Mysterious dissonance on the stock market - Saxo's forecasts for QXNUMX

As a result of the pandemic, equities entered a new paradigm, with valuations and real profitability reaching levels not recorded in recent history. Profit margins in the United States are at all-time highs, while commodity prices are approaching their most recent highs. At the same time, the UN food price index is already near its highest levels in sixty years, and Europe is on the brink of an energy shock. The delta variant contributed to the slowdown in global economic growth and to further difficulties in Asian production centers. So far, this has not had a significant impact on the stock market, where the second-longest boom continues with a weakening of up to 5% since 1999.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

At the same time, capital expenditure in the mining and energy sectors has reached historically low levels, developed countries are accelerating towards decarbonisation, undue emphasis on ESG (environmental, social and governance issues) increase costs for enterprises and global production is reconfigured, leading to a less liquid side of supply in the global economy. Even 10 years ago, no one would have thought that these factors would coincide in time, but now we are dealing with such a situation. The essential question is:

Is there a sustainable state of equilibrium or are we on the verge of a deeper transformation of the financial markets?

US stock valuations are sending a wake-up call - but are they really?

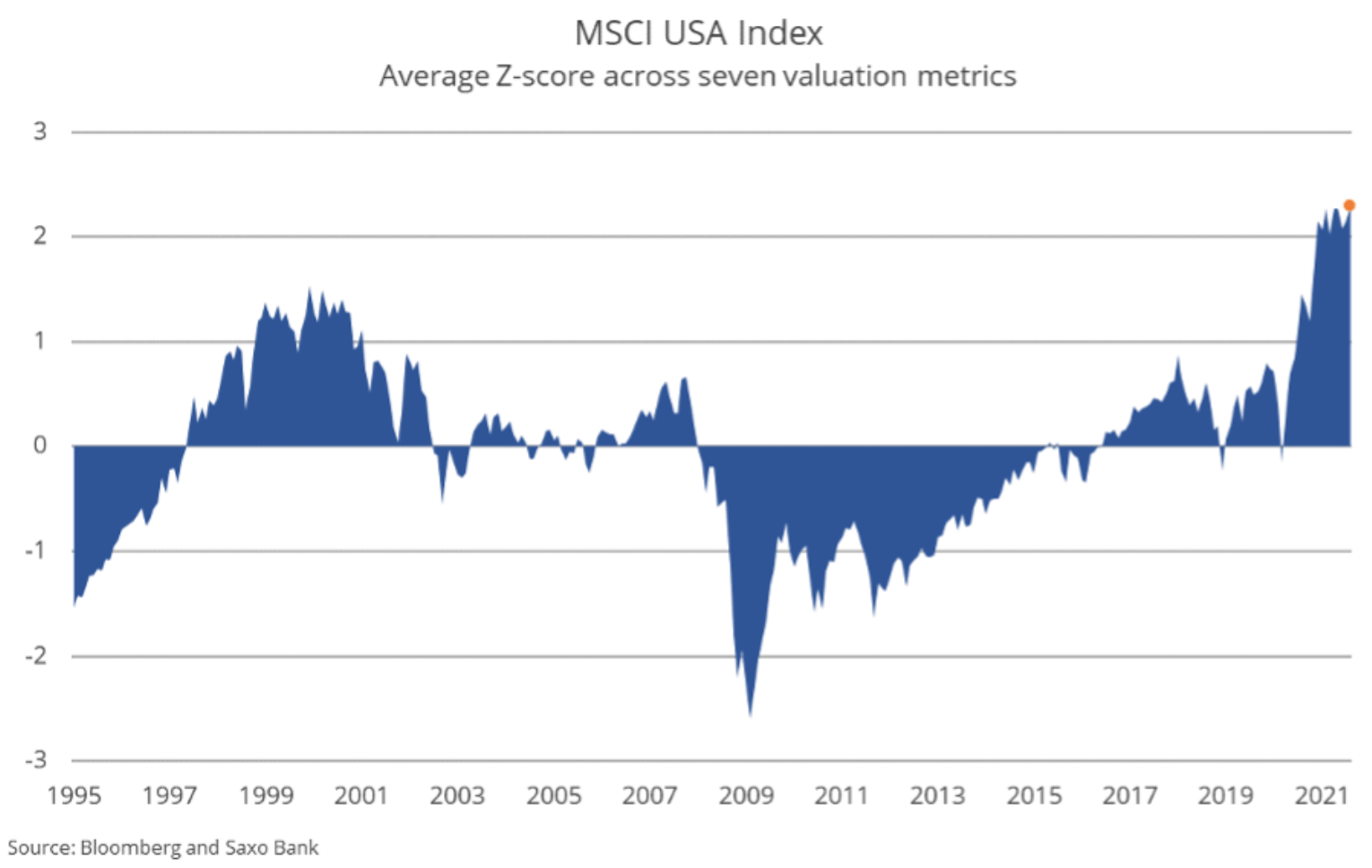

Valuations for global equities - especially US equities - have reached absolute highs as measured by a wide range of indicators. Historically, the current level of valuation is associated with a very low probability of a positive real rate of return in the next 10 years. If we ignore the other factors, it seems that we are dealing with another huge speculative bubble in the stock market, but unlike the Internet bubble, where the alternative was high real yields, this time investors cannot count on significant bond yields - de facto we used the property effect to the maximum. Investors seem willing to take the risk that even with such high valuations, future returns on equities will still prove better than for bonds.

While equity valuations appear dangerously high in absolute terms, the flip side of high valuations are historically low yields. Aswath Damodaran, professor of financial sciences, estimates the risk premium on US equities (projected excess return on equity above the risk-free rate of return) is now 4,6%, compared to just 2% in 1999, the lowest risk premium recorded at stocks in the US since 1960. Let's not forget that the estimated 4,6% equity risk premium could turn out to be a zero-inflation-adjusted return on another period of sustained high inflation.

