Coronavirus unemployment is the real killer

Coronavirus is a purely negative external factor. In the beginning, it caused a negative supply shock, which was quickly offset by the negative shock of total global demand. The fact that global commodity prices are also coming down confirms that we are dealing with a demand shock.

The only short-term solution to the problem of spreading the virus was to promote social distance and impose strict isolation in cases where it was necessary, which further worsened total demand. Households were urged to keep their members at home and avoid social interactions, thus spending less. When consumers spend less, businesses start producing less. In other words, even if some companies are able to maintain production despite these unusual circumstances, they do not necessarily have a reason. This will negatively affect production and lead to mass layoffs. We are at this stage.

About the Author

Christopher Dembik - French economist of Polish origin. Is a global head of macroeconomic research at a Danish investment bank Saxo Bank (a subsidiary of the Chinese company Geely serving 860 HNW customers around the world). He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to the report of the Global Go To Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 000, etc.) and a speaker at international events (COP2, MENA Investment Congress, Paris Global Conference, etc.).

Christopher Dembik - French economist of Polish origin. Is a global head of macroeconomic research at a Danish investment bank Saxo Bank (a subsidiary of the Chinese company Geely serving 860 HNW customers around the world). He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to the report of the Global Go To Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 000, etc.) and a speaker at international events (COP2, MENA Investment Congress, Paris Global Conference, etc.).

Phase I: Temporary mass layoffs

In April, the US economy decreased by more than 20 million jobs as a result of isolation, resulting in an increase in the unemployment rate to 14,7% from the level of 4,4% recorded a month earlier. In the opinion of many members Federal Reserve, unemployment may soon reach 20%, and the final peak may be around 30%. A better indicator of the current situation, however, is probably the share of the number of employed in the total population (persons over 16 years of age), which fell to 51,3%. In other words, only half of all Americans have jobs. The coronavirus hit hardest in the service sector: over 7 million jobs in the tourism and hotel industry have disappeared, almost 2,5 million in the education industry and 2 million in retail. In the charts below we see the unemployment rate broken down by education level. It can be observed that in each case during the period of isolation the unemployment rate has risen fourfold so far, however - similarly to every "normal" recession - the scale of the shock is much larger for persons with lower education. The only significant difference is the amplitude of the shock in such a short period.

Phase II: Hysteresis effect and solvency problems

A significant proportion of the redundancies are considered temporary (up to 70% according to the April report on employment in the non-agricultural sector in the United States). Once the restrictions are lifted, the economy will return to normal and enterprises will re-employ workers made redundant during the crisis. I do not agree with this assumption. If we assume that China is the leading benchmark in this process, we do not have the prospect of a V-shaped recovery. In China, it took a month or a month and a half to restore production capacity to 100%, but consumption is still slow. In March, retail sales fell by 15,8% on a year-over-year basis, while spending on meals in restaurants fell by almost 50% over the same period. Many stores are still hopelessly empty, even in Beijing.

This phenomenon is known as the hysteresis effect. Despite the end of the pandemic, it still has a noticeable impact on consumption and savings. Due to uncertain economic forecasts and concerns about rising unemployment, consumers have a strong tendency to save, which is extremely negative for aggregate demand and contributes to a worsening economic downturn. As a result, companies have increasing solvency problems in addition to the earlier decline in industrial profits (similar to China, where industrial profit in the first quarter of 2020 fell by 37%) and will have no choice but to focus on restoring cash flow and cutting costs, including employment. A vicious circle of slowing down total demand and solvency problems is just starting to spell and will lead to a strong and sustained increase in unemployment, which will be greater in countries without sufficient automatic stabilization mechanisms.

Winners and losers in the world after COVID

The consequences of coronavirus will weaken the economy in the coming years. Policy makers, by providing a significant injection of liquidity to the economy, have delayed this impact, but have not completely eliminated it. A second wave of economic crisis is coming, characterized by weak demand, an unprecedented number of bankruptcies and much higher unemployment. Before the pandemic, the global economy was already in a very weak position due to the high level of public and private debt, inflated market valuations and low growth dynamics. Historical experience shows that, unlike wars, pandemics do not follow a strong recovery, and their negative effects, such as a decrease in investment opportunities or an increase in savings accumulated for a rainy day, can persist for up to 40 years (detailed information is available in a comprehensive article published on the NBER website).

