of England tried desperately to defend the exchange rate, but in 1967 there was a devaluation of the pound. Other countries included "pound block" have not devalued. The step taken by the British government led to the disintegration of the aforementioned bloc. This was due to the loss of confidence in the stability of the pound. Devaluation by more than 14% was a real surprise.

Of course, nowadays currency fluctuations are considered normal, but at the time it was always a shock and a loss of prestige for the country that did it. The 14,3% devaluation was a shock. This was a flaw in the system of fixed exchange rates. If the pound had devalued by 1% per year for a dozen or so years, there would most likely not have been such a shock. The pain would be spread over time. However, political and image factors were decisive. The economic aspects were a side issue. Therefore, the course was held as long as possible.

The devaluation of the pound, coupled with the dropping out of London Pool participants, was the doomsday of the Bretton Woods System. In the long term, maintaining the price of gold at $35 per ounce seemed like a pipe dream. Already in 1968, some economists expected big problems related to the instability of the currency system. Charles A. Combs at the meeting Federal Open Market Committee (FOMC) mentioned that:

“The international financial system is approaching its most dangerous crisis since 1931”.

Goodbye London, Willkomen Zurich

Pressure from buyers made London Pool's operation pointless. It was no longer possible to keep gold prices in check. For this reason The United States and Great Britain agreed to close down the gold trading venue as early as March 14, 1968. With the temporary closure of London Gold Pool has been closed forever. Very quickly, the hole left by LGP was filled Zurich Gold Pool. It was Zurich that became the main place of gold trading in those days. In the 70s, 70% of the world's gold production was traded in Switzerland. The main banks operating on the market were UBS and Credit Suisse.

Zurich. Source: wikipedia.org

Privilège Exorbitant increasingly difficult to maintain

Charles de Gaulle. Source: wikipedia.org

A big opponent of the Bretton Woods system was France, which named the position of the United States in the financial system privilège exorbitant, or exorbitant privilege. One of the opponents was Charles de Gaulle.

It was he who, when he came to power, tried to pursue a policy of far-reaching independence from the USA. It was de Gaulle who was behind France's withdrawal from NATO's military structures. It was only after 43 years in 2009 that France became a military member of NATO again.

France also wanted more and more gold to go to Paris. At first, the United States strongly protested, but in order to save face and its unwavering position in the monetary system, it finally agreed. On August 15, 1971, a French Navy ship arrived at New York Harbor to load gold stored in US vaults. The goal was to return the gold to France. However, France's decision alone would not shake the system. The reason was the fragility of the system. The problems only got worse with each passing year.

The reason for the increased fragility of the system was the increase in the monetary independence of Western European countries and Japan. The balance of power in the world has also changed. Germany and Japan started to matter more and more on the economic map of the world. The return to the convertibility of European currencies in 1958 and the yen in 1964 resulted in an increase in the number of international financial transactions. This created more and more problems with the maintenance of the system. The imbalances became greater and greater.

A step that could save the system would be to heal public finances in the US. However, the ongoing war in Vietnam and large social spending meant that it was a pipe dream. Moreover, the world needed dollars, and the US was unable to compete in world markets with cheaper production from Europe and Japan. Dollars flowed in as a result of a large trade deficit. It would be natural for the dollar to devalue against other currencies. But that would shake the system. The price of $35 per ounce of gold was held as long as possible.

An important role that cemented the position of the United States for a long time was the threat from the USSR and the Warsaw Pact countries. None of the countries NATO did not care about the collapse of the dollar. Consequences were feared. The political and economic crisis in the US may have prompted the USSR to impose its political dominance on Europe. However, it couldn't last forever.

The Bretton Woods system in agony

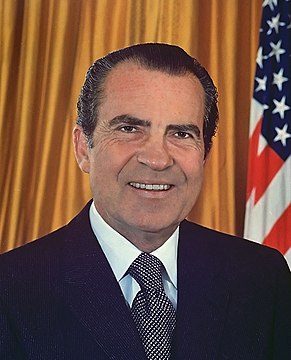

Richard Nixon. Source: wikipedia.org

The longer the US struggled with inflation and a trade deficit, the more unsustainable the situation became. The outflow of gold became more and more painful. In 1971, gold reserves fell to their lowest level since 1938. West Germany, which was the first to stop supporting the dollar, did not improve the situation either. There was also a slow change of forces. At the time of the creation of the new post-war order, the US held half of the world's foreign exchange reserves. In 1970, the share of American reserves was only 16% of the world's foreign exchange reserves. Thus, the role of the dollar was far too big for the size of the American economy and its structural problems.

The situation became so serious that US President Richard Nixon announced a "temporary" suspension of convertibility of the dollar to gold. It was the so-called Nixon shock. The decade of gold began, which began to gain in value very quickly. Interestingly, Nixon's gamble did not cause him to lose political support. However, the following years were very difficult economically. There was a recession in 1973-1975. The entire 70s was a period of stagflation and exchange rate instability.

1971 is the actual death of the Bretton Woods system. However, for many years efforts were made to save the system. Such was the case with the Smithsonian Agreement, which did not stand the test of time. Already in 1973, the EEC countries and Japan decided to introduce floating exchange rates. This was effectively abandoning the Bretton Woods deal. However, a formal ending agreement had to wait until 1976. Then signed the so-called Jamaica Accords.

