Dukascopy PAMM Test - Week # 26. Final encounter

Another month is behind us. Account test Dukascopy PAMM with the amount of PLN 20 it has been going on for half a year. In accordance with the provisions of earlier articles, it is now that we must decide whether we will continue this test. Are you curious about the results achieved in March?

It's not April Fool's Day

In order to remain consistent in my assumptions, I am forced to end the test. After 6 months, I managed to get a plus, but it was so small that in fact I'm still in the red. will think "but how?". Profit throughout the investment period it amounted to only PLN 28. Unfortunately, this does not cover even the 1 / 3 bank transfer costs (and now there will be more payments due). Recognizing that the investment is unprofitable in the medium term, with no prospects for improvement in the future, the funds will be withdrawn this week.

In the same period, the profit on a bank deposit with an interest rate of 3% (and there are even offers for 4% up to PLN 20) would amount to PLN 000 after tax. And thanks to the BGF, the investment can be considered fully safe and not burdened with additional transfer costs.

No variability helped

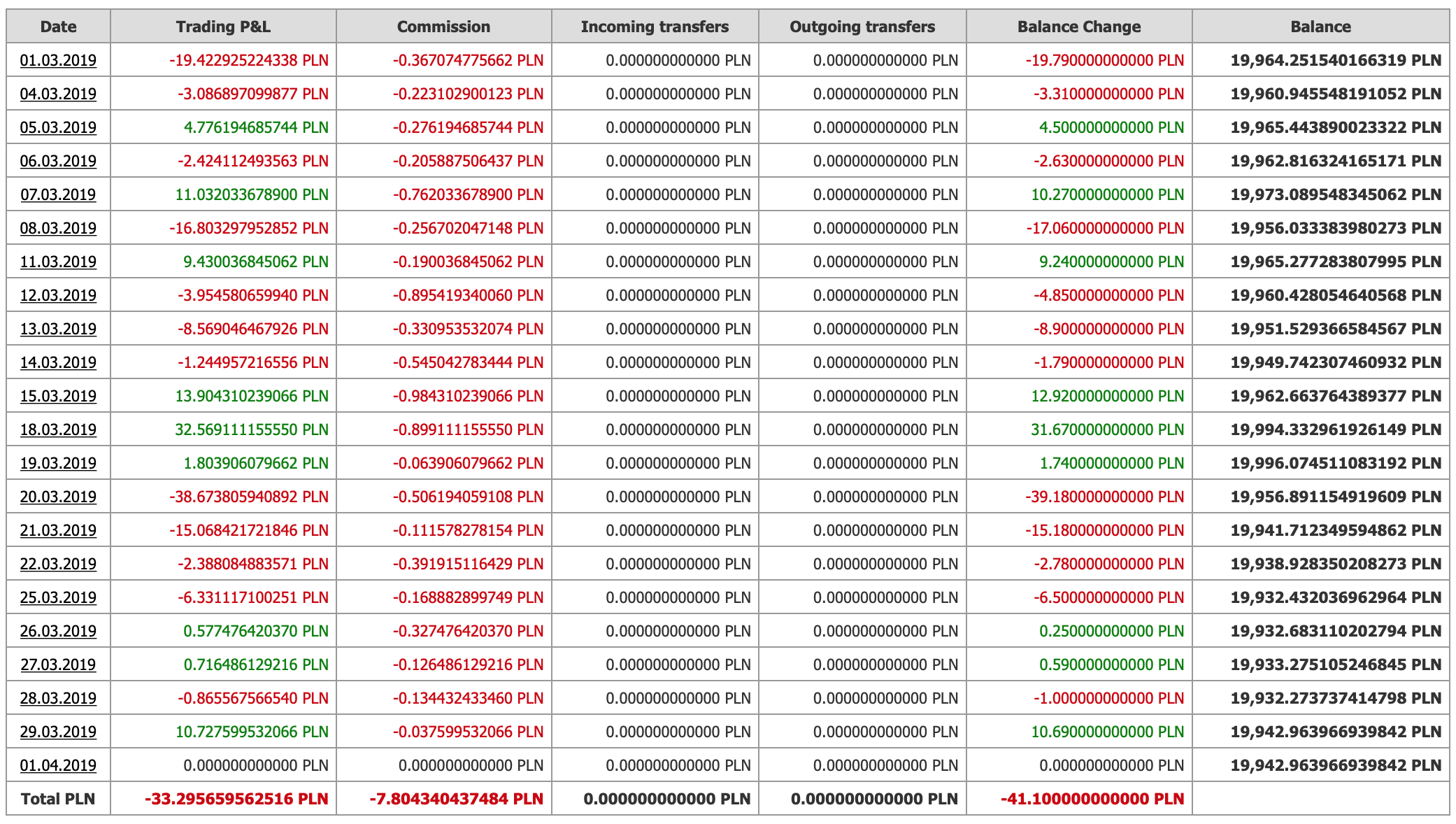

During the test we had to deal with low, medium and high amplitude of fluctuations on the market. There were trends, there were consolidations. From my observations, the period of small trends or average volatility in the side trend was the best. But it also did not help, because the sun came in rain (losses);). In March, a loss of PLN 33 was recorded on the account (PLN 41 with commission costs). Not much, but it's another step in this "bad" page.