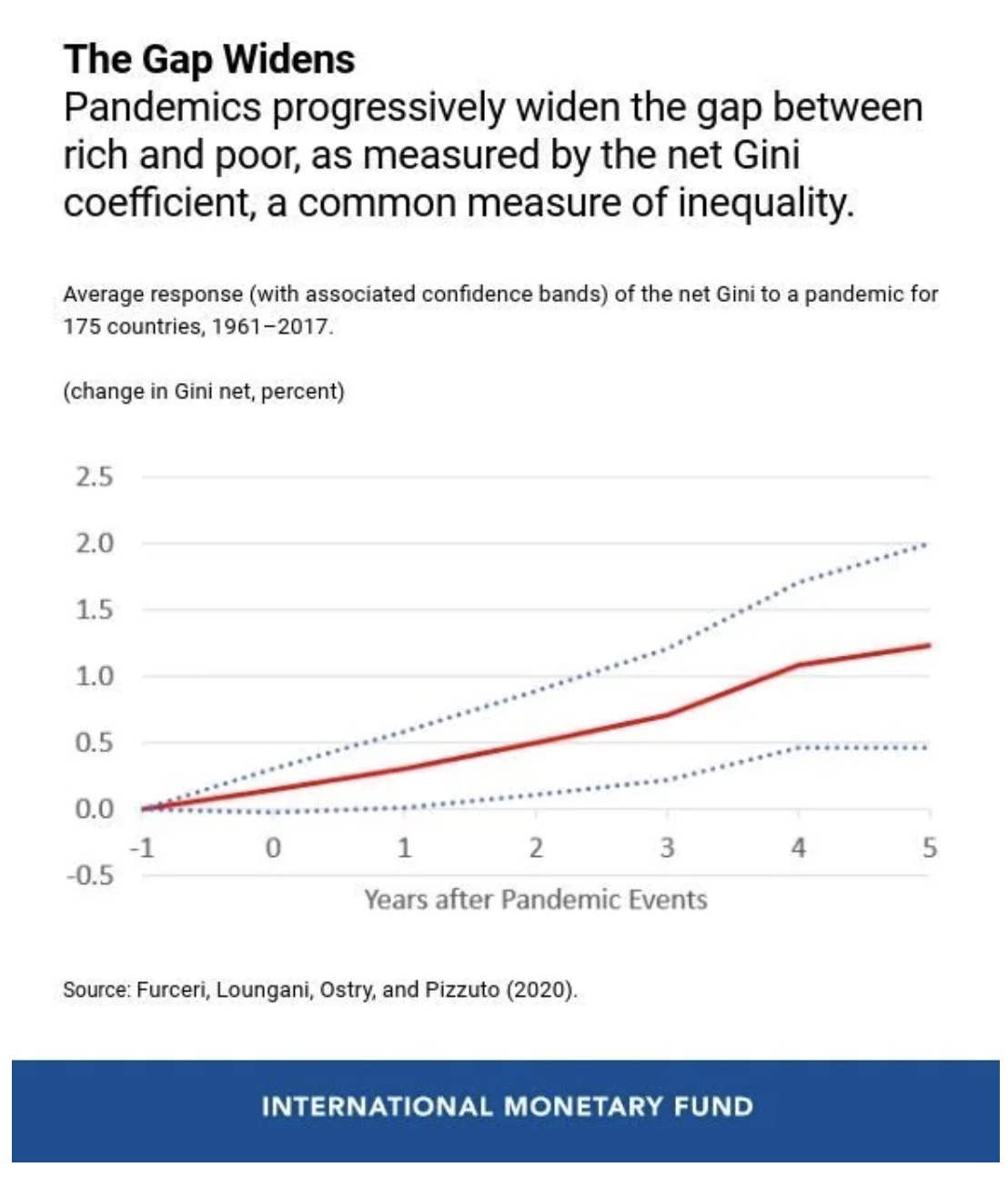

Another characteristic feature of a pandemic is that it contributes to even greater impoverishment of the poor. One of the last articles on the IMF blog, based on net Gini coefficient, he says, a pandemic progressively widens the gap between the poor and the rich, and worsens the employment prospects of people with primary education, as opposed to people with a higher level of education. The most striking conclusion is that inequality tends to increase in the long run (net Gini coefficient after five years is almost 1,5% higher), which confirms that the consequences of a pandemic translate into a general economy in the long term.

