Cryptocurrency traders are looking for high returns

Number of global cryptocurrency users doubled in the first half of 2021, when many new players entered the game. Some of the new traders have a very high risk appetite and highly leveraged positions that are prone to even the slightest downtrend in the market. As a result of the lightning-fast crash on September 7, some of these positions, worth more than $ 3,5 billion, were liquidated in the cryptocurrency derivatives market in just 24 hours.

Despite aggressive trading in certain parts of the crypto community, it was done recently study shows that in 2021, fewer traders were buying cryptocurrencies as part of gambling than in 2020, and more and more of them see cryptocurrencies as an alternative to more conventional investments. As you can see in Chart 1, the main reason to buy cryptocurrencies is still the desire to make a profit, both in the short and long term. Some buyers, however, want to use cryptocurrencies for other purposes such as transfers, payments, and decentralized uses, and these additional cryptocurrency features have started to really gain in importance this year.

About the author

Anders Nysteen - joined Saxo Bank in 2016 to the department Quantitative Strategiesand its main goal is to develop mathematical trading strategies and asset allocation models. Anders holds a degree in physics and nanotechnology from the Technical University of Denmark and a PhD in quantum photonics.

Anders Nysteen - joined Saxo Bank in 2016 to the department Quantitative Strategiesand its main goal is to develop mathematical trading strategies and asset allocation models. Anders holds a degree in physics and nanotechnology from the Technical University of Denmark and a PhD in quantum photonics.

Large influx to blockchain applications

Comparing 2021 to 2017, this year's influx to the cryptocurrency market is more diverse, both in terms of individual cryptocurrencies and different use cases of cryptocurrency tokens in the area of blockchain. These cases include the value storage narrative, decentralized finance, non-convertible tokens (NFT), games and so-called stablecoiny. The value storage narrative, especially for bitcoin, has intensified in the wake of rising inflation, given that companies such as MicroStrategy, Tesla, and Square have included bitcoin in their balance sheets.

The increasing appetite for risk has affected not only Bitcoin, but also supporting blockchains smart contracts, such as Ethereum. Smart contracts enable additional functionalities beyond the classic value transfer and have many use cases in protocols running on these blockchains. One of the main applications is decentralized finance (DeFi), which until the beginning of this year was little known to most cryptocurrency investors. DeFi's overall scope is designed to facilitate classic banking services such as blockchain lending, eliminating the need for a potentially costly middleman to streamline the service.

