Tapering and quantitative easing. Central bank policy - part III

The most important event of the week is ahead of us - the Wednesday meeting of the FOMC. In the headlines of many posts and analysts, we can read about the upcoming tapering. It is a process directly related to monetary policy, which we will explain in more detail today. The topic is very topical in the context of Federal Reserve changes that may take place later this year. The voices of both the analysts and the federal bankers themselves are so far divided. However, it is worth knowing what is involved in tapering and what assets its introduction may have a significant impact on. I invite you to the next article in the series on the policy of central banks, using the example of the Federal Reserve.

Be sure to read: Inflation or speculation? What interest rates can the Fed use? [NS. II]

Quantitative easing

Let's start from the very beginning, which is March 2020. In response to the covid pandemic, many central banks, led by the Federal Reserve, have decided to cut interest rates. This meant greater credit freedom, lower debt servicing costs and ultimately help in reviving the economy. Along with the reduction in interest rates, another important arm in stimulating the economy has been triggered - large-scale asset purchases (more commonly known as quantitative easing or QE). QE program is an abbreviation of the English name quantitative easing. Its use increases the money supply in circulation. This is for a simple reason. by buying assets from the market, banks put money into it. This type of measures (buying debt securities) is one of the unconventional supply incentives on the market. QE is used primarily in order to be able to additionally stimulate the economy without the need to lower interest rates. Interestingly, quantitative easing does not change (ultimately does not increase) the assets of commercial banks, but only changes the amount of liquid assets.

Since July 2020, the Fed has been buying $ 80 billion in Treasury Securities and $ 40 billion in Mortgage Backed Securities (MBS) each month. the economy rebounded in mid-2021, so the Fed bankers' stance changed somewhat. They started talking about slowing down or slowing down the pace of bond purchases - that is, tapering.

Buying bonds

Much of quantitative easing is buying bonds. The structure of these purchases is defined in the relevant FED regulations. By buying US government debt and mortgage-backed securities (MBS), the Fed is limiting the supply of these bonds in the wider market. This allows private investors who wish to hold these securities through de facto not a very good period for them, then they will raise the prices of the remaining supply, lowering their profitability. This process and the effect it produces is called the "portfolio balance" effect. Thanks to it, even in periods of a strong recession in the economy, in which real, short-term interest rates are balancing at zero, buying long-term bonds causes that long-term interest rates remain above this limit. So there is more space left for shopping to stimulate the economy.

One more thing should be said here - the translation of profitability into the economy. Government bond yields are the benchmark for other private sector interest rates, such as corporate bonds and mortgage loans. The interest rates themselves have a direct impact on the ability of farms to incur liabilities, on decision-making processes in terms of investing funds - financial surpluses (with little or no interest at banks) and the potential to purchase goods and services.

Tapering - removal of monetary incentives

Let's move on to discussing the phenomenon of tapering itself. It is a response to quantitative easing. During the application of QE programs, assets were bought from the market. Tapering is therefore a process leading to a slowdown and reduction of the buying rate. Thus, it does not stop it at all, although it does reduce it significantly. Tapering does not refer to the total reduction of the Federal Reserve's balance sheet or the mass sale of purchased assets, but only to the reduction of the pace of its expansion (acquisition). At some point after the end of the reduction of purchases (effective tapping), the central bank may gradually reduce the size of its balance sheet, allowing previously purchased securities to "float" out of the balance sheet without replacing them (buying a similar debt coupon).

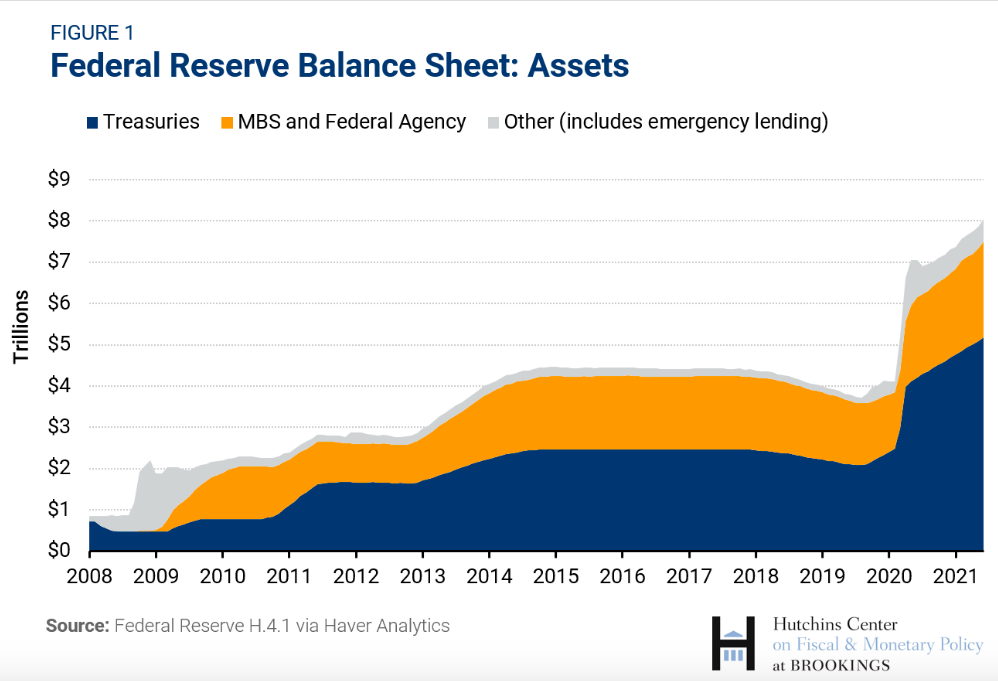

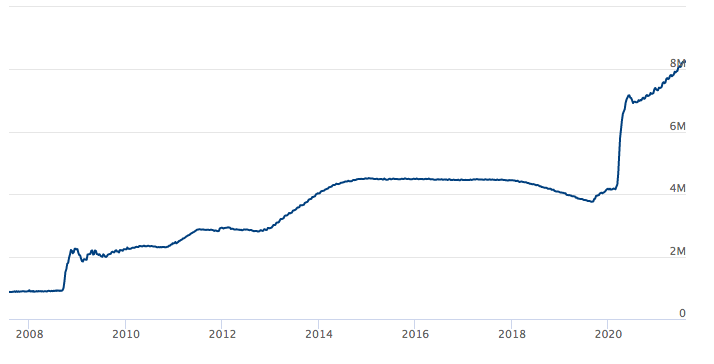

FED balance sheet. Source: Federal Reserve

The chart above shows the Federal Reserve's balance sheet since 2008. Free "outflow" (flattening of the average) can be seen in the post-crisis periods. On the other hand, intensive purchases - quantitative easing, ie stimulation of the economy with the "other arm" (ie not directly by interest rates) in times of crisis. This chart also clearly shows what we said a few sentences above. Tapering is not associated with a complete sale of assets, but with a slowing down of the pace of purchases. In this case, the motivation of the Federal Reserve to reduce the pace of purchases is to slowly remove the monetary stimulus from the economy. The Taperig is therefore an announcement to change the monetary policy towards its tightening. However, it does not say a definite "no" to the option of further, potential stimulation, if necessary.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)