The duration of the action has increased dramatically over the past 10 years

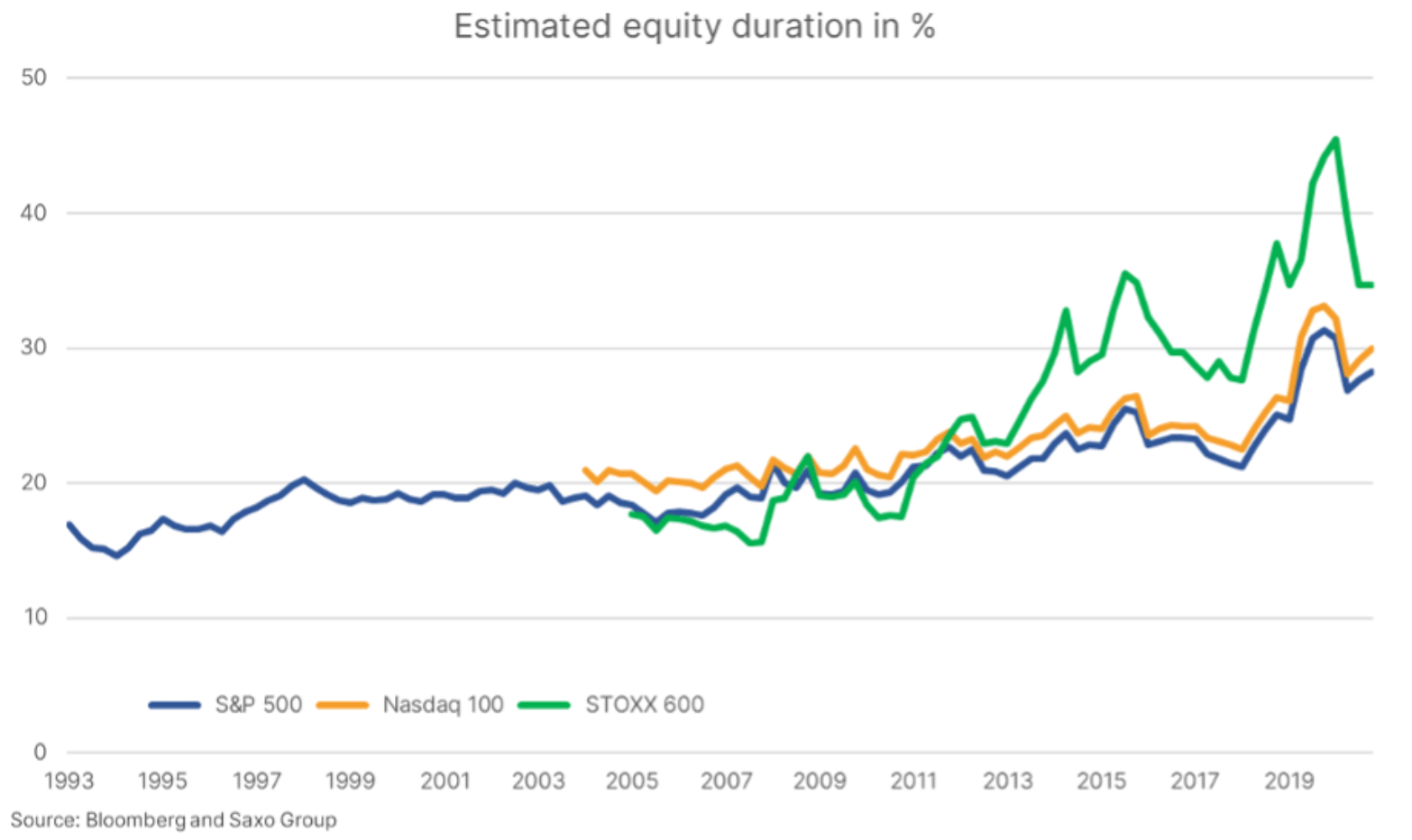

With bond yields at historically low levels, a natural question arises about the future of equities should yields rise again. In the context of bonds, the concept of duration (dur) is well known and can be measured quite precisely. A one percentage point change in the ten-year yield on US bonds represents a decline of about 7% for government bonds with a maturity of 7-10 years. However, it is completely different in the case of the duration of the action.

We used the approximation methods described in the paper Implied Equity Duration: A New Measure of Equity Risk ("Implied Action Duration: A New Equity Risk Indicator," Dechow et al., 2002). In addition, we adjusted profits and book value for R&D expenditure, which is capitalized and amortized over three years. The R&D adjustment makes the Nasdaq 100 companies appear cheaper as they spend 7,9% of their revenues on research and development, compared to just 3,7% for companies in the the S&P 500 index; in accordance with the applicable accounting principles, expenditure for research and development purposes is also immediately recognized in costs. Instead of the fixed cost of shares used in the publication by Dechow et al. we used the dynamic cost of shares, which is a function of the current level of interest rates.

As our stock estimate shows, in theory stocks have become more sensitive to changes in interest rates recently compared to 10 or 20 years ago. We clearly see that after the global financial crisis there has been an explosion of sensitivity to changes in interest rates, and due to the fact that in Germany interest rates turned negative and the implied duration of equities in Europe increased dramatically. At the same time, world debt levels have reached 356% of GDP and real estate prices have risen to record levels. Everywhere you look, every indicator has become sensitive to change interest rateswhich in itself limits the maximum rate of rate increase above which the entire system becomes severely strained.

