Volume Spread Analysis: Frequently Asked Questions and Answers [FAQ]

In the recently published article, we brought you closer to cis the Volume Trading Analysis (VSA) methodology, which is based on the analysis of volume and price changes. This concept was developed by Tom Williams decades ago, and yet its principles are still valid and extremely effective.

The undisputed expert on this strategy, who has documented market successes, is Rafał Glinicki, who recently led a webinar explaining what VSA is and how to use the volume on Forex market. If you were unable to attend the event, you can watch the video here:

We received many questions from you about the methodology itself, which is why we decided to collect the most frequent ones and prepare answers to them.

VSA - frequently asked questions [FAQ]

#1. Where to get real volume and at what values is it available?

The real volume comes from the exchange where the given security is listed. For example: the volume on currencies can be seen on contracts corresponding to a given currency pair, etc. For EUR / USD it is a symbol contract 6E, listed on the CME Chicago Stock Exchange. When choosing a broker, make sure that the data they contain real volume, not tick volume, so it is worth comparing the data provided by the broker with the data from a reliable source.

#2. In which markets does the VSA methodology work?

VSA operates in stocks, futures and forex (currency futures only). The actual volume here is the key factor that makes the picture of a given market complete.

#3. What is the benefit of using the VSA methodology in the markets?

The VSA methodology focuses on evaluating supply and demand, which in turn determine the direction of the price. Thanks to the VSA signals, we are able to chart precisely recognize the entry points of demand or supply. As a result, we know which side dominates in a given price range. Trading in line with the dominant party in the market allows you to gain a significant market advantage.

#4. What are game scenarios and whether there will be scenarios in the Trader Intraday project based on VSA?

Scenarios are repetitive arrangements based on a coherent decision-making process resulting from the VSA methodology and tools that give a statistical advantage on the market. At the same time, they allow precise control of the loss (stop loss). In project "Trader Intraday" participants receive three original scenarios by Rafał Glinicki, according to which they will trade during the practical part. The direction of executed trades is determined "Live" by the Supervisor, and the participants focus on recognizing scenarios and taking positions, which translates significantly into an increase in the results achieved along with the experience they acquire during the workshops.

#5. Will there be places to play in the practical part of the TI training?

In the practical part, the Supervisor sets directions live and participants trade based on scenarios. Once a week there is a webinar where the plays from a given week are discussed along with the most interesting places and a discussion of repeated mistakes. In addition, each play is evaluated by supervisors, thanks to which traders have feedback on the quality of trades made.

#6. What are the performance statistics for VSA-based scenarios?

In 2022, a live market test was carried out, in which Rafał Glinicki and his team showed the effectiveness of the VSA analysis. The description and course of the test can be found here:

A video of the results can be seen here:

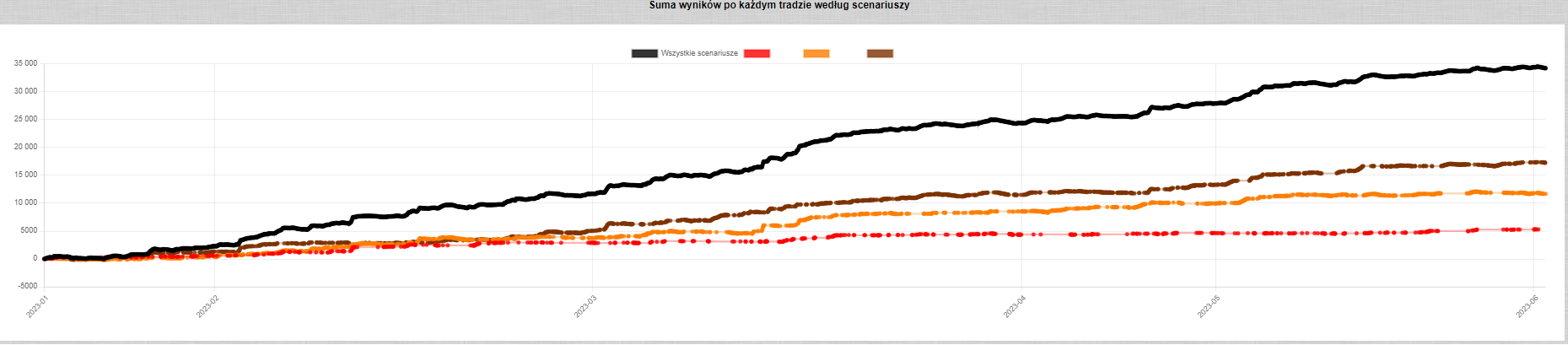

Resulting curve worked out by the whole group for the three scenarios included in the Trader Intraday training as of the beginning of 2023, it looks like this:

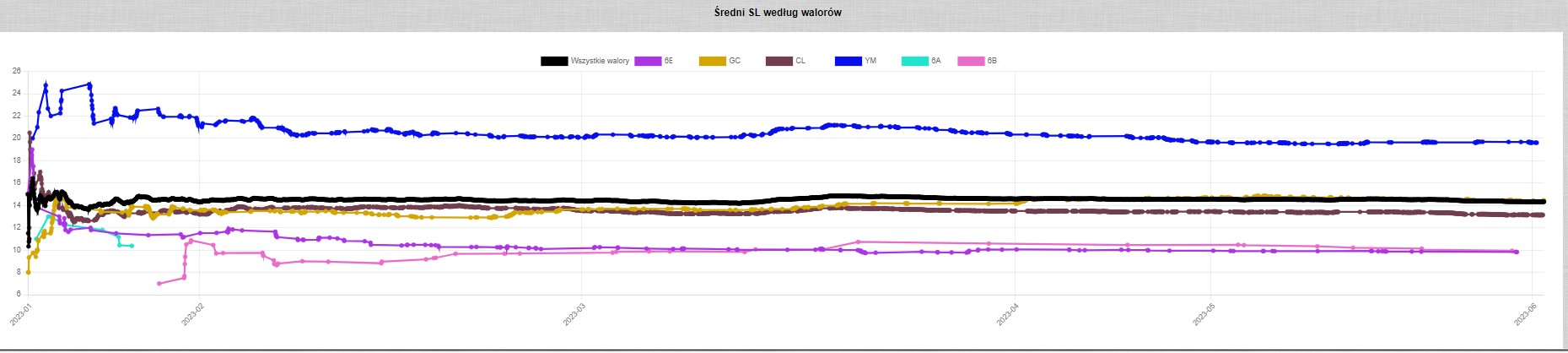

These results were achieved with a very low average Stop Loss:

#7. How can I join the Trader Intraday Project?

Details about the project can be found at VSA Trader website.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Volume Spread Analysis: Frequently Asked Questions and Answers [FAQ] vs faq](https://forexclub.pl/wp-content/uploads/2023/06/vsa-faq.jpg?v=1685689430)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)

![Volume Spread Analysis: Frequently Asked Questions and Answers [FAQ] Bretton woods system](https://forexclub.pl/wp-content/uploads/2023/06/system-z-bretton-woods-102x65.jpg?v=1685556440)

![Volume Spread Analysis: Frequently Asked Questions and Answers [FAQ] bitcoin cryptocurrency market](https://forexclub.pl/wp-content/uploads/2022/10/rynek-kryptowalut-bitcoin-102x65.jpg?v=1665483045)

Leave a Response