The stock market and the collapse of the system

It may seem that the collapse of the Bretton Woods System should shake the financial market in the United States. After all, it was one of the "dollar falls". However, the market reacted to this news.… increase in share prices. The market feared inflation, which would be bad for savings. As a result, cash burned your hands and landed on the stock market and in gold.

The graph below shows the behavior price of the S&P 500 index between 1968 and 1973. The great bear market in the stock market ended in May 1970. This was a year before the "suspension" of convertibility to the dollar. Of course, the 70s were not good for the stock market.

S&P 500 chart, D1 interval, 1969-1973. Source: TradingView

The Bretton Woods system has collapsed. The world's reaction?

The collapse of the Bretton Woods System ended the convertibility of currencies to gold. Since then, currencies are not even indirectly tied to this metal. Instead, the exchange rate determines the market. One thing has not changed. The dollar is still the most important currency in the financial system. Of course, her position was nibbled on for many years. One competitor was the euro, but the 2011 crisis undermined the credibility of this currency. There is more and more talk about CNY these days. However, whatever they write, the dollar is still number one in the world for now.

From the point of view of economics, the 70s were a time of great challenges in the countries of the "West". Efforts were made to freeze prices to prevent inflation. It did not improve the situation either OPEC cartel, which in 1973 led to the oil shock. The 70s were a period of stagflation, i.e. high inflation and low economic growth. However, this period was followed by one of the best (for many countries) periods of development. We're talking about the 80's and 90's.

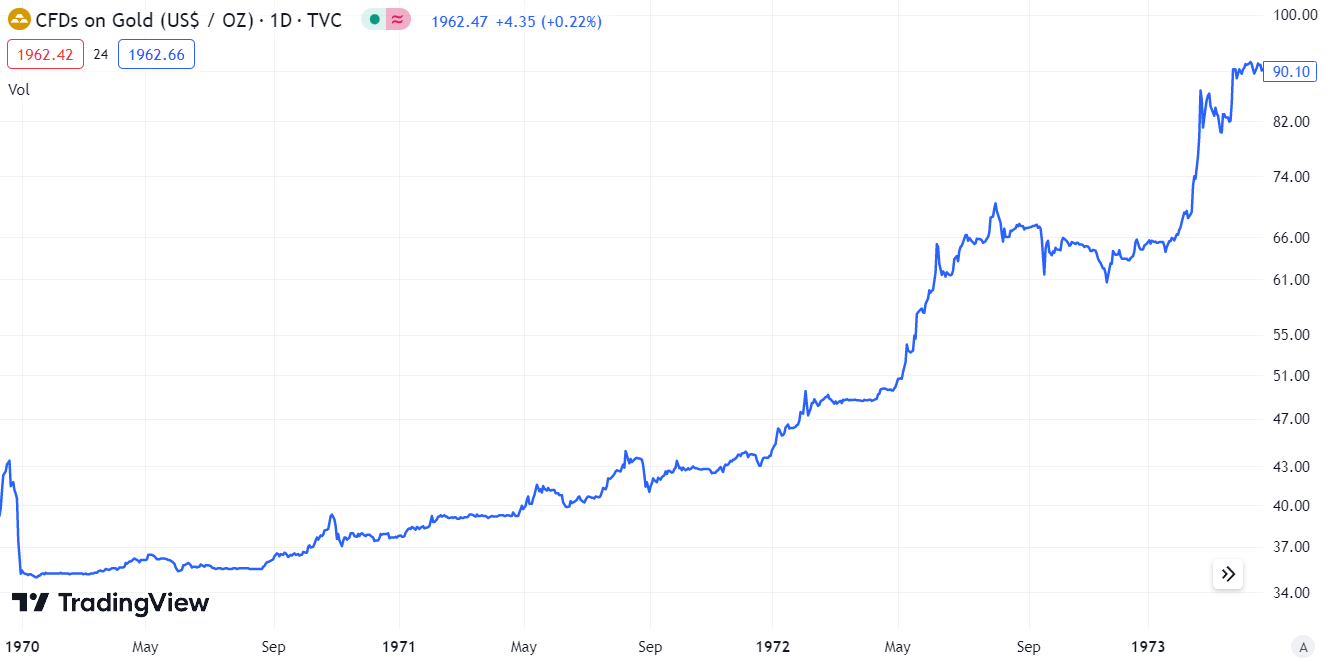

The collapse of the system led to a drastic increase in gold prices. This resulted from making the prices of this metal more realistic, the value of which was artificially kept at a low level.

Gold CFD chart, D1 interval, 1970-1974. Source: TradingView

The liberalization of exchange rates significantly increased the risk of foreign investment. In order to minimize this risk, investors began to look for opportunities to hedge against changes in exchange rates. This resulted in a rapid development of the derivatives market. Moreover, the currency market has become a haven for speculators.

The liberalization of exchange rates allowed many countries to introduce free movement of capital. This allowed for the dynamic development of less developed economic areas. Free movement of capital has taken a hiccup for less sustainable economies. There were debt and currency crises.

Another innovation after the collapse of the system was the introduction of the inflation targeting mechanism. Central banks tried to prevent too much money supply. The inflation target, i.e. the acceptable level of inflation, was to serve this purpose. If inflation was getting much higher than the target, the central bank "cooled" the economy. The deflationary environment forced central banks to adopt more loose monetary policy.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response