Premature dollar burial or financial system revolution?

2022 is an amazing year for currencies. By saying 'Amazing' I mean volatility, potential and changes in monetary policy on a global scale. As far as we expected after Federal Reserve more unconventional actions in connection with the unusual period for the US, few people expected that the conflict would extend for such a long time. In today's post, I want to present a slightly different, non-emotional side of the military operations carried out in Ukraine. The side that is currently leading to a "quiet" and small revolution in the financial system.

The voices of the financial and geopolitical world, which notice the problems of dollar domination, have been speaking more and more boldly lately. They came to the fore particularly strongly when imposing sanctions on Russia. We know that most energy commodity contracts (including the quotes themselves) are based on a payment in USD. The embargoes issued by the US and EU countries are aimed at reducing and eliminating Russian energy from exports as much as possible. The problem arose when Putin demanded payment for oil and gas in rubles and made an offer to his favored contractors to pay for energy resources in their domestic currencies.

Of course, the genesis of the USD as the world's reserve currency is quite extensive, so in this article we will focus only on the most important issues that are of the greatest importance in the context of a potential revolution in the financial system. I invite you to the article in which I want to show you some interesting facts about USD and its currently declining importance on the global arena.

Less than 60%

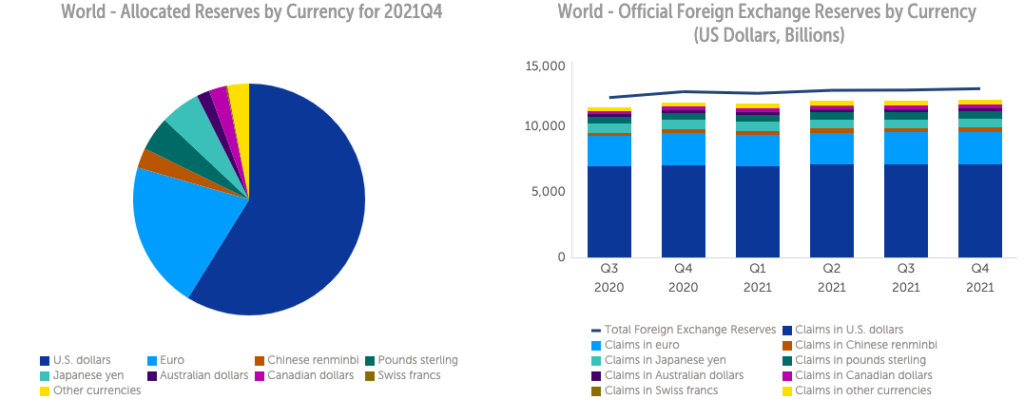

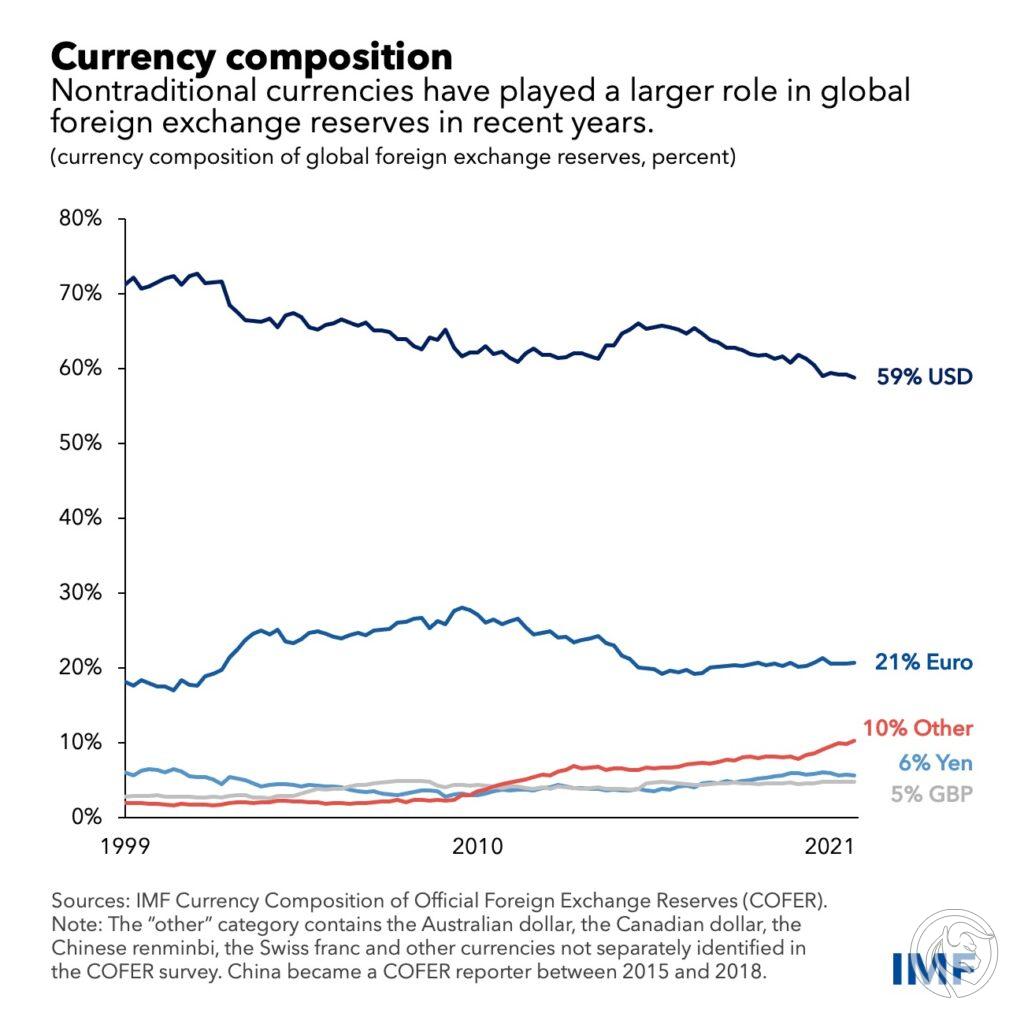

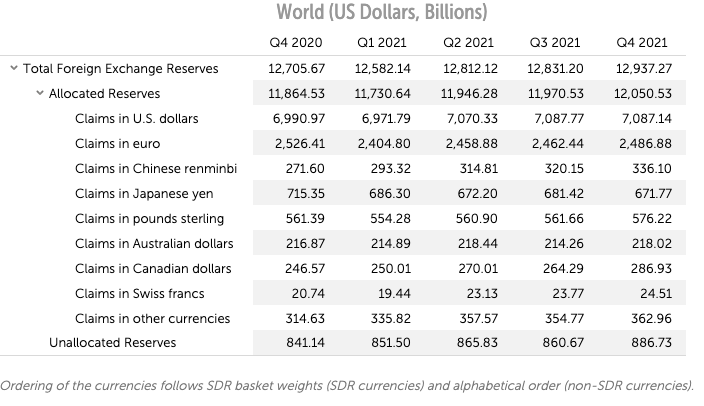

One of the more interesting charts that show the long-term transformation of the currency market is the one published by IMF. The domination of the USD in the world currency market is still unquestionable, which gives the USA a huge privilege over other countries in terms of, for example, debt creation. The United States can therefore borrow money from other countries in its own currency. So if the US dollar depreciates, the US dollar depreciates, and so does debt. American companies can make international transactions in their own currency without the need for currency conversion fees.

Interestingly, for almost two decades we have been observing (particularly strongly in the last quarter) a decline in the share of the US dollar in global currency reserves. Currently, this level is around 59%, where in 1999 70% of all reserves were deposited in the dollar. What is worth noting about this graphic, but what we will tell you more about, is the increase in the share of the "other" category, i.e. other currencies. This could be the start of an interesting transformation of accumulating reserves in local currencies, or of a more proportional spread of currency risk.

