The energy crisis could turn stocks in this sector into the winners of the century

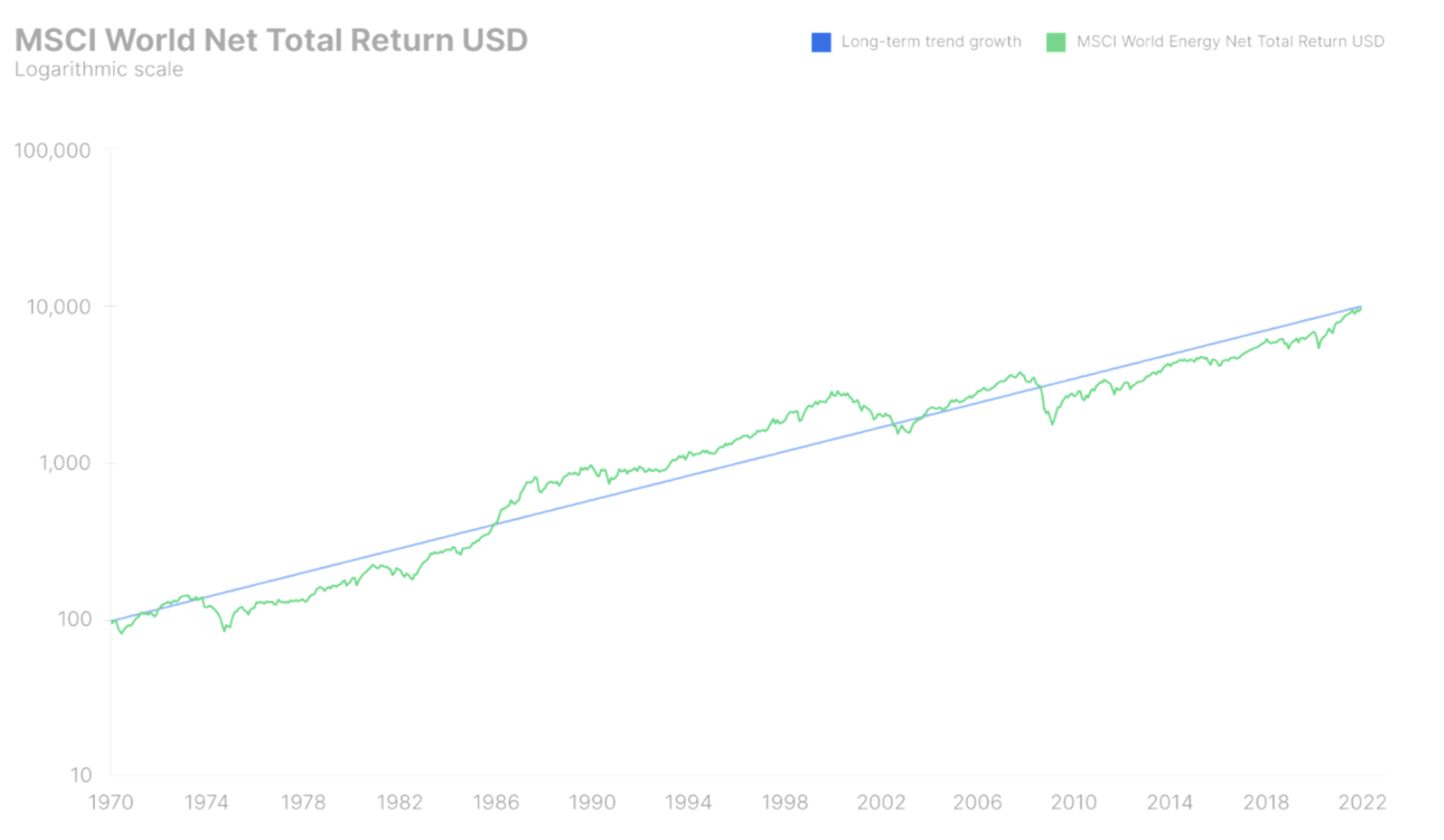

Equities ended 2021 with a gain of 23,3% on the index expressed in USD MSCI Worldextending the streak started in 2020 with a profit of 14,3%. While these returns are well above the long-term returns on stocks, the MSCI World index has remained below the long-term trendline since the early 1970s and the risk premium for US stocks is now estimated at 4,7%. Add to this the current 6,4-year US bond yield, the expected return on US equities would be XNUMX%. While we do not believe that the equity market in general is overvalued in terms of interest rates, there are definitely speculative niches in this market that show a tendency to bubble. These niches have narrowed sharply in the last three months due to expectations of interest rate hikes.