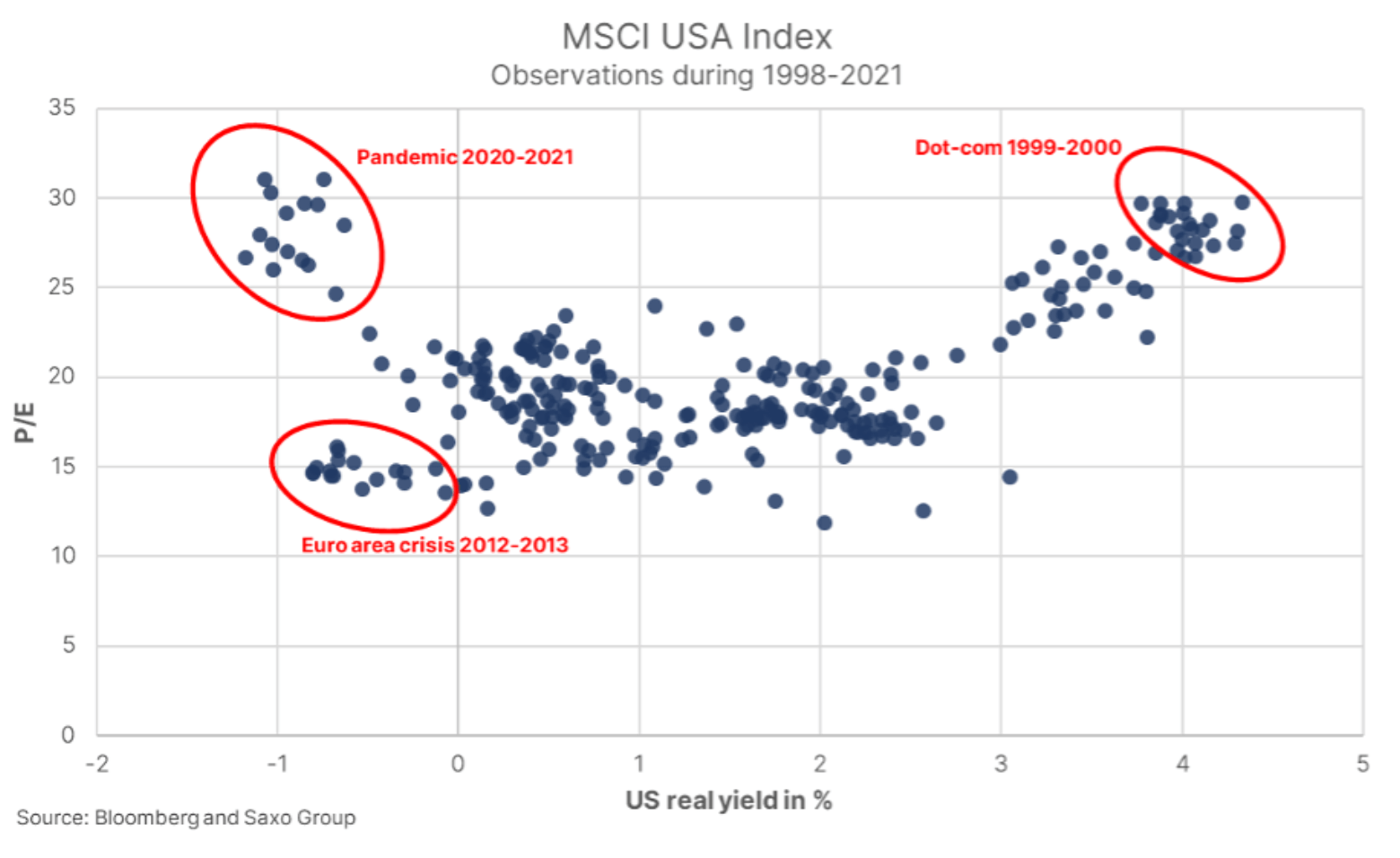

Unlike bonds, duration is not a precise indicator for stocks due to the lack of a finite period of cash flows. Moreover, all parameters for estimating the duration of shares are associated with considerable uncertainty. Another method of interpreting the duration of an action is to plot the P / E levels of the index Msci USA versus US real profitability (4-year profitability in the United States minus the XNUMX-year profitability above the break-even point). The current level of valuation as measured by the P / E ratio has not been observed since the Internet bubble, however, contrary to today's negative real yields, real yields at the time were above XNUMX%. Can the entirety of this increase in stock valuations be explained by negative real yields?

In 2012 and early 2013, even before Bernanke's famous speech on limiting asset purchases, real yields were almost the same negative as they are today, but stock valuations were halved. The main differences between the situation in 2012 and the current situation are a more mature stock market boom, which has strengthened investor confidence, as well as the recent post -andemic recovery due to excessive fiscal stimulus. These factors may have prompted investors to extrapolate high growth, justifying high equity valuations. In addition, there are more retail investors in the market today, following the return and narrative and the profits virtually-Monopolies of American technology companies significantly accelerated after 2012.