"Distantization" Israel

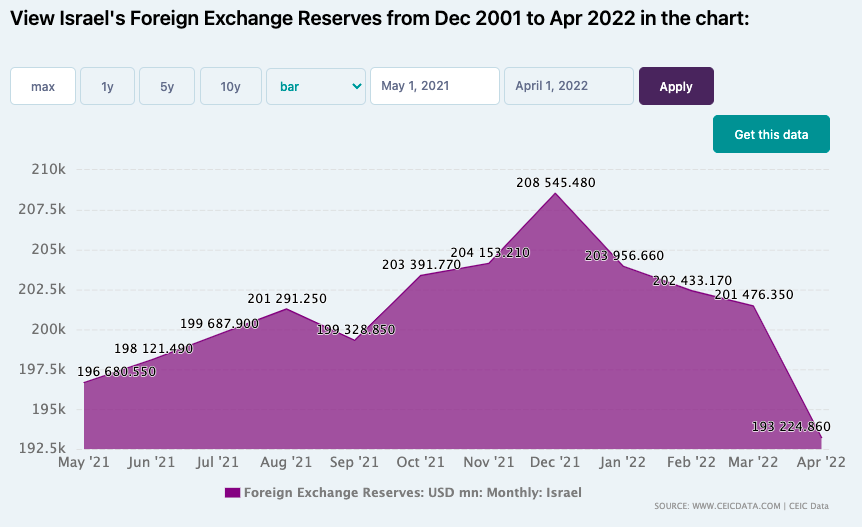

An example of one of the most interesting transformations is Israel's recent decision to build up reserves. On April 24, 2022, four new currencies were added, including the Chinese renminbi. As reported in the report The Central Bank of Israel this move was made to diversify the current foreign reserves. One can ask a rather trivial question. What is diversification for? In theory and in practice, the risk is spread across different assets. Currently, most eggs are in one basket - the USD basket.

Israel's foreign reserves, which exceeded $ 200 billion for the first time last year, are traditionally made up of dollars, euros and British pounds. Israel will now include Canadian and Australian dollars in its currency reserves, as well as the Japanese yen and the Chinese renminbi. On the one hand, the addition of currencies can be considered a natural move of the bank, because since the reserves have increased, they need to be diversified somehow. Movements leading to a reduction of USD and EUR (by 8,3% and 30% respectively) in Israel's foreign reserves are explained by a "new investment philosophy".

Blowing in the cold

The increase in global currency reserves is observed practically all the time. This could be the reason for a trend that is shifting away from hoarding them in USD. Against this background, two main factors can be distinguished that may be responsible for these trends:

- higher returns and lower volatility of "local" currencies

- automatic liquidity management systems in central banks significantly support trading in these currencies.

There is a certain amount of hypocrisy in this. "Nontraditional" currencies, which are increasingly appearing in reserve portfolios, use the Fed's bilateral swap lines. Let us explain at this point what it is. The line is something like an agreement between two central banks whereby one receives the USD and the other the equivalent of a given currency. Simply put, a country's central bank can borrow dollars from the Fed via swap lines and inject them into commercial banks. This solution is not new to the financial world. It came to the fore particularly strongly during covid, when the demand for USD increased along with the risk of a crisis. Returning to the merits, however, the use by central banks of the Fed's swap lines and the simultaneous increase in the share of non-traditional currencies in their own reserves is something of a mini-revolution from which you can easily withdraw in the event of trouble.

"Economic Weapons of Mass Destruction"

Valéry Marie René Georges Giscard d'Estaing, long-time Minister of Finance of France, was and is often cited in the context of the US advantage that the dollar gives it as the world's reserve currency. He called this situation "Excessive privilege", which has been repeated over the years by opponents of the dollar domination on the market. Raghuram rajan, the former governor of the Reserve Bank of India calls this power "an economic weapon of mass destruction." Moving in this direction, in the subsection we will take into account the risks that have recently been particularly strongly noticed by the world and which may have a strong impact on the anti-dollar recalibration of currency reserves.

The title ones "Mass destruction" we noticed perfectly after the US freezing of US $ 630 billion in Russian reserves as part of a sanctions package. This made it possible for the US to punish Russia without military involvement in the conflict. As CNN writes:

“With great power comes great responsibility: when you use weapons of mass destruction, even economic, people get scared. To save themselves from the same fate as Russia, other countries are diversifying their investments from the US dollar to other currencies. "

And it is precisely in this field that one of the greatest risks to maintaining the strength of the USD as the reserve currency of the world is currently emerging. During the blockade that Russia imposed on April 27, blocking the supply of energy resources to, among others, Poland due to the failure to pay in rubles, it became clear which way the dollar risk would be disqualified.