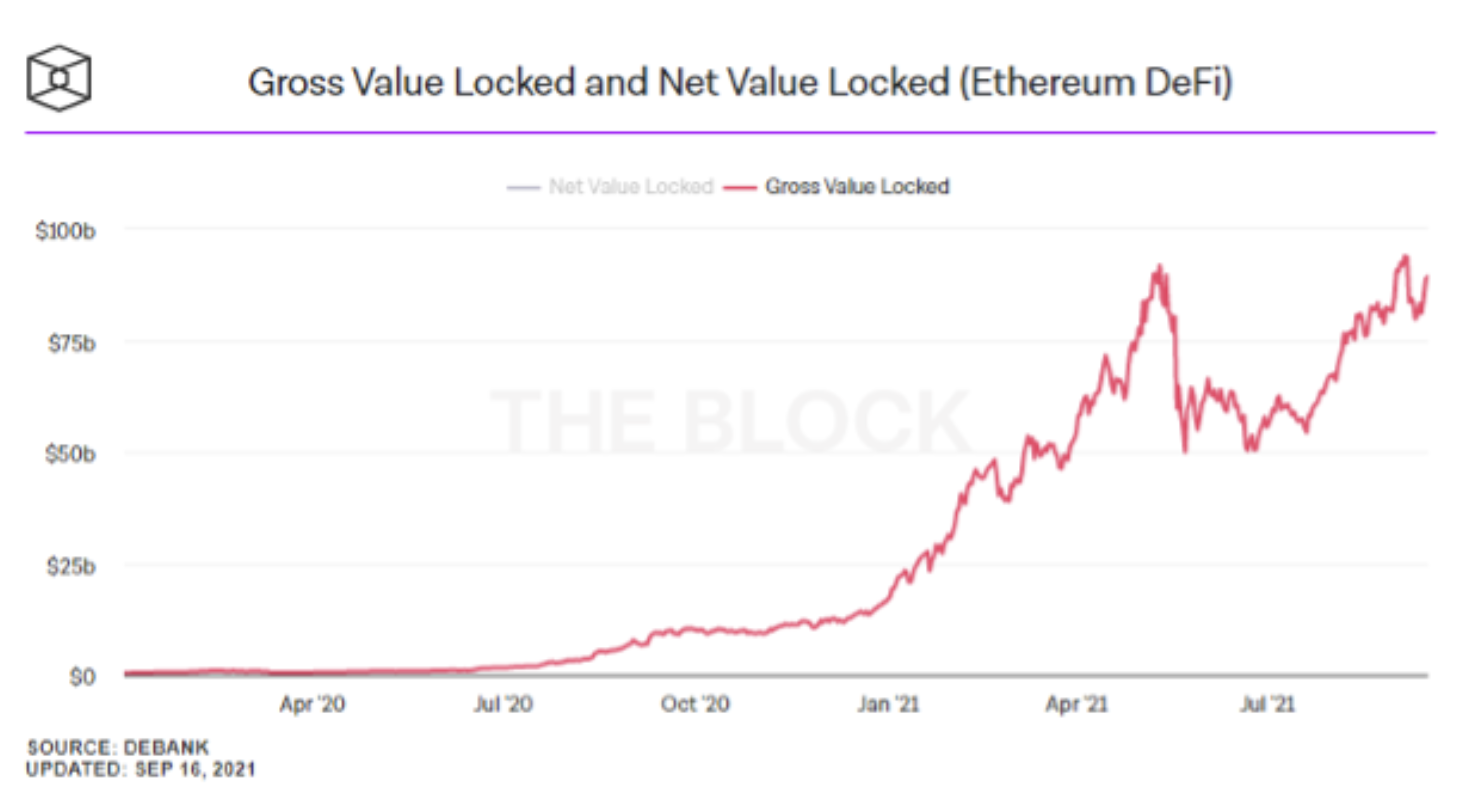

From September 2020, value blocked in DeFi protocols on the ethereum network increased from $ 8 billion to $ 84 billion (see Figure 2), and other similar blockchains saw comparable growth. Value is most often locked in trading, loan and currency stabilization protocols. By blocking cryptocurrency tokens in decentralized protocols, investors are promised a profitability of up to 10% per annum, compared to the often negative interest rate of keeping fiat money in a bank account. However, this is not a risk-free method as when lending under decentralized protocols, the lender covers the smart contract risks associated with hacking attacks and errors, as well as the risks of a decentralized system such as forgetting wallet credentials.

Another significant application of smart contracts has also unexpectedly emerged. This year there has been a boom in the trade in digital versions of works of art, films and illustrations. Turnover of the so-called non-exchangeable tokens (NFT) are held on blockchains to ensure the uniqueness of digitized assets; the largest network that makes this possible today is ethereum. The NFT trade peaked in February when a hitherto unknown artist with a pseudonym Beeple has sold a single NFT for $ 69 million. In August and September, the trading volume of the NFT went up. In particular, NFTs such as CryptoPunks, consisting of 10 unique characters, have sold for millions of dollars. This proves not only the growing interest of investors in portfolio diversification through unique tokens, but above all the expectation that the market can only profit.