Last year, the global energy crisis developed at a slow pace, exploding in the hands of Asia and Europe at the end of the year, and European natural gas futures contracts from May 2020 rose by 2%. Higher energy prices - the theme of Saxo's quarterly forecasts - are a tax on consumers and businesses. They can push up consumer prices and reduce margins through higher direct operating costs and secondary inflationary pressures that affect industries differently. They can also cause interest rates to rise by directly increasing the discount rate for future free cash flows and thus lowering equity valuations. There are many reasons to assume that energy prices will remain high for the foreseeable future due to under-investment, ESG and the green transition. This will encourage investors to gain exposure to the entire energy sector to balance their portfolios with too much technology and growth stocks.

The role of the energy sector in the equity markets has become irrelevant

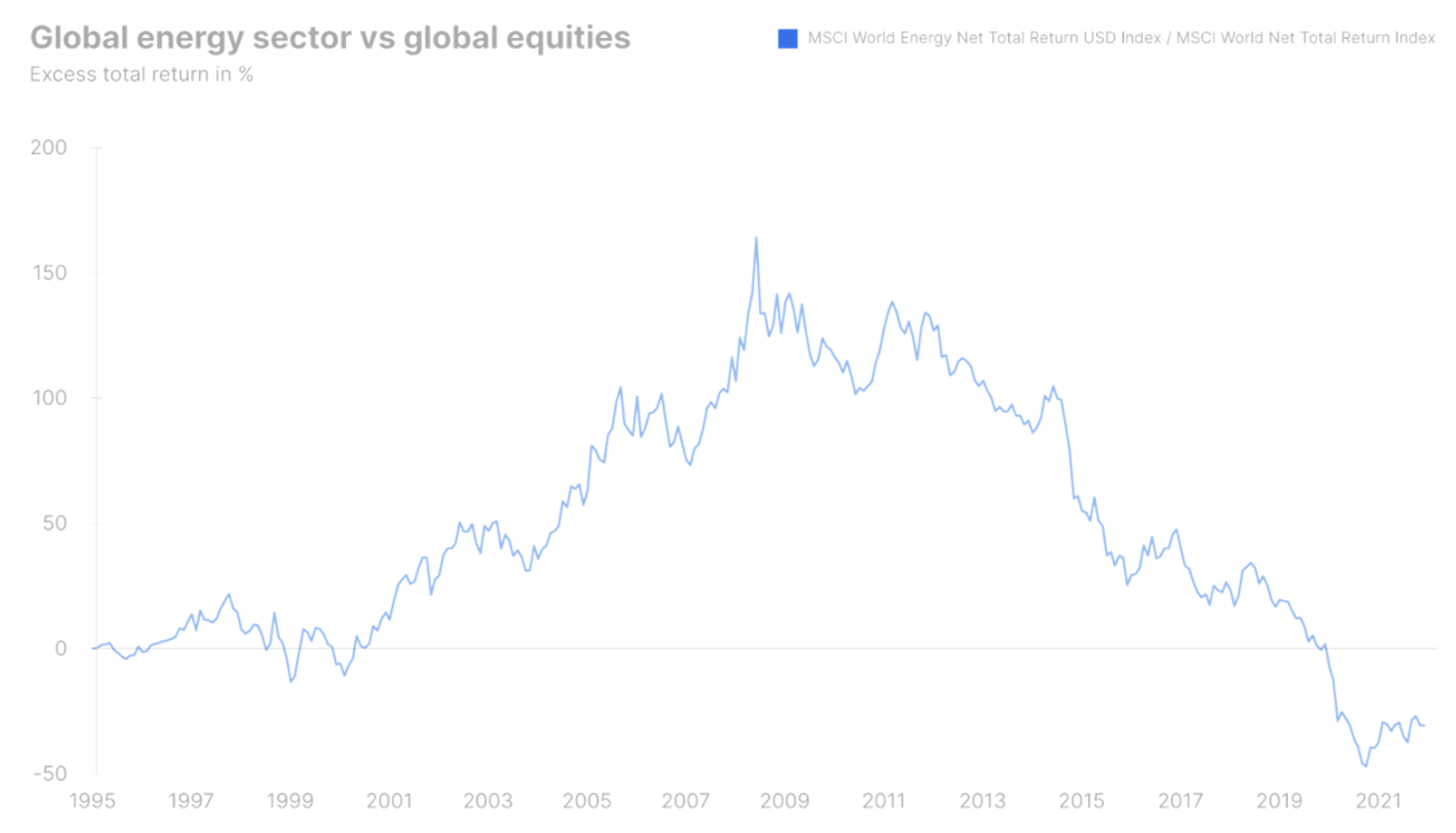

In January 1995, the energy sector was XNUMX percent weighted on the S&P 500 index and was thus the fifth largest sector by market capitalization in the world's largest economy and the world's largest stock market. Since then, the energy sector has experienced an incredible boom, which peaked in June 2008, when the price of Brent crude oil reached $ 140 per barrel. During this period, the global energy sector outperformed the global stock market by 7,5% yoy, providing a combined USD return of 16,2% yoy.

The main factor behind this energy boom was the rapid economic progress of China and - most importantly - its accession to the World Trade Organization, which gave rise to an unprecedented transfer of production from countries OECD to the Middle Kingdom. The Chinese economy was less energy efficient than the industrial sector in OECD countries, and most of the electricity produced for households and industry came from coal, oil and gas. Soaring energy prices between 1995 and 2008 led to an investment boom that subsequently turned out to be anathema to the sector. However, by June 2008, the energy sector increased its weight on the S&P 500 index to 16,2%, second only to the information technology sector (16,4%) and even ahead of the financial sector (14,2%).

