This year, growth in Asia will be zero - commentary to the IMF report

The main conclusions of the latest IMF report on the global economy and the effects of COVID-19 are as follows:

- The global economy will experience the worst recession since the Great Depression - this year it may shrink to -3%. This process will affect both developed and developing economies.

- Only two countries will end 2020 with positive GDP growth: India and China, accounting for 45% of global growth. The fastest growing key economy will be India (+ 1,9% this year) and China (+ 1,2%).

- In other countries, growth will be negative: United States (-5,9%), Japan (-5,2%), Russia (5,5%), European Union (-7,5%).

- Asia is expected to see zero growth this year for the first time in 60 years.

- The economic losses associated with the COVID-19 pandemic in 2020-2021 are estimated at USD 9 trillion.

- Assuming that there will be no second or third wave of incidence and that appropriate measures will be implemented at global level, the IMF forecasts a rebound in global growth in 2021 to + 5,8%.

Below are interesting charts from the IMF report. The first presents a comparison of the impact of the 2008 financial crisis and the current crisis on GDP growth broken down into developed and emerging economies. Unlike 2008, when emerging economies recorded decent GDP growth, there is currently no desynchronization of global growth. As part of the current crisis, the recession will affect both developed and emerging economies.

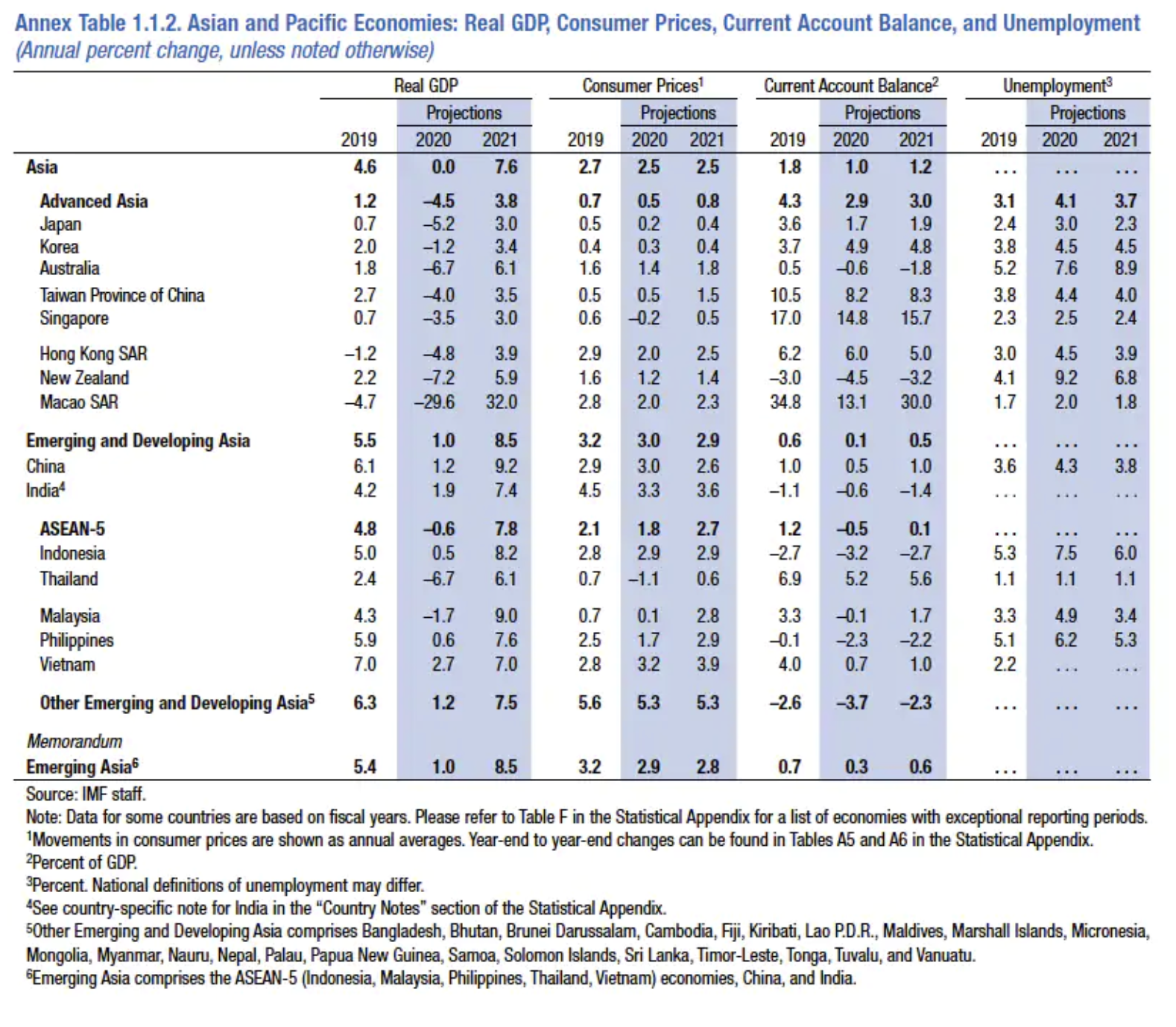

The next chart presents the latest IMF forecasts for the Asia-Pacific region, which accounts for around 45% of global growth. It presents the main economic indicators: real GDP growth, CPI, current account balance and unemployment rate. The most striking fact is that Asia is likely to see zero growth this year compared to + 4,6% in 2019. Downward corrections are significant, from 3,5 percentage points for South Korea to over 9 percentage points for Thailand. However, if the appropriate conditions are met (i.e. the pandemic will expire in the second half of 2020 and the political measures taken prove effective), the IMF forecasts strong rebound next year at + 7,6%.

Comment for the report

The Covid-19 pandemic is an unprecedented crisis for policy makers because it causes disruptions in both supply and demand. The supply shock is related to the inability of companies to resume operations, while demand is falling in almost every country, with the most rapid increase in countries where strict isolation has been implemented.

Globally, politicians have taken appropriate measures to fight the crisis and have not hesitated before significant liquidity injections for financial markets or the announcement of extraordinary support packages. In March, the Central Banks purchased assets with a net worth of almost USD 7 trillion in G1,4 countries - this is a record amount in historical terms, almost five times higher than the largest amount of asset purchases on a monthly basis during the global financial crisis. In addition, according to our calculations, the value of the total fiscal stimulus package in the G7 countries since the beginning of March, including state guarantees, is about EUR 5,5 trillion or 17% of total GDP - a level that has never been achieved in the previous crisis (detailed information available are part of our report on G7 policy, monitoring the latest monetary and fiscal policy measures implemented in the G7 countries). The above data show how unprecedented the current crisis is.

