The strength of Polish bonds, shares earned a dozen or so percent

In the extended July market commentary, VIG/C-QUADRAT TFI experts analyze the macro-economic environment of Poland, the Eurozone and the USA, look at global and domestic stock and bond markets and check how corporate bonds behave in the context of the June CJEU judgment on CHF loans . Below we present selected information from the report.

Macro-economic environment

Poland

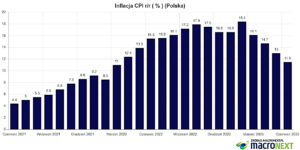

In June, price stabilization continued. Flash CPI reading for May was confirmed (0%MoM and 13%YoY). What's more, also the flash CPI inflation reading for June suggests price stabilization over the month and thus an increase in inflation by 11,5% per year.

The following are still worrying: high core inflation (11,5%) and prospects abolition of anti-inflation shields since 2024

Retail sales fell below expectations and increased by 1,8%YoY in current prices (vs. 4% consensus), and fell by 6,8%YoY in constant prices (vs. -5,6% expected).

Announcements of some MPC members about interest rate cuts at the end of the year and a negative verdict of the CJEU on CHF loans (the need to create additional PLN 42 billion in reserves) did not have a major impact on the Polish zloty, which strengthened for the 5th month in a row.

Eurozone / Germany

European Central Bank raised interest rates by 0,25 percentage points. up to 4%. The final inflation readings for May were disinflationary, but the preliminary readings for June spoil the mood of central bankers. HICP inflation in June, according to preliminary data, increased by 0,3%, while market expectations assumed stabilization of prices over the month, the annual growth of this indicator reaches 5,5-5,6%.

Retail sales in Germany turned out to be a surprise for May, which increased by 0,4%MoM (vs. 0% forecast) and fell -3,6%YoY (vs. -4,3% consensus).

USA

In the US, interest rates remained unchanged, although the Fed's rhetoric remains hawkish. Data about CPI inflation were slightly lower than market forecasts (CPI +0,1% m/m vs. 0,2% consensus and +4% y/y vs. 4,1% forecast), and core inflation was in line with expectations (+0,4% m/m and + 5,3% y/y).

The situation on the labor market was stable, some data surprised positively (employment in non-agricultural and private sectors), and some negatively (unemployment rate increased to 3,7%).

On the other hand, retail sales surprised positively (up by 0,3% m/m vs. -0,1% consensus) and the final GDP reading for Q2023 2 (+1,4% y/y vs. XNUMX% forecast). which does not allow members FOMC to declare success in the fight against inflation.

Global markets - stocks

Global stock markets (especially developed markets) had a very good month. In particular, once again American tech companies stood out (this is almost a 39% increase in the NASDAQ100 index in the first half of 2023).

Looking a bit broader, only less than 30 companies from S & P500 index is responsible for the growth of this index by over a dozen percent, which means that a small percentage of companies were responsible for the growth of the leading indices.

What we are interested in is whether the other sectors (except technologies) will join the leading sector or whether – once again – there will be a dynamic rotation between the highly valued sectors and the low valued ones (cyclical companies - finance, trade, industry and raw materials).

Currently, a strong labor market and wage growth are stopping central banks from cutting interest rates, and the longer interest rates remain high, the greater the likelihood that industries already affected by the high interest rate environment may continue to surprise negatively.

To sum up - VIG/C-QUADRAT TFI experts believe that it is worth paying attention to a slightly higher level of cash in the wallet – valuations of leading technology companies leave no room for error, and rotation to lower-priced cyclical sectors can be dynamic with any positive surprises.

It should also be emphasized that the leading US and European equity markets are clearly above their long-term averages.

Domestic market - shares

After a very good first half of 2023, where the indices of both large and medium-sized companies gave earnings of several percent, and the index of small companies even more than 20% - VIG / C-QUADRAT TFI experts are analyzing what may be a further catalyst for the domestic stock market in the second half of the year.

The current stimulus, i.e. the effect of weakening the US dollar - is slowly dying out. Nevertheless, even the current level of the exchange rate is favorable for the decrease in the cost of imports from Asian directions.

On the other hand, the favorable Euro exchange rate continues supports the profitability of Polish exports. The poor PMI reading for countries in the EURO zone, which indicates weak industrial activity in Europe, remains a problem.

As for the risk factors - the negative verdict of the CJEU on CHF loans - although negative in the long term - was lost in the "stream" of very good data from the banking sector, which was positively received by investors. In short, the banking sector will be able to afford additional reserves for CHF loans.

Geopolitical risks seem to be stabilizing – Ukraine is making further progress on the front. On the other hand, the events in Belarus are a little worrying and cause some tension.

To sum up, the easiest period of growth on the domestic market is behind us – Polish stocks are no longer very cheap, and we may have a more turbulent summer ahead of us than average.

Source: banker.pl

Corporate bonds

The Polish corporate bond market remained unmoved by the CJEU judgment on CHF loans, which was negative for banks, which suggests that such a scenario was fully priced in by the market. On the primary market, there was an abundance of offers and, interestingly, demand for some issues significantly exceeded supply.

The managers of VIG/C-QUADRAT TFI expect that during the holiday season there will be slightly less traffic on the primary market. On the secondary market, prices will not fluctuate much, although we believe investors' activity has increased. On the secondary foreign market there was also little volatility and credit spreads remained low.

Treasury bonds

June began with a decrease in the yield on treasury bonds to around 5,9% (10-year bonds). However, with the upcoming CJEU judgment on CHF loans, Polish bonds were "returning" the profits from the beginning of the month. On the judgment day, profitability increased to over 6,1%, i.e. above the May closing. However, in the following days the markets quickly returned to the deflationary scenario. Yields fell by 0,3pp in just over a week. percent and fluctuated around 5,8% by the end of the month.

To sum up: The strength of Polish bonds is surprising in the face of increases in bond yields on the core markets. However, it cannot be ruled out that in the case of a positive scenario (strong disinflation) the trend will be maintained, although in the medium term we see a risk of a sell-off of Polish treasury bonds.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

Leave a Response