June 2008, when the world plunged into the devastating credit crisis and the ensuing economic crisis, was the peak month for the global energy industry. Despite widespread stimulus from China and the United States pulling the entire world out of the abyss, and the subsequent rise in energy prices and energy stocks, markets have suffered long-term damage. Massive overinvestment in oil and gas exploration, coupled with much higher costs in the sector during the boom years, led to a decline in profitability and return on capital. Also, demand did not grow as fast as before as China's urbanization continued and the Middle Kingdom economy became more energy efficient, while the global economy continued to suffer from the effects of the financial crisis.

From June 2008 to December 2021, the global energy sector underperformed the global stock market by 9,4% yoy, offsetting the good performance generated over the last 13 years. Global energy fell 2008% between June 2021 and December 21,2, a nominal return before inflation. In the same period, the global stock market grew by 201%, and in December 2021, the weight of the energy sector on the S&P 500 index fell to 2,7%, making it the third smallest sector, only ahead of the utilities and utilities sectors. At the same time, the information technology sector increased its weight on the S&P 500 index to 29,2%.

The brutal truth in 2022 is that the energy sector plays a small role in global stock markets in terms of impacting earnings, but our entire global economy is still based on energy. The rise in wealth over the past 300 years has been a long technological journey from burning wood to burning coal to discovery oil i natural gasand then nuclear energy, to a switch to renewable energy sources such as wind and sun. As the whole world is based on energy, it is of enormous importance to the economy, and the energy crisis is making politicians, consumers and businesses aware of how important it is and how much we all took energy for granted.

Hunger for investment in the physical world

There are many reasons for the current energy crisis, some short-term and others long-term. The most obvious are China's shift towards coal energy, Germany's withdrawal from nuclear energy, Russia's geopolitical games, the global natural gas market via LNG, underinvestment in oil and gas supplies, and unprecedented weather phenomena reducing electricity production from hydro and wind power plants.