In Asia, which was the first region to suffer from coronavirus effects, the political response is equally impressive, and often occurred much faster, at least in the context of health protection. This definitely explains why Asia will do better than other regions, even though the effects of the crisis are much worse there than in the case of the global financial crisis or the Asian financial crisis of the late 90s. Various measures taken have contributed to the suppression of a pandemic (e.g. in South Korea or Taiwan) and led to the launch of extensive support programs for businesses and consumers, including direct disbursements in some countries (e.g. Singapore or Hong Kong).

In China, the political response is more modest than in the case of the United States or Europe, because the authorities initially recognized that the shock would be temporary. The aid mainly involved a USD 130 billion support package for SMEs and subsidies for the purchase of green vehicles for the automotive sector, but more targeted measures are planned that would be targeted in particular at households and enterprises that have suffered most due to the pandemic.

Based on maritime transport data, we can see that intra-regional trade in Asia is accelerating, however, due to the lack of customers from Europe and the United States, the Asian motor for global growth will not be restarted in the near future, and the outlook for Asian companies for the coming months is not very optimistic. In addition, there is still considerable uncertainty about the development of the coronavirus situation (the second wave of infections forced Singapore to implement isolation) and the economy's ability to restart quickly after the crisis.

Recent statistics from China confirm that a V-shaped recovery is unlikely. The baseline scenario concerns the U-shaped recovery, but the speed of this recovery will depend on many factors, including the hysteresis effect, also called memory effect. In the publication Longer-Run Economic Consequences of Pandemics (March 2020) Jorda, Singh and Taylor argue that pandemics usually have deep, long-term consequences, such as labor shortages or greater savings. Similarly, COVID-19 is likely to translate into consumption, unemployment, investment, etc., with a high probability. In the long term, in many countries, a pandemic will lead to impairment, a change in consumer behavior, and a greater propensity to save. We are particularly afraid of underestimating long-term negative consequences for the tourism sector. In the long term, the Asian countries that are most dependent on tourism will record the biggest losses (in particular Thailand, where tourism accounts for 20% of direct GDP). In addition, given the increase in protectionism (Japan has allocated JPY 243 billion to help companies relocating production from China), forecasts for global trade and the Asian region are extremely worrying at this stage.

source: Christopher Dembik, director of macroeconomic analysis in Saxo Bank

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)