About half of Russian gas importers have already opened accounts with Gazprombank for payment under the new program - said Deputy Prime Minister of Russia Alexander Nowak. It is true that it is currently difficult to verify this statement. On the other hand, it is hard to believe that in the face of rampant inflation caused mainly by the increase in energy commodity prices, some countries would not agree to this arrangement for a temporary "peace of mind".

Russia has decided to submit new energy bids to the countries with which it has so far provided intensively supplied raw materials. Among them there is China, which is very eager to settle transactions in its own currency. Of course, this situation diametrically accelerates China's interests aimed at increasing the exposure and importance of its own currency in the global system. It is enough to take into account only the next, most significant oil supply for the Middle Kingdom, i.e. Saudi Arabia. For several years, talks have been held between the two countries in the context of settling at least some of the black gold transactions in the RMB. As you can guess, this process has been dramatically accelerated in the face of the situation between China and Russia.

Summation

In order to be as objective as possible about the subject of the revolution in the financial system and the tendency to "de-polarize" it, let us consider two issues. The first is a constant domination that, although it has lost its importance for two decades, is still overwhelming. The loss of this significant privilege as the world's reserve currency is unlikely for the time being. Although the last time has taught us that the impossible becomes possible, the transformation in the next few years seems to be still very distant. Naturally, a currency / s would have to appear on the horizon that could replace and successively replace the USD. Still 40% of all global transactions are made in the dollar, with 3% in the case of the Chinese RMB. The American market has developed a strong position over the years and continues to be an attractive place to invest in capital despite falling returns on investment. Only in 2021, foreign direct investment increased by 77%which was also associated with the postovid revival in the economy. In my opinion, the lack of alternatives is the main problem. No other currency is able to provide the liquidity that the market needs at the moment on such a scale.

On the other hand, when considering the other side that indicates a change in the global currency direction, one must bear in mind the risks. This risk was revealed particularly strongly in the Russian-Ukrainian conflict and the sanctions imposed by the USA. They are a very important signal for countries that do not belong to the broadly understood "west" in the form of more intensive withdrawal from the dependence of economies on the USD.

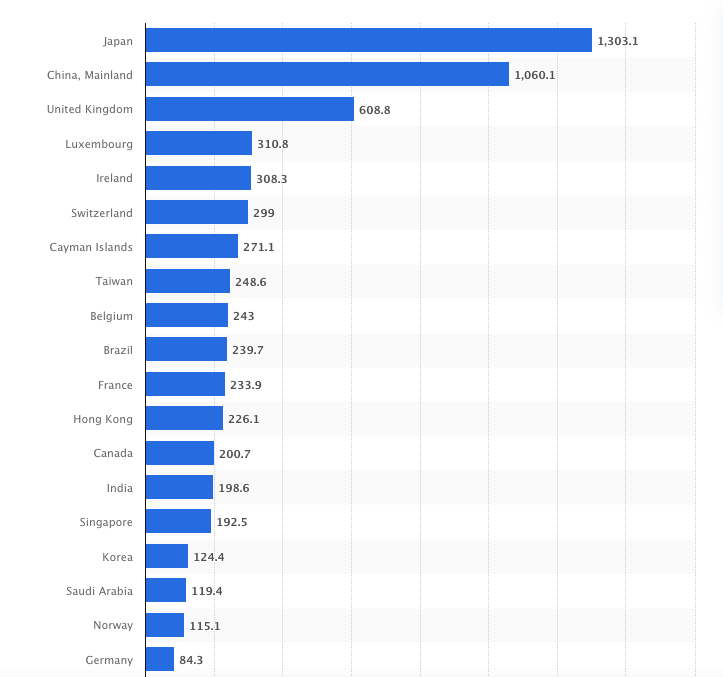

The second country with the largest share of US debt is China. Therefore, it is difficult for countries that cooperate economically with Russia, which have alternatives to use their own currencies in export / import transactions, to continue to finance the American debt so readily. This can be considered unreasonable hypocrisy and treading on thin ice by the US. On the one hand, with one package of sanctions they are able to cut off the selected country and its financial system from the dollar, on the other hand, they want it to continue to buy its debt and finance its economic development.

One more topic is on the horizon, now seems to be a distant topic of the digital Chinese yuan, on which the authorities have been working so intensively recently. This is a more visionary and long-term advantage at the moment, which in my opinion, at the height of the digital currency transformation, may be particularly important.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)