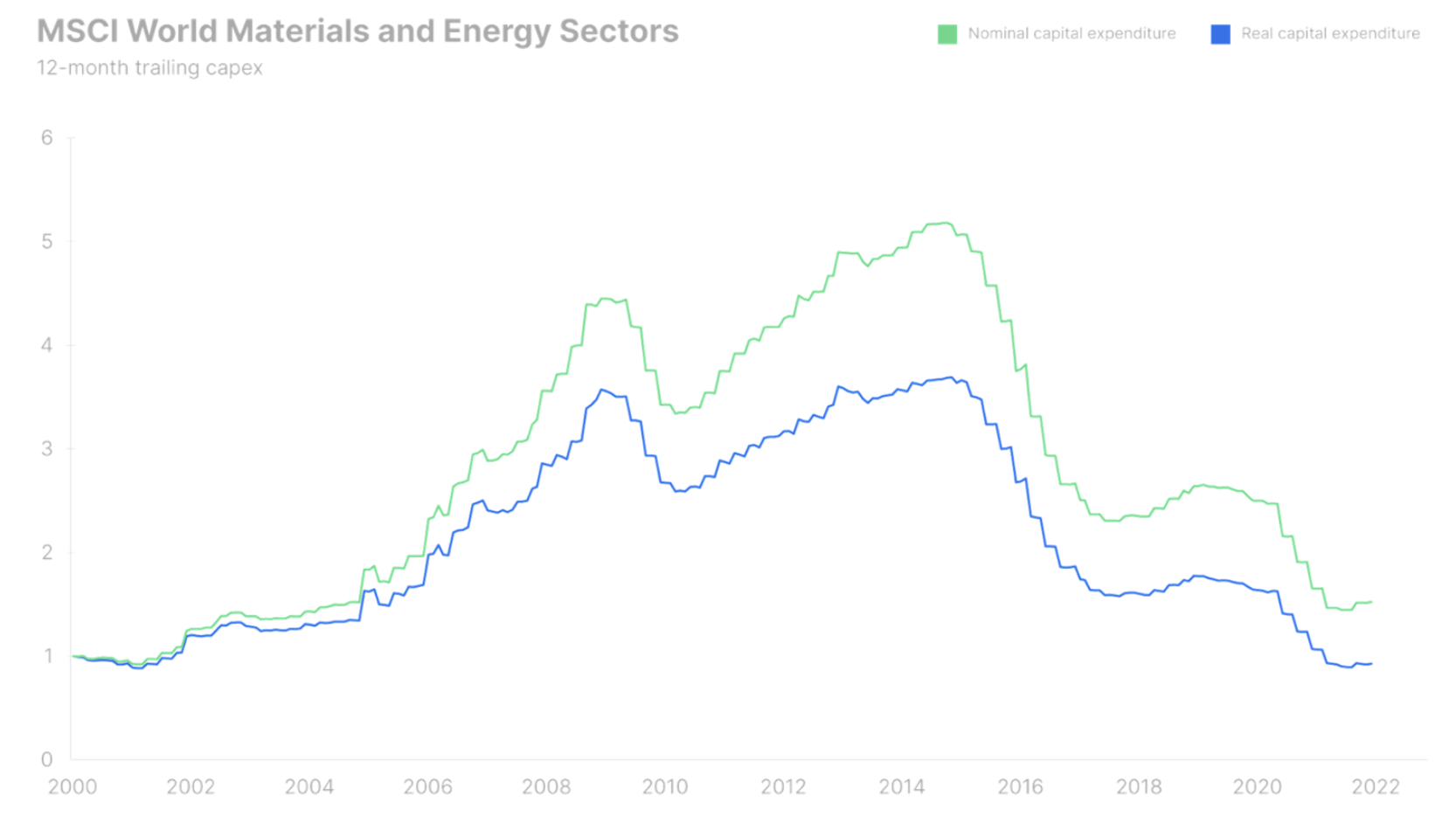

One of the most fascinating charts for the global energy sector is the change in capital expenditure between 2000 and 2021. The boom period from 2000 to 2008 resulted in an increase in investment outlays by 350%. The financial crisis only led to a slight decline, after which investment started to accelerate again as the sector believed that demand would continue to grow at an unchanged pace. However, the miracle of fracking technology secured an unprecedented supply of crude oil from the United States, plunging prices sharply and canceling out the vast majority of investments made between 2009 and 2014.

Since the oil price slump in 2014-2016 and beyond, the growing awareness of climate change, coupled with ESG mandates and massive returns on equity with exposure to digitization, have starved the energy sector for investment. The current level of investment outlays is the lowest in 20 years in real terms and the lowest since 2004 in nominal terms. The investment drought, which has lasted for more than seven years, will contribute to an increase in the attractiveness of energy prices in the coming years. The largest consumer of oil is the transport sector, and due to its electrification, the oil market is potentially the biggest long-term loser of the green transition. Before this happens, however, the sector faces another very profitable period in the years of the energy crisis. The global energy sector is currently trading at a 5-month 4,7% forward dividend yield and assuming a 10% long-term dividend growth rate, the long-term expected return on investment in the global energy sector is close to XNUMX%. This could make energy equities the winner of the century in the coming decade, and the implied expected returns are too good for global investors to ignore.

The energy landscape and its components in the stock markets

The relocation of industrial production to China over the past two decades, and the delay by politicians in deciding on climate change, coincidentally with digitization, have led to a dangerous turning point at which these "energy loans" will have to be repaid. The cost will be higher energy prices in the long run due to the green transition, and much higher oil and gas prices due to underinvestment and the discovery that in order to live in a "green paradise" in the future, we first need to sin a little on fossil fuel energy.