The chart shows that real yields do not have to change significantly in order for US stocks to become significantly lower under the right conditions. The observed variance of valuations with negative real yields is two or three times higher than for all other real yield quantiles after 1998. In other words, the risk borne by investors is high. The duration of action theory predicts that volatility and idiosyncratic risk increase with the duration of the action. In other words, we expect volatility to increase, particularly in the event of high technology stocks.

So what kind of companies are most sensitive to interest rate increases? The theory assumes that companies with a low (or even negative) return on equity, high growth rates or high valuations have the longest duration of shares. The subset of stocks that we believe will turn out to be the most sensitive to changes in interest rates is definitely our thematic basket of "bubble stocks", as well as companies private equity, real estate industry and highly valued stock exchange debuts. While there is calm in the stock markets, upward investors should now balance their portfolios with defensive and low-duration stocks, such as commodities and high-quality companies with high return on equity and below-average valuations.

Unique American Companies

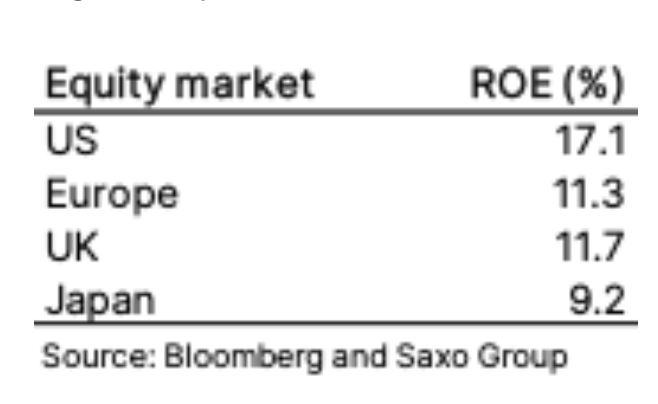

US stocks are valued high, which does not mean there is no basis for this. One of the factors is low real yields, but the same could be said for Europe, where we still do not see similar valuations. Part of the explanation is that American companies have a much higher return on equity, currently amounting to 17,1% compared to 11,3% in Europeand as we mentioned in the research context, US companies on average have more stable earnings and faster growth rates due to the greater share of digital companies in public markets.

The high return on equity of US companies indicates that even at the elevated current valuation levels, US equities outperform European equities. Assume that US and European companies will generate the current level of annual return on equity in the next five years: even if US equities are 25% more expensive today in terms of P / W ratio and after five years their valuation will drop to European levels, and yes, they will generate a 29% higher return in this period. It should therefore be clear to investors that there are really good arguments to be made in order not to invest in US stocks.

Inflation and margin reduction

The biggest threat to economies, financial markets and stocks is inflation. Since 2008, it has been able to shake the entire structure. Policies suggesting a demand shock are being implemented around the world, but in fact there is now a supply side shock due to a pandemic, a lack of investment in the physical world, and accelerated decarbonisation through electrification and renewable energies. These factors put enormous pressure on commodity prices, and we believe that the green transformation, combined with the current political trajectory, will lay the groundwork for new supercyclethat will last a decade.

In addition, policies in developed countries and China will increasingly address inequality to prevent social unrest, which means higher taxes on business and capital to support higher wage growth for low-income people. The combined effects of these measures could cause inflation to rise for even longer, exceeding the US average of 2,3% since late 1991. One of the unknowns is what central banks will do if inflation stays above average for an extended period of time. time given that the world has become very sensitive to changes in interest rates. Central banks can raise rates, which will hit our indebted economy, or they can refrain from doing so, allowing real yields to take even more negative values. In these conditions, is there a scenario of unexpected and unjustified growth on the stock market? This cannot be ruled out.