Bitcoin's domination in the market is under threat again

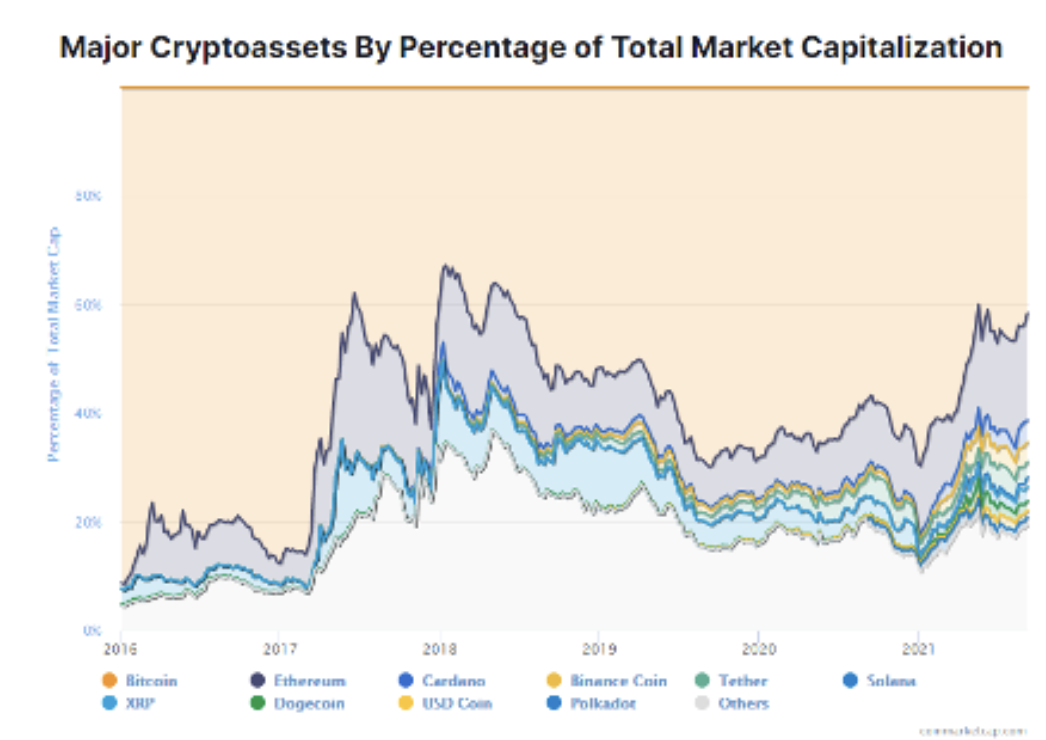

With the rapidly evolving smart contract applications, bitcoin's dominance is under threat again; it was the first time during the wave of debuts of new cryptocurrencies in 2017. A number of players compete for market capitalization: bitcoin as the first cryptocurrency on the market, enjoying the status of "digital gold" and a reputation as a method of storing value; ethereum as a technically better cryptocurrency than bitcoin, which was the first to offer smart contracts, although scalability is limited in the current version; as well as newer generations of cryptocurrencies as they are technically superior in terms of scalability, ecology and interoperability, although many are still in the implementation / development phase. It is far too early to announce a winner in this battle, but this year has clearly been in favor of new generations of cryptocurrencies, as shown in Chart 3.

In our opinion, by the end of 2021, the main factor in the market will be expectations regarding the use of smart contracts and decentralized protocols. We anticipate an increased risk appetite for decentralized protocols as part of our drive for high returns, which in turn will increase the amount blocked in DeFi protocols. Investors in the cryptocurrency market, however, should be wary of a few risks.

Big movements in the cryptocurrency market, especially in the context of smaller cryptocurrencies, may not be the result of an improvement in the fundamentals, but only resemble a bubble where traders acquire assets solely to take advantage of an uptrend. On the regulatory side, decentralized protocols lack a regulatory framework and there is no legal protection for the investor; a single hacker attack can eliminate the entire investment. Many government agencies are pushing for tightening DeFi regulations, which could significantly affect ethereum and other DeFi blockchains, and little bitcoin. On the other hand, bitcoin's disadvantage may be the added emphasis on the global green agenda due to the high energy demand to run the bitcoin blockchain, while "greener" cryptocurrencies, requiring less energy, may only feel little impact.

All Saxo forecasts are available at this address.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-300x200.jpg?v=1709558918)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-300x200.jpg?v=1711601376)