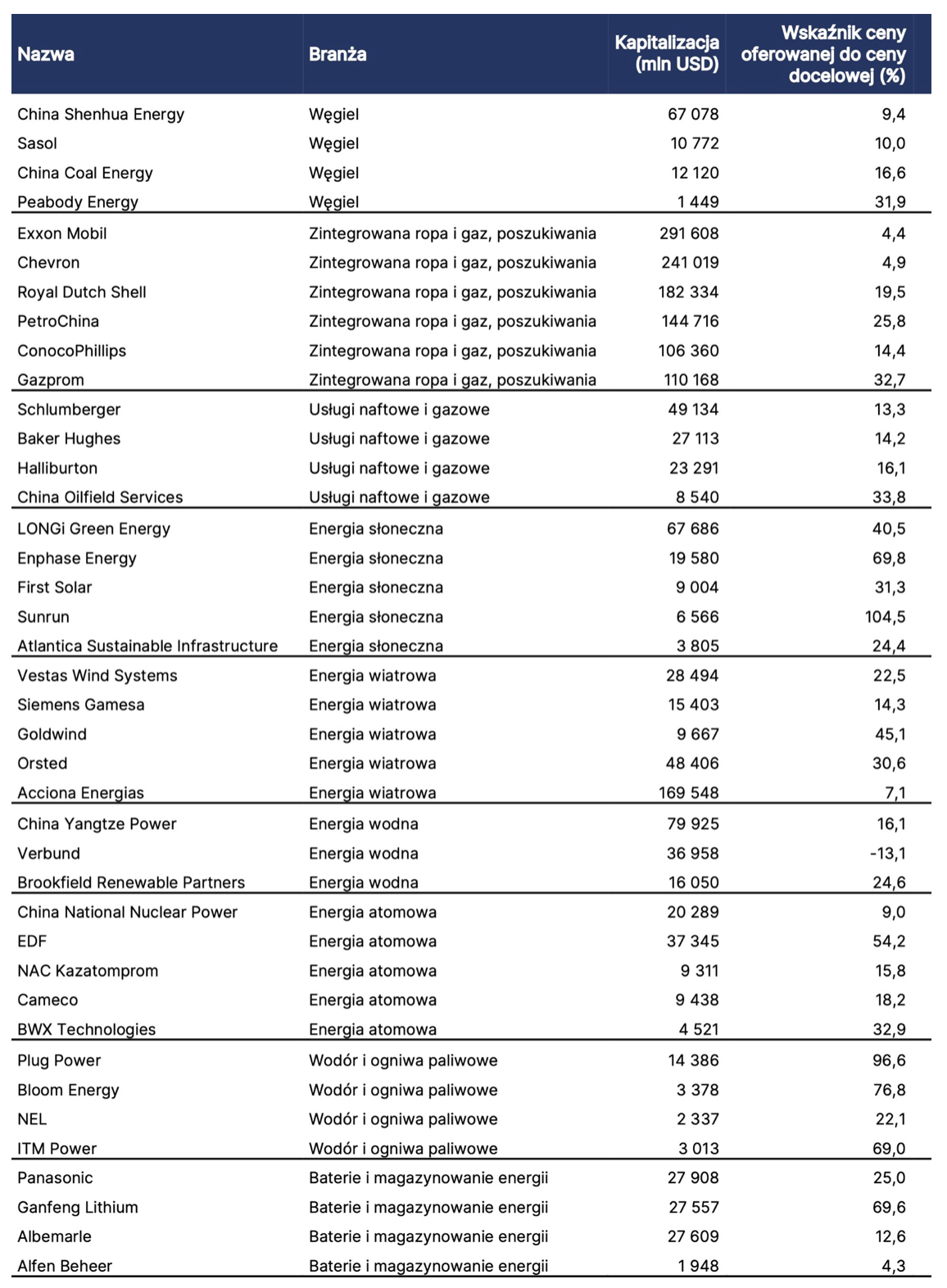

The table below presents 40 companies from the global energy market and key industries such as coal, integrated oil and gas exploration and exploration, solar, wind, hydro, hydro, nuclear, hydrogen and fuel cells, and finally batteries. This list is not exhaustive, but it is intended to provide investors with inspiration for obtaining exposure to individual parts of the energy landscape. We excluded utilities as a separate category - although this sector is responsible for electricity production - because they are usually strictly regulated and cannot increase margins, and in some cases cannot fully transfer the increase in production costs.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)