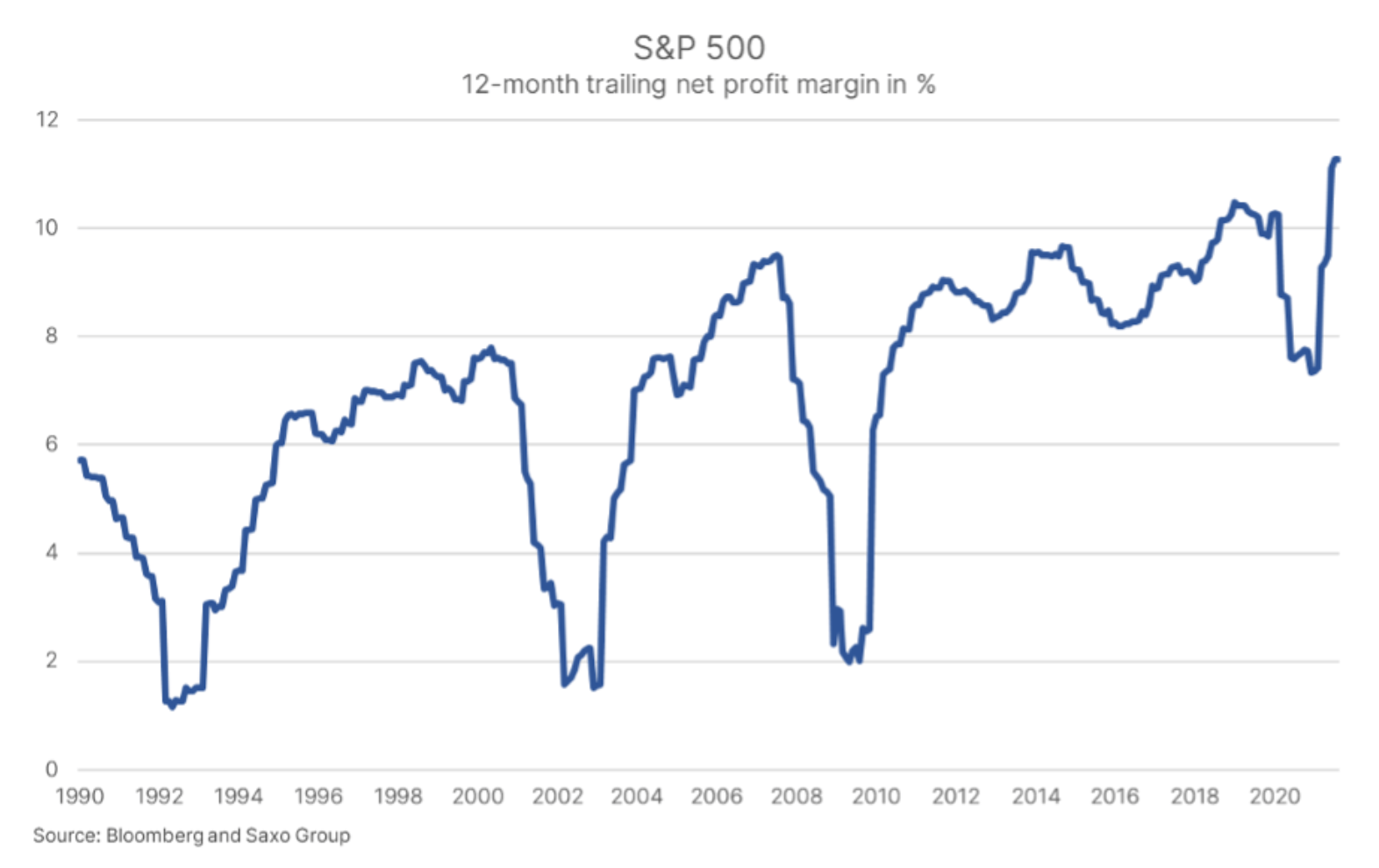

The flip side of the rise in commodity prices and wages concerns profit margins in the corporate sector. The S&P 500 Index recorded its highest profit margin since 1990 and market forces, unless broken, should trigger a return to the average. This will hold back earnings growth, unless nominal growth remains high, but that would require further fiscal stimulus and an end to the pandemic.

Shares are priced for perfection and a world that will not change, continuing the trends of the last 10 years. However, if it is really "different this time", investors on the stock market will face results that have not been recorded for several decades. Let's end this outlook for the equity markets by saying that while equities are expensive, there is no more attractive alternative for long-term investors. Inflation and interest rates are currently the real risk for equity investors, so we recommend lowering the duration of stocks in terms of investment portfolios as long as there is peace in the stock markets.

All Saxo forecasts are available at this address.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)