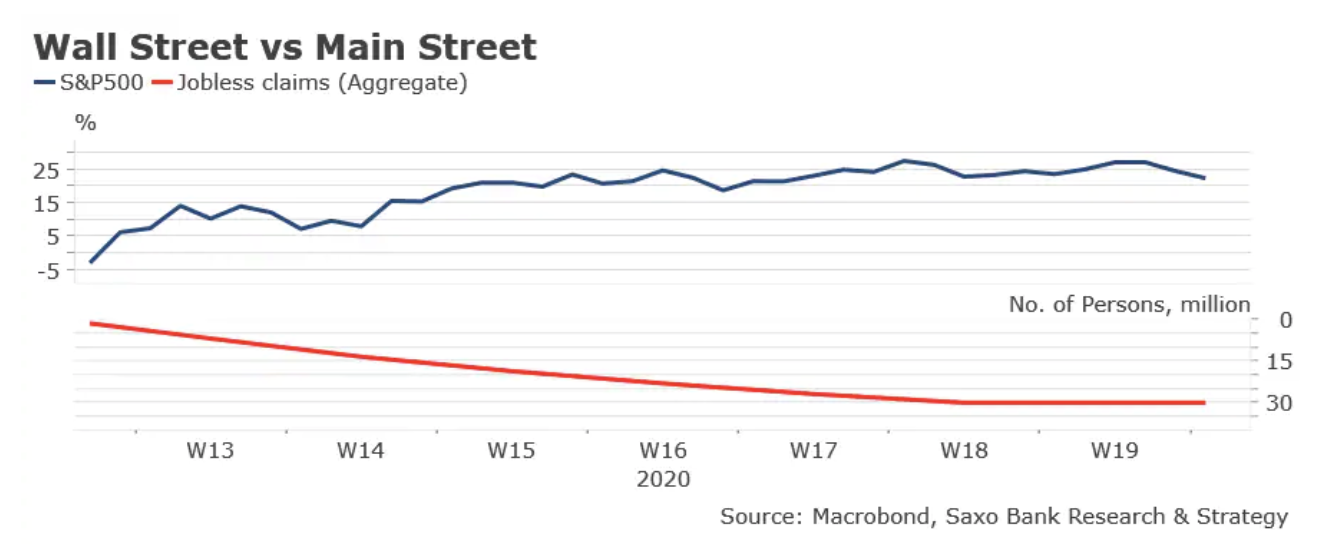

There is a risk that the difference between rich and poor is symbolized in the chart below by changes in the S&P 500 index from a minimum on March 23, and the total increase in claims for unemployment benefits in the United States over the same period will further deepen. In recent years, both the IMF and Bank of England have developed a number of studies showing that quantitative easing causes a lasting jump in wealth inequality due to rising financial asset prices. Given the extent of liquidity injections provided by central banks around the world and the primary impact on the stock exchange, only 1% could be a win in the current crisis. On the other hand, the rest of the population will lose, in particular people with lower education, forced to cope with rising unemployment and a decrease in purchasing power. The coronavirus-related unemployment threatens the social contract between citizens and the state and can pave the way for populism. Governments will undoubtedly seek to solve the problem of unemployment and inequality by implementing a more redistributive policy and deepening the fiscal deficit. Is that enough? I do not yet know the answer to this question, but I do know that policy makers cannot once again fail these 99%.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![STI 30 – Singapore Stock Exchange – Does a great country also mean a great index? [Guide] singapore stock exchange sti 30 singapore](https://forexclub.pl/wp-content/uploads/2024/05/singapurska-gielda-sti-30-singapur-184x120.jpg?v=1715232642)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response