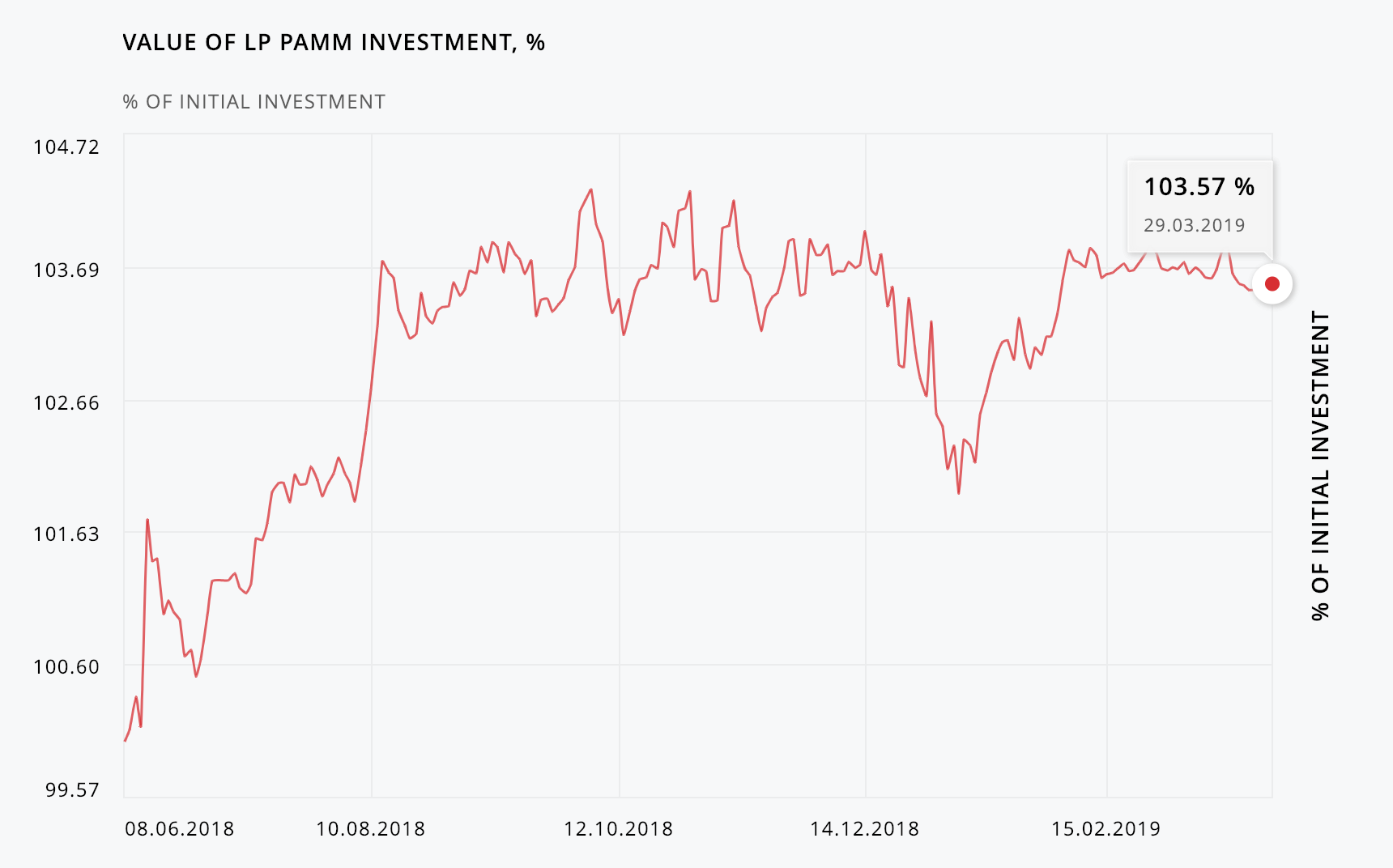

Start-up capital: 19 906 zł

Current capital: 19 934 zł

The rate of return: + 0,14 %

The current duration of the investment: 210 days

- Test complete -

Below I present how the daily balance of the account changed from the publication of the last article.

Click to zoom

Wnioski

Perhaps I came across a worse period in management actions Dukascopy. And maybe the assumed simulation results of 11% per year are also optimistic. However, the fact is that regardless of the time during the last 6 months I would start the test, my results would still be similar. During all this time, a period of substantial profits could not be observed, even those that would later be offset by a series of losses.

Investing in Dukascopy PAMM LP is certainly not risky. The capital drawback exceeded 1% only once, and even slightly if not. However, the profits turned out to be also "unspectacular" :). For a relatively small amount, in the current market conditions, the investment is unprofitable. Along with the low risk, the chances for a correspondingly higher profit are slim - a bank deposit turns out to be a better solution. In the case of larger amounts, where it is more difficult for us to obtain a favorable percentage in the bank, in the long term, PAMM can be an interesting alternative and, under favorable conditions, a chance to generate satisfactory profits at low risk.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![SyncTrading TeleTrade - Another week with profit [TEST # 3] synctrading teletrade test week 3](https://forexclub.pl/wp-content/uploads/2020/10/synctrading-teletrade-test-tydzien-3-300x200.jpg?v=1602656245)

![SyncTrading TeleTrade - First positions, first profits [TEST # 2]](https://forexclub.pl/wp-content/uploads/2020/10/synctrading-teletrade-test-2-300x200.jpg?v=1601987632)

![SyncTrading TeleTrade - We choose traders [TEST # 1] synctrading teletrade test 1](https://forexclub.pl/wp-content/uploads/2020/09/synctrading-teletrade-test-1-300x200.jpg?v=1601361410)